Ira and retirement plan limits for 2016

•

1 like•31 views

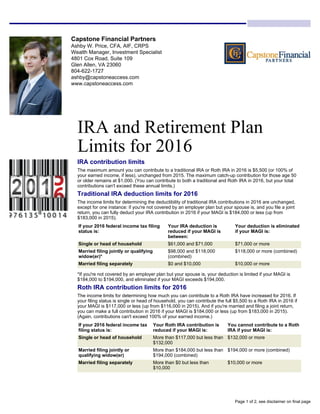

The document summarizes IRA and retirement plan contribution limits for 2016. The maximum IRA contribution limit remains $5,500, with a $1,000 catch-up limit for those over 50. Traditional IRA deduction limits are unchanged except for one instance. Roth IRA contribution limits have increased slightly for some income levels. Employer retirement plan limits like 401(k) contributions remain at $18,000 with a $6,000 catch-up limit. Defined contribution plan maximum allocation is $53,000 plus catch-up.

Report

Share

Report

Share

Download to read offline

Recommended

2017 Retirement Account Savings Limits

In 2017, you have another chance to max out your retirement accounts. Here is a rundown of yearly contribution limits for the popular retirement savings vehicles.

2010 traditional and roth contribution limits

This document provides information on contribution limits and eligibility for traditional and Roth IRAs in 2010 based on filing status and modified adjusted gross income (MAGI). It outlines the contribution limits for traditional and Roth IRAs as $5,000 or $6,000 if over age 50. It also provides tables that show whether taxpayers can take a full deduction, partial deduction, or no deduction for traditional IRA contributions based on their filing status and MAGI. Additional tables provide income limits for determining eligibility to contribute to a Roth IRA.

July 2019 Palm Springs Housing Report

July 2019 Palm Springs Housing Report. July is usually a down month due to seasonal factors.

Team Michael Keller Williams

DRE# 00938044

2016 tax provisions for individuals a review

Flexible Spending Accounts (FSAs) are limited to $2,550 per year in 2016 (same as 2015) and apply only to salary reduction contributions under a health FSA.

2016 Tax Planning Financial Planning Guide

This personal tax and financial planning guide is intended to provide you with useful tax facts and planning

information that may help you with your 2016 tax planning. We encourage you to seek qualified tax

planning advice prior to implementing any tax planning strategies, to ensure you are following the options

appropriate to your unique circumstances.

Doosan 180 Days Deferred Lease Special

No interest & no payments for six months!

Fair Market Value Lease with a 60 month

term, if Equipment Cost is $24,000, and your

payment is $312 per month.

Make no payments for 180 Days from start

of lease, Save up to $1,000 or more- you only

make 55 payments of $322 per month!

Lease rates, payments and savings may vary

based on lease terms and pricing. All offers

subject to credit approval.

Mountain Lake Minerals Inc. Announces Appointment of Sasha Jacob as Advisor

Mountain Lake Minerals Inc. is a Canadian-based exploration company. It is currently listed on the Canadian Securities Exchange under the trading symbol MLK. The company has recently appointed Mr. Sasha Jacob, the CEO and President of Jacob Capital Management Inc., as a strategic, marketing, and financial advisor. Mr. Jacob will serve as the guidance for Mountain Lake Minerals Inc. in accelerating its strategic exploration and development plans. His expert insights will serve greatly to the company's forward-looking plans for acquisition of other Canadian gold mining assets.

Bfe newsletter-summer-2017

Three key financial terms expatriates should know to manage their finances are:

1) FATCA requires reporting of foreign assets over certain thresholds and penalties for noncompliance.

2) FBAR requires reporting of foreign bank accounts if balances exceed $10,000.

3) CRS is an automatic exchange of financial account information between countries for tax purposes.

Recommended

2017 Retirement Account Savings Limits

In 2017, you have another chance to max out your retirement accounts. Here is a rundown of yearly contribution limits for the popular retirement savings vehicles.

2010 traditional and roth contribution limits

This document provides information on contribution limits and eligibility for traditional and Roth IRAs in 2010 based on filing status and modified adjusted gross income (MAGI). It outlines the contribution limits for traditional and Roth IRAs as $5,000 or $6,000 if over age 50. It also provides tables that show whether taxpayers can take a full deduction, partial deduction, or no deduction for traditional IRA contributions based on their filing status and MAGI. Additional tables provide income limits for determining eligibility to contribute to a Roth IRA.

July 2019 Palm Springs Housing Report

July 2019 Palm Springs Housing Report. July is usually a down month due to seasonal factors.

Team Michael Keller Williams

DRE# 00938044

2016 tax provisions for individuals a review

Flexible Spending Accounts (FSAs) are limited to $2,550 per year in 2016 (same as 2015) and apply only to salary reduction contributions under a health FSA.

2016 Tax Planning Financial Planning Guide

This personal tax and financial planning guide is intended to provide you with useful tax facts and planning

information that may help you with your 2016 tax planning. We encourage you to seek qualified tax

planning advice prior to implementing any tax planning strategies, to ensure you are following the options

appropriate to your unique circumstances.

