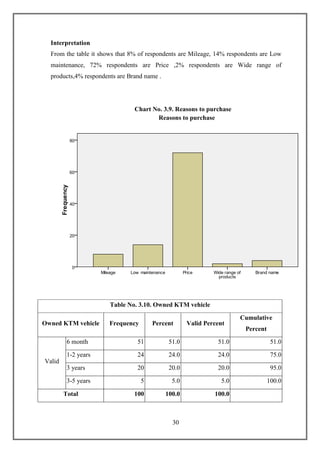

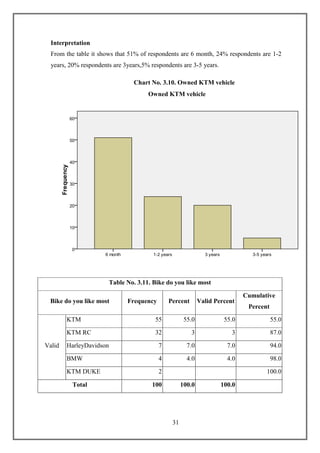

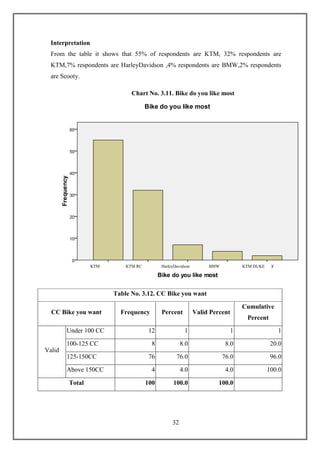

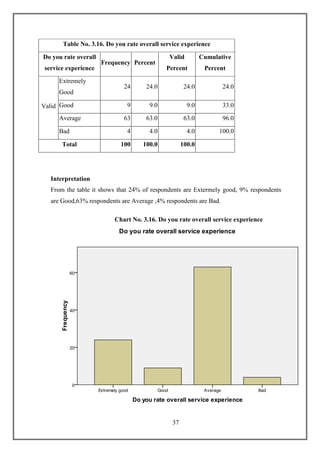

This document provides details about a study on consumer behavior related to different brand bikes with special reference to KTM bikes in Coimbatore, India. The document includes an introduction outlining the objectives and scope of the study, as well as the research methodology used which involves collecting primary data through questionnaires and secondary data. It also describes the sample design of 100 KTM customers in Coimbatore using non-probability convenient sampling. The study aims to understand factors influencing customer decisions to purchase KTM bikes and their responses to services.