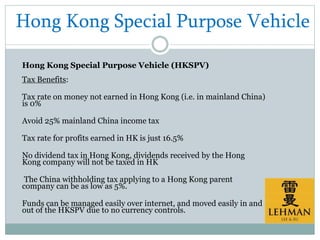

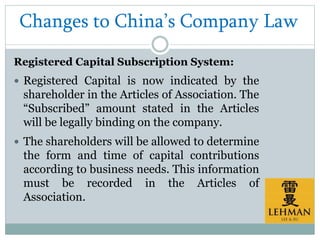

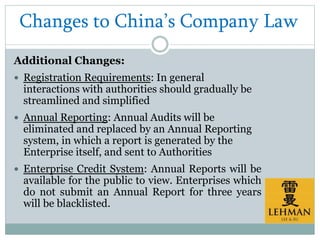

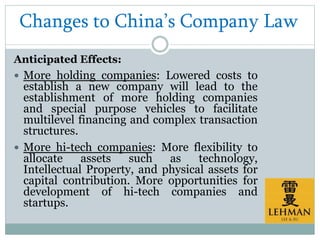

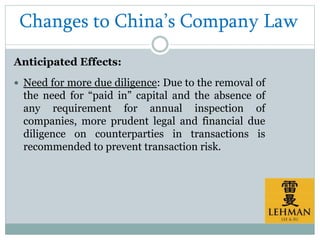

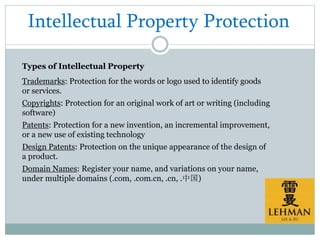

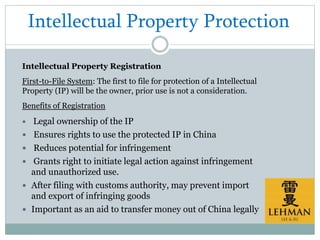

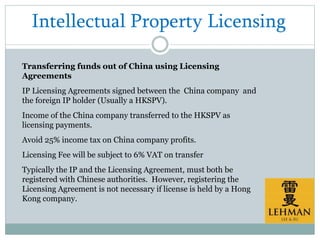

Hong Kong Special Purpose Vehicle (HKSPV) is a company founded in Hong Kong that holds IP rights for a mainland China company. It provides limited liability, easy exit from China, and tax benefits. A Wholly Foreign Owned Enterprise (WFOE) allows foreign companies to do business in China with more control than a joint venture. China's new Company Law removes minimum capital requirements and allows more flexibility in capital contributions. Intellectual property like trademarks and patents should be registered in China to protect ownership and allow legal action against infringement.