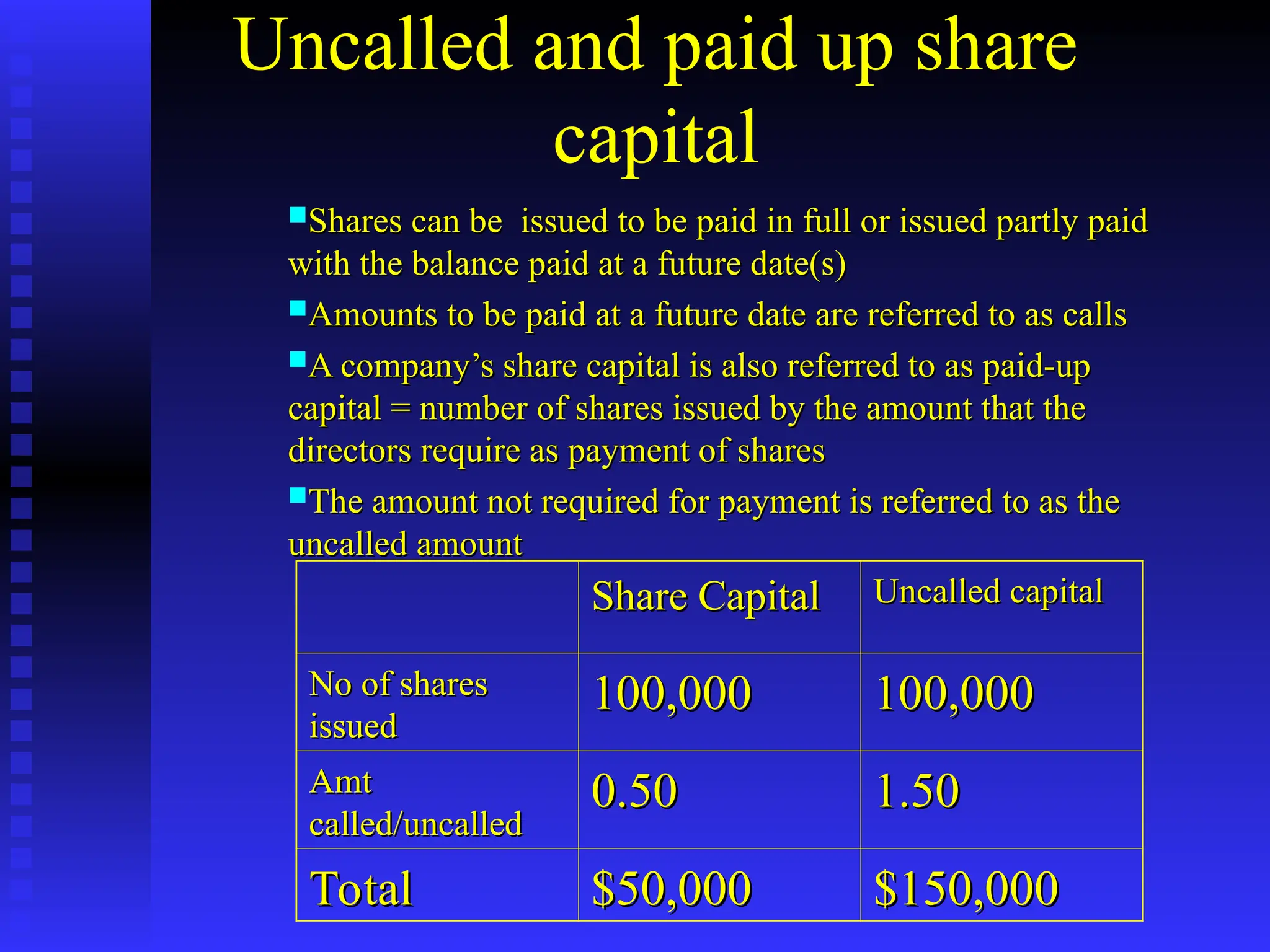

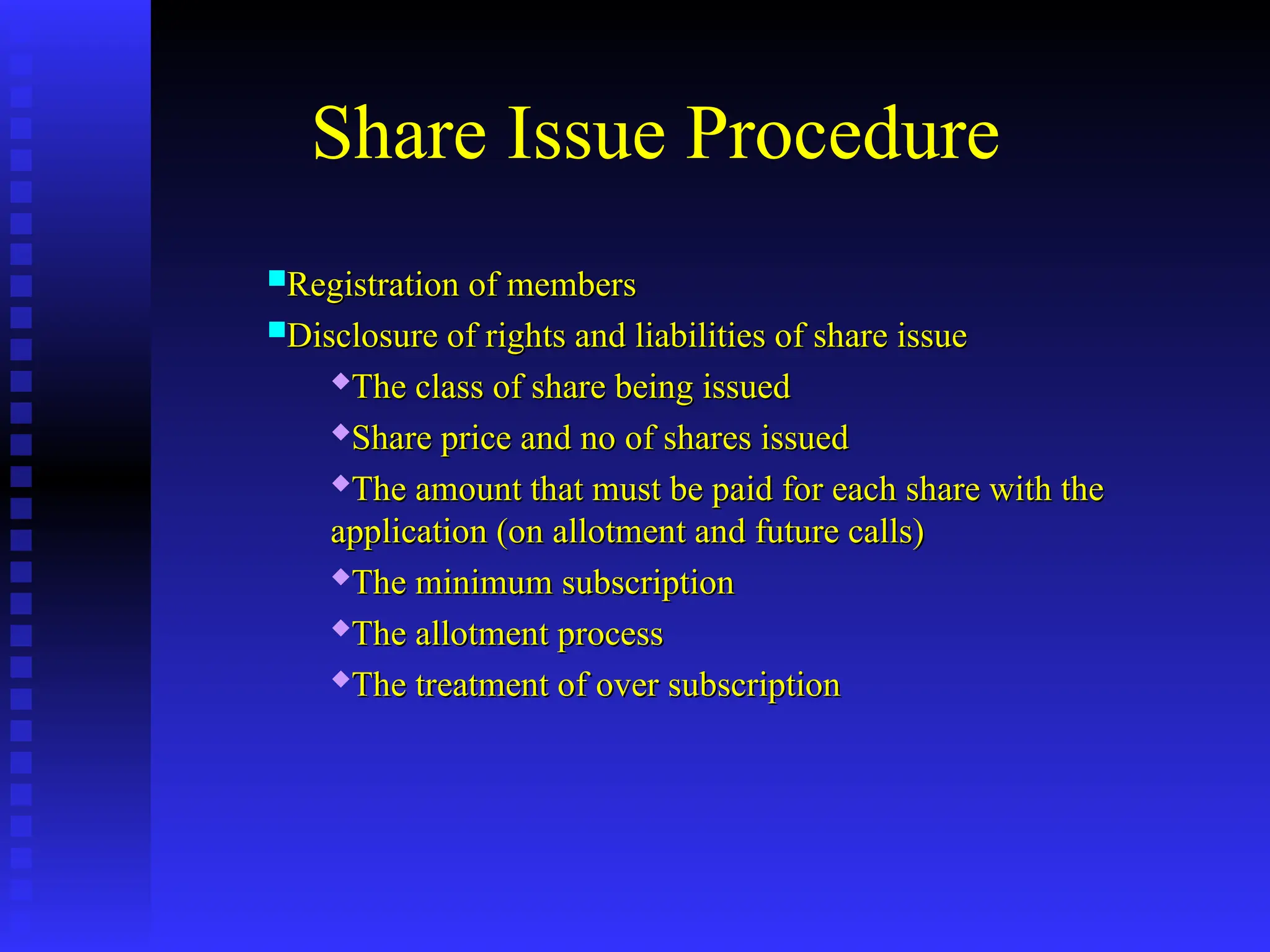

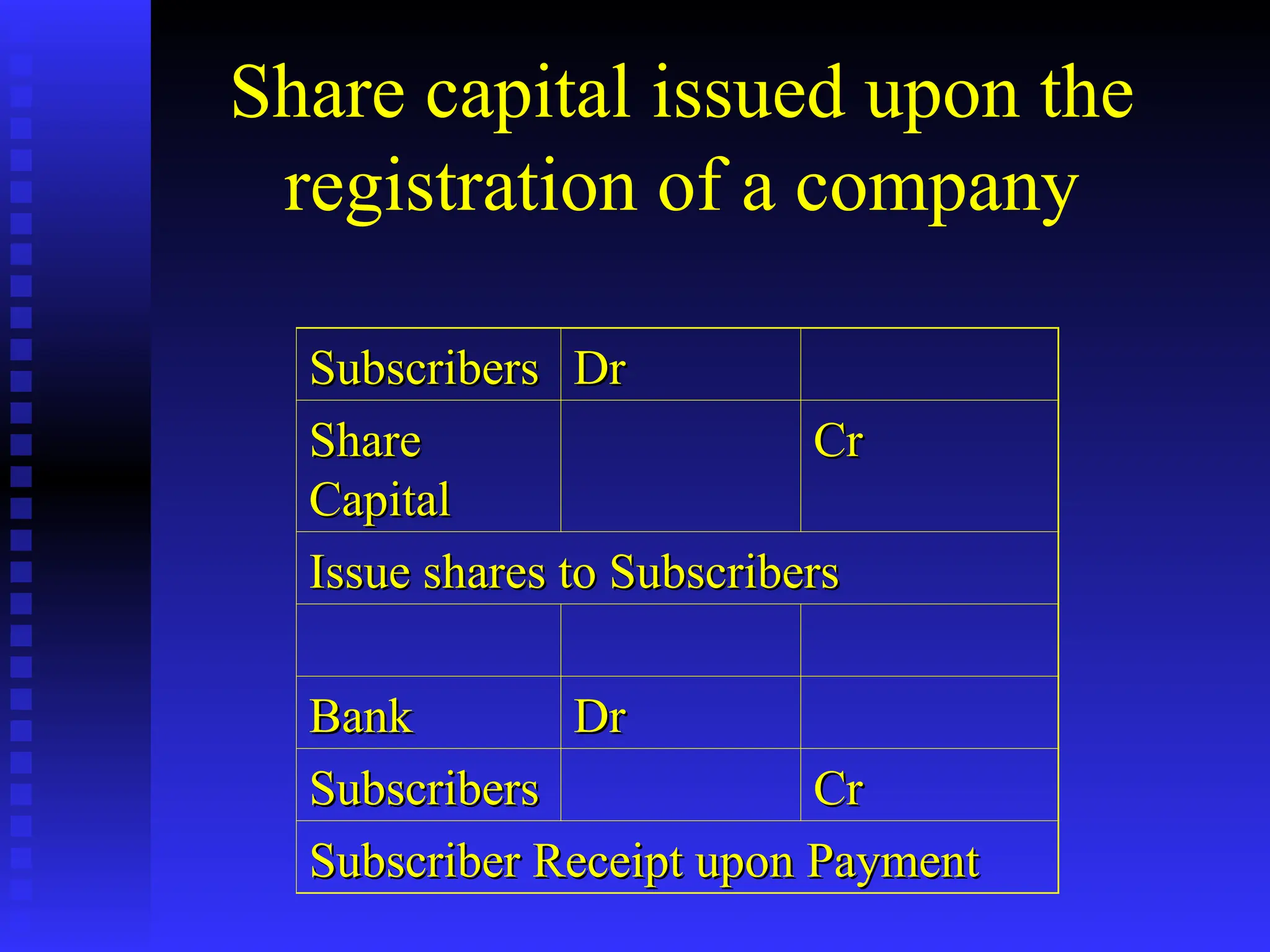

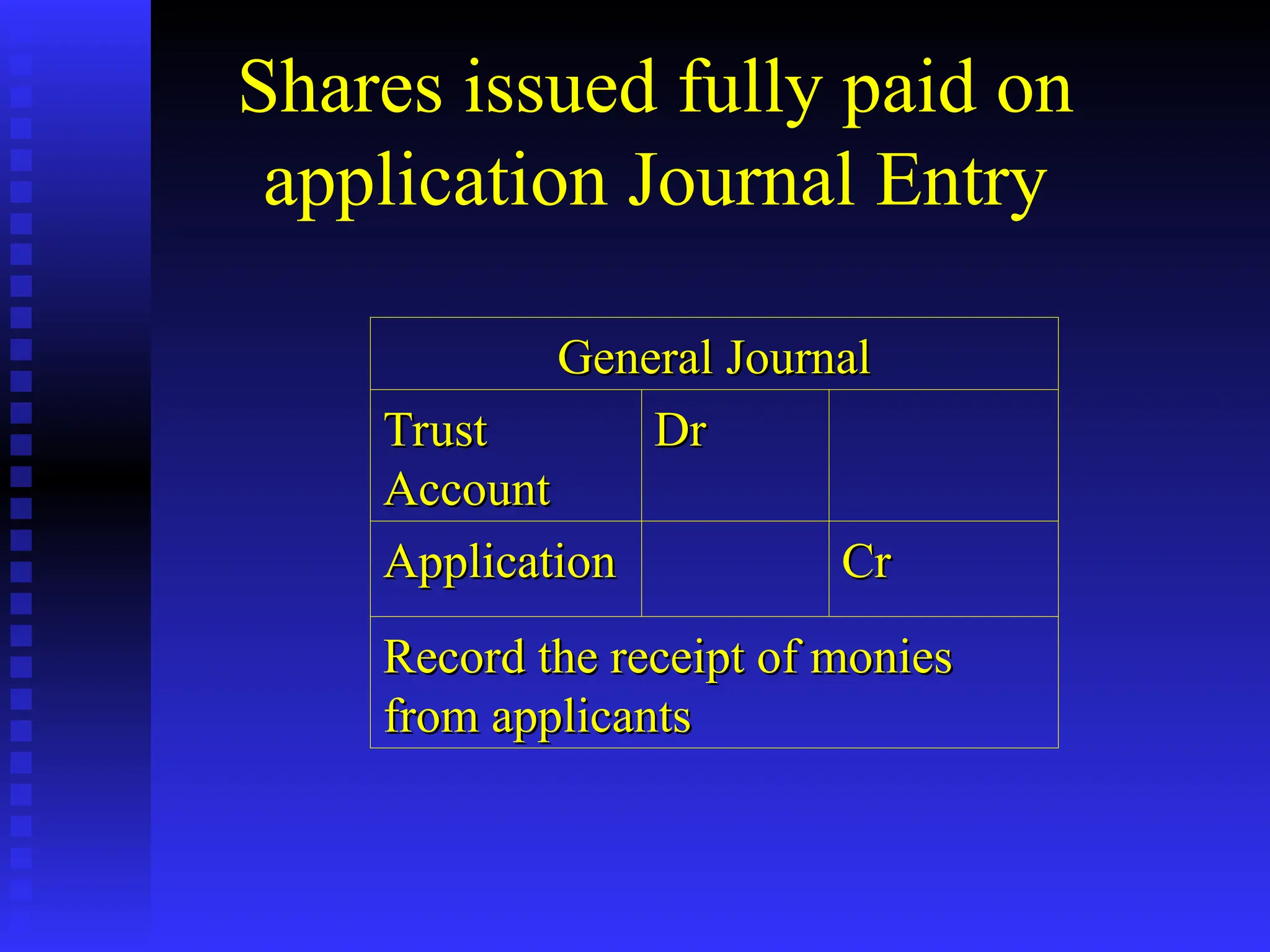

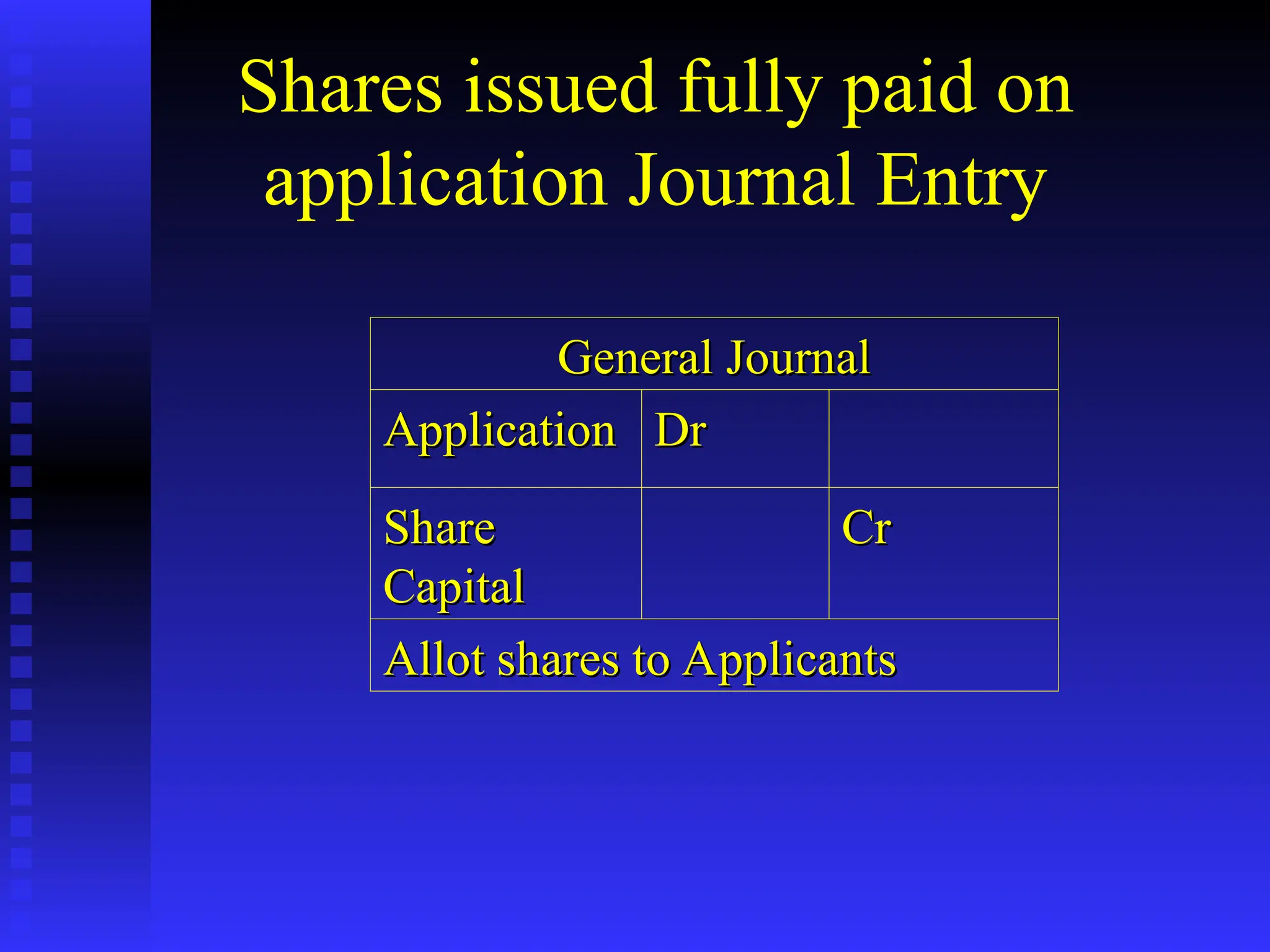

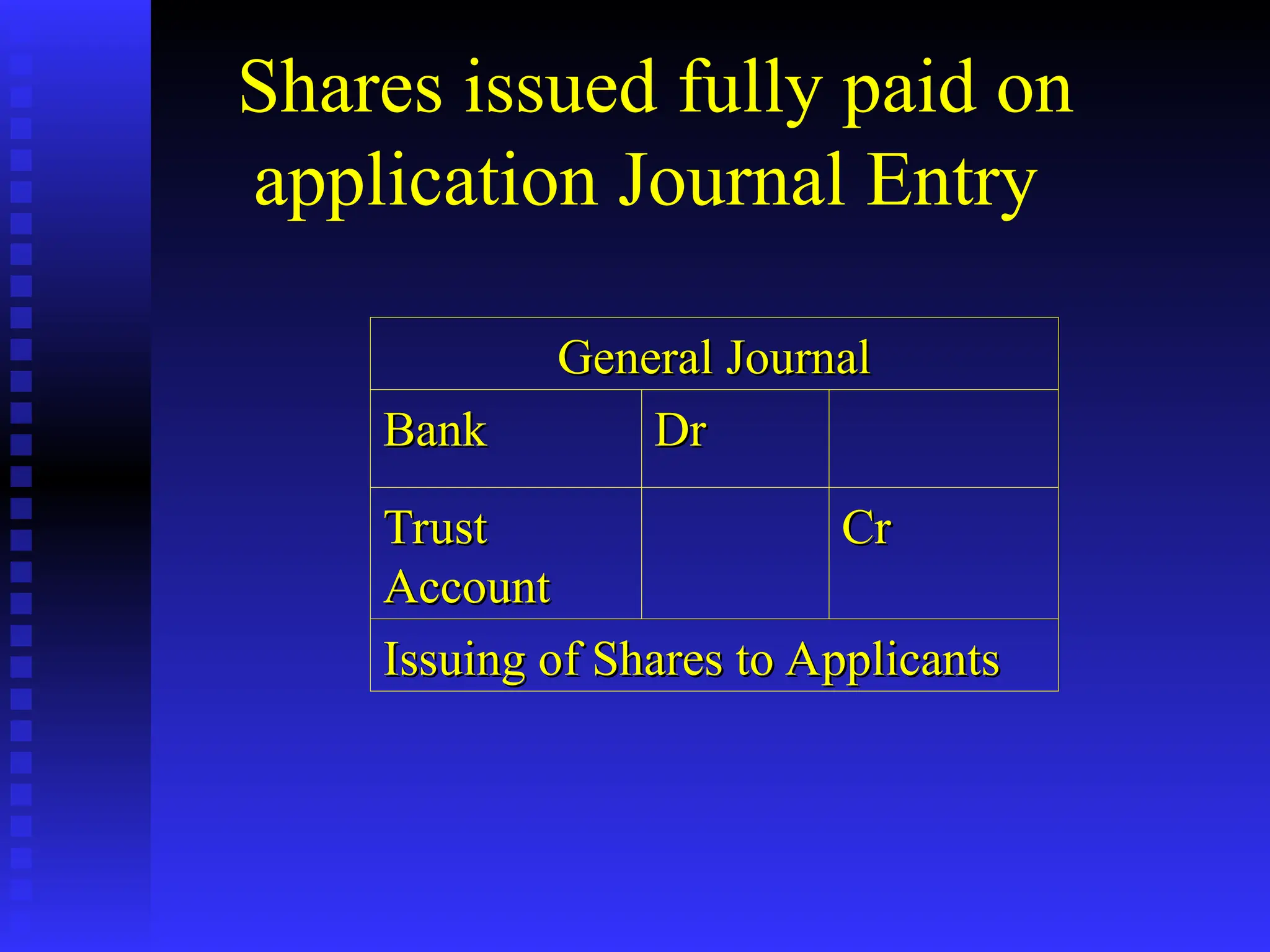

