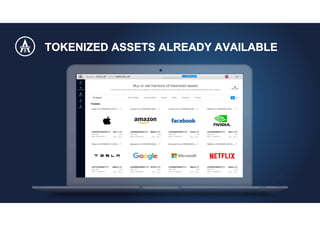

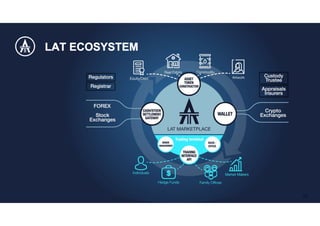

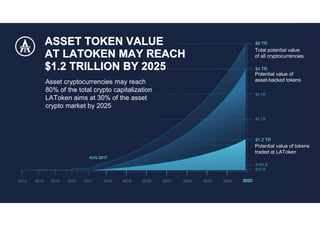

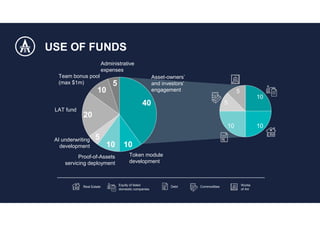

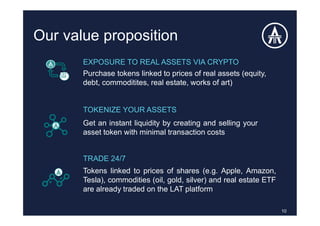

LAToken is a platform that allows users to tokenize and trade real-world assets via cryptocurrency. It issues tokens linked to the price of publicly traded assets like real estate, art, and commodities. Cryptoholders can buy these asset tokens using cryptocurrency on the LAT platform. On a predetermined settlement date, LAToken buys back the asset tokens from holders at the current market price of the underlying asset. The platform aims to become a leading global marketplace for asset-backed tokens with a potential annual trading volume of $1.2 trillion by 2025.