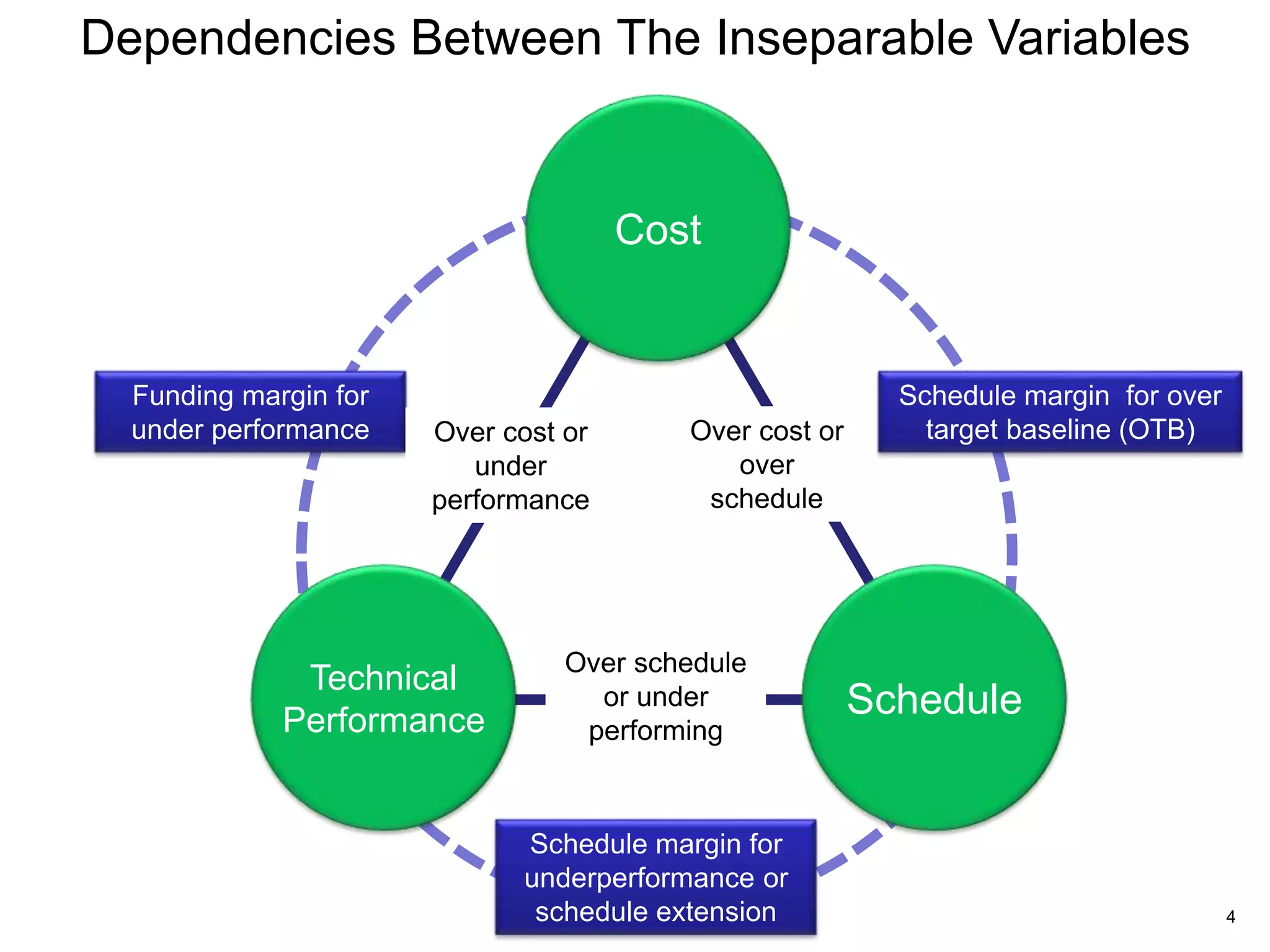