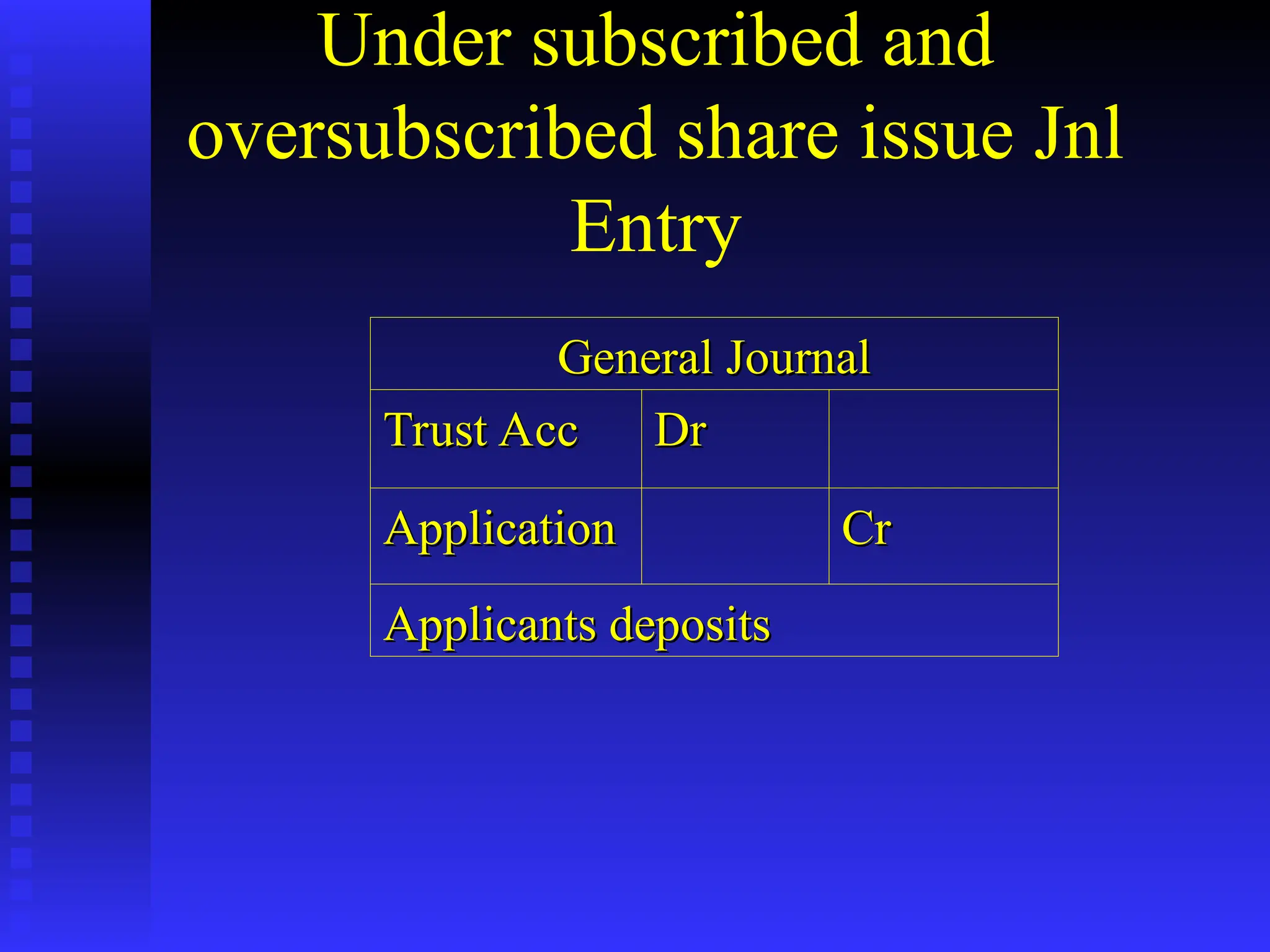

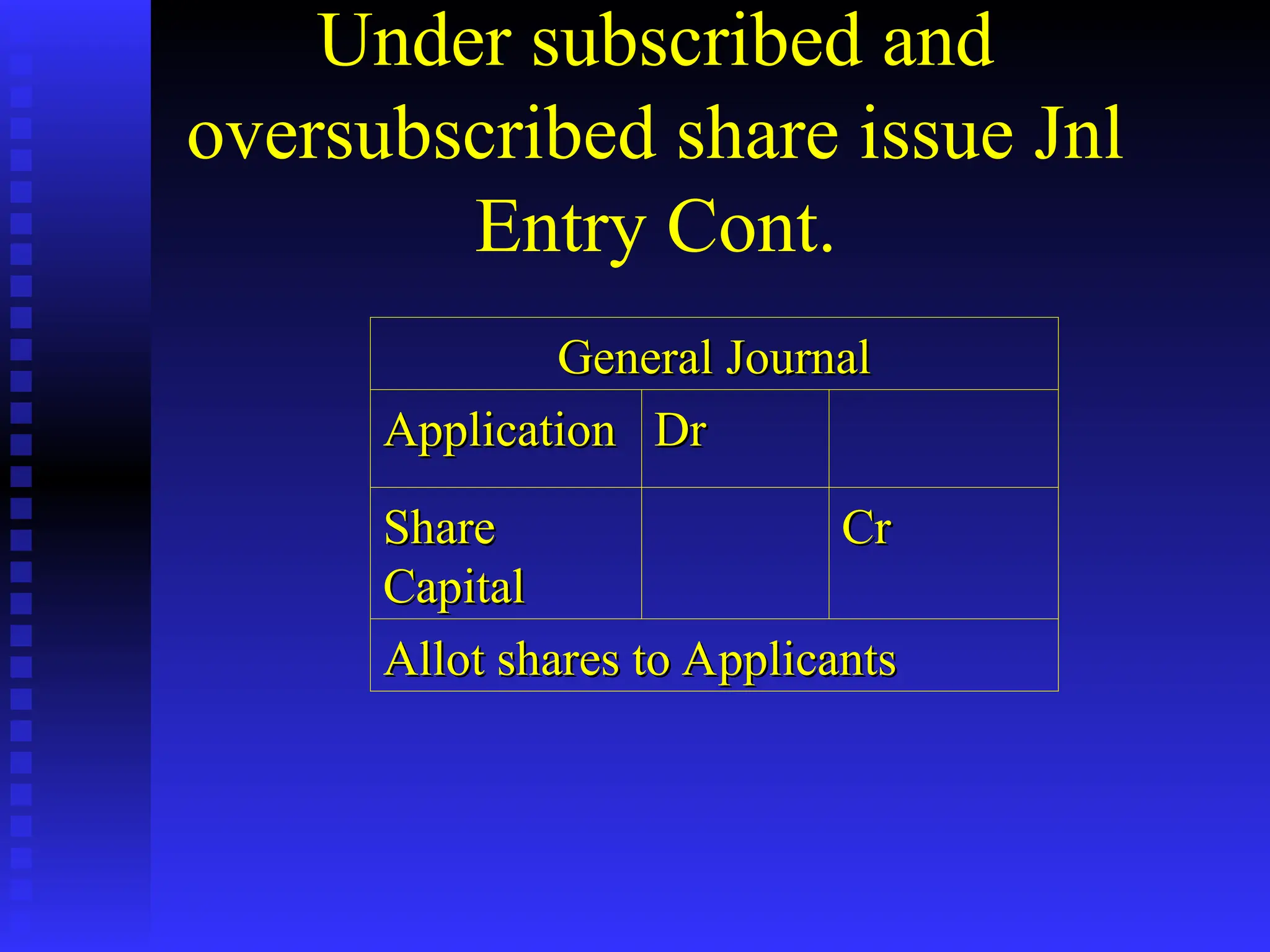

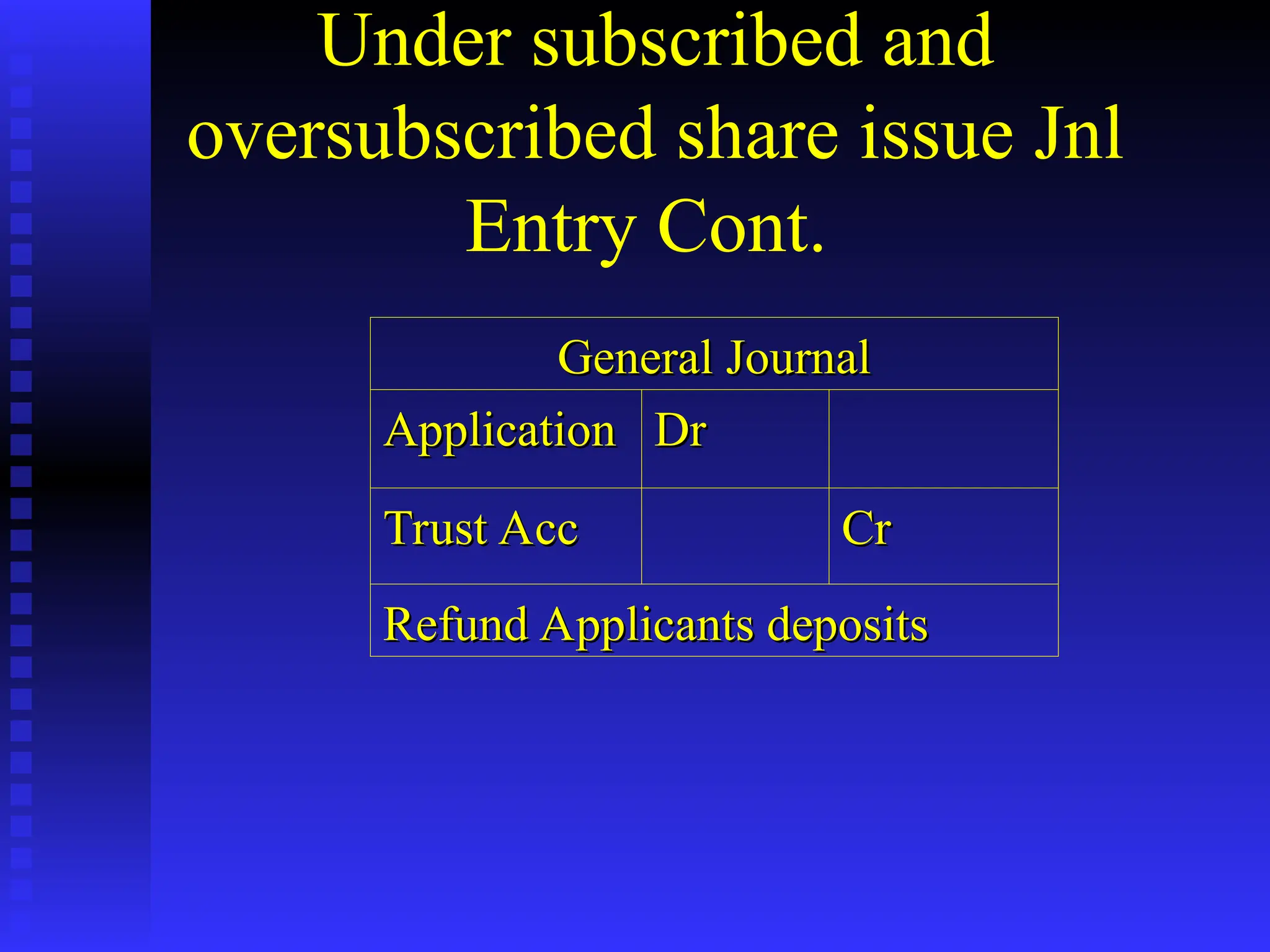

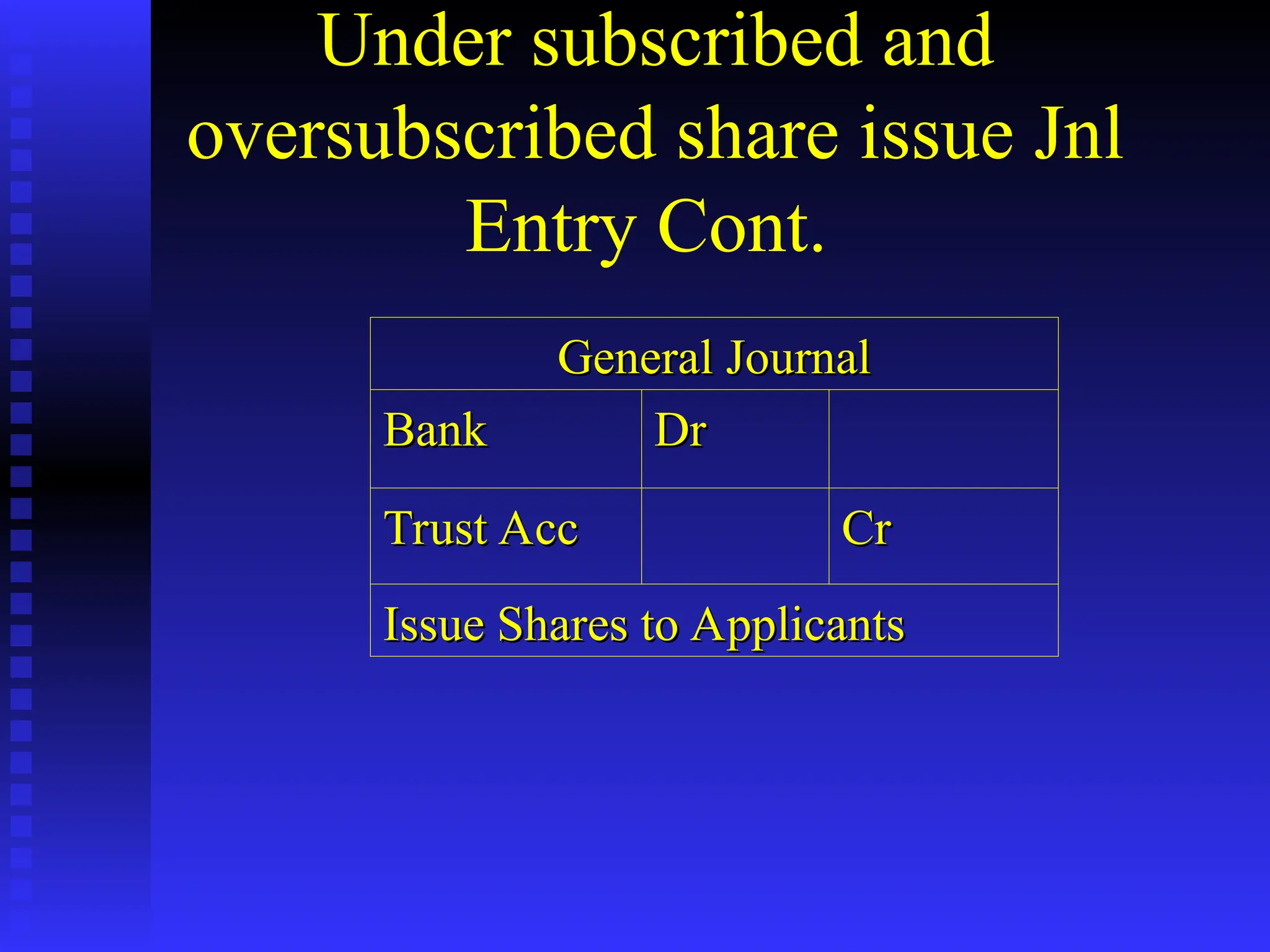

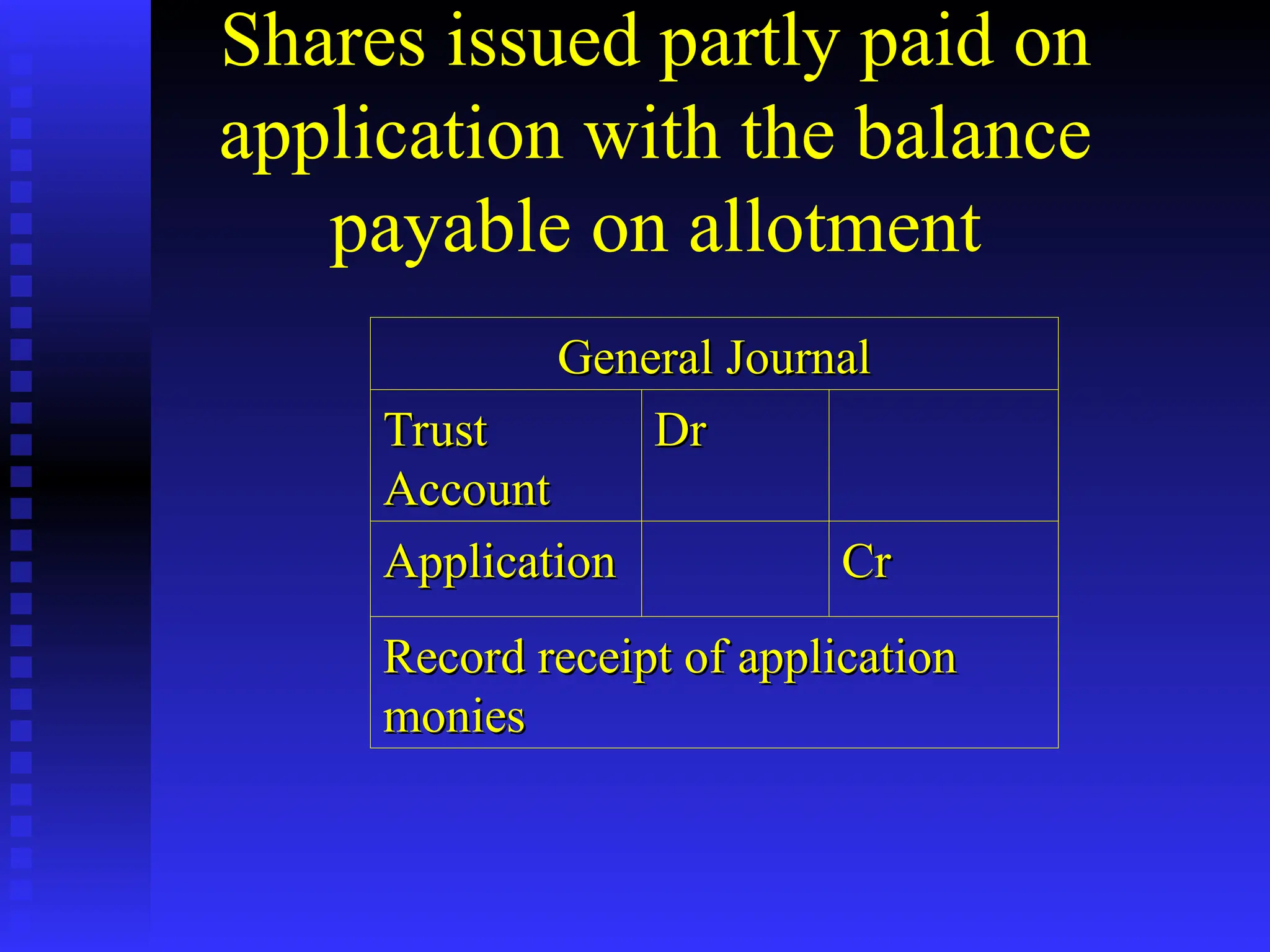

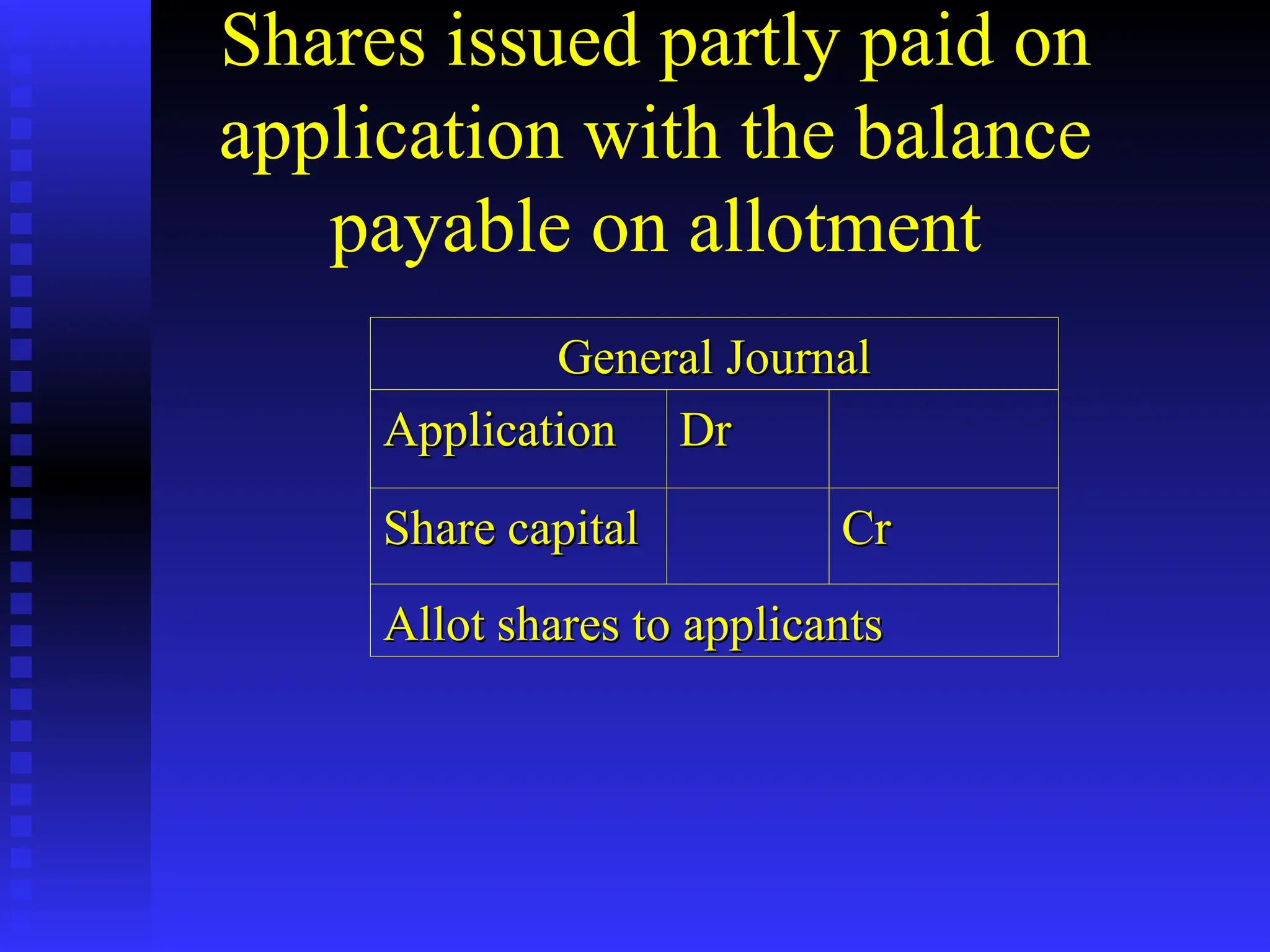

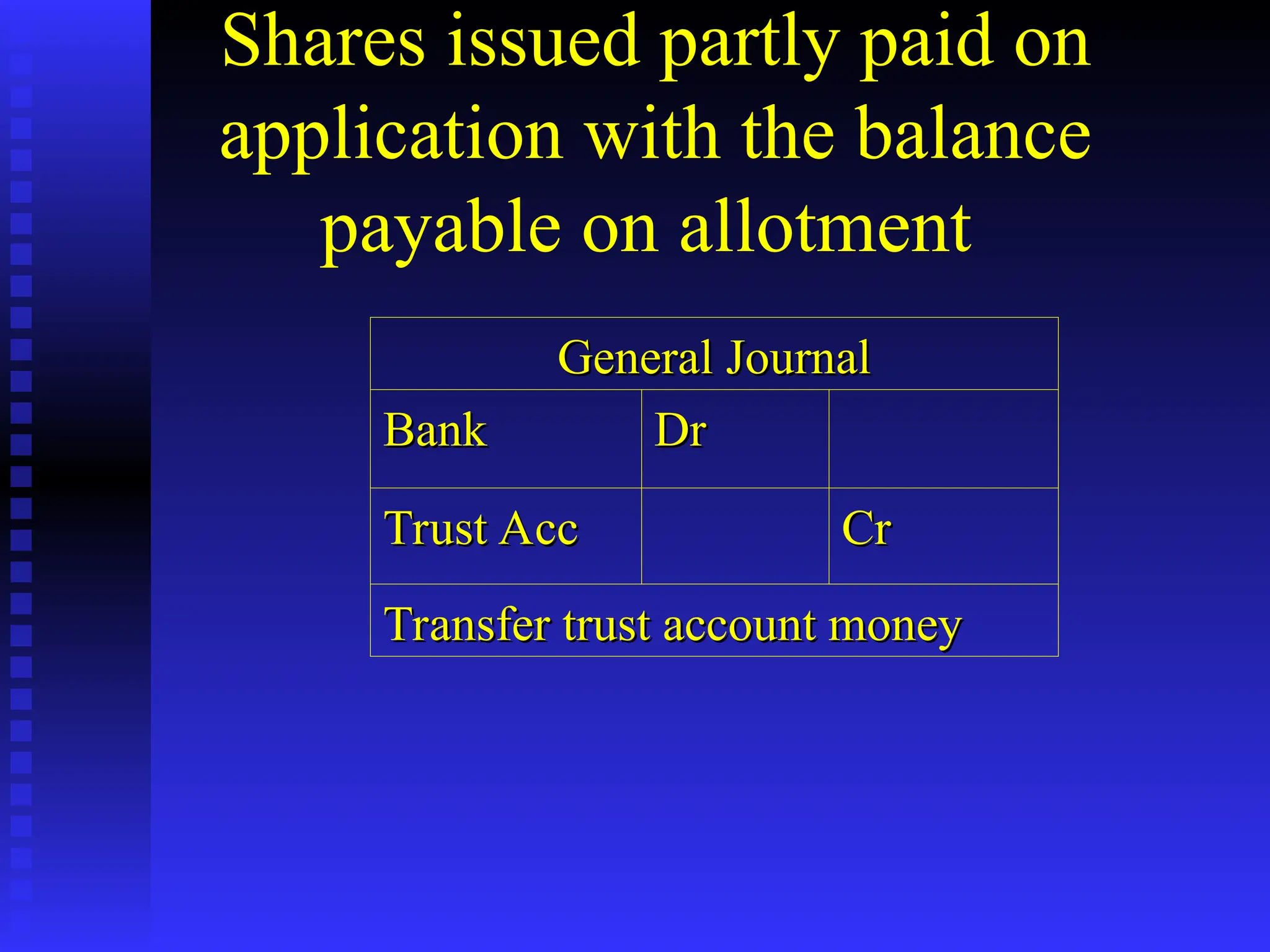

