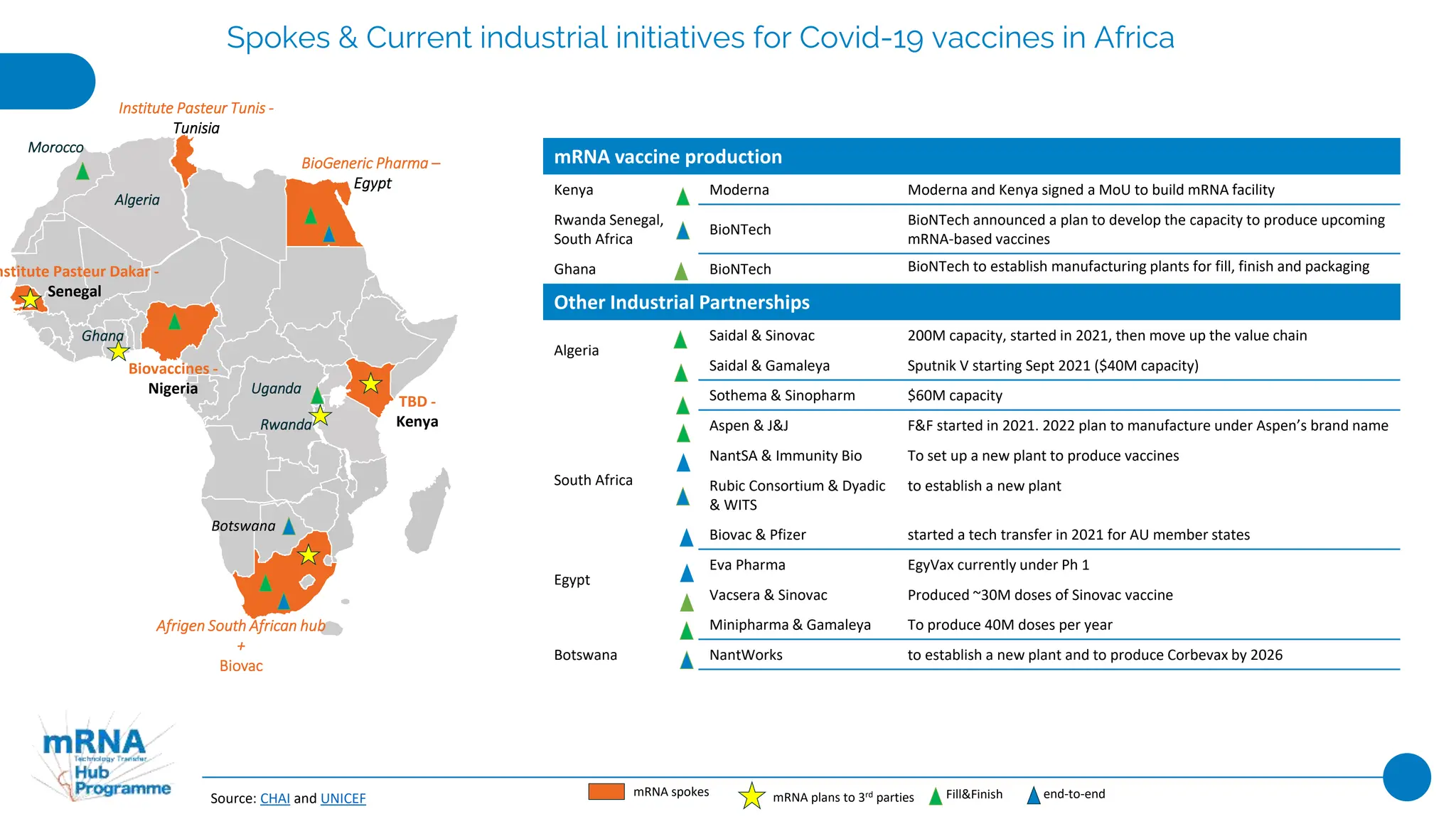

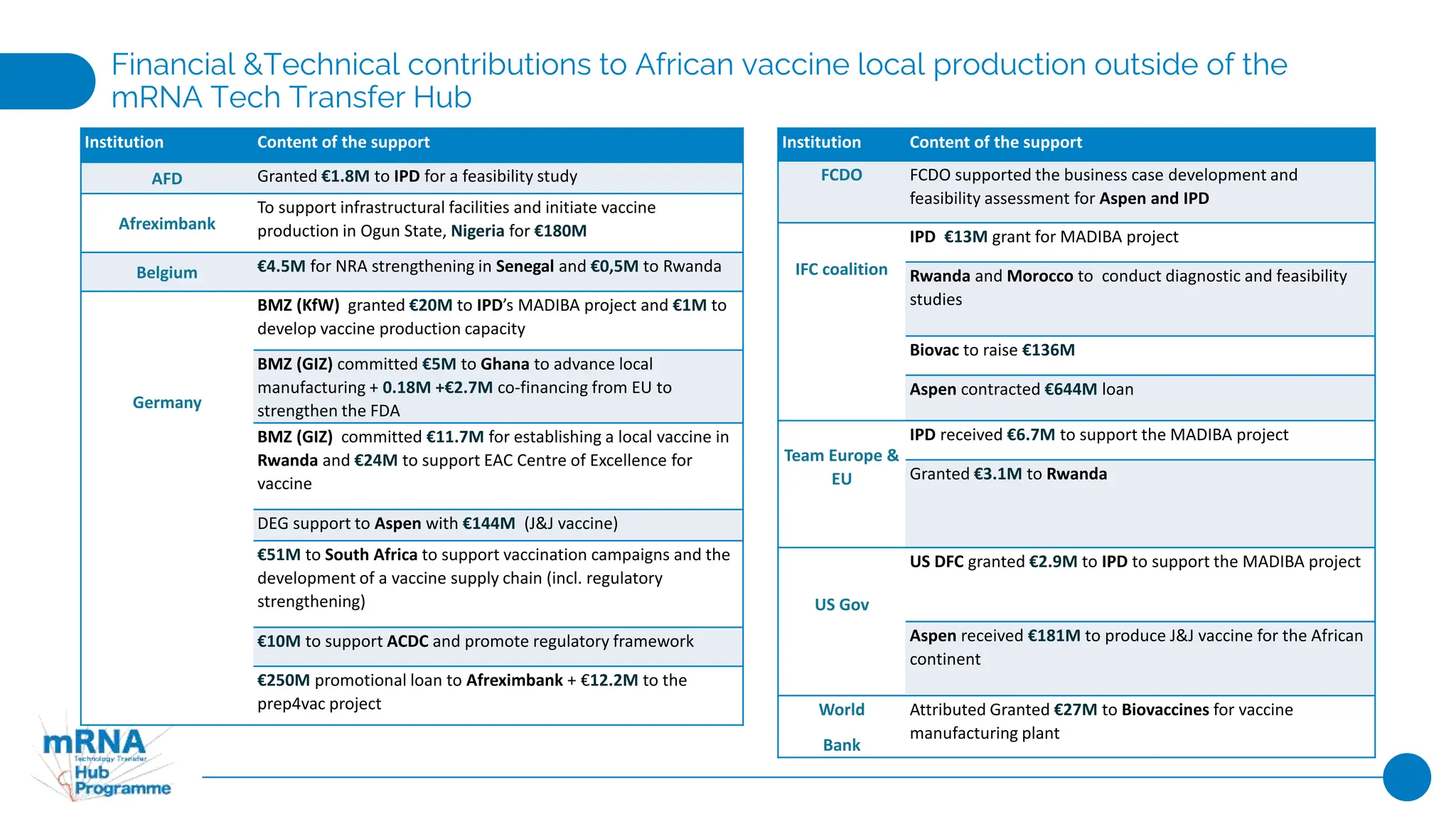

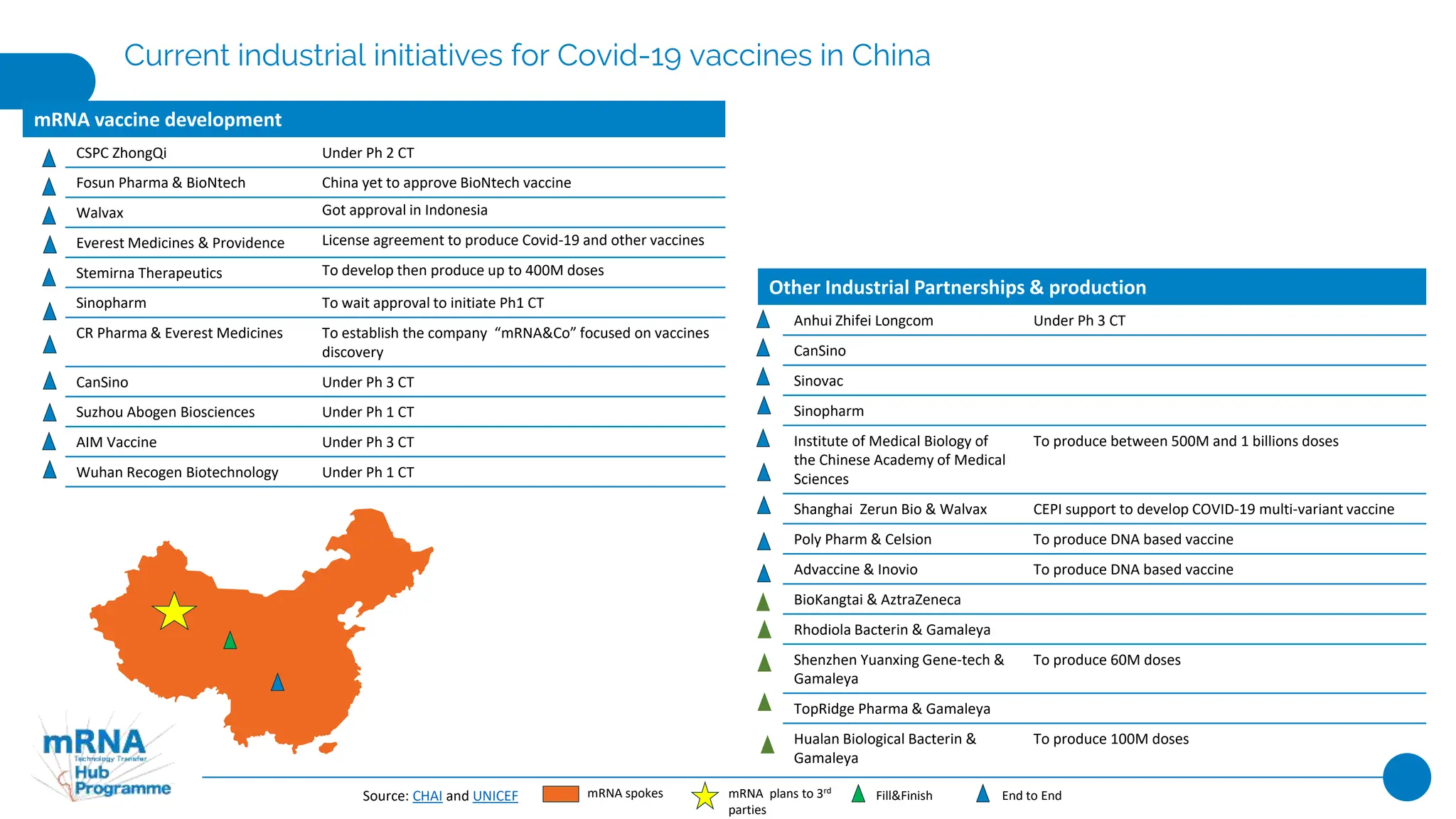

This document provides an overview of current industrial initiatives for COVID-19 vaccine production in various regions of Africa, Latin America, Asia, India, and China. It outlines existing and planned mRNA vaccine development as well as other partnerships between companies and research institutions to develop and produce COVID-19 vaccines through various stages of the value chain from drug substance to fill and finish. Financial and technical support provided by governments and organizations to strengthen local vaccine production capacity is also summarized.