Doosan 180 Days Deferred Lease Special

No interest & no payments for six months!

Fair Market Value Lease with a 60 month

term, if Equipment Cost is $24,000, and your

payment is $312 per month.

Make no payments for 180 Days from start

of lease, Save up to $1,000 or more- you only

make 55 payments of $322 per month!

Lease rates, payments and savings may vary

based on lease terms and pricing. All offers

subject to credit approval.

Mountain Lake Minerals Inc. Announces Appointment of Sasha Jacob as Advisor

Mountain Lake Minerals Inc. is a Canadian-based exploration company. It is currently listed on the Canadian Securities Exchange under the trading symbol MLK. The company has recently appointed Mr. Sasha Jacob, the CEO and President of Jacob Capital Management Inc., as a strategic, marketing, and financial advisor. Mr. Jacob will serve as the guidance for Mountain Lake Minerals Inc. in accelerating its strategic exploration and development plans. His expert insights will serve greatly to the company's forward-looking plans for acquisition of other Canadian gold mining assets.

Bfe newsletter-summer-2017

Three key financial terms expatriates should know to manage their finances are:

1) FATCA requires reporting of foreign assets over certain thresholds and penalties for noncompliance.

2) FBAR requires reporting of foreign bank accounts if balances exceed $10,000.

3) CRS is an automatic exchange of financial account information between countries for tax purposes.

Your Annual Financial To-Do List

Looking for ideas to improve your finances in 2017? Here is a list of things you can do before & for 2017.

2016 Individual Tax Planning Supplement

The right tax strategy stays current with your environment.

The political landscape isn’t the only thing changing in

2016. Estate planning opportunities are also shifting. This

supplement incorporates estate planning updates and other

considerations into tips designed to decrease your 2016 tax

bill. Charts throughout the supplement, including tax rates,

qualified retirement plan limitations and FICA/Medicare

taxes further help with your tax planning.

2015-year end tax report

- Our goal is to help clients coordinate tax reduction with their investment portfolios by staying up to date on tax strategies.

- This report discusses 2015 year-end tax strategies, but your situation is unique so discuss strategies with your tax preparer.

- The document reviews various tax strategies for 2015 including reviewing your retirement savings options, capital gains and losses, and Roth IRA conversions.

RETIREMENT PLANNING-RRSP AND TFSA:STRATEGIES FOR INVESTMENT

Retirement planning requires saving through both an RRSP and TFSA. An RRSP allows tax deferral on contributions and should be used when in a high tax bracket currently. A TFSA provides tax-free growth on investment earnings and is better when in a low tax bracket or saving for non-retirement goals. Both plans have annual contribution limits and allow investing in assets like mutual funds and GICs. Proper use of these registered savings vehicles combined with defined financial goals can help ensure adequate retirement income.

July Newsletter

This document provides a summary of an investment newsletter from Atlantic Sun Financial Group. It discusses three main topics:

1. A mid-year investment check-up, encouraging investors to review portfolio performance, investment strategies, and tax efficiency.

2. An overview of Roth 401(k) plans, including eligibility, contribution limits, tax treatment of contributions and earnings, and comparison to traditional 401(k) plans.

3. A brief discussion on finding forgotten or unclaimed funds from old accounts, bank deposits, or stock holdings.

2018 IRA Contribution Limit Guide

This document provides a summary of contribution limits for various retirement accounts in 2018, including Traditional and Roth IRAs, SEPs, SIMPLEs, Individual(k)s, HSAs, and Coverdell ESAs. The main points covered are:

- Traditional and Roth IRA contribution limits are $5,500 each ($6,500 if over age 50) and phase out at higher income levels

- SEP, SIMPLE, and Individual(k) plans allow for higher contribution limits up to $55,000 but have additional eligibility requirements

- HSAs allow contributions up to $3,450 individual/$6,900 family and grow tax-free if used for medical expenses

- Coverdell

Accountants in new york

Accountants, are you ready for the US?

In the United States, the fiscal powers of taxation is based on three levels: federal, state and municipal. The federal income tax, in particular, is a pay-as-you-go tax.

From November 7 to 10, the Italian accountants will stay in New York city, on a mission in the US. We went to look around the contents by the IRS (Inland Revenue Service) in the field of “Tax Withholding and Estimated Tax”, for use in 2016.

The federal income tax is a pay-as-you-go tax. You must pay the tax as you earn or receive income during the year. There are two ways to pay-as-you-go: Tax Withholding and Estimated Tax.

Kfs ira review

This document provides an overview and comparison of traditional IRAs and Roth IRAs. It discusses key factors to consider when choosing between the two options such as eligibility for tax-deductible contributions, contribution and income limits, tax treatment of distributions, required minimum distributions, and bankruptcy protections. Hypothetical examples are presented to illustrate how the different accounts may perform over long time horizons under varied rate of return and tax assumptions. The document emphasizes the importance of saving for retirement early and maximizing tax-advantaged retirement accounts.