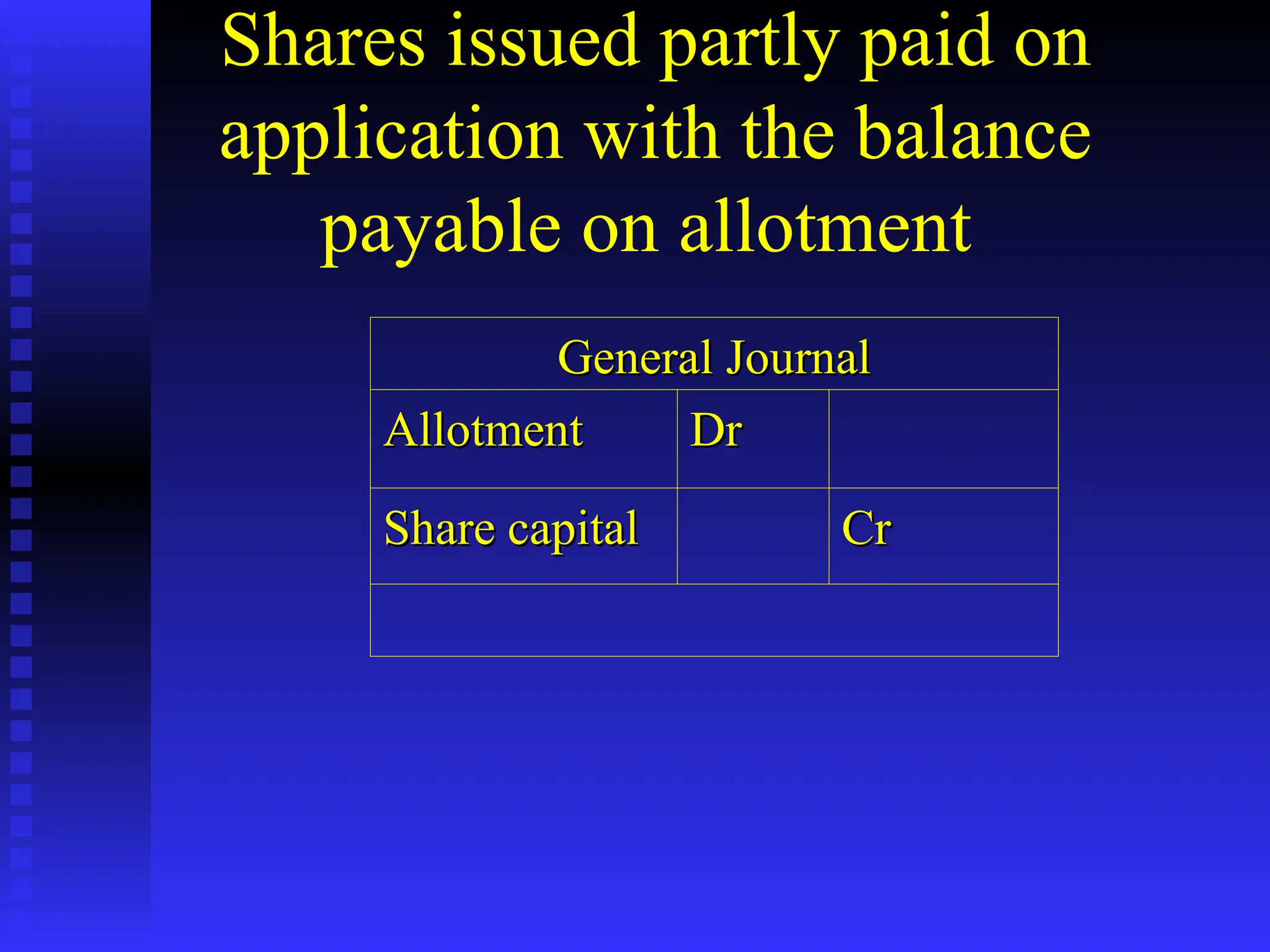

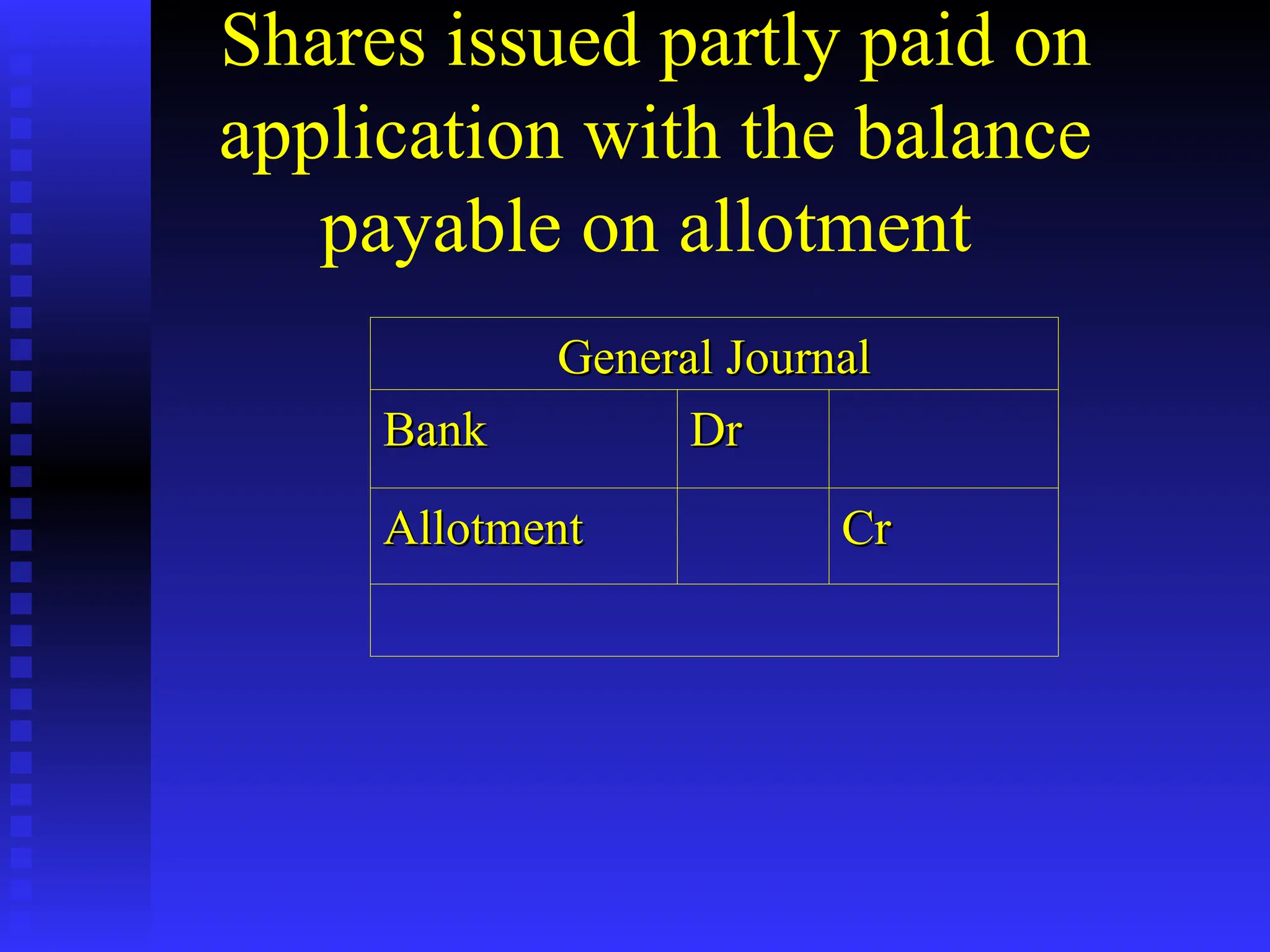

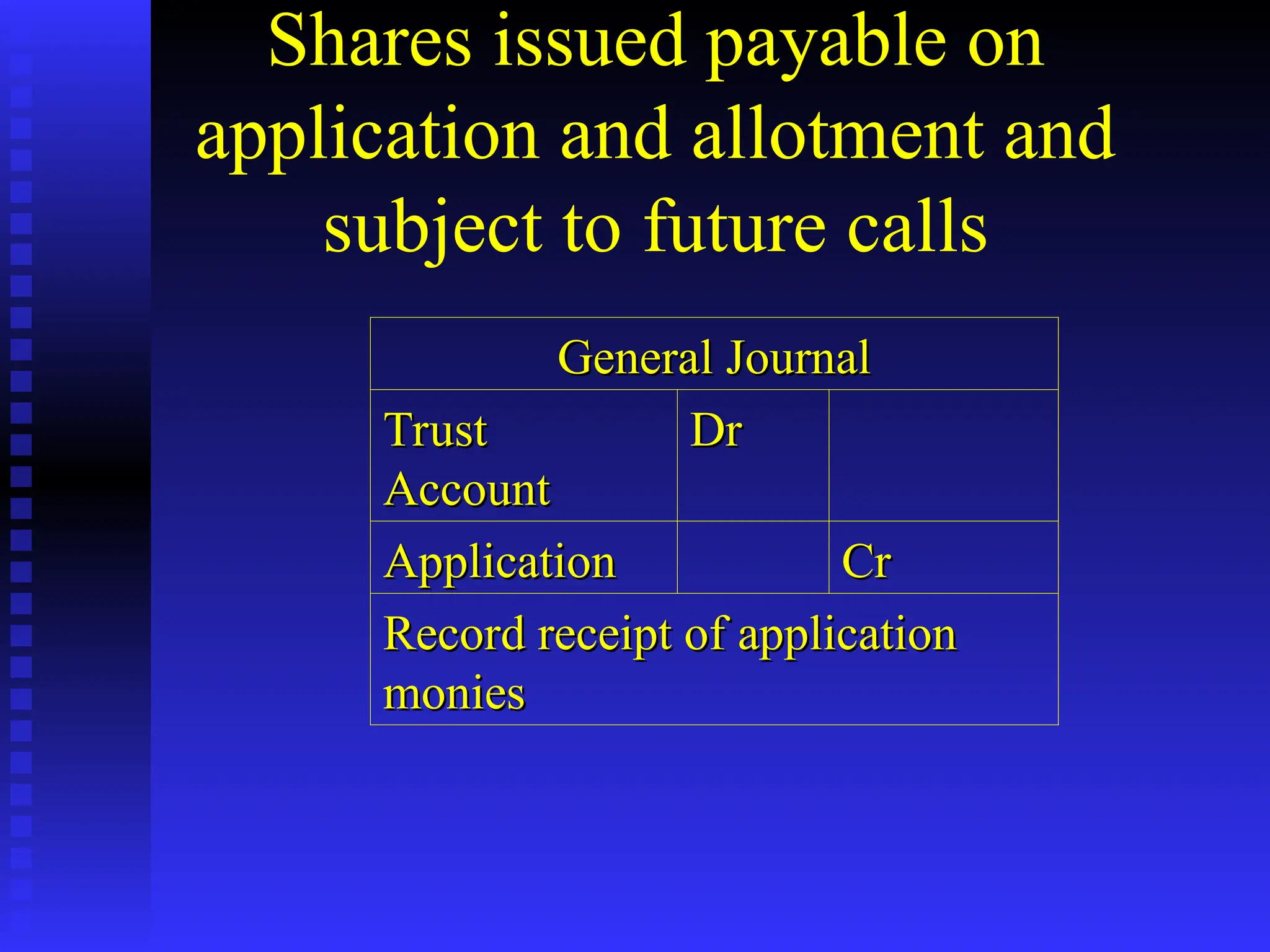

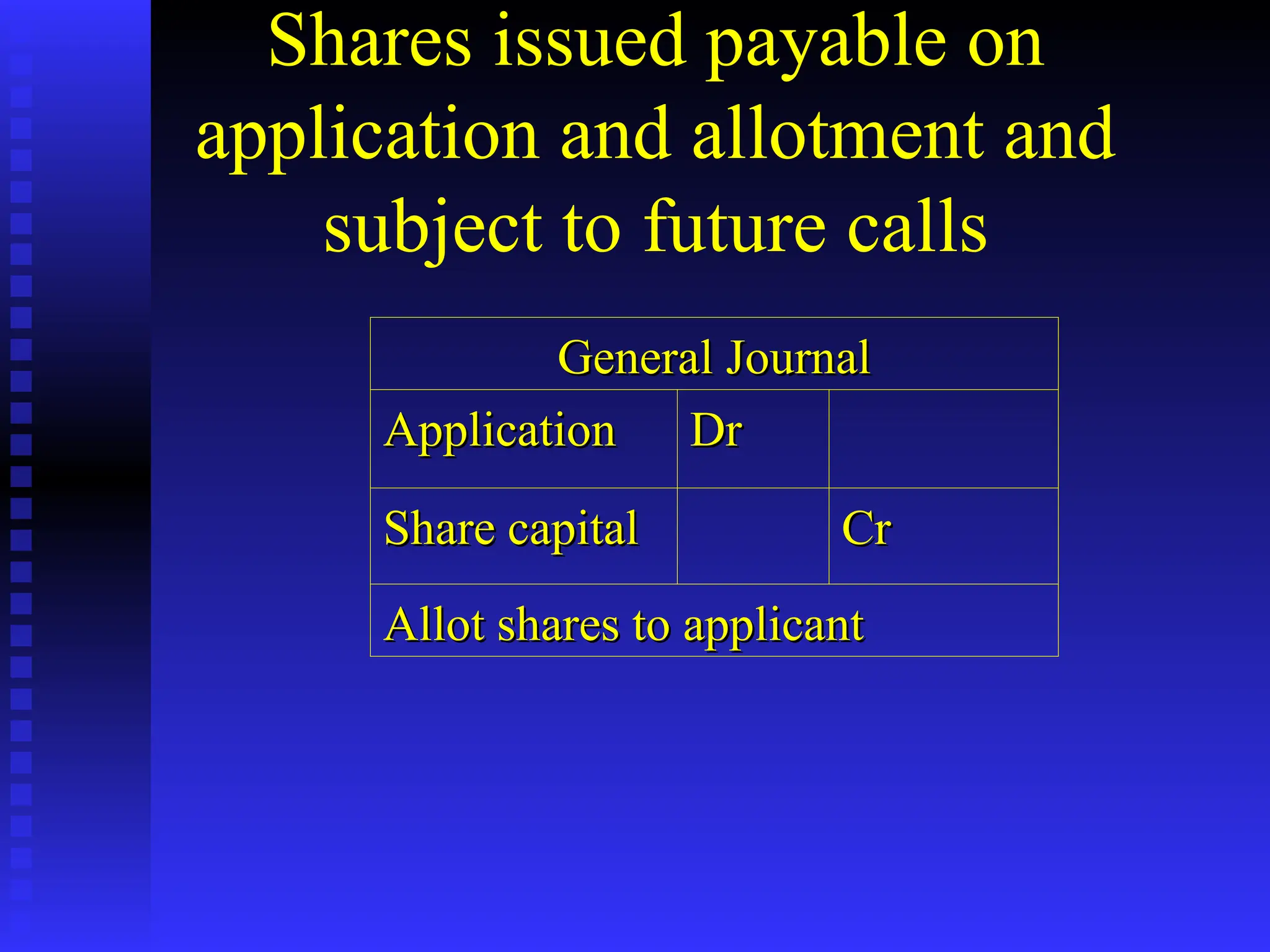

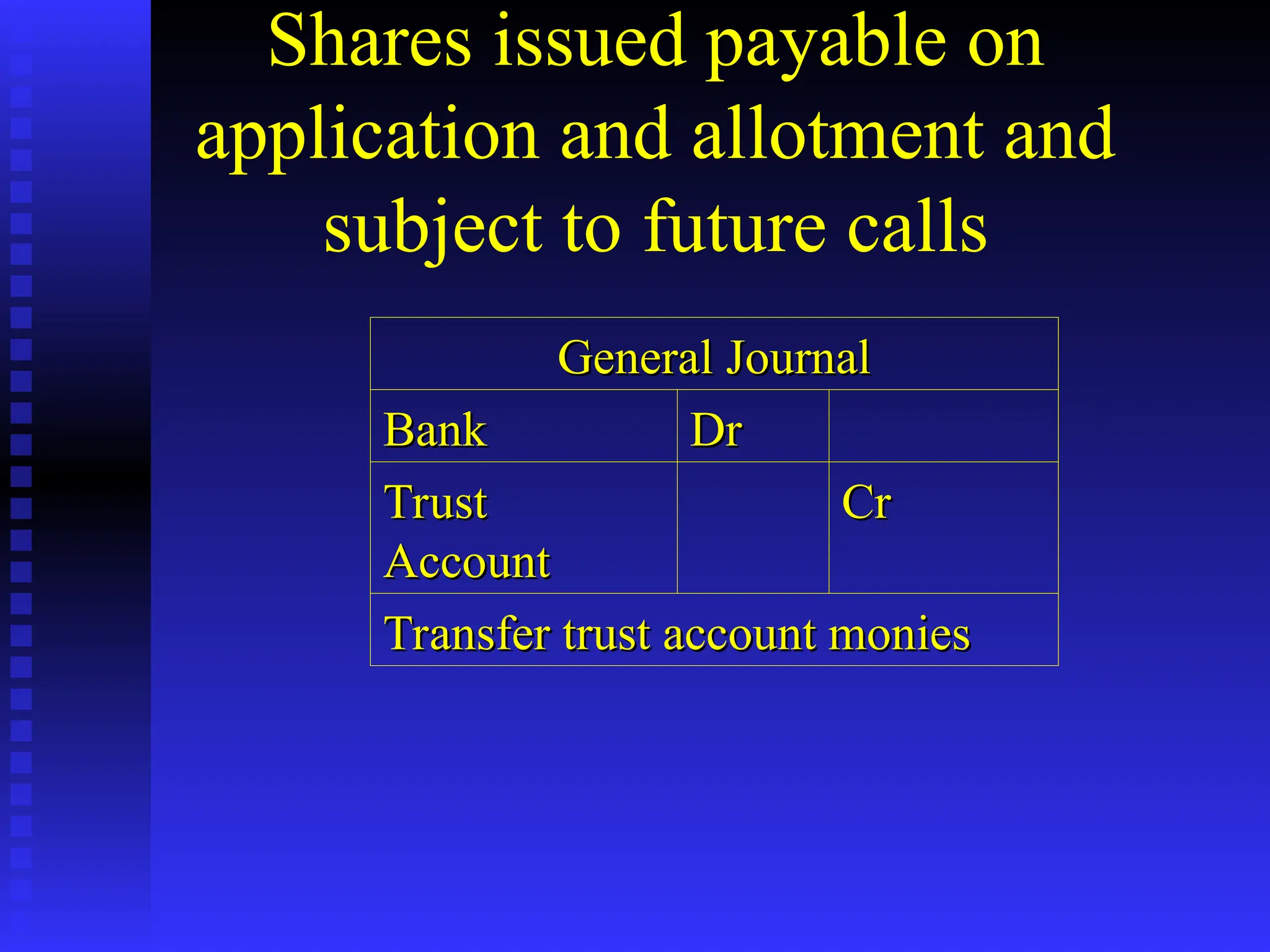

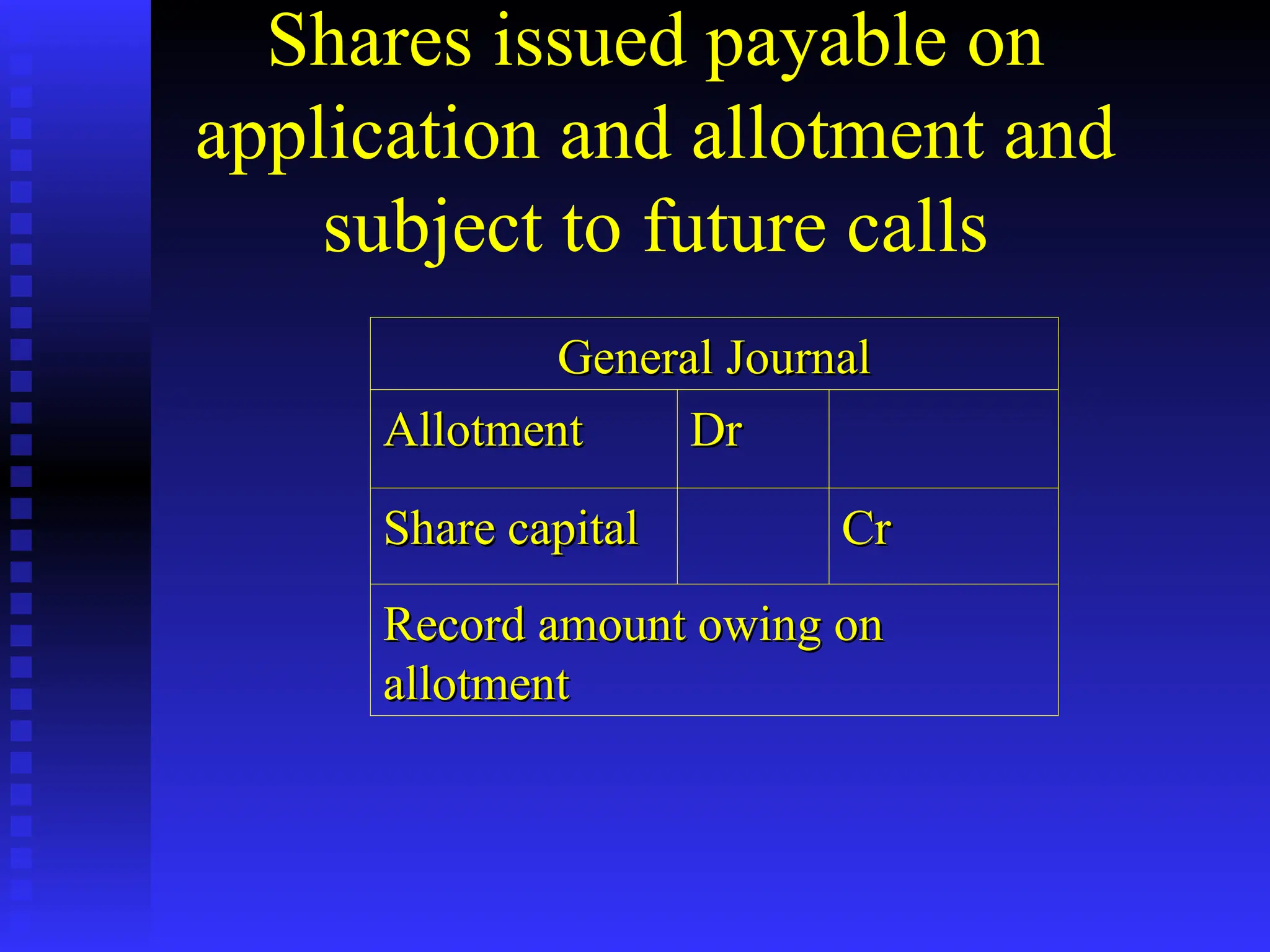

