Embed presentation

Downloaded 12 times

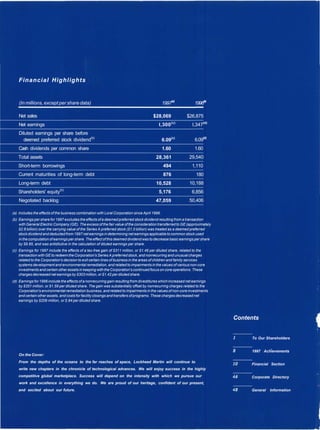

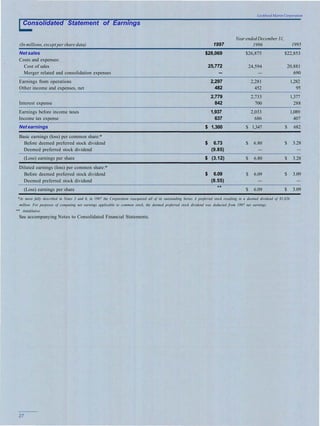

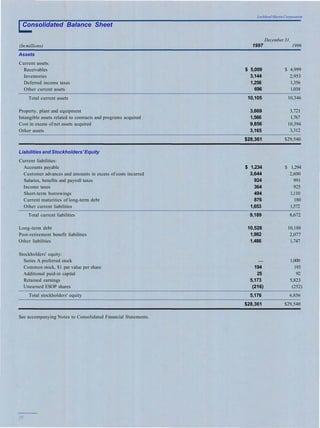

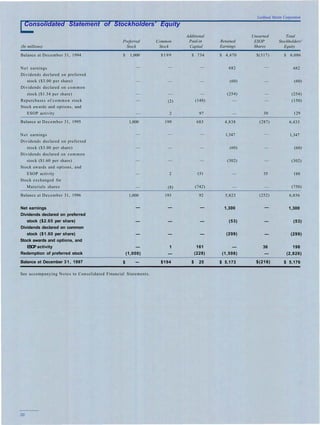

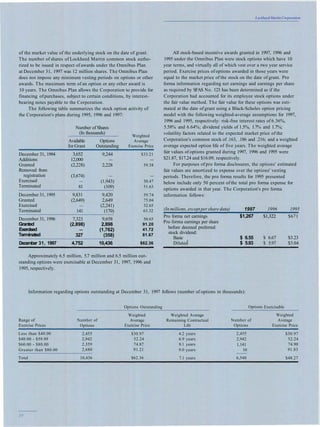

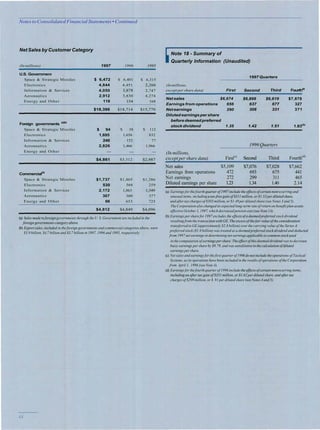

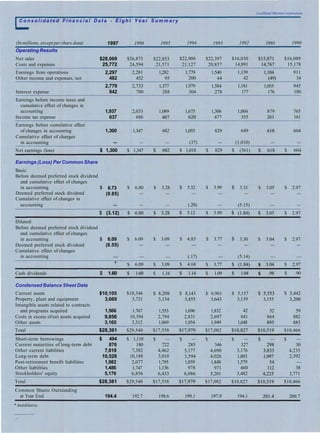

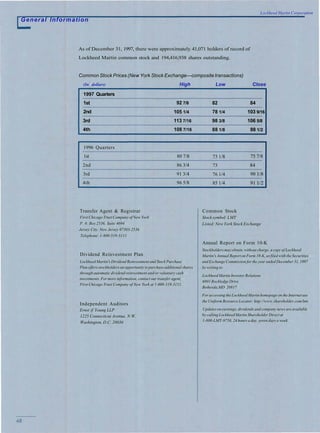

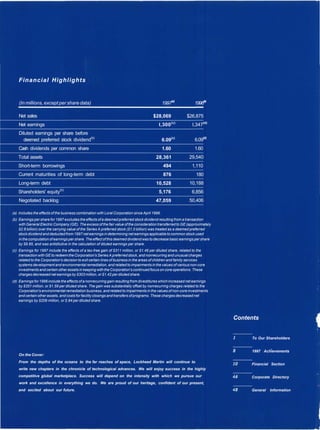

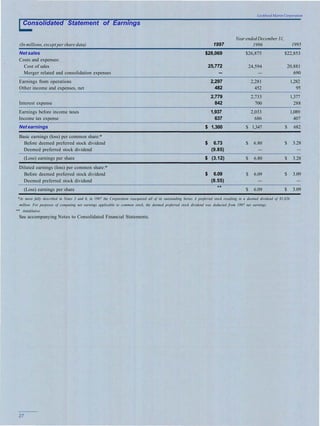

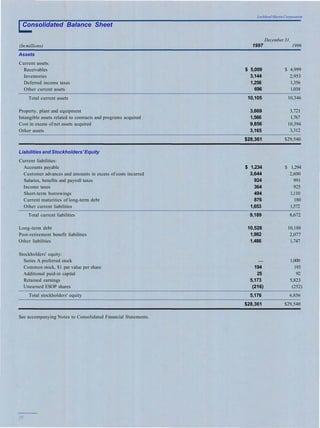

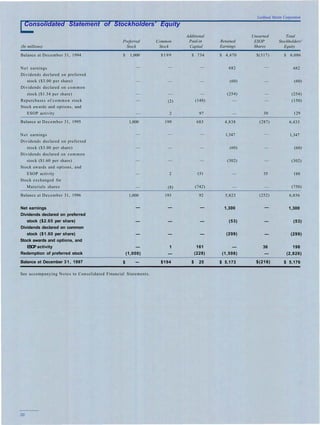

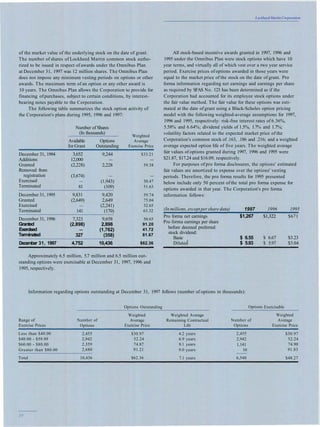

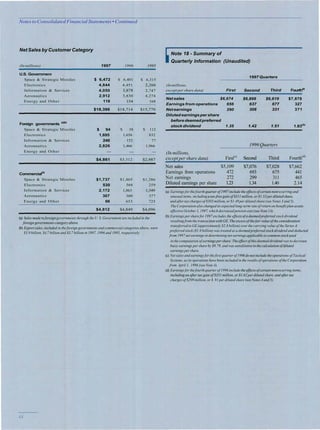

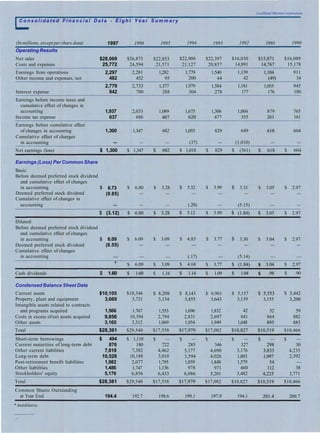

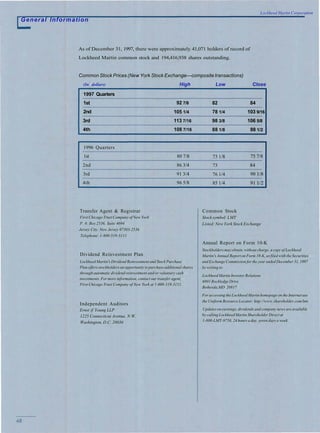

The annual report summarizes Lockheed Martin's financial and operational performance in 1997. Some key highlights include: - Net sales reached a record $28.1 billion, up from $26.9 billion in 1996. - Net earnings were $1.3 billion. Excluding non-recurring items, earnings per share grew 11% over 1996. - The company achieved significant cost reductions ahead of schedule, and improved competitiveness as evidenced by a record high win rate on competitive bids. - $1.6 billion in cash was generated in 1997 through free cash flow and divestitures. Cash was used to reduce debt and enhance shareholder value. - Goals for 1998 include continued cash generation, and