2017 Individual Tax Planning Supplement

This document provides an overview and tips for 2017 individual tax planning. It summarizes key tax rates, deductions, credits, and strategies to consider for reducing tax liability for the year. Potential tax reform proposals could change rates and provisions for 2018, so the document recommends planning based on current tax law and taking advantage of opportunities before year-end 2017 to be effective in mitigating taxes. It includes charts outlining various tax rates, limits, phaseouts and considerations for married and unmarried filers.

Tax Alert - Preparation Key to Managing Tax Rate Increases

Canada will see new federal and provincial tax rates in 2016 following a change in government. Top personal income tax rates are expected to increase in most provinces, which property owners and business owners should consider in their 2015 tax planning. Strategies such as prepaying taxes in 2015, altering the mix of salaries and dividends, maximizing TFSA contributions, and deferring RRSP deductions can help mitigate the impact of rising tax rates next year. Advanced planning is recommended for those who will face higher taxes to develop the most beneficial overall tax strategy.

Adding HSA to Your 401(k) Advisory Practice - David Ritchie - Ryan Tiernan

Speakers:

- David Ritchie, VP, Sales, BPAS VEBA & HRA/HSA Services

- Ryan Tiernan, Senior HSA Consultant, Access Point HSA

Roth 457 Education Module

One of a suite of individual retirement education modules created for Nationwide Financial, the Retirement Goals Education Module explains the difference between a traditional and a Roth 457 plan.

The module system gives retirement specialists the ability to create longer, fully customizable presentations by allowing them to mix, match and combine individual modules in the suite. This enables the sales force a greater flexibility in planning meetings and answering individual plan and participant needs.

Horner Downey & Co Year End 2017-18 Newsletter

This document provides information and advice about ways to reduce taxes before the end of the 2017/18 tax year on April 5th, including maximizing personal tax allowances, reviewing company car arrangements, taking business profits tax-efficiently, considering retirement planning options, and utilizing savings vehicles like ISAs. It also notes upcoming tax changes in 2018/19 such as reductions to the dividend allowance and increases to tax rates on company cars.

The Monthly Advisory October 2016

The document provides information on various financial topics, including analyzing company earnings reports, year-end tax planning tips, common financial concerns among different generations, and factors to consider when evaluating an early retirement offer from an employer. Specifically, it discusses how earnings reports can influence stock prices but may not reliably indicate long-term outlook; lists 10 tax tips such as deferring income or accelerating deductions; outlines concerns such as retirement or meeting expenses that baby boomers, Gen Xers, and millennials commonly share; and advises evaluating an early retirement offer based on the severance package, medical coverage, and ability to live on savings without penalties.

IRS 590

This document is a publication from the Internal Revenue Service that provides information about Individual Retirement Arrangements (IRAs). It discusses rules and limits for traditional IRAs and Roth IRAs, including who is eligible to contribute, contribution limits, deductibility of contributions, required minimum distributions, taxation of distributions, and penalties. The publication also addresses Savings Incentive Match Plans for Employees (SIMPLE) and the Retirement Savings Contributions Credit (Saver's Credit). Key changes for 2013 and 2014 are highlighted.

June 2018 Newsletter

The document provides information and advice for newly married couples on managing finances together after marriage. It recommends that couples openly communicate to develop a shared financial plan and goals. It also suggests preparing a joint budget that accounts for all income and expenses to help stay on track financially. Additionally, the document discusses options for saving for retirement through employer-sponsored plans and spousal IRAs to maximize savings opportunities. Open communication and coordination between spouses is presented as key to building wealth over time through a unified retirement strategy.

Horner Downey & Co Year End Strategies Newsletter

The document discusses strategies for business owners to reduce taxes in the current tax year before the deadline of April 5th, 2018. It focuses on reviewing company car policies given rising tax percentages, and considering paying employees for business miles instead of providing a company car. It also discusses extracting profit from a business in a tax-efficient manner through dividends versus salary/bonuses given changes to dividend tax rates, and other options like incorporation or pension contributions.

Horner downey and company ltd year end strategies

The document discusses strategies for business owners to reduce taxes in the current tax year before the deadline of April 5th, 2018. It focuses on reviewing company car policies given rising tax percentages, and considering paying employees for business miles instead of providing a company car. It also discusses extracting profit from a business in a tax-efficient manner through dividends versus salary/bonuses given changes to dividend tax rates, and other options like incorporation or pension contributions.

Horner Downey & Co Year End Strategies Newsletter

The document discusses various tax planning strategies that can be implemented before 5 April 2018 to reduce tax liabilities. It recommends reviewing business motoring strategies as company cars may not always be the most tax-efficient option. It also suggests maximizing the use of personal allowances across a family, utilizing tax advantaged savings schemes like ISAs and pensions, and considering different methods of extracting profit from a business in a tax efficient manner like dividends. The document is aimed at helping clients identify areas to improve their financial planning and tax position before the end of the tax year.

Horner downey and company ltd ye 201718

The document discusses various tax planning strategies that can be implemented before 5 April 2018 to reduce tax liabilities. It recommends reviewing business motoring strategies as company cars may not always be the most tax-efficient option. It also suggests maximizing the use of personal tax allowances across a family, extracting profits from a business in a tax-efficient manner such as through dividends, and contributing more to pension funds to benefit from tax relief. The document provides information on the annual ISA allowance and the new Lifetime ISA. It stresses the importance of ongoing tax planning throughout the year.