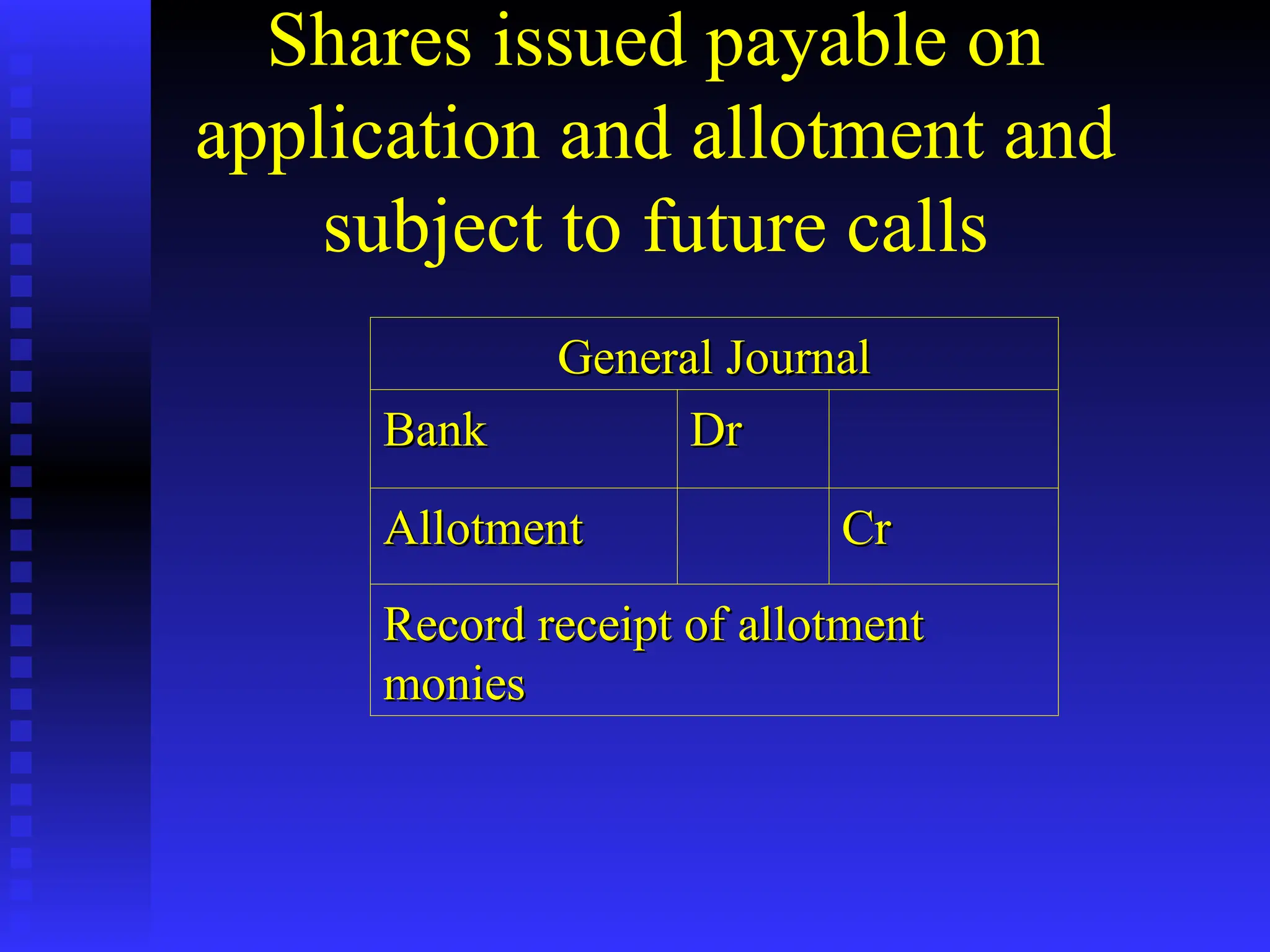

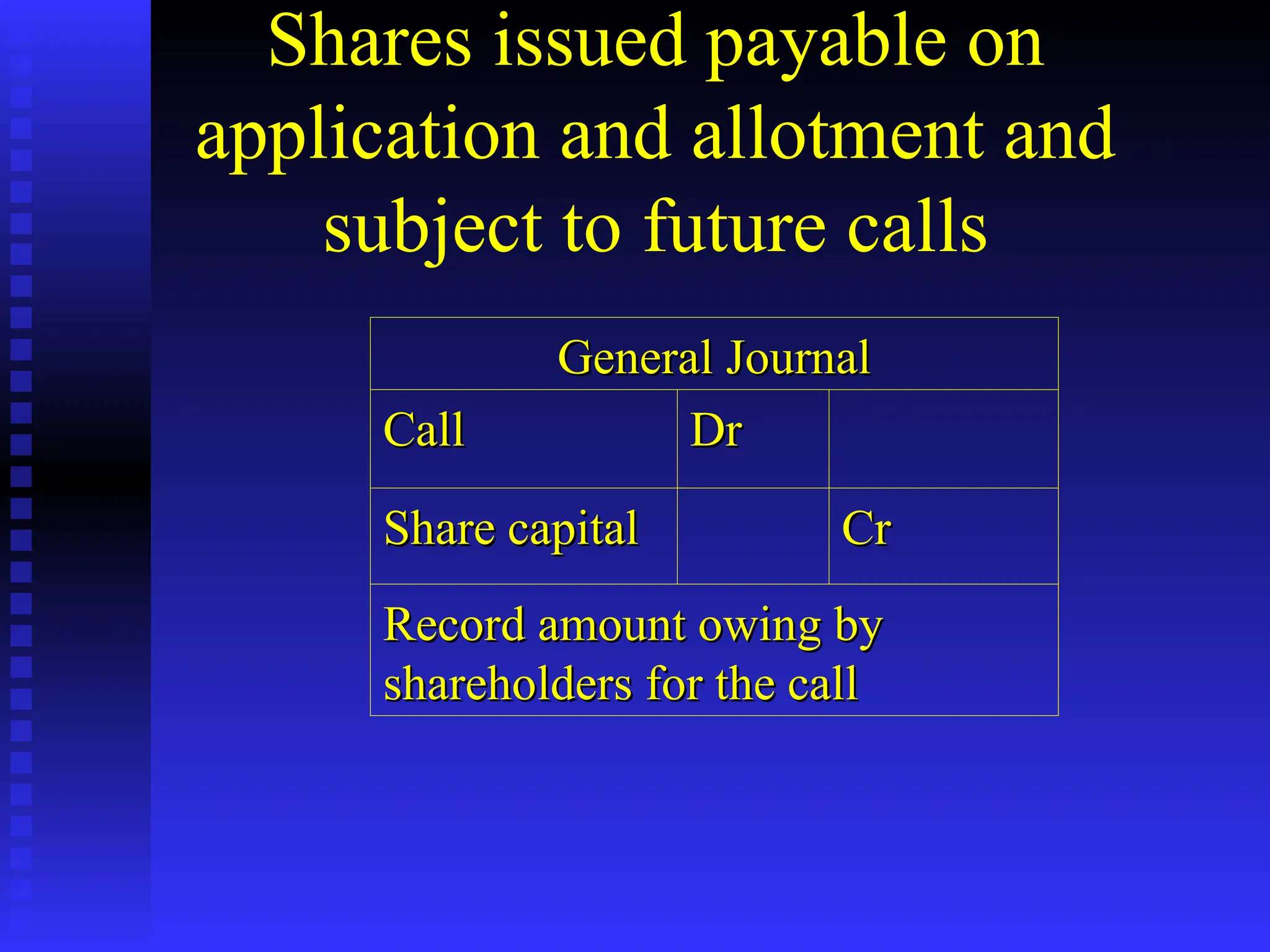

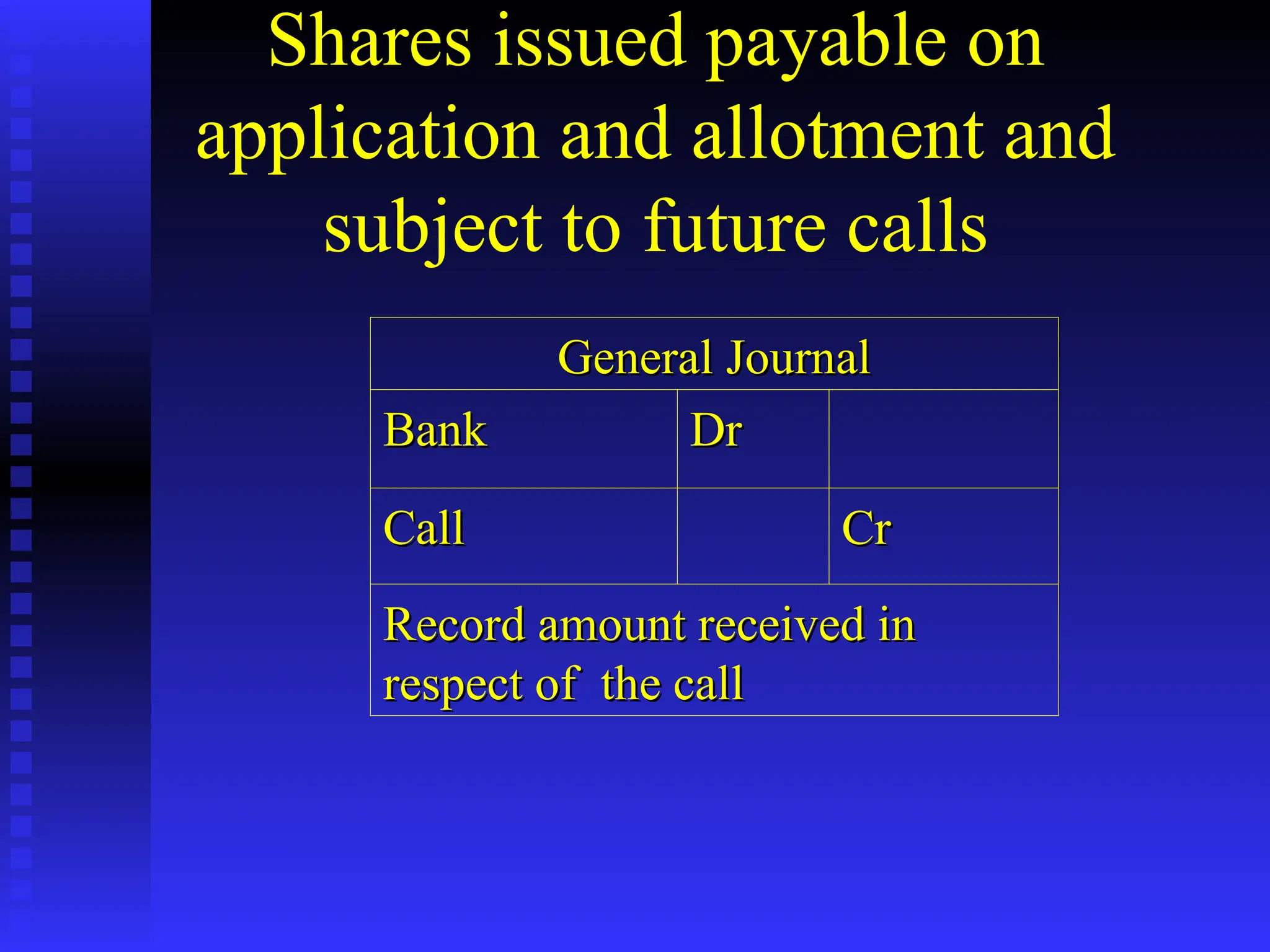

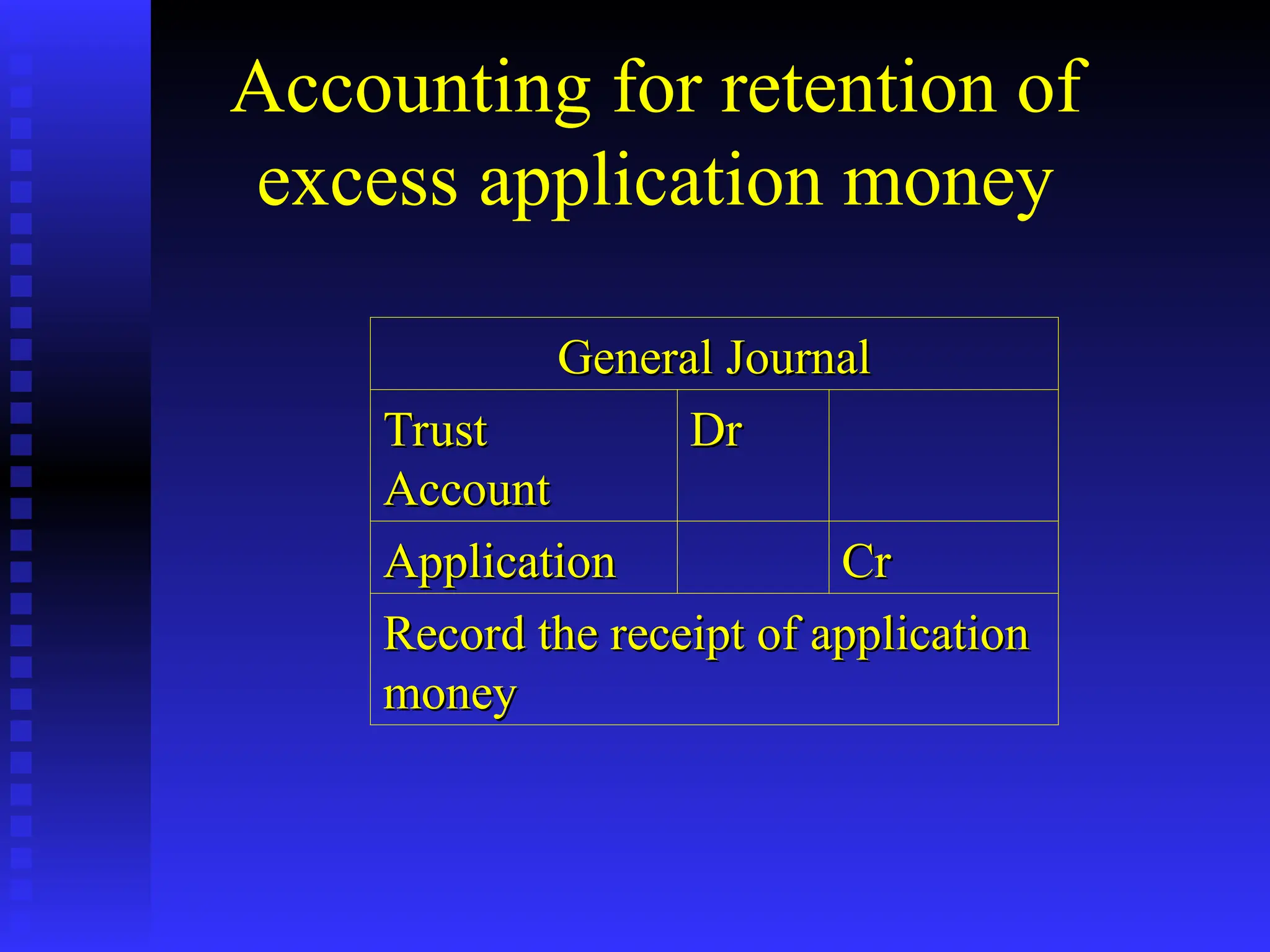

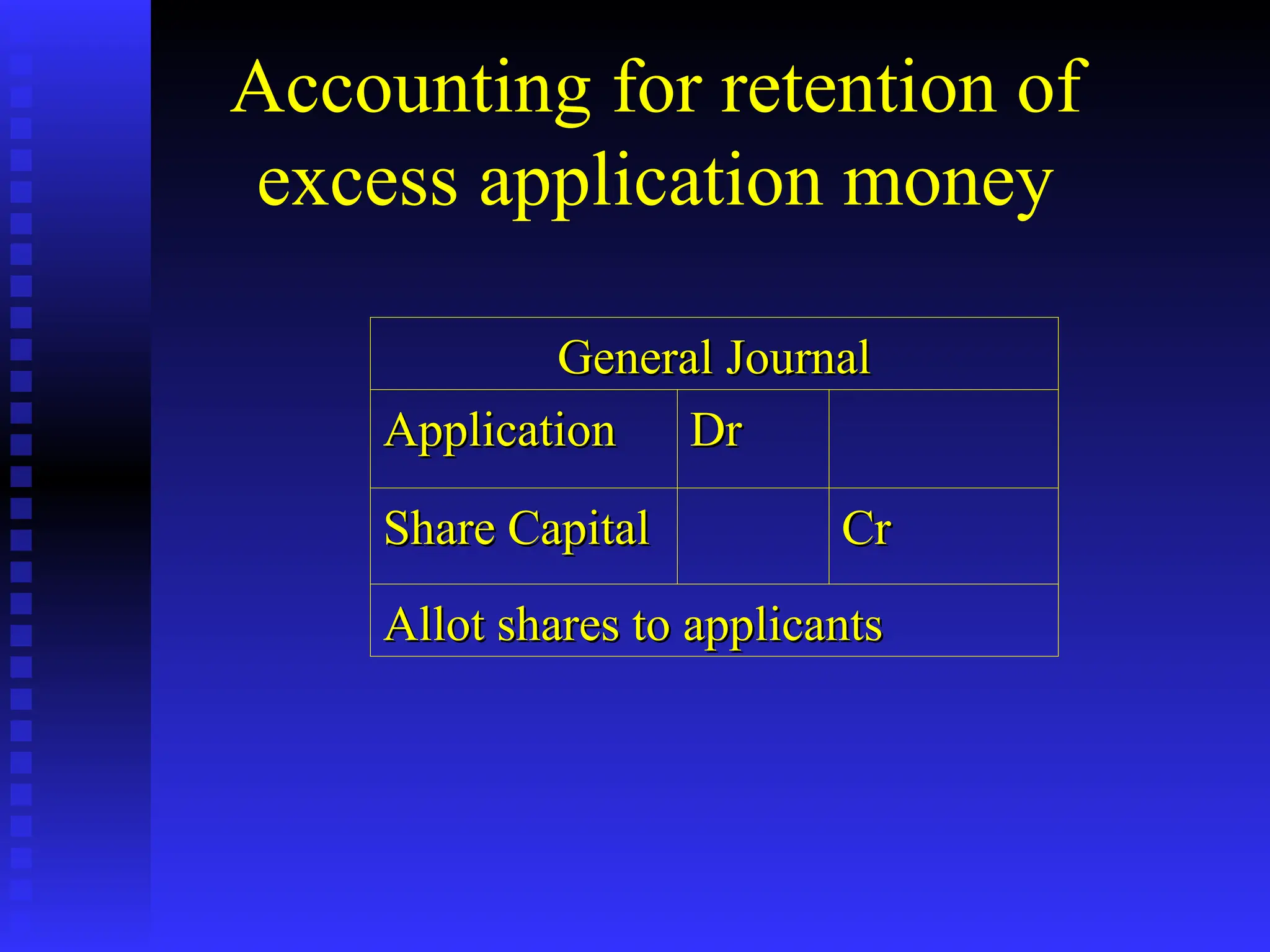

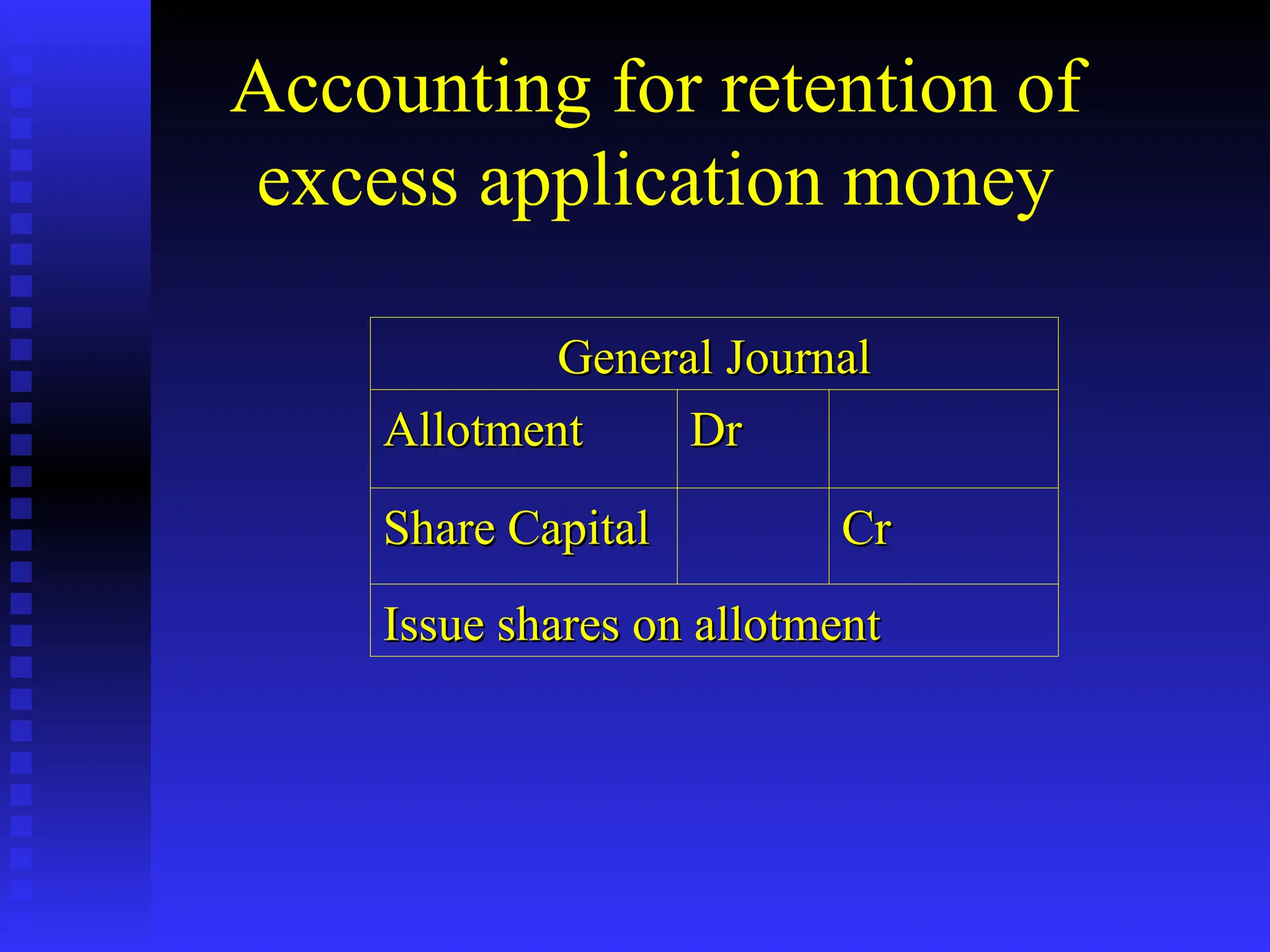

