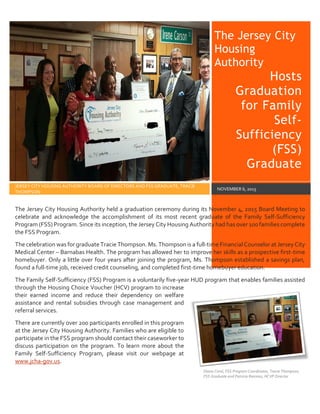

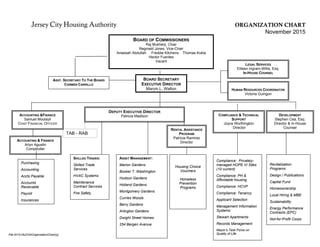

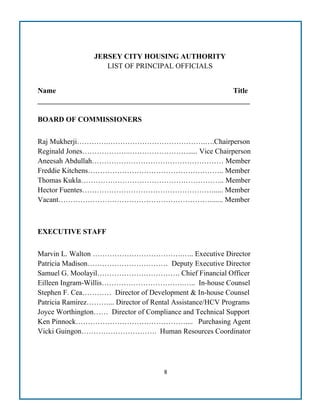

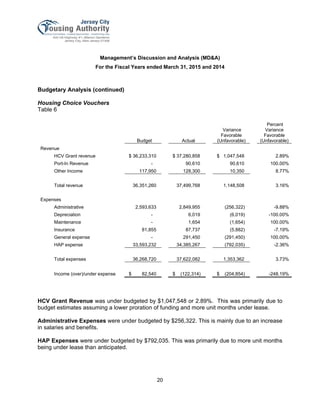

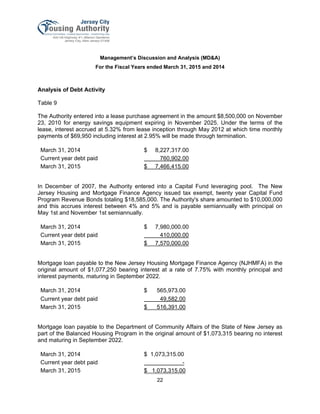

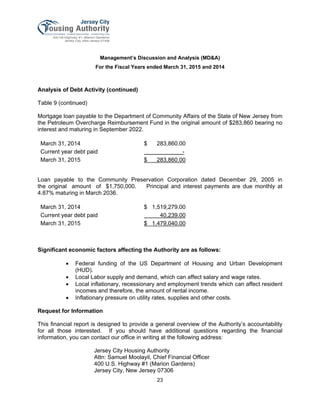

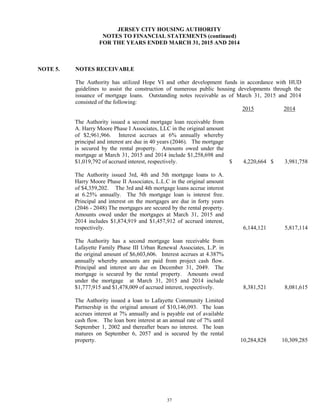

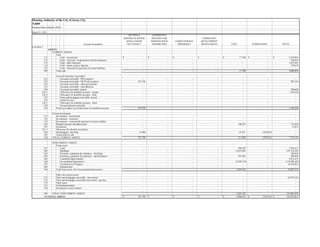

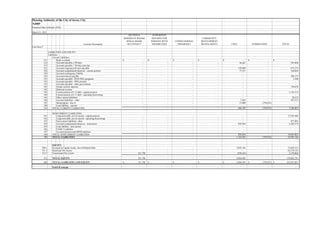

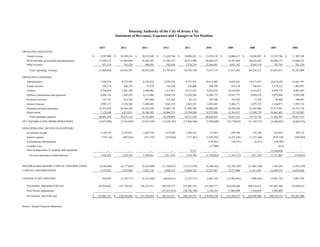

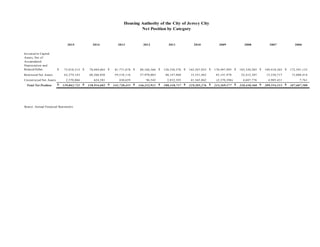

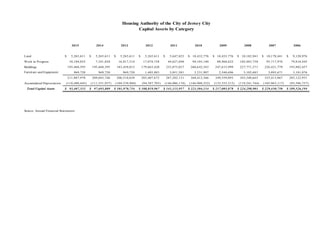

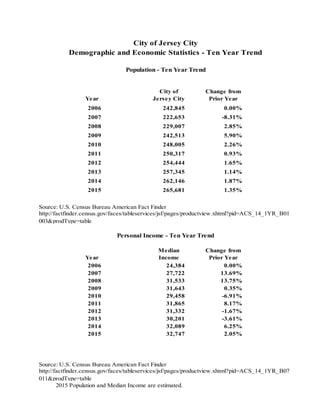

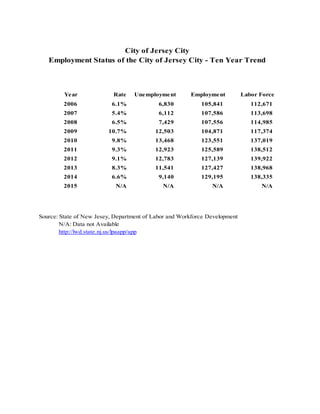

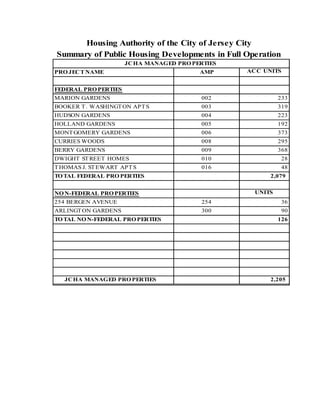

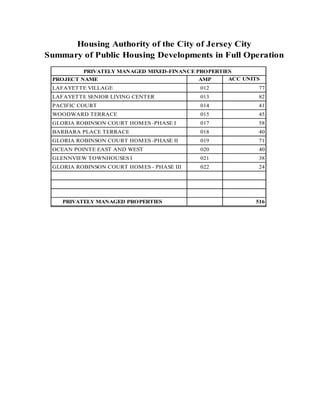

The Jersey City Housing Authority's mission is to develop and manage high-quality, safe, affordable, sustainable and accessible housing, and to foster resident self-sufficiency. The document provides details on the Authority's 2015 Comprehensive Annual Financial Report, including its programs, funding sources, economic factors, and financial results. It experienced an operating loss in 2015 but less than the previous year due to expense reductions. The Authority aims to further improve efficiency and reduce costs.