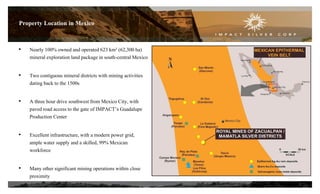

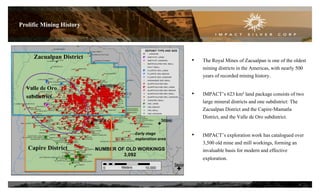

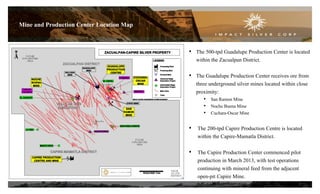

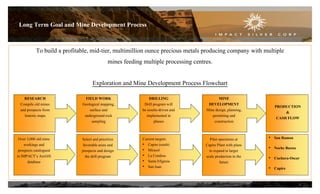

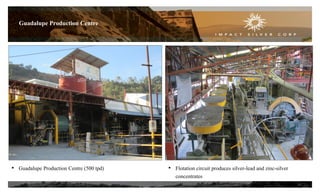

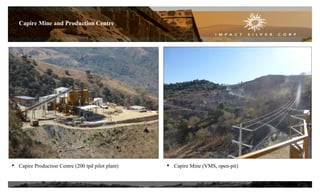

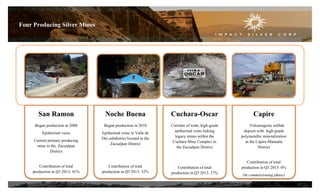

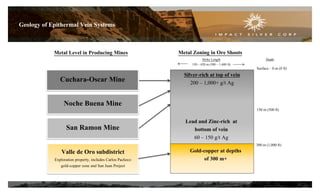

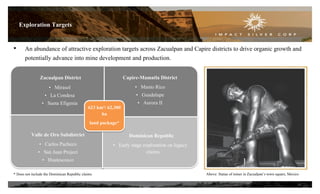

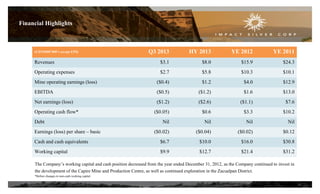

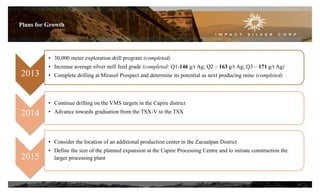

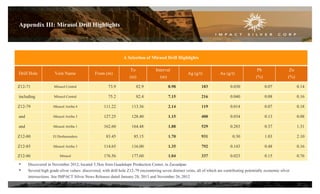

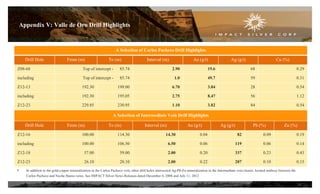

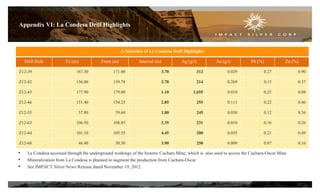

IMPACT Silver is a junior silver producer with two production centers in Mexico. It has four producing silver mines currently feeding its centers. IMPACT aims to grow through continued exploration of its large land package, with the goal of developing multiple mines to feed multiple processing centers and become a mid-tier precious metals producer. Key targets for further exploration and potential development include Mirasol, La Condesa, Santa Efigenia, and others across its Zacualpan and Capire districts.