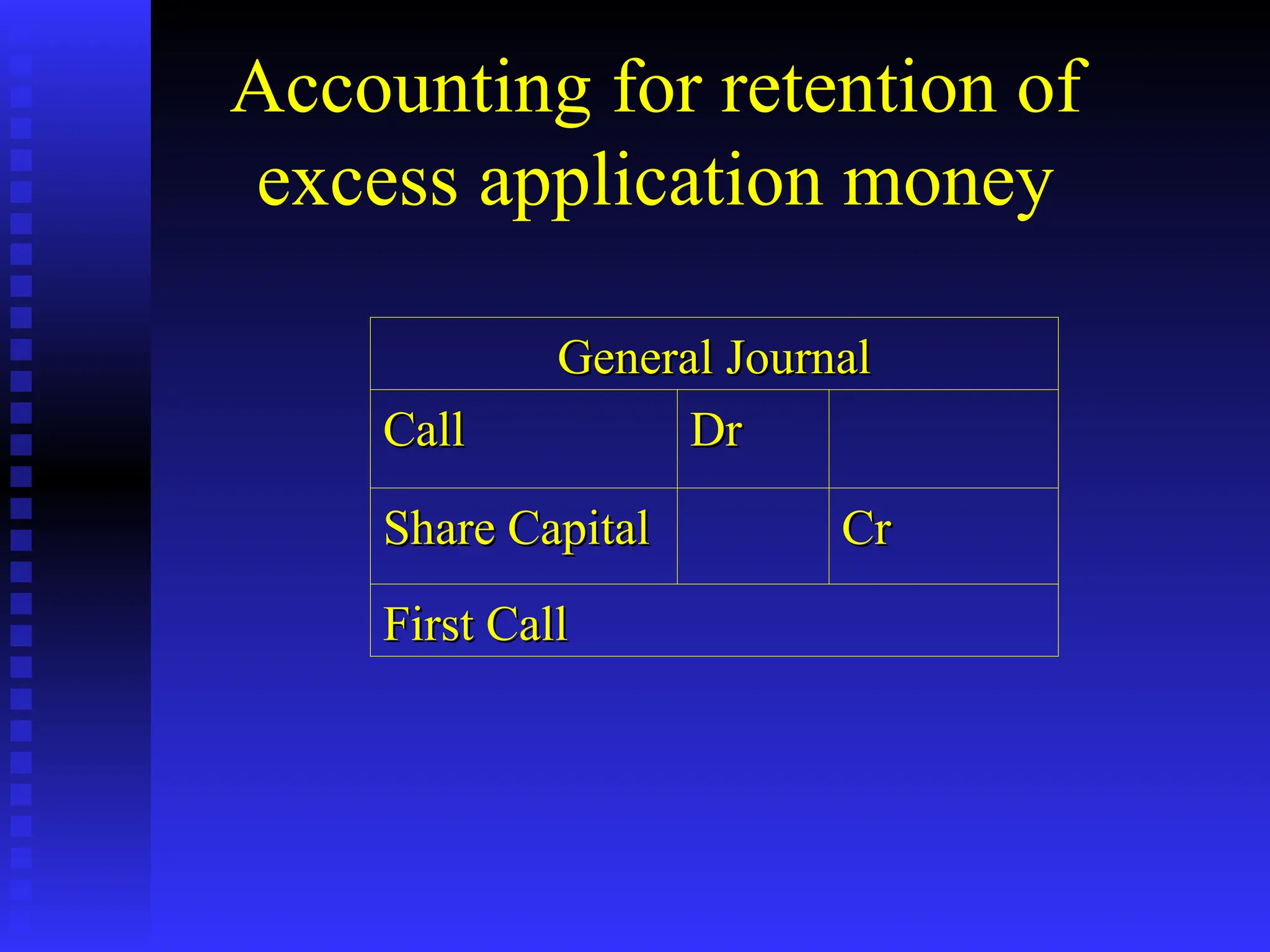

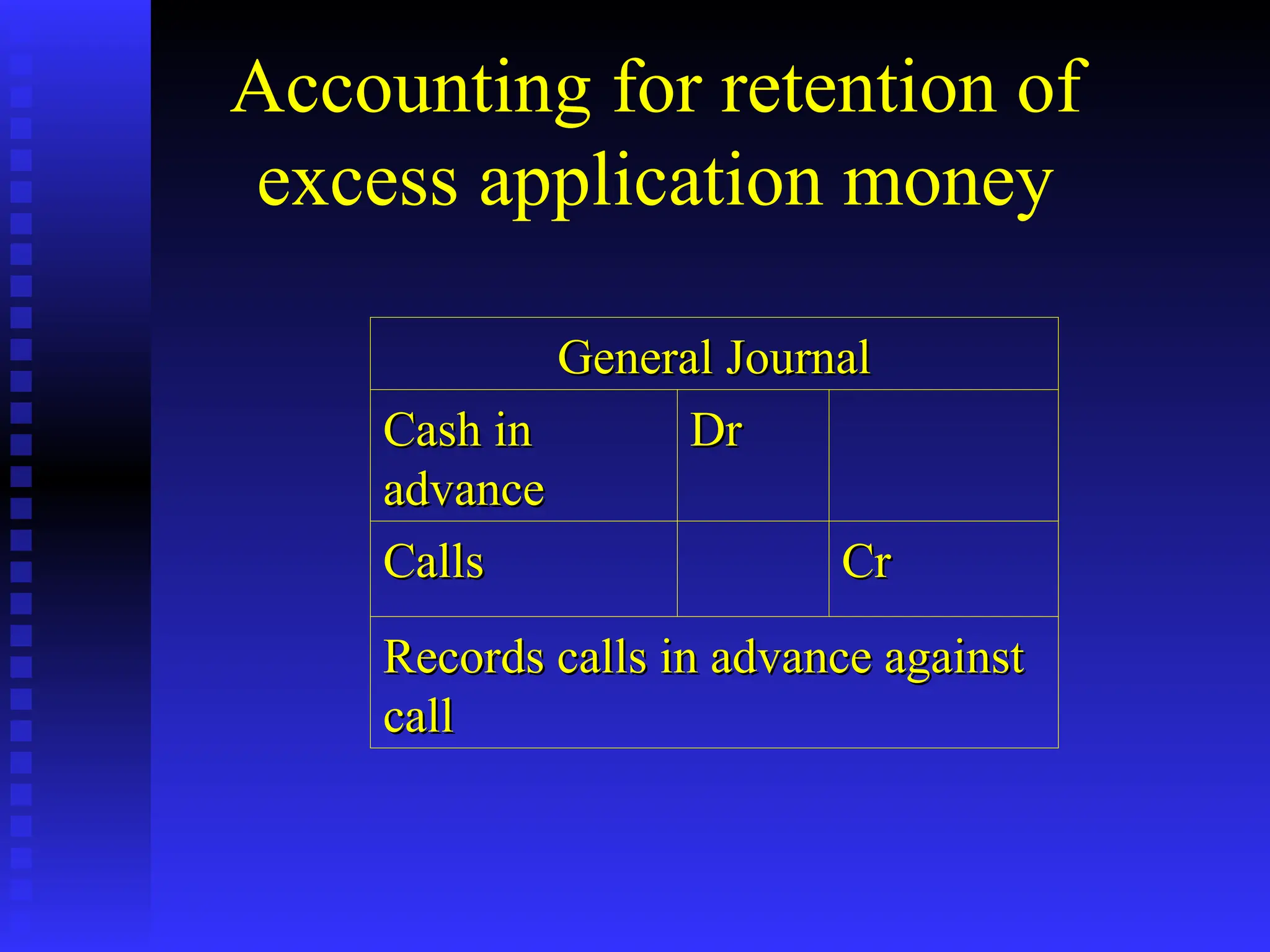

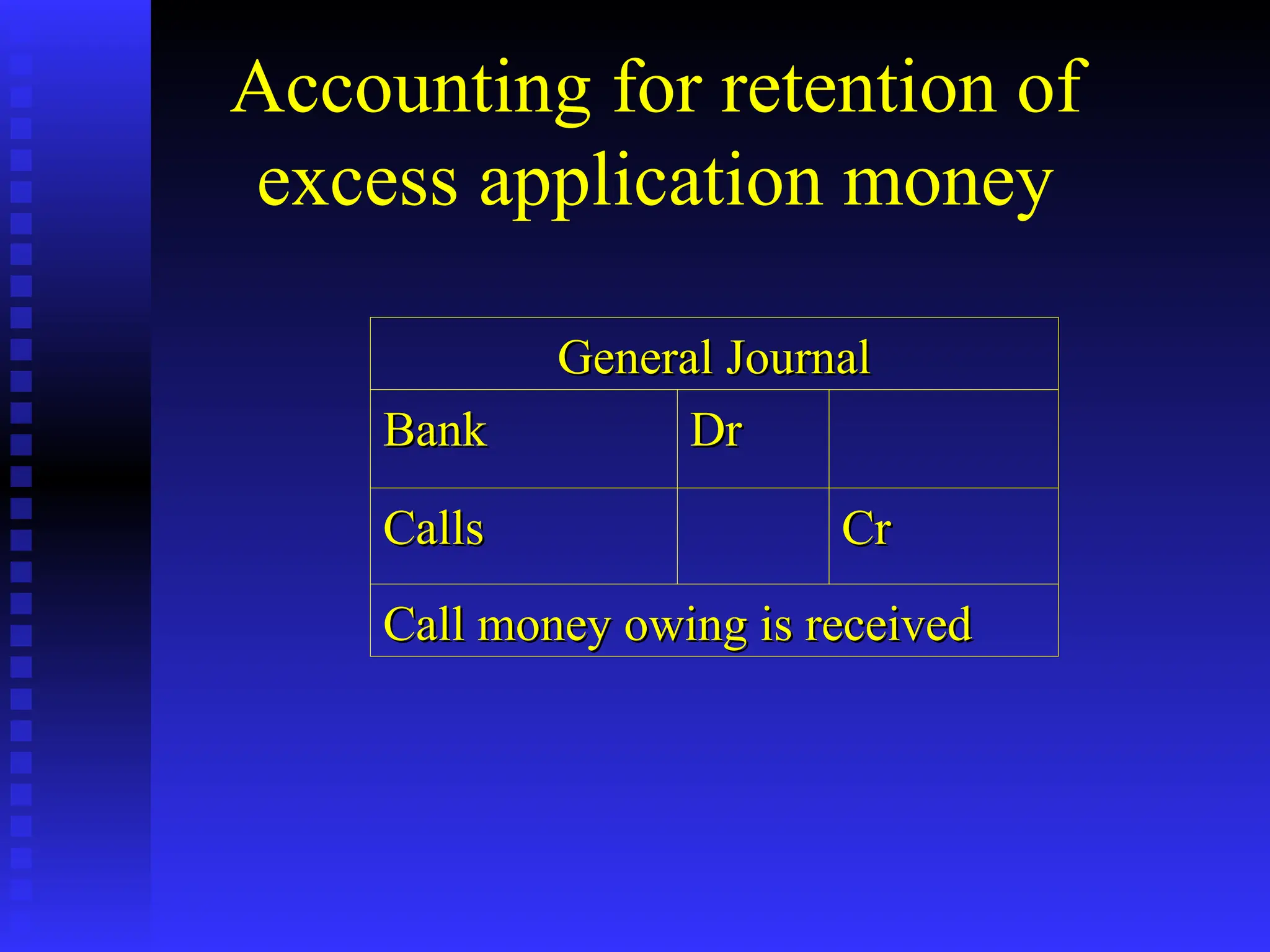

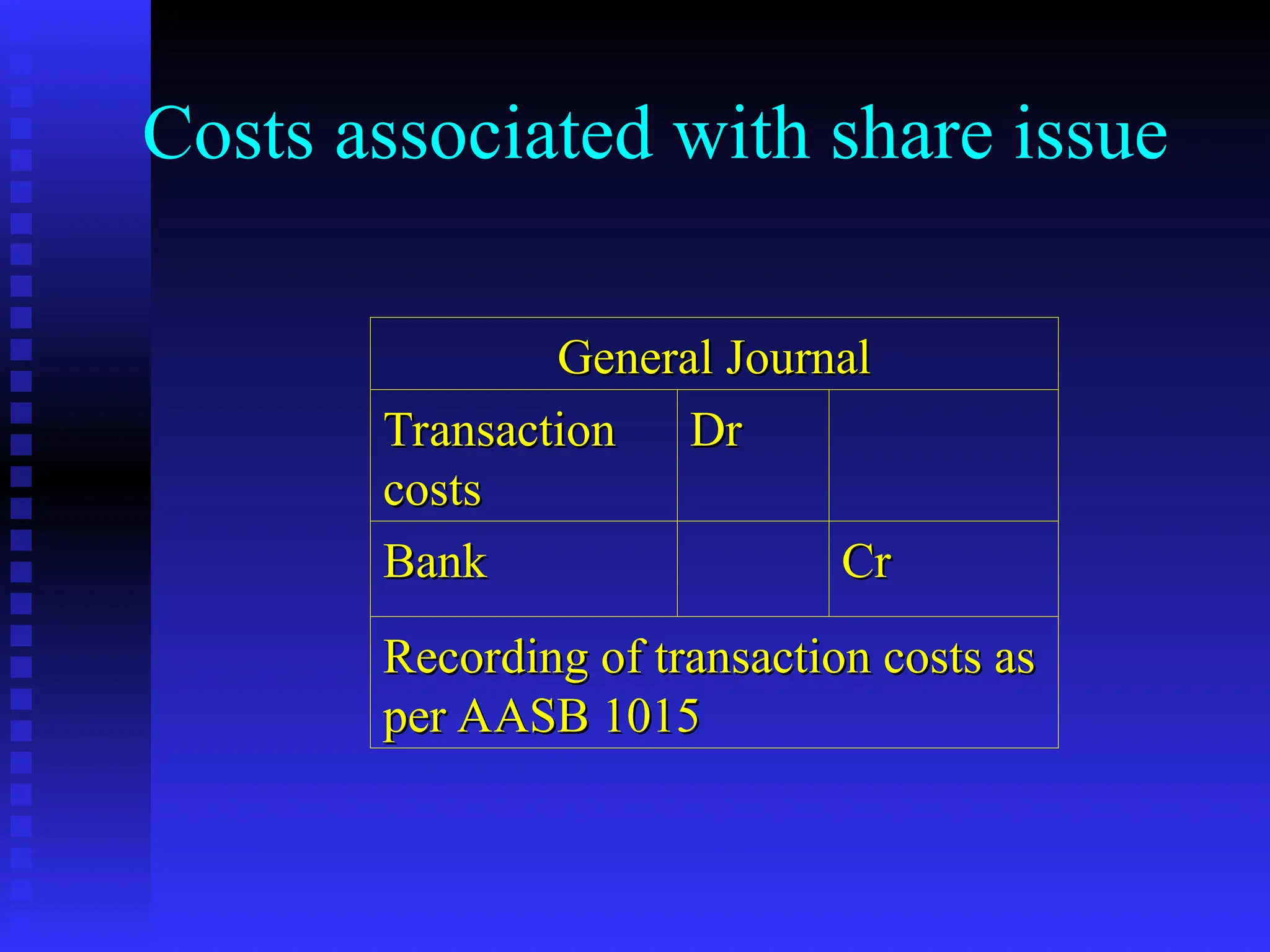

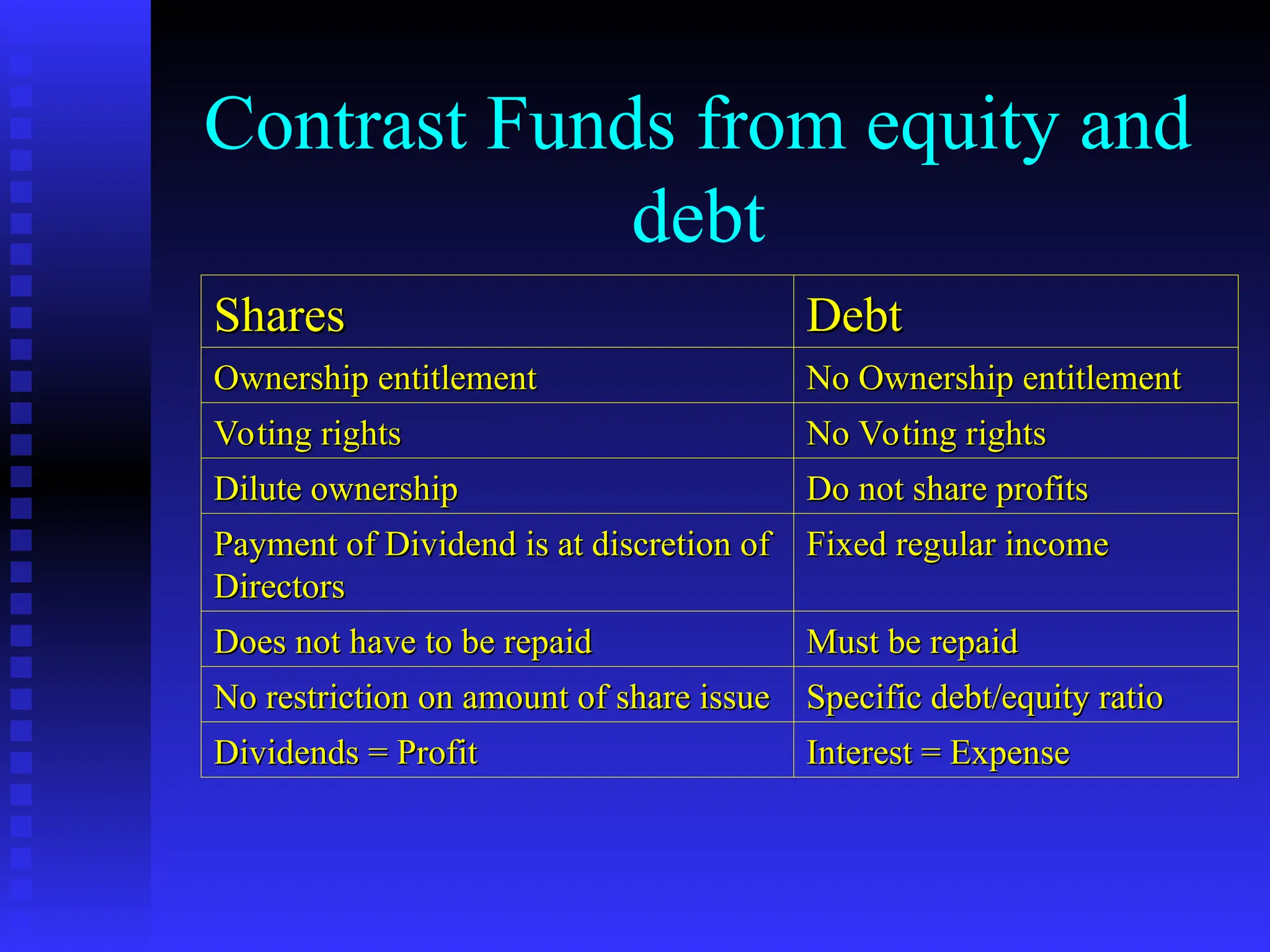

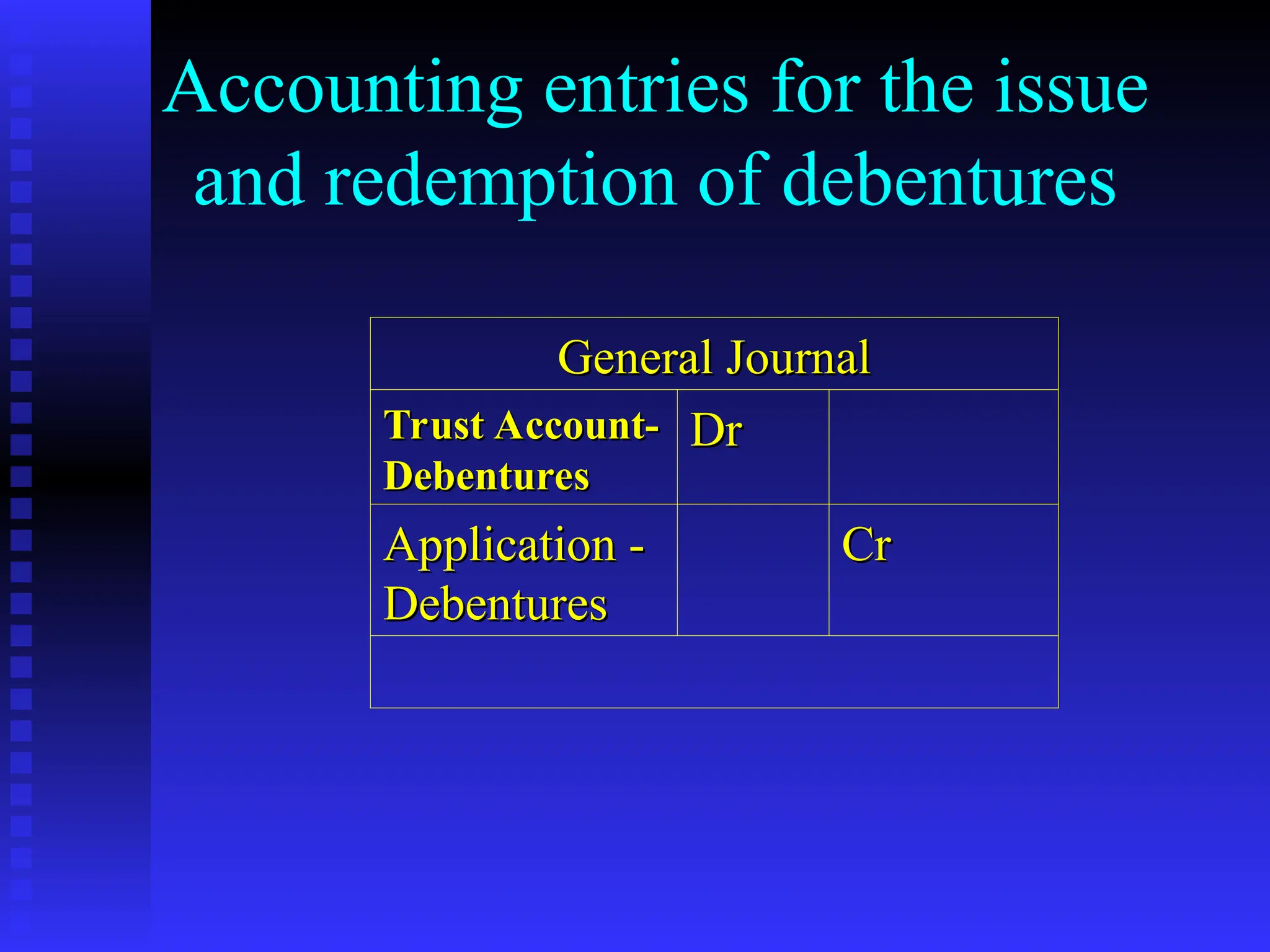