How Non-Banking Financial Companies Empower Startups With Venture Debt Financing

How Non-Banking Financial Companies Empower Startups With Venture Debt Financing

Independent Study - College of Wooster Research (2023-2024)

"Does Foreign Direct Investment Negatively Affect Preservation of Culture in the Global South? Case Studies in Thailand and Cambodia."

Do elements of globalization, such as Foreign Direct Investment (FDI), negatively affect the ability of countries in the Global South to preserve their culture? This research aims to answer this question by employing a cross-sectional comparative case study analysis utilizing methods of difference. Thailand and Cambodia are compared as they are in the same region and have a similar culture. The metric of difference between Thailand and Cambodia is their ability to preserve their culture. This ability is operationalized by their respective attitudes towards FDI; Thailand imposes stringent regulations and limitations on FDI while Cambodia does not hesitate to accept most FDI and imposes fewer limitations. The evidence from this study suggests that FDI from globally influential countries with high gross domestic products (GDPs) (e.g. China, U.S.) challenges the ability of countries with lower GDPs (e.g. Cambodia) to protect their culture. Furthermore, the ability, or lack thereof, of the receiving countries to protect their culture is amplified by the existence and implementation of restrictive FDI policies imposed by their governments.

My study abroad in Bali, Indonesia, inspired this research topic as I noticed how globalization is changing the culture of its people. I learned their language and way of life which helped me understand the beauty and importance of cultural preservation. I believe we could all benefit from learning new perspectives as they could help us ideate solutions to contemporary issues and empathize with others.

More Related Content

Similar to Ira and retirement plan limits for 2016

Your Annual Financial To-Do List

Looking for ideas to improve your finances in 2017? Here is a list of things you can do before & for 2017.

2016 Individual Tax Planning Supplement

The right tax strategy stays current with your environment.

The political landscape isn’t the only thing changing in

2016. Estate planning opportunities are also shifting. This

supplement incorporates estate planning updates and other

considerations into tips designed to decrease your 2016 tax

bill. Charts throughout the supplement, including tax rates,

qualified retirement plan limitations and FICA/Medicare

taxes further help with your tax planning.

2015-year end tax report

- Our goal is to help clients coordinate tax reduction with their investment portfolios by staying up to date on tax strategies.

- This report discusses 2015 year-end tax strategies, but your situation is unique so discuss strategies with your tax preparer.

- The document reviews various tax strategies for 2015 including reviewing your retirement savings options, capital gains and losses, and Roth IRA conversions.

RETIREMENT PLANNING-RRSP AND TFSA:STRATEGIES FOR INVESTMENT

Retirement planning requires saving through both an RRSP and TFSA. An RRSP allows tax deferral on contributions and should be used when in a high tax bracket currently. A TFSA provides tax-free growth on investment earnings and is better when in a low tax bracket or saving for non-retirement goals. Both plans have annual contribution limits and allow investing in assets like mutual funds and GICs. Proper use of these registered savings vehicles combined with defined financial goals can help ensure adequate retirement income.

July Newsletter

This document provides a summary of an investment newsletter from Atlantic Sun Financial Group. It discusses three main topics:

1. A mid-year investment check-up, encouraging investors to review portfolio performance, investment strategies, and tax efficiency.

2. An overview of Roth 401(k) plans, including eligibility, contribution limits, tax treatment of contributions and earnings, and comparison to traditional 401(k) plans.

3. A brief discussion on finding forgotten or unclaimed funds from old accounts, bank deposits, or stock holdings.

2018 IRA Contribution Limit Guide

This document provides a summary of contribution limits for various retirement accounts in 2018, including Traditional and Roth IRAs, SEPs, SIMPLEs, Individual(k)s, HSAs, and Coverdell ESAs. The main points covered are:

- Traditional and Roth IRA contribution limits are $5,500 each ($6,500 if over age 50) and phase out at higher income levels

- SEP, SIMPLE, and Individual(k) plans allow for higher contribution limits up to $55,000 but have additional eligibility requirements

- HSAs allow contributions up to $3,450 individual/$6,900 family and grow tax-free if used for medical expenses

- Coverdell

Accountants in new york

Accountants, are you ready for the US?

In the United States, the fiscal powers of taxation is based on three levels: federal, state and municipal. The federal income tax, in particular, is a pay-as-you-go tax.

From November 7 to 10, the Italian accountants will stay in New York city, on a mission in the US. We went to look around the contents by the IRS (Inland Revenue Service) in the field of “Tax Withholding and Estimated Tax”, for use in 2016.

The federal income tax is a pay-as-you-go tax. You must pay the tax as you earn or receive income during the year. There are two ways to pay-as-you-go: Tax Withholding and Estimated Tax.

