- Lundin Gold held a conference call on August 12, 2020 to discuss its second quarter 2020 results

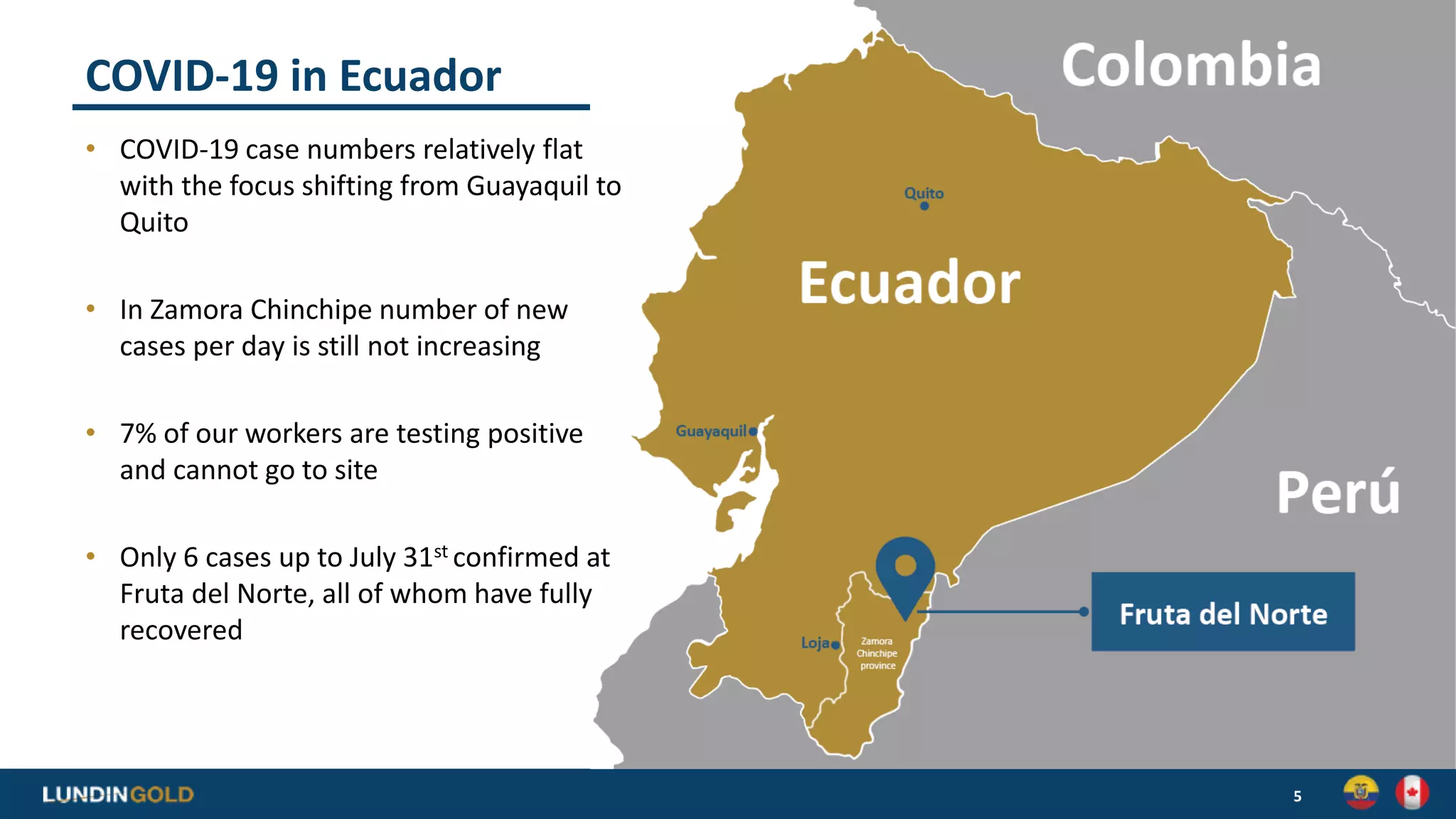

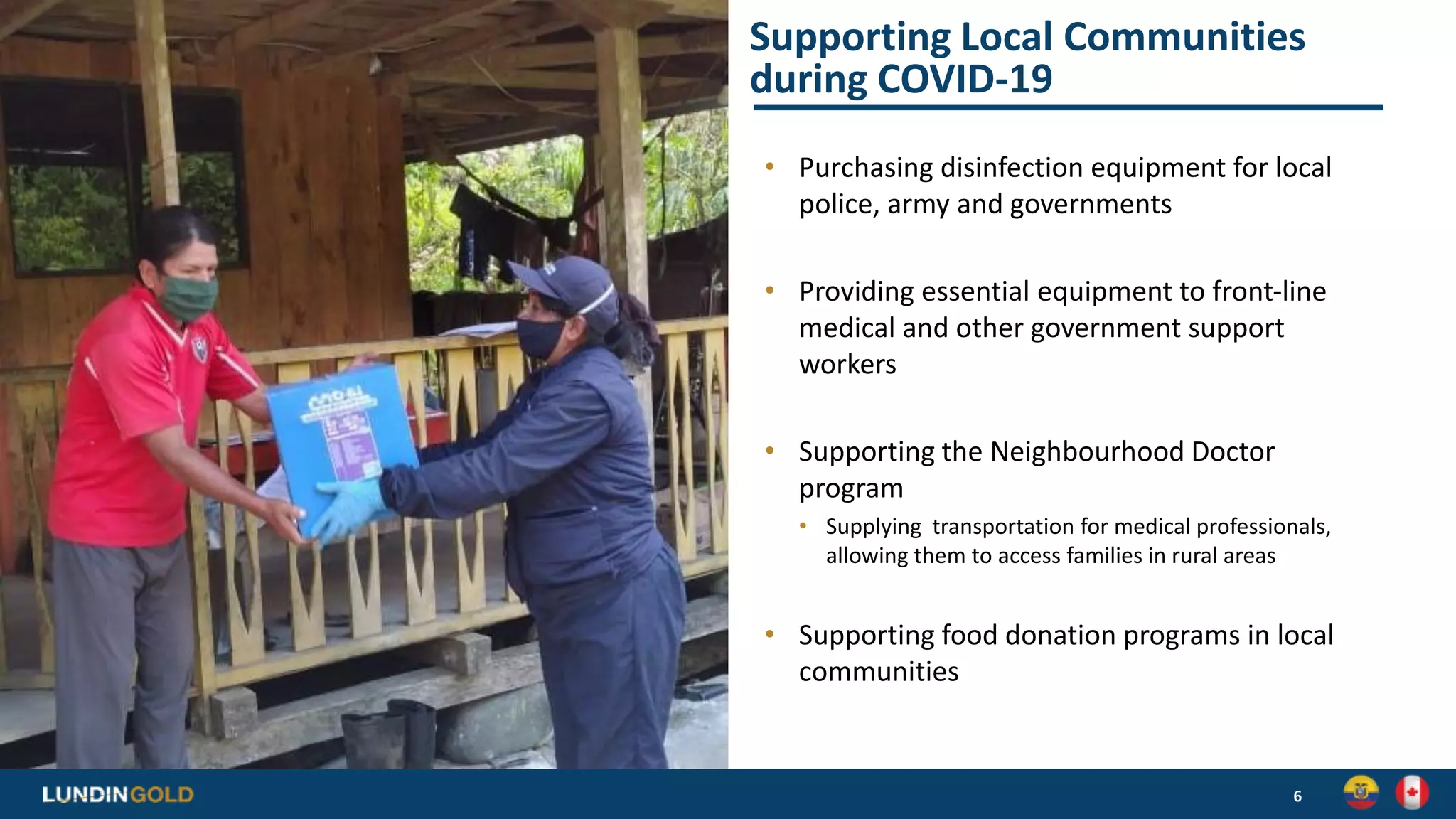

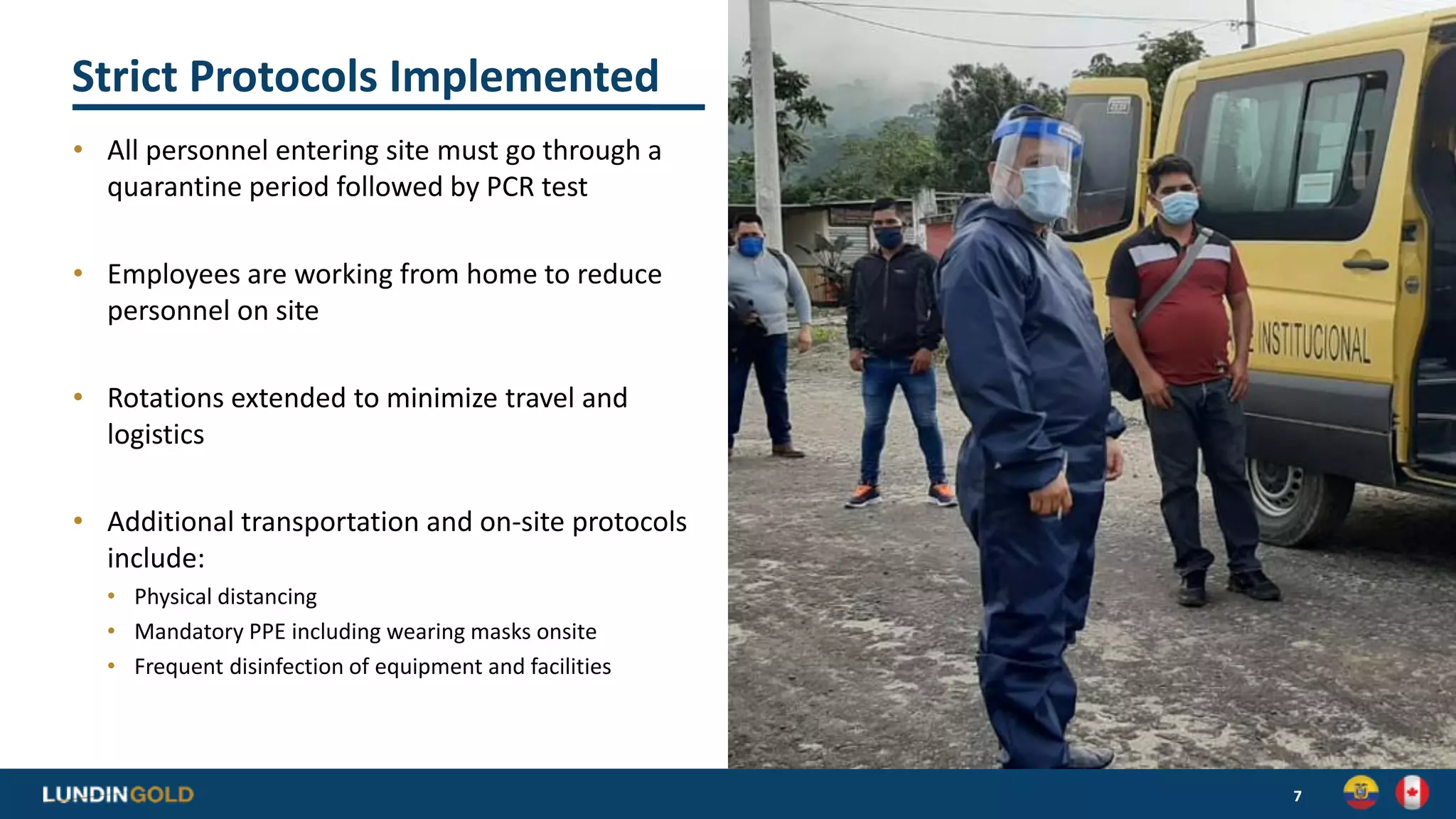