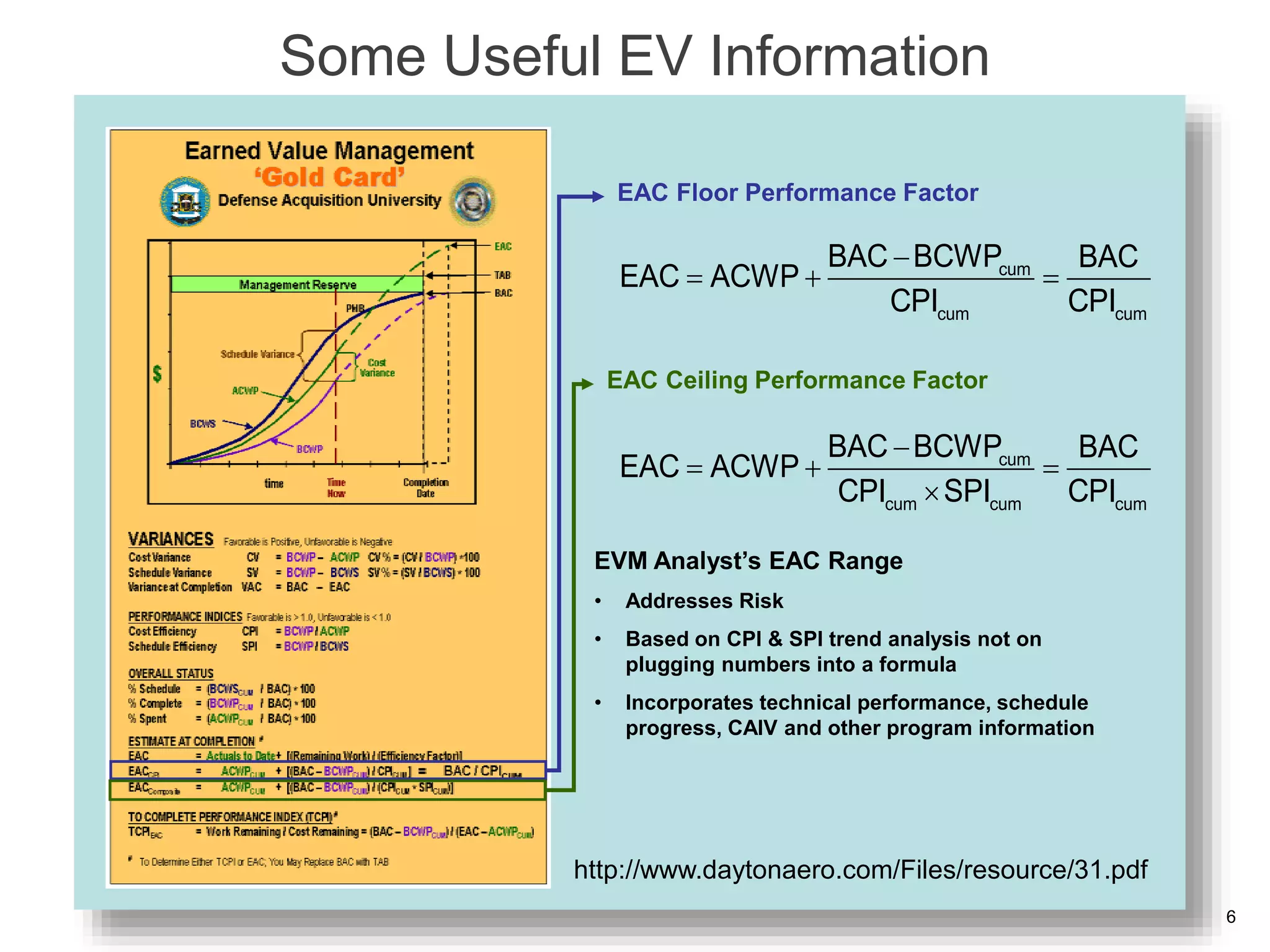

