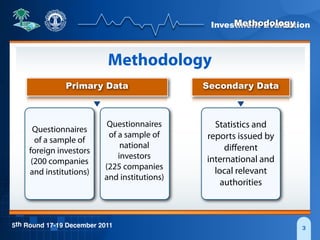

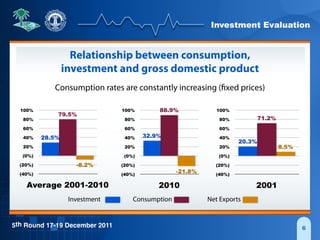

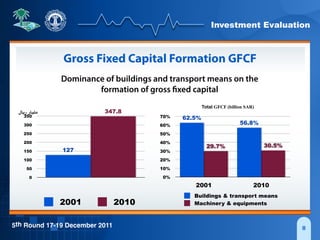

This document summarizes an evaluation of investment in Saudi Arabia presented at the 5th Riyadh Economic Forum from December 17-19, 2011. It examines national and foreign investment trends, attractions and obstacles using data collection methods like surveys of investors and officials. Key findings include the dominance of real estate and infrastructure in investment, high levels of government and central bank investments abroad despite domestic needs, and obstacles reported by local investors like bureaucracy and inconsistent laws. Foreign direct investment is growing but its impact on employment and development is limited. Overall the evaluation aims to analyze Saudi Arabia's investment environment and identify means of improving it.