- Operations were suspended in late March due to COVID-19 but resumed in July after implementing strict health and safety protocols

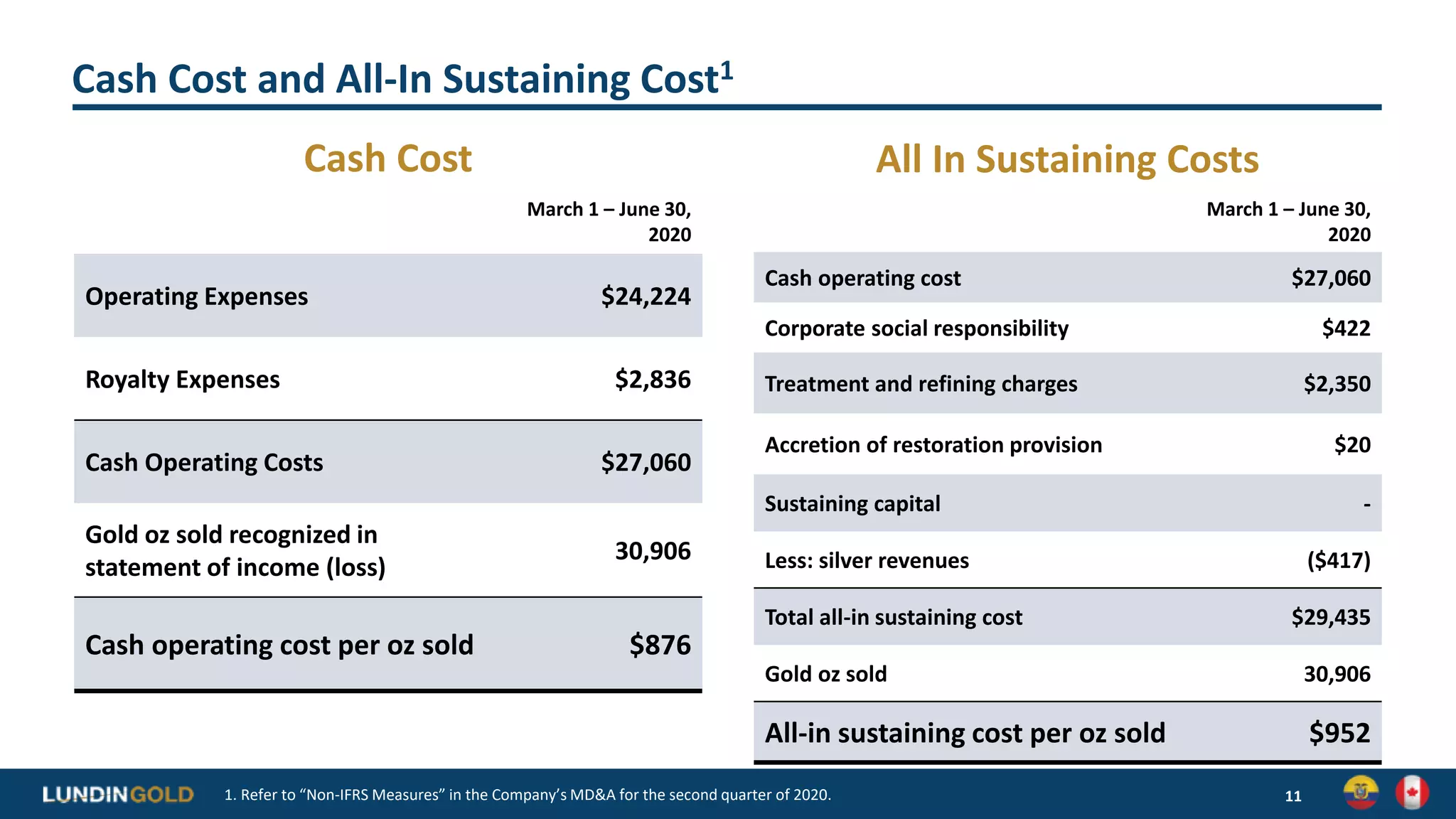