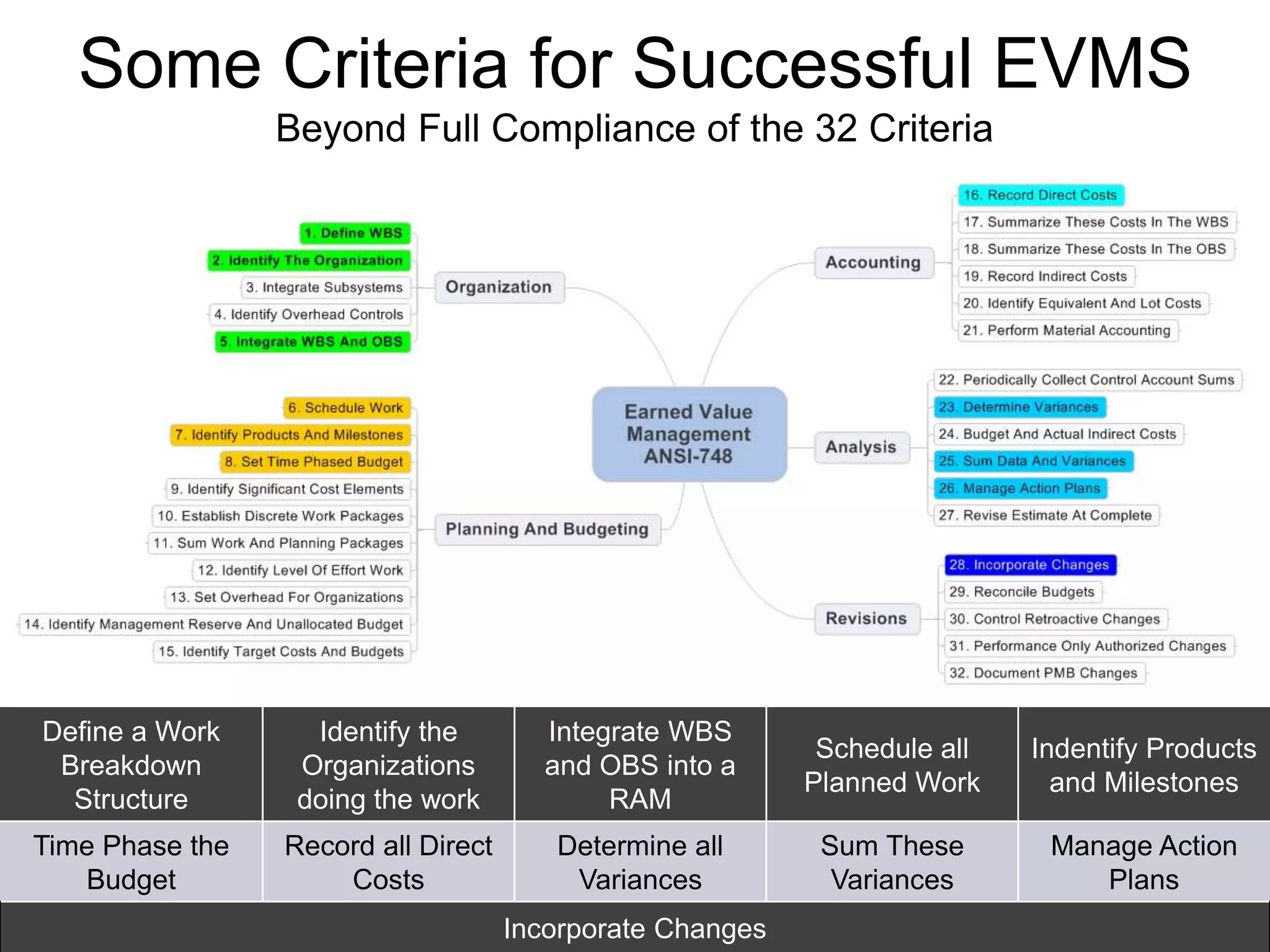