Kfs ira review

This document provides an overview and comparison of traditional IRAs and Roth IRAs. It discusses key factors to consider when choosing between the two options such as eligibility for tax-deductible contributions, contribution and income limits, tax treatment of distributions, required minimum distributions, and bankruptcy protections. Hypothetical examples are presented to illustrate how the different accounts may perform over long time horizons under varied rate of return and tax assumptions. The document emphasizes the importance of saving for retirement early and maximizing tax-advantaged retirement accounts.

2017 Individual Tax Planning Supplement

This document provides an overview and tips for 2017 individual tax planning. It summarizes key tax rates, deductions, credits, and strategies to consider for reducing tax liability for the year. Potential tax reform proposals could change rates and provisions for 2018, so the document recommends planning based on current tax law and taking advantage of opportunities before year-end 2017 to be effective in mitigating taxes. It includes charts outlining various tax rates, limits, phaseouts and considerations for married and unmarried filers.

Tax Alert - Preparation Key to Managing Tax Rate Increases

Canada will see new federal and provincial tax rates in 2016 following a change in government. Top personal income tax rates are expected to increase in most provinces, which property owners and business owners should consider in their 2015 tax planning. Strategies such as prepaying taxes in 2015, altering the mix of salaries and dividends, maximizing TFSA contributions, and deferring RRSP deductions can help mitigate the impact of rising tax rates next year. Advanced planning is recommended for those who will face higher taxes to develop the most beneficial overall tax strategy.

Adding HSA to Your 401(k) Advisory Practice - David Ritchie - Ryan Tiernan

Speakers:

- David Ritchie, VP, Sales, BPAS VEBA & HRA/HSA Services

- Ryan Tiernan, Senior HSA Consultant, Access Point HSA

Roth 457 Education Module

One of a suite of individual retirement education modules created for Nationwide Financial, the Retirement Goals Education Module explains the difference between a traditional and a Roth 457 plan.

The module system gives retirement specialists the ability to create longer, fully customizable presentations by allowing them to mix, match and combine individual modules in the suite. This enables the sales force a greater flexibility in planning meetings and answering individual plan and participant needs.

Horner Downey & Co Year End 2017-18 Newsletter

This document provides information and advice about ways to reduce taxes before the end of the 2017/18 tax year on April 5th, including maximizing personal tax allowances, reviewing company car arrangements, taking business profits tax-efficiently, considering retirement planning options, and utilizing savings vehicles like ISAs. It also notes upcoming tax changes in 2018/19 such as reductions to the dividend allowance and increases to tax rates on company cars.

The Monthly Advisory October 2016

The document provides information on various financial topics, including analyzing company earnings reports, year-end tax planning tips, common financial concerns among different generations, and factors to consider when evaluating an early retirement offer from an employer. Specifically, it discusses how earnings reports can influence stock prices but may not reliably indicate long-term outlook; lists 10 tax tips such as deferring income or accelerating deductions; outlines concerns such as retirement or meeting expenses that baby boomers, Gen Xers, and millennials commonly share; and advises evaluating an early retirement offer based on the severance package, medical coverage, and ability to live on savings without penalties.

IRS 590

This document is a publication from the Internal Revenue Service that provides information about Individual Retirement Arrangements (IRAs). It discusses rules and limits for traditional IRAs and Roth IRAs, including who is eligible to contribute, contribution limits, deductibility of contributions, required minimum distributions, taxation of distributions, and penalties. The publication also addresses Savings Incentive Match Plans for Employees (SIMPLE) and the Retirement Savings Contributions Credit (Saver's Credit). Key changes for 2013 and 2014 are highlighted.

June 2018 Newsletter

The document provides information and advice for newly married couples on managing finances together after marriage. It recommends that couples openly communicate to develop a shared financial plan and goals. It also suggests preparing a joint budget that accounts for all income and expenses to help stay on track financially. Additionally, the document discusses options for saving for retirement through employer-sponsored plans and spousal IRAs to maximize savings opportunities. Open communication and coordination between spouses is presented as key to building wealth over time through a unified retirement strategy.

Horner Downey & Co Year End Strategies Newsletter

The document discusses strategies for business owners to reduce taxes in the current tax year before the deadline of April 5th, 2018. It focuses on reviewing company car policies given rising tax percentages, and considering paying employees for business miles instead of providing a company car. It also discusses extracting profit from a business in a tax-efficient manner through dividends versus salary/bonuses given changes to dividend tax rates, and other options like incorporation or pension contributions.

Horner downey and company ltd year end strategies

The document discusses strategies for business owners to reduce taxes in the current tax year before the deadline of April 5th, 2018. It focuses on reviewing company car policies given rising tax percentages, and considering paying employees for business miles instead of providing a company car. It also discusses extracting profit from a business in a tax-efficient manner through dividends versus salary/bonuses given changes to dividend tax rates, and other options like incorporation or pension contributions.

Horner Downey & Co Year End Strategies Newsletter

The document discusses various tax planning strategies that can be implemented before 5 April 2018 to reduce tax liabilities. It recommends reviewing business motoring strategies as company cars may not always be the most tax-efficient option. It also suggests maximizing the use of personal allowances across a family, utilizing tax advantaged savings schemes like ISAs and pensions, and considering different methods of extracting profit from a business in a tax efficient manner like dividends. The document is aimed at helping clients identify areas to improve their financial planning and tax position before the end of the tax year.