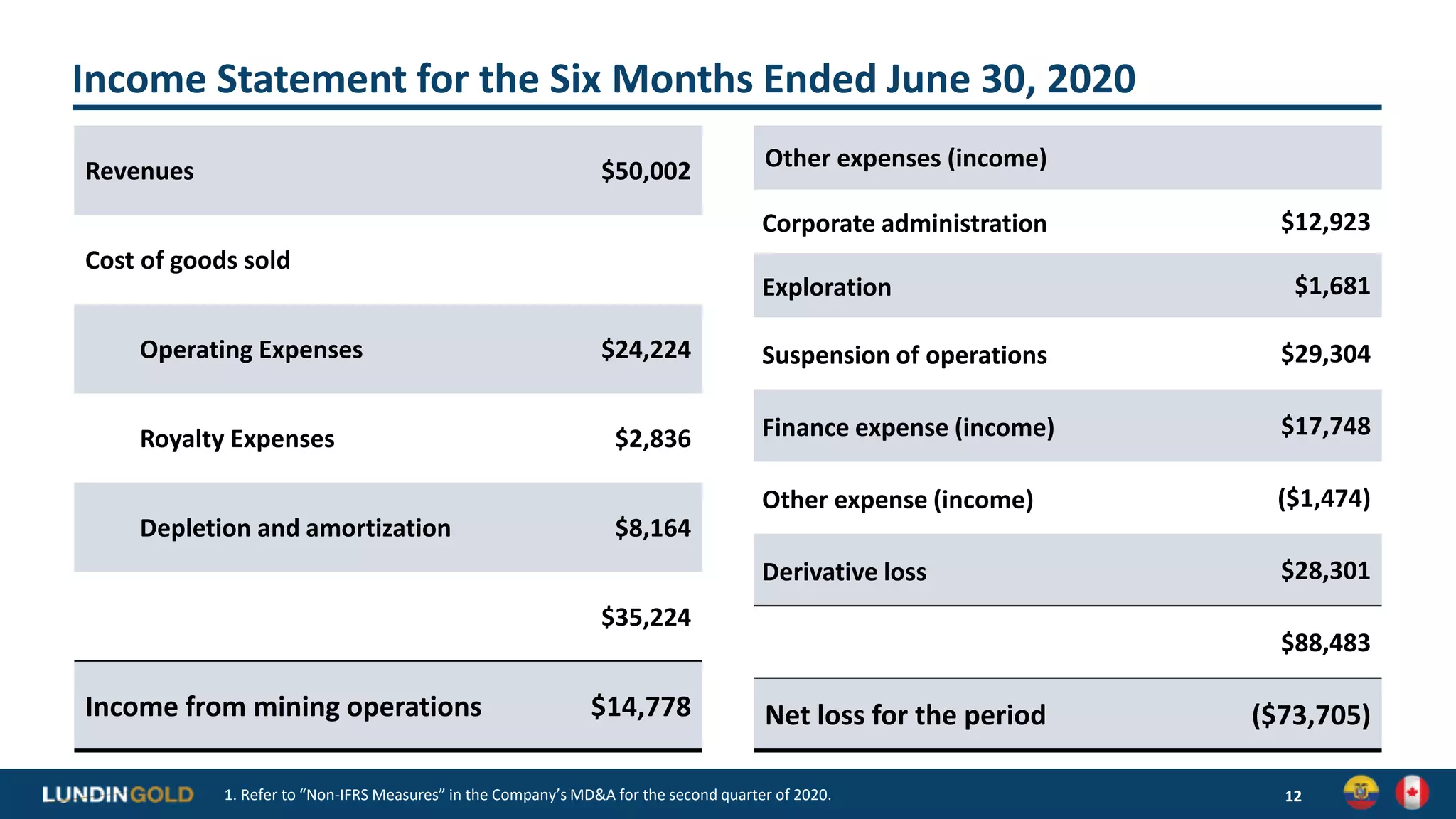

- 30,906 ounces of gold were sold during the period at an average realized