Embed presentation

Download to read offline

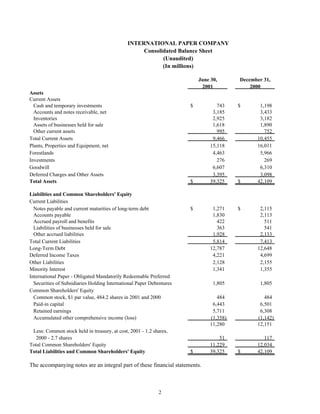

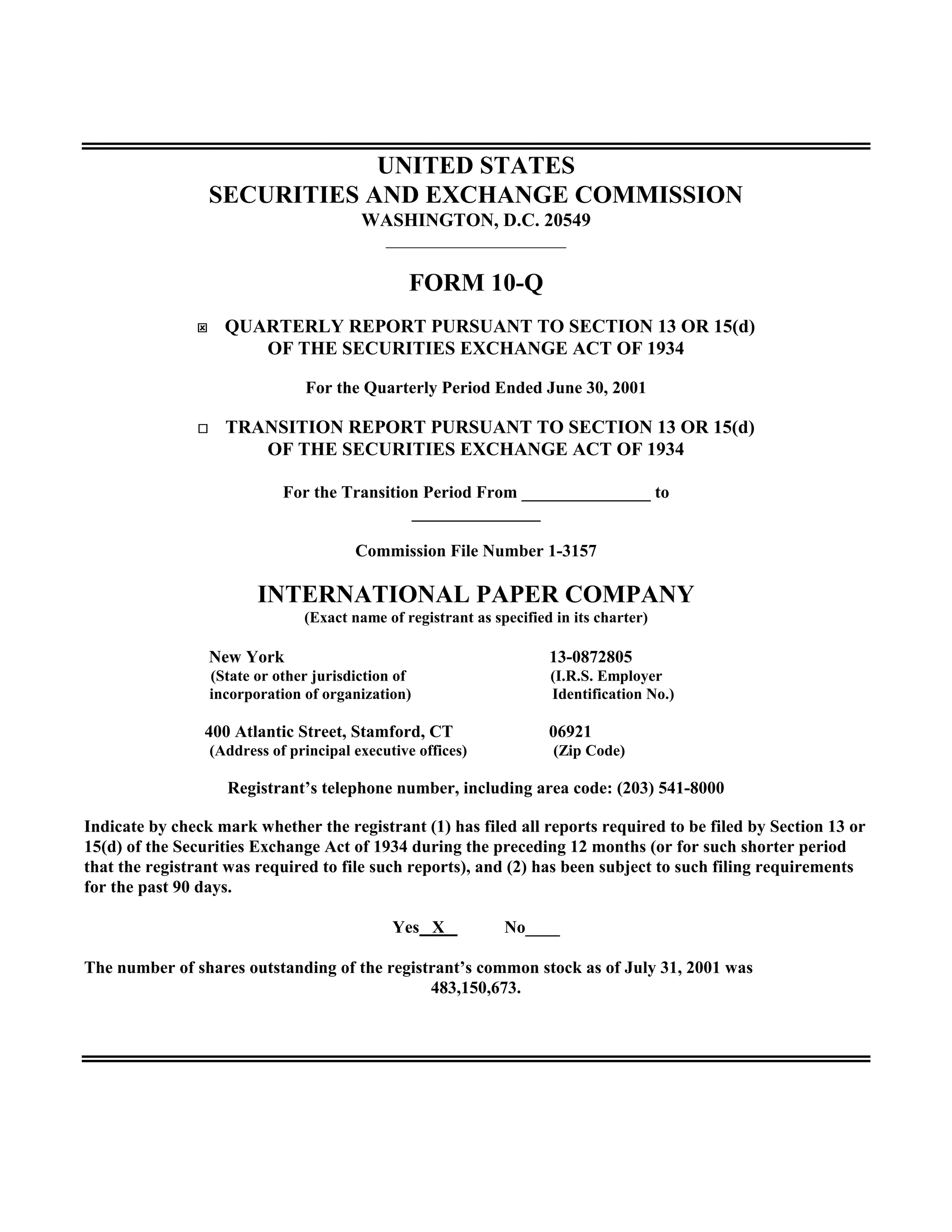

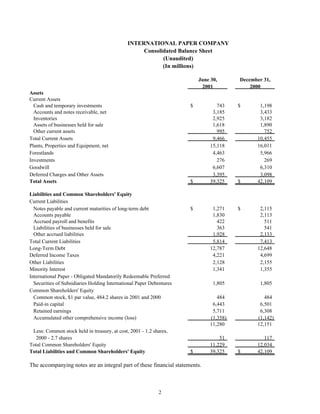

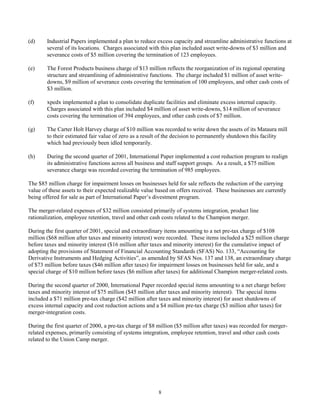

This document is International Paper Company's Form 10-Q quarterly report filed with the SEC for the quarter ended June 30, 2001. It includes International Paper's consolidated financial statements and notes for the quarter. The financial statements show a net loss of $313 million for the quarter compared to net earnings of $270 million in the prior year period. Revenues decreased slightly to $6.7 billion for the quarter from $6.8 billion in the prior year. Costs and expenses increased to $6.9 billion from $6.1 billion due primarily to restructuring and impairment charges.