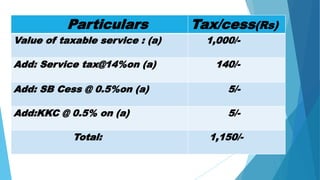

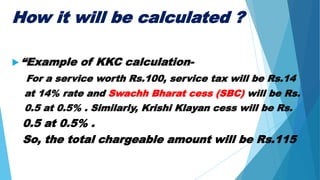

The document discusses Krishi Klayan cess, a tax introduced by the Indian government in 2016 to improve agricultural facilities. The cess is collected at 0.5% on all taxable services and can only be used for agriculture-related purposes. It is aimed at financing initiatives to promote agriculture and farmer welfare. The effective service tax rate increased to 15% with the addition of the 0.5% Krishi Klayan cess on June 1, 2016.