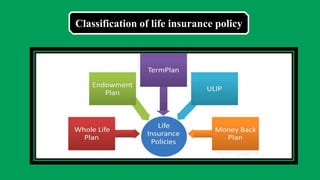

Life insurance is an agreement between a policy owner and insurer where the insurer agrees to pay a sum of money upon the death or other specified event of the insured individual. There are several types of life insurance policies that provide death benefits and savings options such as term insurance, whole life insurance, endowment policies, money back policies, and unit linked insurance policies. These policies offer advantages like life protection, tax benefits, guaranteed and potential returns, and flexibility.