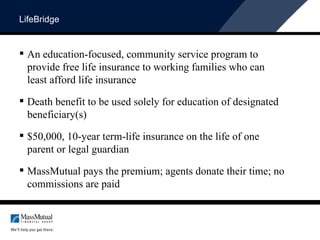

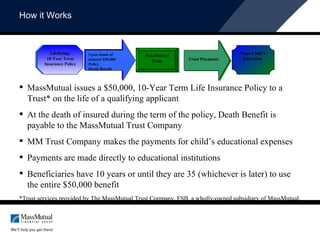

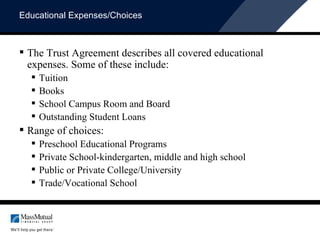

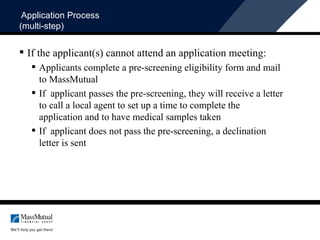

MassMutual's Lifebridge program provides free $50,000 life insurance to working families, focusing on educational expenses for their children. The program targets parents aged 19-42 with dependent children, ensuring the death benefit is used solely for education. Community organizations and employers play a key role in promoting the program and assisting with the application process.

![Thank You! Thoughts … Suggestions … Discussion … Questions, etc . MassMutual Financial Group is a marketing designation (or fleet name) for Massachusetts Mutual Life Insurance Company (MassMutual) and its affiliates. Contact: Jason M. Cocco MassMutual Financial Group 2 Bala Plaza, Suite 901 Bala Cynwyd, PA 19004 P: 610-766-3084 C: 609-221-3292 Email: [email_address]](https://image.slidesharecdn.com/lifebridge-124448083641-phpapp02/85/Lifebridge-11-320.jpg)