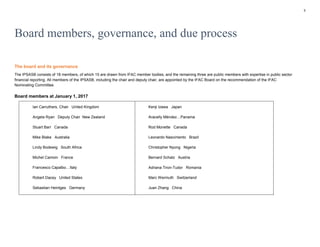

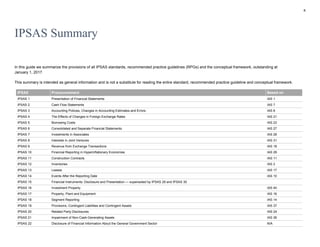

This document provides an overview and summary of International Public Sector Accounting Standards (IPSAS). It discusses why governments adopt IPSAS, the background and governance of the IPSAS Board, how IPSAS are used around the world, and cash-basis IPSAS. It also lists the current IPSAS standards and guidelines and notes they are based on International Financial Reporting Standards (IFRS) or address public sector-specific financial reporting issues.