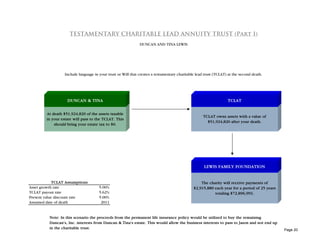

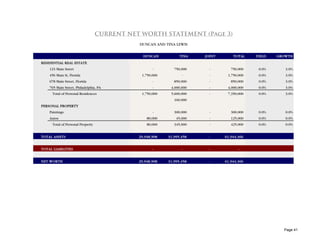

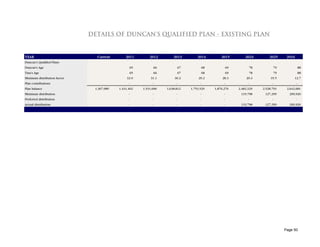

The document discusses a case study webinar presented by InKnowVision, LLC. It then provides details on the goals and objectives of Duncan and Tina Lewis, which include maintaining their lifestyle, providing for the surviving spouse, maintaining liquidity, ensuring the successful transition of Duncan's business to their son Jason, and reducing taxes. It also lists family information and grandchildren. Finally, it introduces a plan strategies roadmap for the Lewis family, which includes creating grantor deemed owner trusts and gifting assets to them.