Horner downey and company ltd ye 201718

The document discusses various tax planning strategies that can be implemented before 5 April 2018 to reduce tax liabilities. It recommends reviewing business motoring strategies as company cars may not always be the most tax-efficient option. It also suggests maximizing the use of personal tax allowances across a family, extracting profits from a business in a tax-efficient manner such as through dividends, and contributing more to pension funds to benefit from tax relief. The document provides information on the annual ISA allowance and the new Lifetime ISA. It stresses the importance of ongoing tax planning throughout the year.

Similar to Ira and retirement plan limits for 2016 (20)

RETIREMENT PLANNING-RRSP AND TFSA:STRATEGIES FOR INVESTMENT

RETIREMENT PLANNING-RRSP AND TFSA:STRATEGIES FOR INVESTMENT

Tax Alert - Preparation Key to Managing Tax Rate Increases

Tax Alert - Preparation Key to Managing Tax Rate Increases

Adding HSA to Your 401(k) Advisory Practice - David Ritchie - Ryan Tiernan

Adding HSA to Your 401(k) Advisory Practice - David Ritchie - Ryan Tiernan

Recently uploaded

How Non-Banking Financial Companies Empower Startups With Venture Debt Financing

How Non-Banking Financial Companies Empower Startups With Venture Debt Financing

Independent Study - College of Wooster Research (2023-2024)

"Does Foreign Direct Investment Negatively Affect Preservation of Culture in the Global South? Case Studies in Thailand and Cambodia."

Do elements of globalization, such as Foreign Direct Investment (FDI), negatively affect the ability of countries in the Global South to preserve their culture? This research aims to answer this question by employing a cross-sectional comparative case study analysis utilizing methods of difference. Thailand and Cambodia are compared as they are in the same region and have a similar culture. The metric of difference between Thailand and Cambodia is their ability to preserve their culture. This ability is operationalized by their respective attitudes towards FDI; Thailand imposes stringent regulations and limitations on FDI while Cambodia does not hesitate to accept most FDI and imposes fewer limitations. The evidence from this study suggests that FDI from globally influential countries with high gross domestic products (GDPs) (e.g. China, U.S.) challenges the ability of countries with lower GDPs (e.g. Cambodia) to protect their culture. Furthermore, the ability, or lack thereof, of the receiving countries to protect their culture is amplified by the existence and implementation of restrictive FDI policies imposed by their governments.

My study abroad in Bali, Indonesia, inspired this research topic as I noticed how globalization is changing the culture of its people. I learned their language and way of life which helped me understand the beauty and importance of cultural preservation. I believe we could all benefit from learning new perspectives as they could help us ideate solutions to contemporary issues and empathize with others.

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

SWAIAP Fraud Risk Mitigation Prof Oyedokun.pptx

SWAIAP Fraud Risk Mitigation Prof Oyedokun.pptxGodwin Emmanuel Oyedokun MBA MSc PhD FCA FCTI FCNA CFE FFAR

Lecture slide titled Fraud Risk Mitigation, Webinar Lecture Delivered at the Society for West African Internal Audit Practitioners (SWAIAP) on Wednesday, November 8, 2023.

Seminar: Gender Board Diversity through Ownership Networks

Seminar on gender diversity spillovers through ownership networks at FAME|GRAPE. Presenting novel research. Studies in economics and management using econometrics methods.

What's a worker’s market? Job quality and labour market tightness

What's a worker’s market? Job quality and labour market tightnessLabour Market Information Council | Conseil de l’information sur le marché du travail

In a tight labour market, job-seekers gain bargaining power and leverage it into greater job quality—at least, that’s the conventional wisdom.

Michael, LMIC Economist, presented findings that reveal a weakened relationship between labour market tightness and job quality indicators following the pandemic. Labour market tightness coincided with growth in real wages for only a portion of workers: those in low-wage jobs requiring little education. Several factors—including labour market composition, worker and employer behaviour, and labour market practices—have contributed to the absence of worker benefits. These will be investigated further in future work.Bridging the gap: Online job postings, survey data and the assessment of job ...

Bridging the gap: Online job postings, survey data and the assessment of job ...Labour Market Information Council | Conseil de l’information sur le marché du travail

OJP data from firms like Vicinity Jobs have emerged as a complement to traditional sources of labour demand data, such as the Job Vacancy and Wages Survey (JVWS). Ibrahim Abuallail, PhD Candidate, University of Ottawa, presented research relating to bias in OJPs and a proposed approach to effectively adjust OJP data to complement existing official data (such as from the JVWS) and improve the measurement of labour demand.Pensions and housing - Pensions PlayPen - 4 June 2024 v3 (1).pdf

Wayhome's analysis of the UK market and how pension schemes can help solve the problems it presents younger people

在线办理(GU毕业证书)美国贡萨加大学毕业证学历证书一模一样

学校原件一模一样【微信:741003700 】《(GU毕业证书)美国贡萨加大学毕业证学历证书》【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

STREETONOMICS: Exploring the Uncharted Territories of Informal Markets throug...