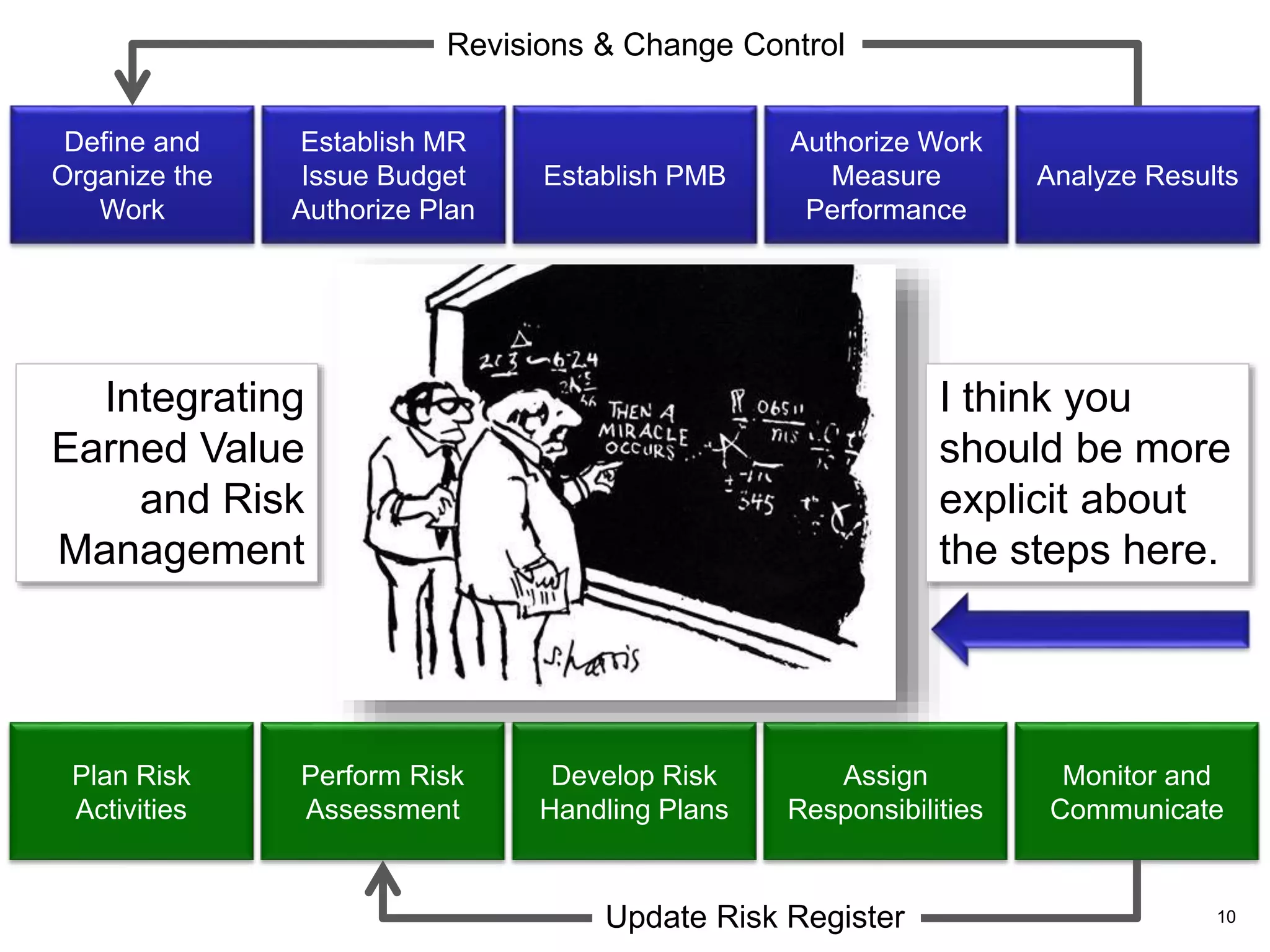