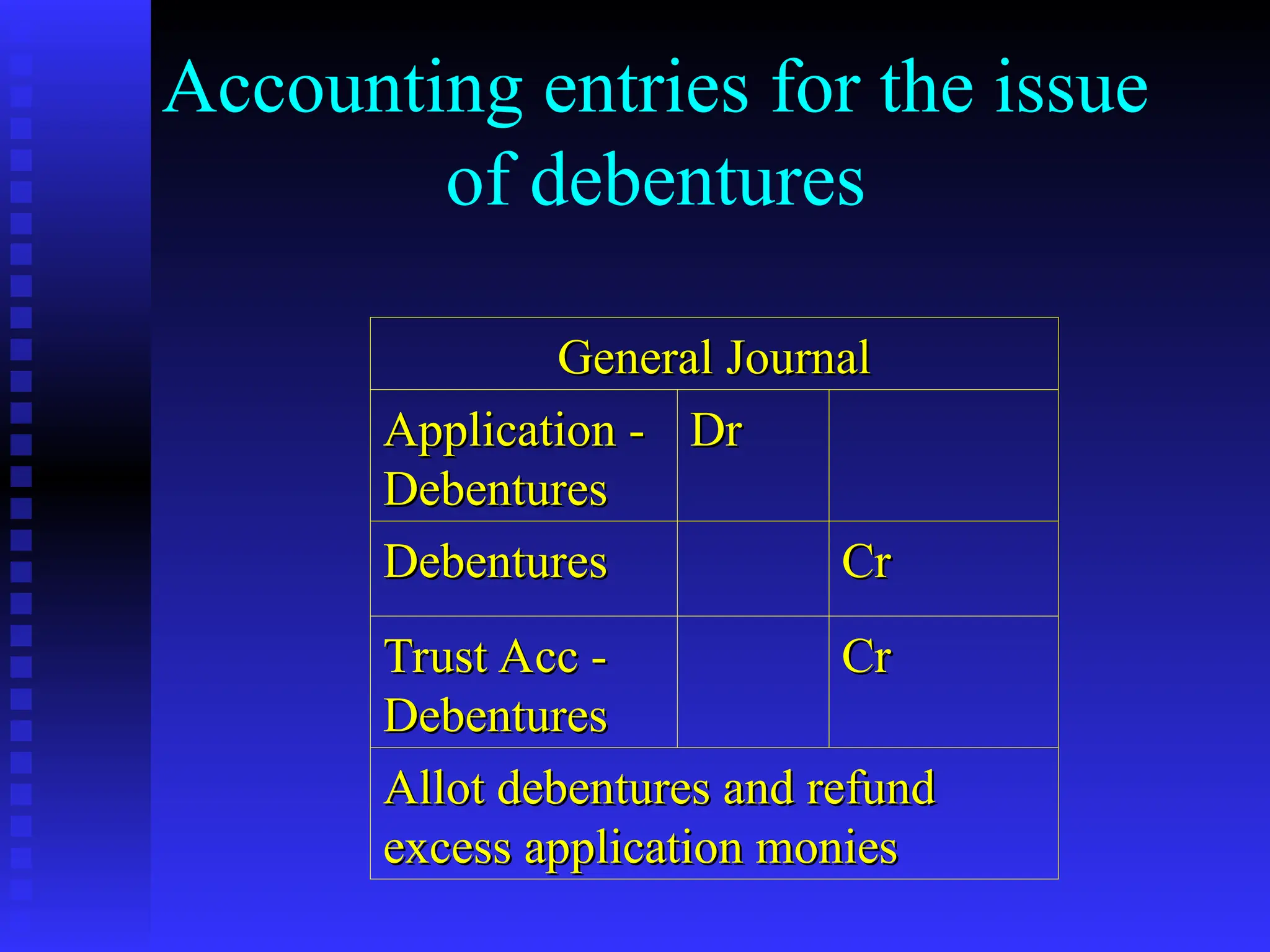

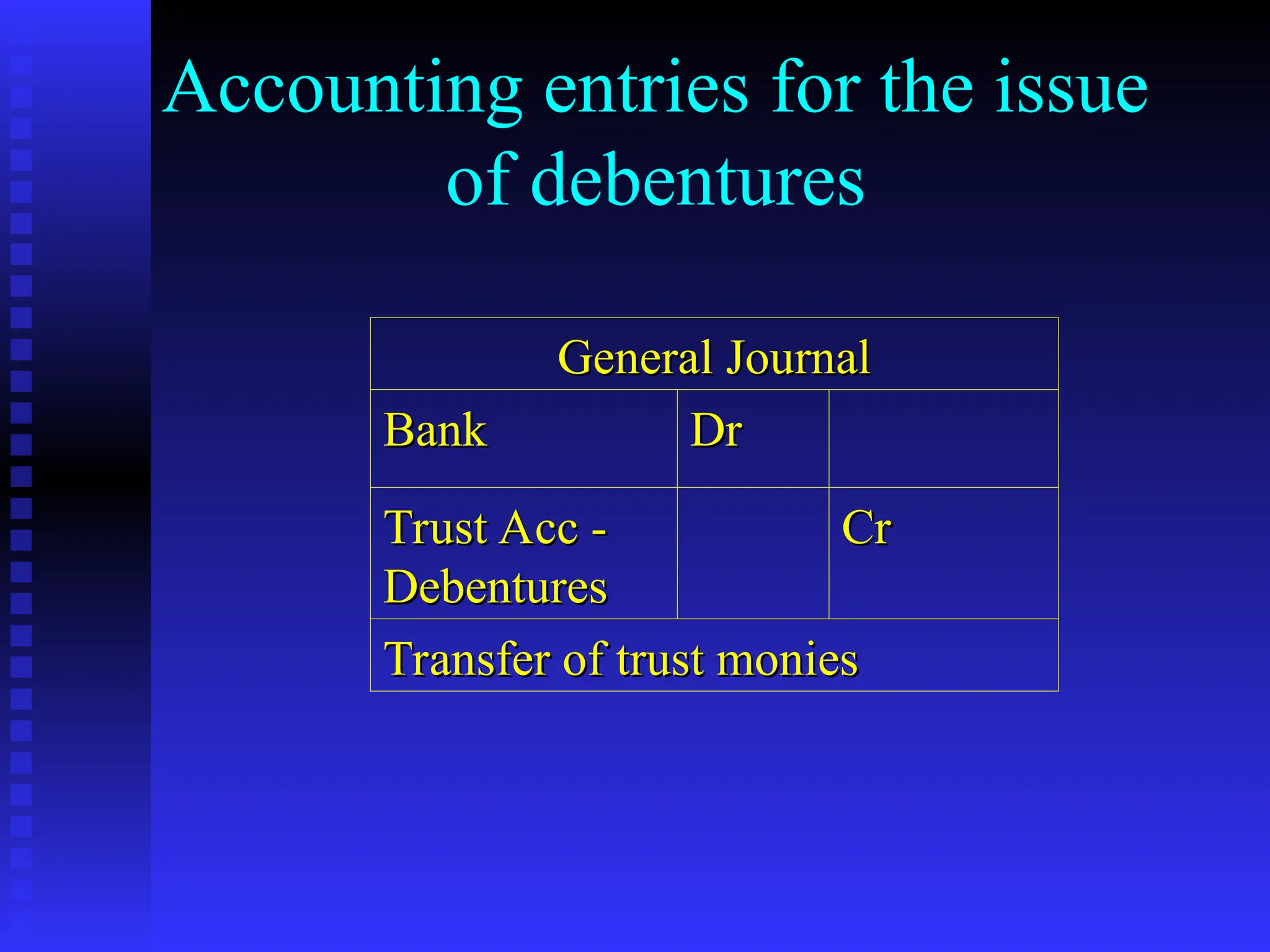

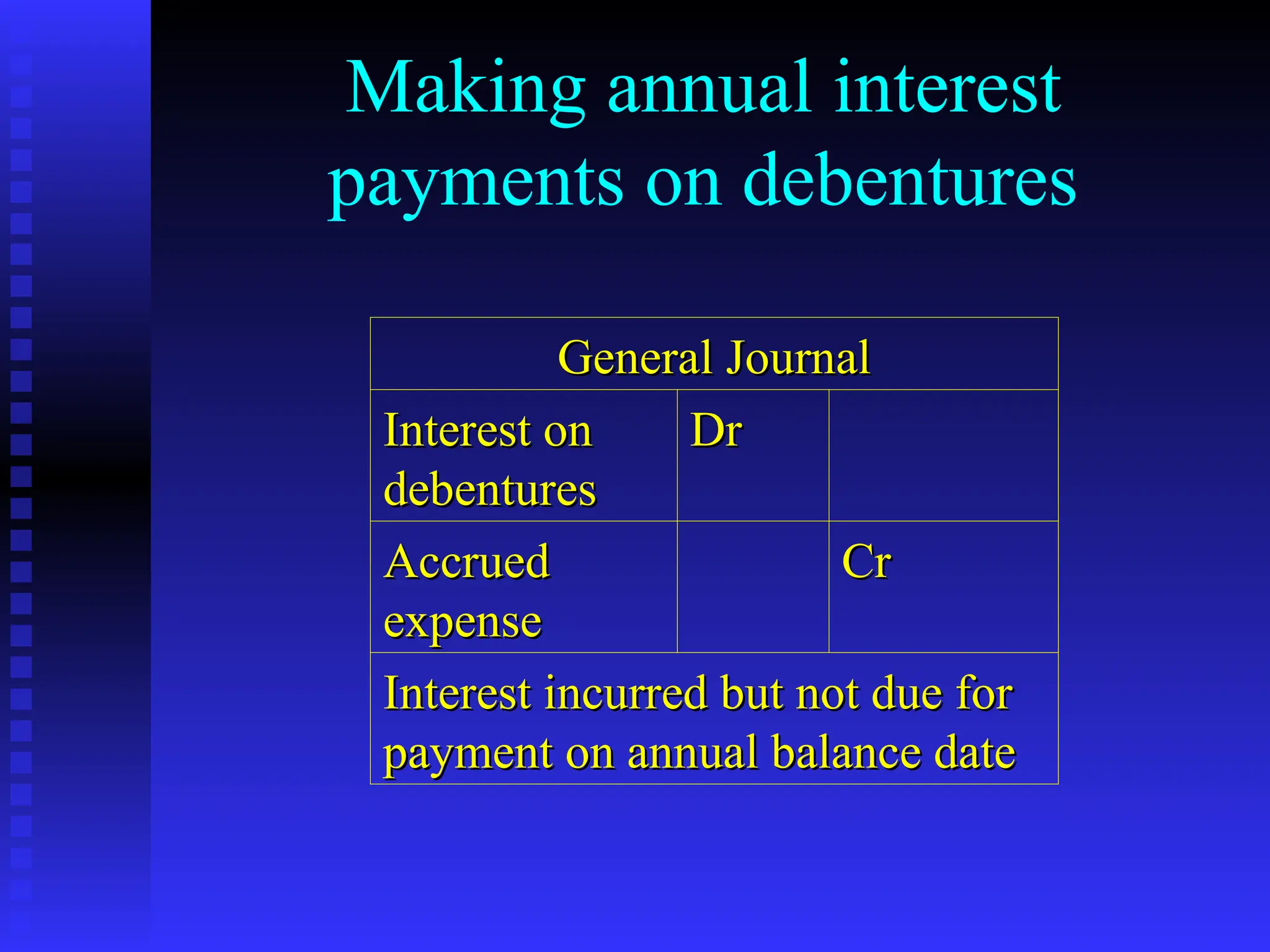

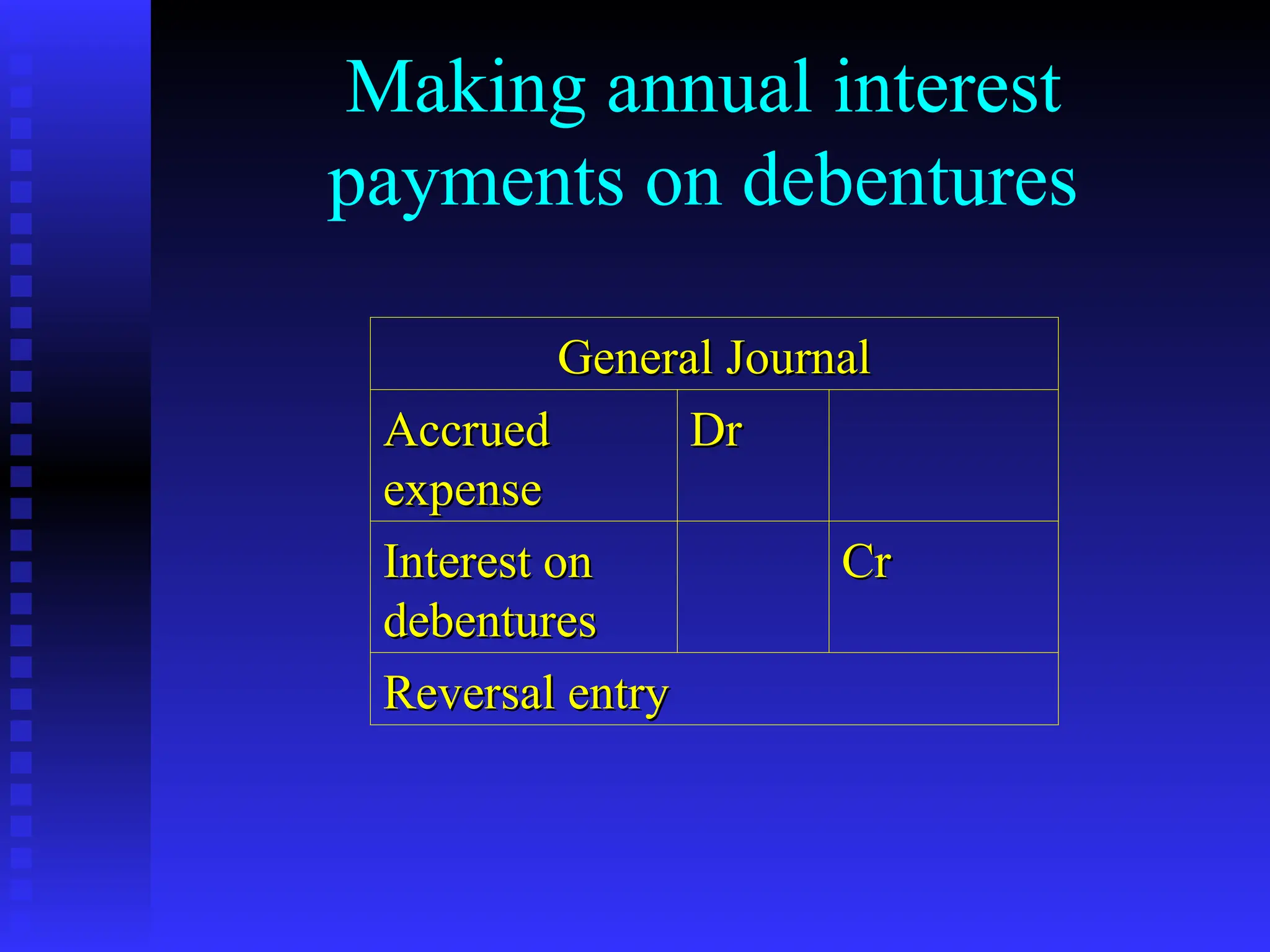

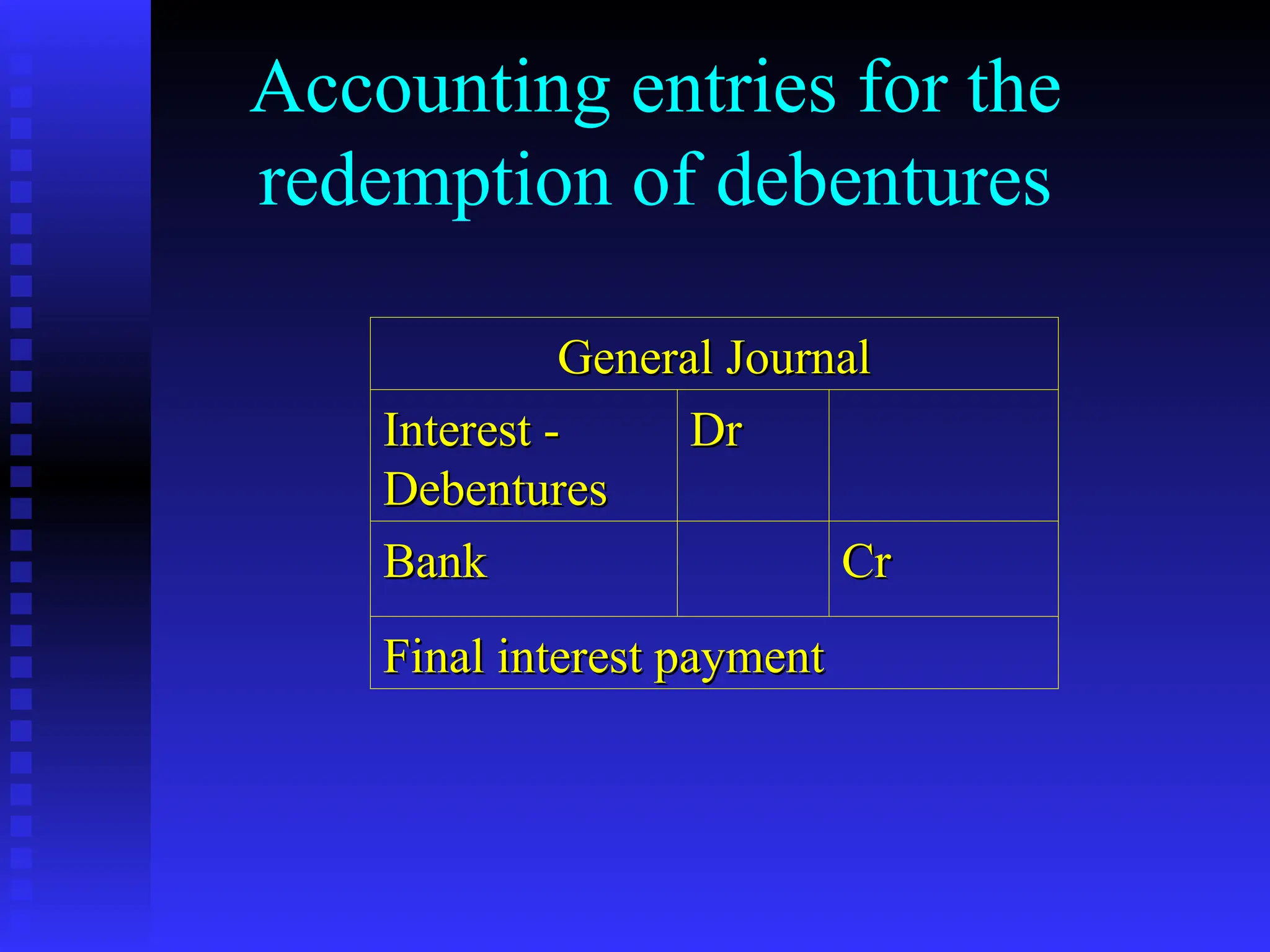

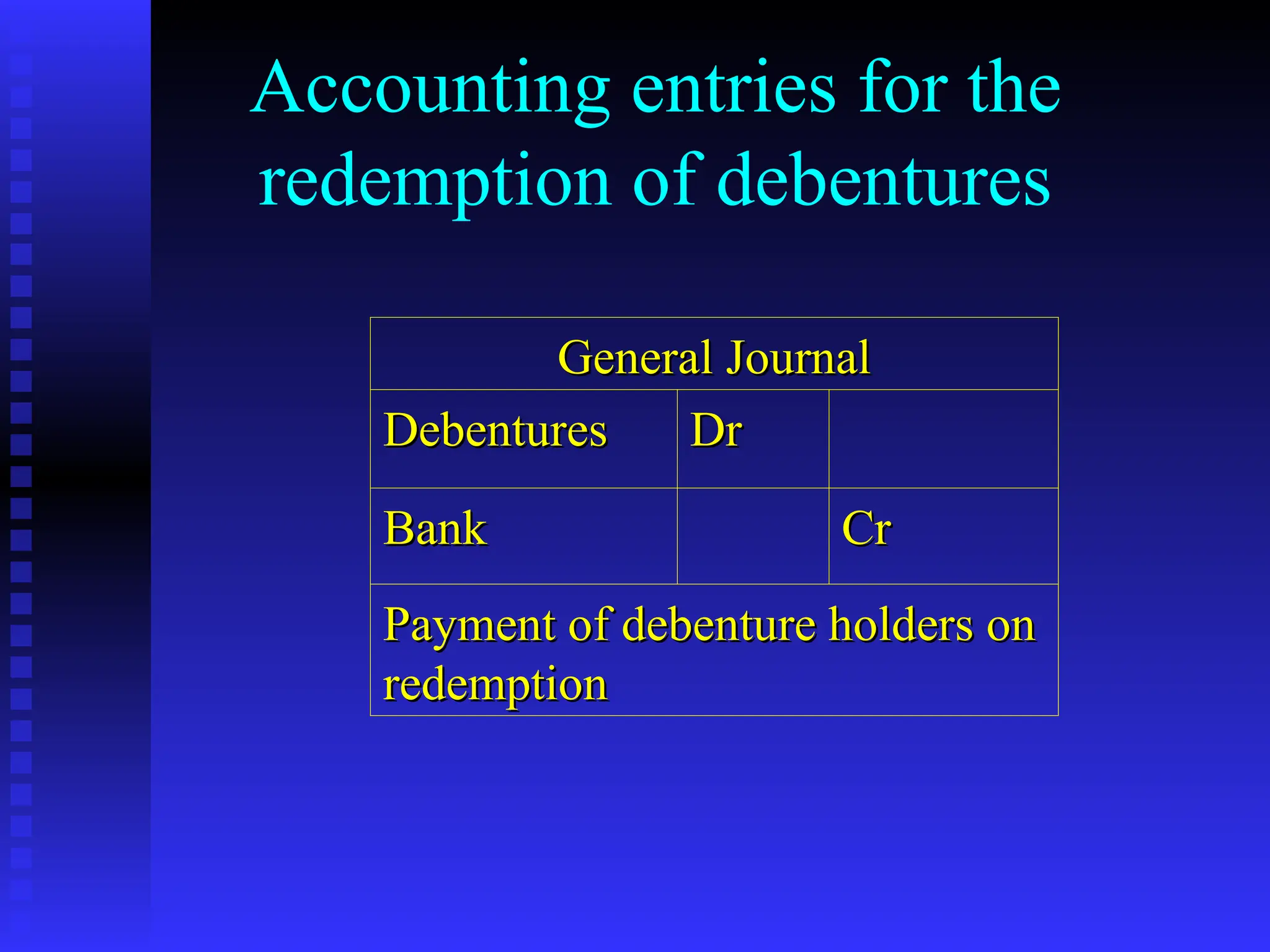

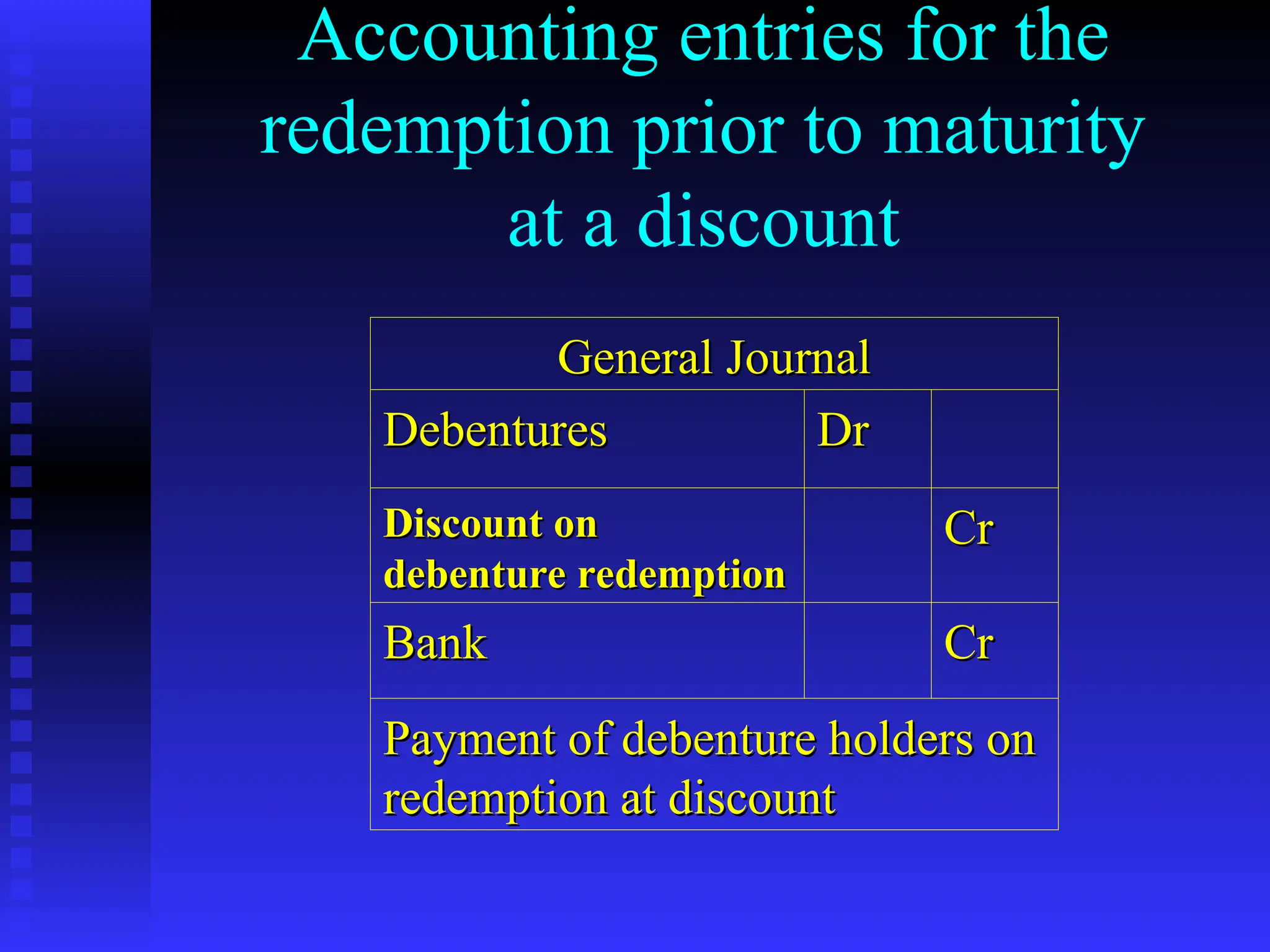