Delve into the world of STREETONOMICS, where a team of 7 enthusiasts embarks on a journey to understand unorganized markets. By engaging with a coffee street vendor and crafting questionnaires, this project uncovers valuable insights into consumer behavior and market dynamics in informal settings."

快速制作美国迈阿密大学牛津分校毕业证文凭证书英文原版一模一样

原版一模一样【微信:741003700 】【美国迈阿密大学牛津分校毕业证文凭证书】【微信:741003700 】学位证,留信认证(真实可查,永久存档)offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原海外各大学 Bachelor Diploma degree, Master Degree Diploma

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

falcon-invoice-discounting-a-strategic-approach-to-optimize-investments

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.

5 Tips for Creating Standard Financial Reports

Well-crafted financial reports serve as vital tools for decision-making and transparency within an organization. By following the undermentioned tips, you can create standardized financial reports that effectively communicate your company's financial health and performance to stakeholders.

Financial Assets: Debit vs Equity Securities.pptx

financial assets represent claim for future benefit or cash. Financial assets are formed by establishing contracts between participants. These financial assets are used for collection of huge amounts of money for business purposes.

Two major Types: Debt Securities and Equity Securities.

Debt Securities are Also known as fixed-income securities or instruments. The type of assets is formed by establishing contracts between investor and issuer of the asset.

• The first type of Debit securities is BONDS. Bonds are issued by corporations and government (both local and national government).

• The second important type of Debit security is NOTES. Apart from similarities associated with notes and bonds, notes have shorter term maturity.

• The 3rd important type of Debit security is TRESURY BILLS. These securities have short-term ranging from three months, six months, and one year. Issuer of such securities are governments.

• Above discussed debit securities are mostly issued by governments and corporations. CERTIFICATE OF DEPOSITS CDs are issued by Banks and Financial Institutions. Risk factor associated with CDs gets reduced when issued by reputable institutions or Banks.

Following are the risk attached with debt securities: Credit risk, interest rate risk and currency risk

There are no fixed maturity dates in such securities, and asset’s value is determined by company’s performance. There are two major types of equity securities: common stock and preferred stock.

Common Stock: These are simple equity securities and bear no complexities which the preferred stock bears. Holders of such securities or instrument have the voting rights when it comes to select the company’s board of director or the business decisions to be made.

Preferred Stock: Preferred stocks are sometime referred to as hybrid securities, because it contains elements of both debit security and equity security. Preferred stock confers ownership rights to security holder that is why it is equity instrument

<a href="https://www.writofinance.com/equity-securities-features-types-risk/" >Equity securities </a> as a whole is used for capital funding for companies. Companies have multiple expenses to cover. Potential growth of company is required in competitive market. So, these securities are used for capital generation, and then uses it for company’s growth.

Concluding remarks

Both are employed in business. Businesses are often established through debit securities, then what is the need for equity securities. Companies have to cover multiple expenses and expansion of business. They can also use equity instruments for repayment of debits. So, there are multiple uses for securities. As an investor, you need tools for analysis. Investment decisions are made by carefully analyzing the market. For better analysis of the stock market, investors often employ financial analysis of companies.

Earn a passive income with prosocial investing

Invest in prosocial funds that earn you an income while improving the world

Abhay Bhutada Leads Poonawalla Fincorp To Record Low NPA And Unprecedented Gr...

Under the leadership of Abhay Bhutada, Poonawalla Fincorp has achieved record-low Non-Performing Assets (NPA) and witnessed unprecedented growth. Bhutada's strategic vision and effective management have significantly enhanced the company's financial health, showcasing a robust performance in the financial sector. This achievement underscores the company's resilience and ability to thrive in a competitive market, setting a new benchmark for operational excellence in the industry.

Recently uploaded (20)

How Non-Banking Financial Companies Empower Startups With Venture Debt Financing

How Non-Banking Financial Companies Empower Startups With Venture Debt Financing

Independent Study - College of Wooster Research (2023-2024)

Independent Study - College of Wooster Research (2023-2024)

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

Seminar: Gender Board Diversity through Ownership Networks

Seminar: Gender Board Diversity through Ownership Networks

What's a worker’s market? Job quality and labour market tightness

What's a worker’s market? Job quality and labour market tightness

Bridging the gap: Online job postings, survey data and the assessment of job ...

Bridging the gap: Online job postings, survey data and the assessment of job ...

Pensions and housing - Pensions PlayPen - 4 June 2024 v3 (1).pdf

Pensions and housing - Pensions PlayPen - 4 June 2024 v3 (1).pdf

STREETONOMICS: Exploring the Uncharted Territories of Informal Markets throug...

STREETONOMICS: Exploring the Uncharted Territories of Informal Markets throug...

G20 summit held in India. Proper presentation for G20 summit

G20 summit held in India. Proper presentation for G20 summit

falcon-invoice-discounting-a-strategic-approach-to-optimize-investments

falcon-invoice-discounting-a-strategic-approach-to-optimize-investments

Abhay Bhutada Leads Poonawalla Fincorp To Record Low NPA And Unprecedented Gr...