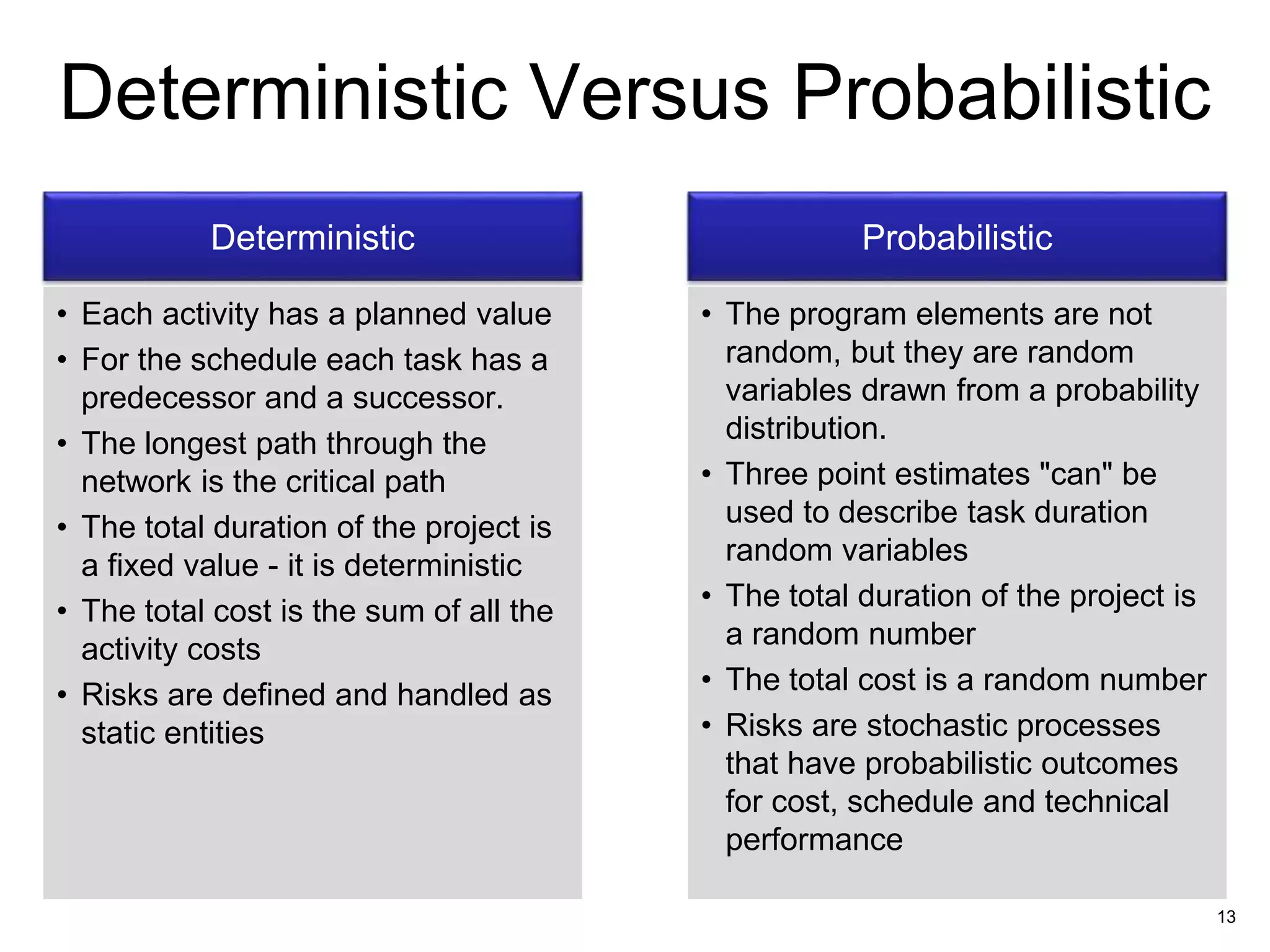

