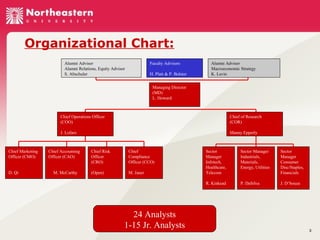

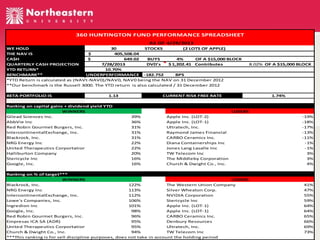

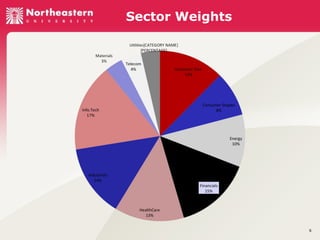

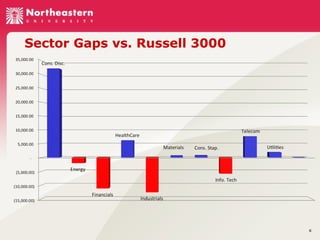

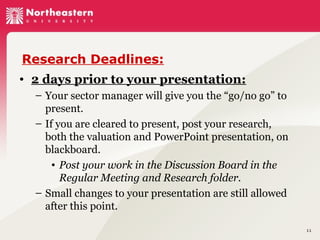

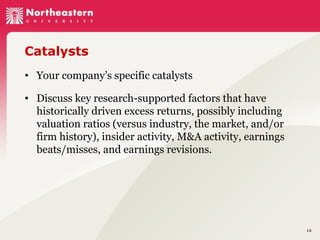

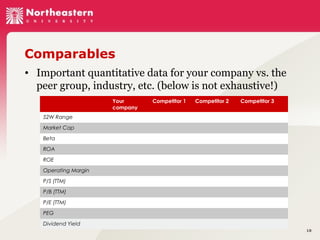

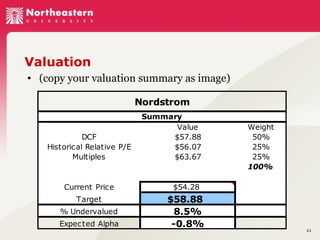

This document provides an overview of the 360 Huntington Fund, a student-run investment fund. It outlines the fund's structure and organizational chart, with various manager roles. It discusses the fund's performance and holdings. Research deadlines and responsibilities for analysts are also outlined. The fund aims to give students experience in equity research, portfolio management, and other investment concepts.