Abhay Bhutada Leads Poonawalla Fincorp To Record Low NPA And Unprecedented Gr...

Tumelo-deep-dive-into-pass-through-voting-Feb23 (1).pdf

Tumelo-deep-dive-into-pass-through-voting-Feb23 (1).pdf

Ira and retirement plan limits for 2016

- 1. Capstone Financial Partners Ashby W. Price, CFA, AIF, CRPS Wealth Manager, Investment Specialist 4801 Cox Road, Suite 109 Glen Allen, VA 23060 804-622-1727 ashby@capstoneaccess.com www.capstoneaccess.com IRA and Retirement Plan Limits for 2016 IRA contribution limits The maximum amount you can contribute to a traditional IRA or Roth IRA in 2016 is $5,500 (or 100% of your earned income, if less), unchanged from 2015. The maximum catch-up contribution for those age 50 or older remains at $1,000. (You can contribute to both a traditional and Roth IRA in 2016, but your total contributions can't exceed these annual limits.) Traditional IRA deduction limits for 2016 The income limits for determining the deductibility of traditional IRA contributions in 2016 are unchanged, except for one instance: if you're not covered by an employer plan but your spouse is, and you file a joint return, you can fully deduct your IRA contribution in 2016 if your MAGI is $184,000 or less (up from $183,000 in 2015). If your 2016 federal income tax filing status is: Your IRA deduction is reduced if your MAGI is between: Your deduction is eliminated if your MAGI is: Single or head of household $61,000 and $71,000 $71,000 or more Married filing jointly or qualifying widow(er)* $98,000 and $118,000 (combined) $118,000 or more (combined) Married filing separately $0 and $10,000 $10,000 or more *If you're not covered by an employer plan but your spouse is, your deduction is limited if your MAGI is $184,000 to $194,000, and eliminated if your MAGI exceeds $194,000. Roth IRA contribution limits for 2016 The income limits for determining how much you can contribute to a Roth IRA have increased for 2016. If your filing status is single or head of household, you can contribute the full $5,500 to a Roth IRA in 2016 if your MAGI is $117,000 or less (up from $116,000 in 2015). And if you're married and filing a joint return, you can make a full contribution in 2016 if your MAGI is $184,000 or less (up from $183,000 in 2015). (Again, contributions can't exceed 100% of your earned income.) If your 2016 federal income tax filing status is: Your Roth IRA contribution is reduced if your MAGI is: You cannot contribute to a Roth IRA if your MAGI is: Single or head of household More than $117,000 but less than $132,000 $132,000 or more Married filing jointly or qualifying widow(er) More than $184,000 but less than $194,000 (combined) $194,000 or more (combined) Married filing separately More than $0 but less than $10,000 $10,000 or more Page 1 of 2, see disclaimer on final page

- 2. Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2016 Employer retirement plans All of the significant employer retirement plan limits for 2016 remain unchanged from 2015. The maximum amount you can contribute (your "elective deferrals") to a 401(k) plan in 2016 is $18,000. This limit also applies to 403(b), 457(b), and SAR-SEP plans, as well as the Federal Thrift Plan. If you're age 50 or older, you can also make catch-up contributions of up to $6,000 to these plans in 2016. (Special catch-up limits apply to certain participants in 403(b) and 457(b) plans.) If you participate in more than one retirement plan, your total elective deferrals can't exceed the annual limit ($18,000 in 2016 plus any applicable catch-up contribution). Deferrals to 401(k) plans, 403(b) plans, SIMPLE plans, and SAR-SEPs are included in this aggregate limit, but deferrals to Section 457(b) plans are not. For example, if you participate in both a 403(b) plan and a 457(b) plan, you can defer the full dollar limit to each plan--a total of $36,000 in 2016 (plus any catch-up contributions). The amount you can contribute to a SIMPLE IRA or SIMPLE 401(k) plan in 2016 is $12,500, and the catch-up limit for those age 50 or older remains at $3,000. Plan type: Annual dollar limit: Catch-up limit: 401(k), 403(b), governmental 457(b), SAR-SEP, Federal Thrift Plan $18,000 $6,000 SIMPLE plans $12,500 $3,000 Note: Contributions can't exceed 100% of your income. The maximum amount that can be allocated to your account in a defined contribution plan (for example, a 401(k) plan or profit-sharing plan) in 2016 is $53,000, plus age-50 catch-up contributions. (This includes both your contributions and your employer's contributions. Special rules apply if your employer sponsors more than one retirement plan.) Finally, the maximum amount of compensation that can be taken into account in determining benefits for most plans in 2016 is $265,000, and the dollar threshold for determining highly compensated employees (when 2016 is the look-back year) is $120,000, both unchanged from 2015. Securities may be offered through Kestra Investment Services, LLC, (Kestra IS), member FINRA/SIPC. Investment Advisory Services may be offered through Kestra Advisory Services, LLC, (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS may or may not be affiliated with the firm branded on this material. Page 2 of 2