price of $1,680 per ounce

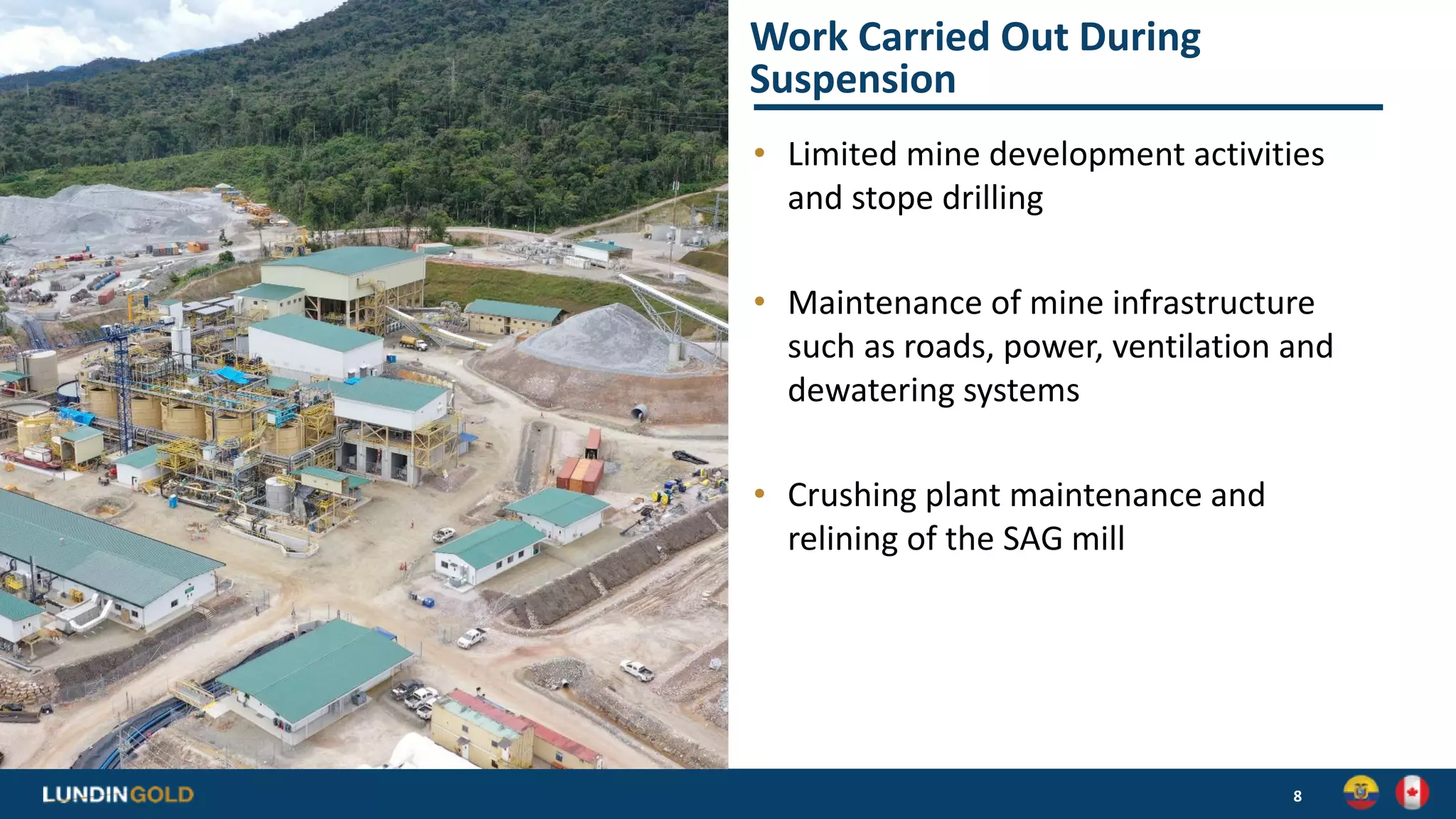

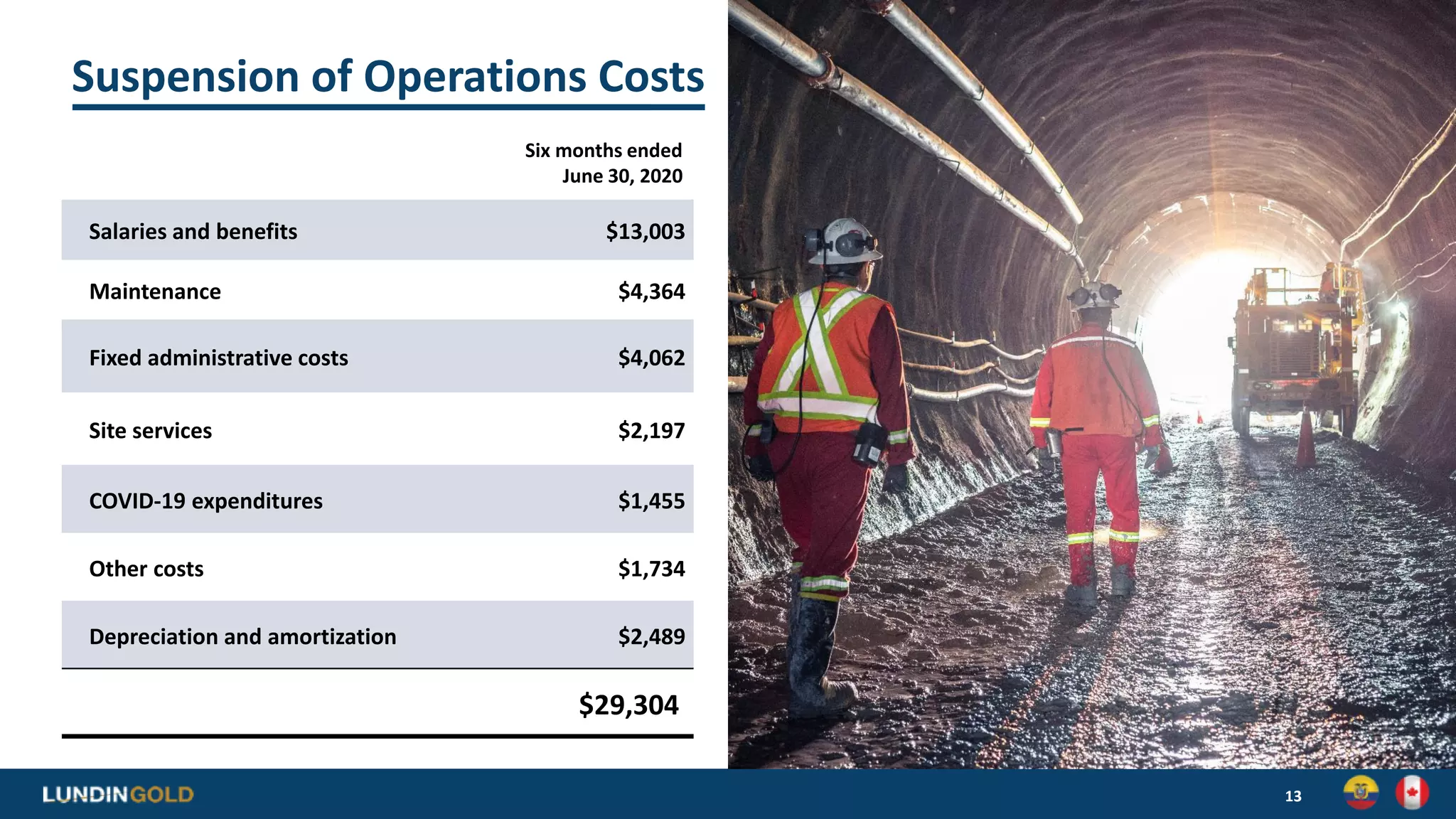