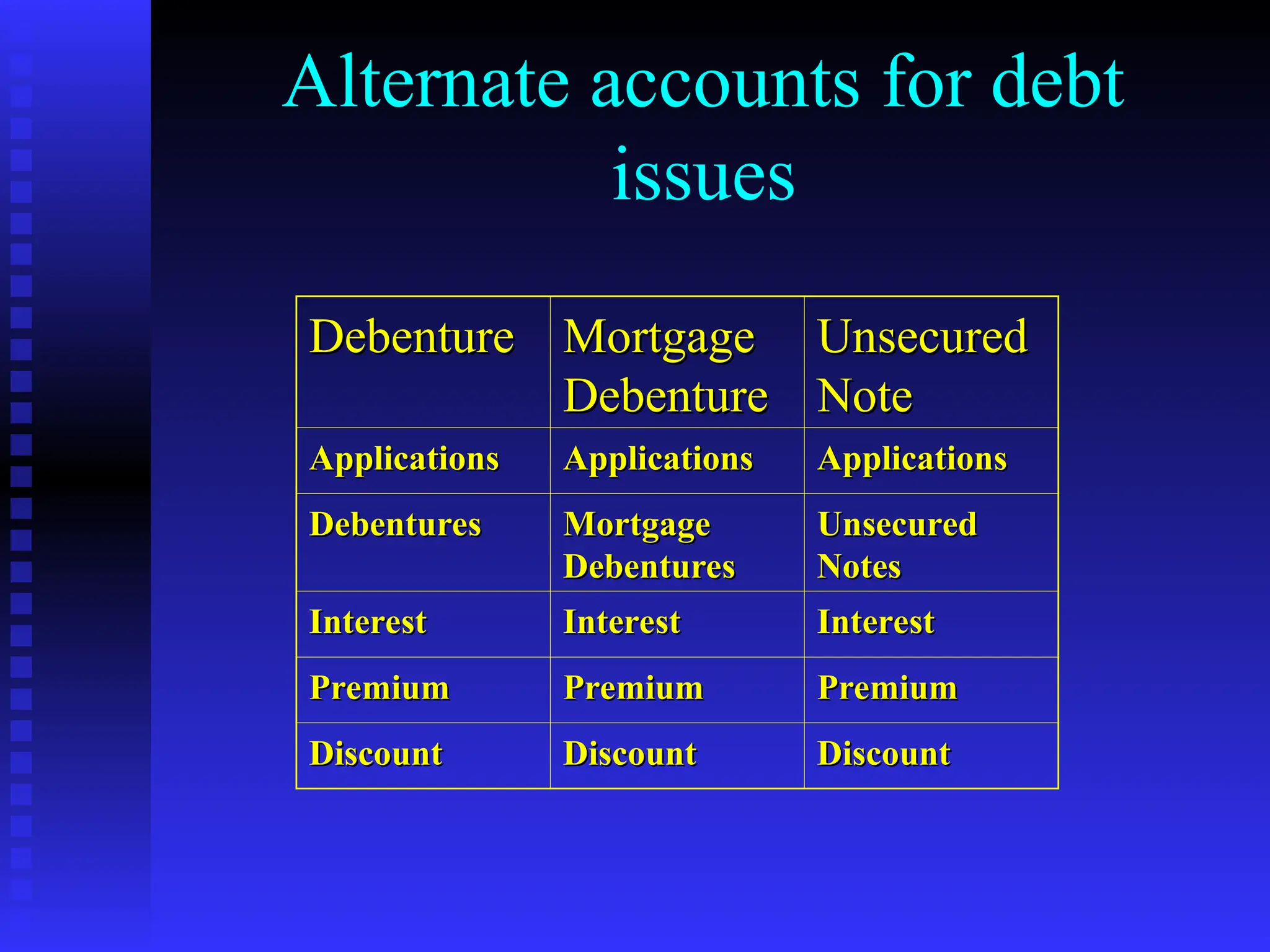

The document provides a comprehensive overview of the accounting principles related to the issuance and redemption of shares and debentures. It covers definitions, classifications, and accounting entries for various share types, along with costs associated with share issues and the procedures for issuing shares and debentures. Additionally, it discusses the implications of calls on shares, public prospectus, and the key differences between equity and debt financing.