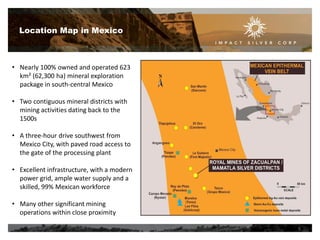

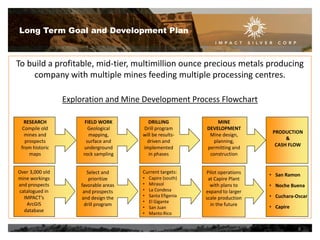

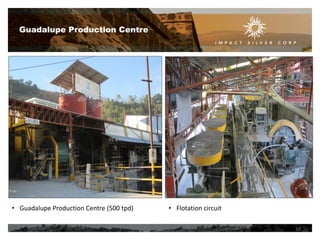

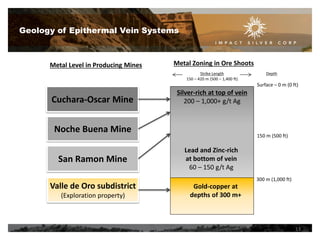

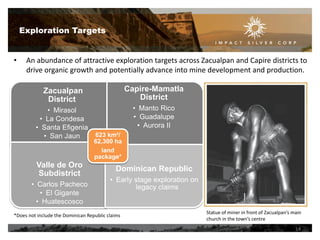

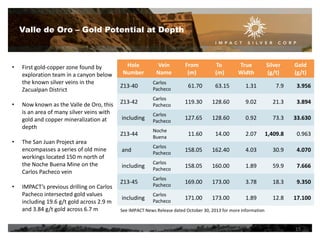

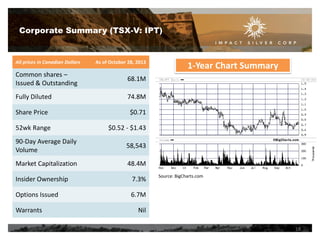

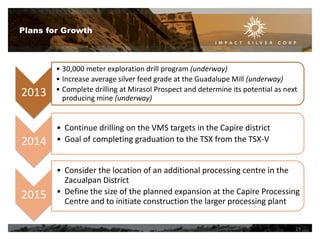

IMPACT Silver is a junior silver producer with mining operations and exploration properties in Mexico. The company operates two processing centers, with a total capacity of 700 tonnes per day, fed by four producing silver mines. IMPACT aims to grow through continued exploration of its large land package, with the goal of developing new mines and expanding production. The company cautions that forward-looking statements are based on assumptions and actual results may vary due to exploration, development, operating, and other risks.