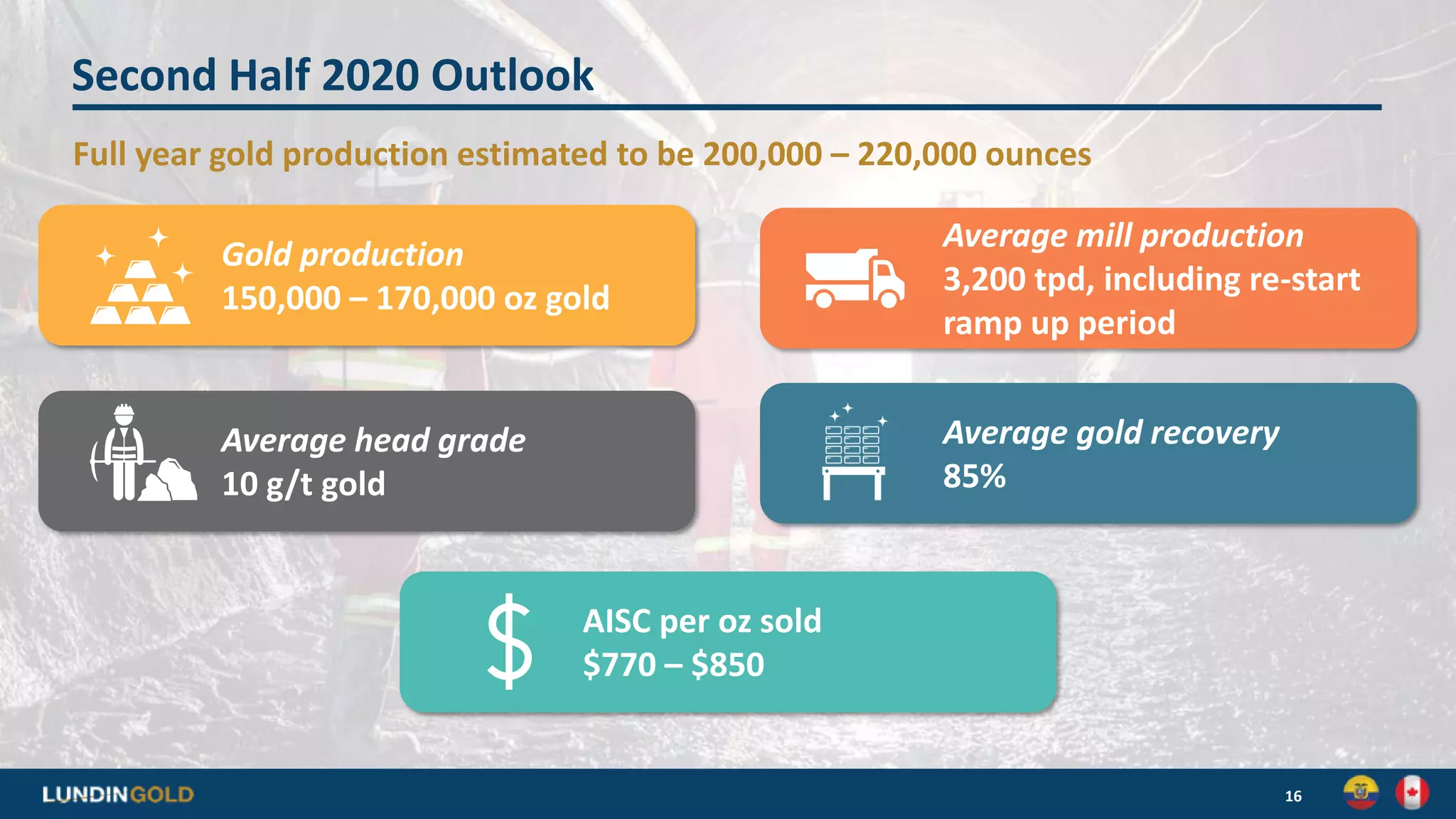

- The company incurred costs of $29.3 million related to the suspension of operations and is focused on ramping production back up in the second half of the year