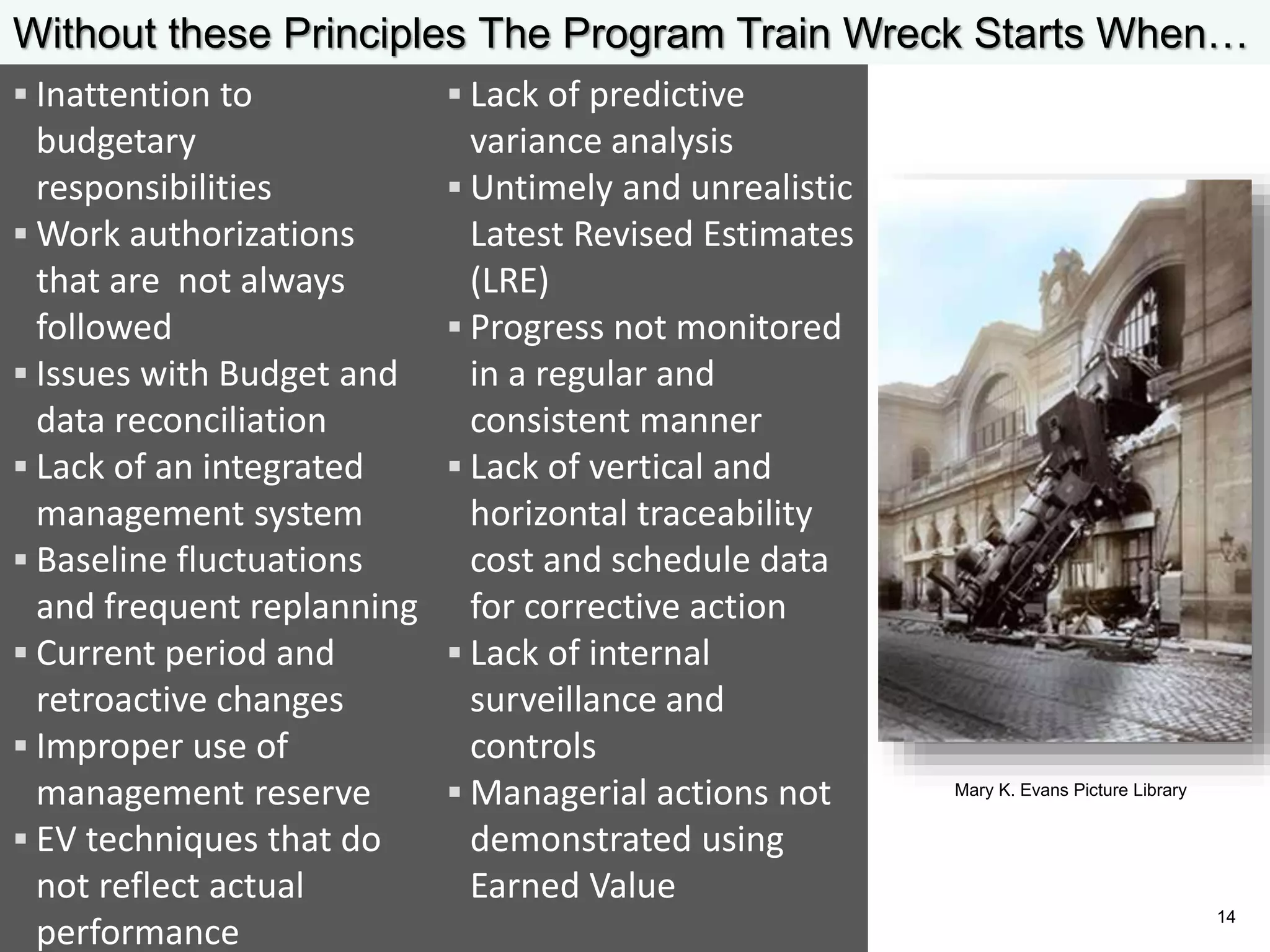

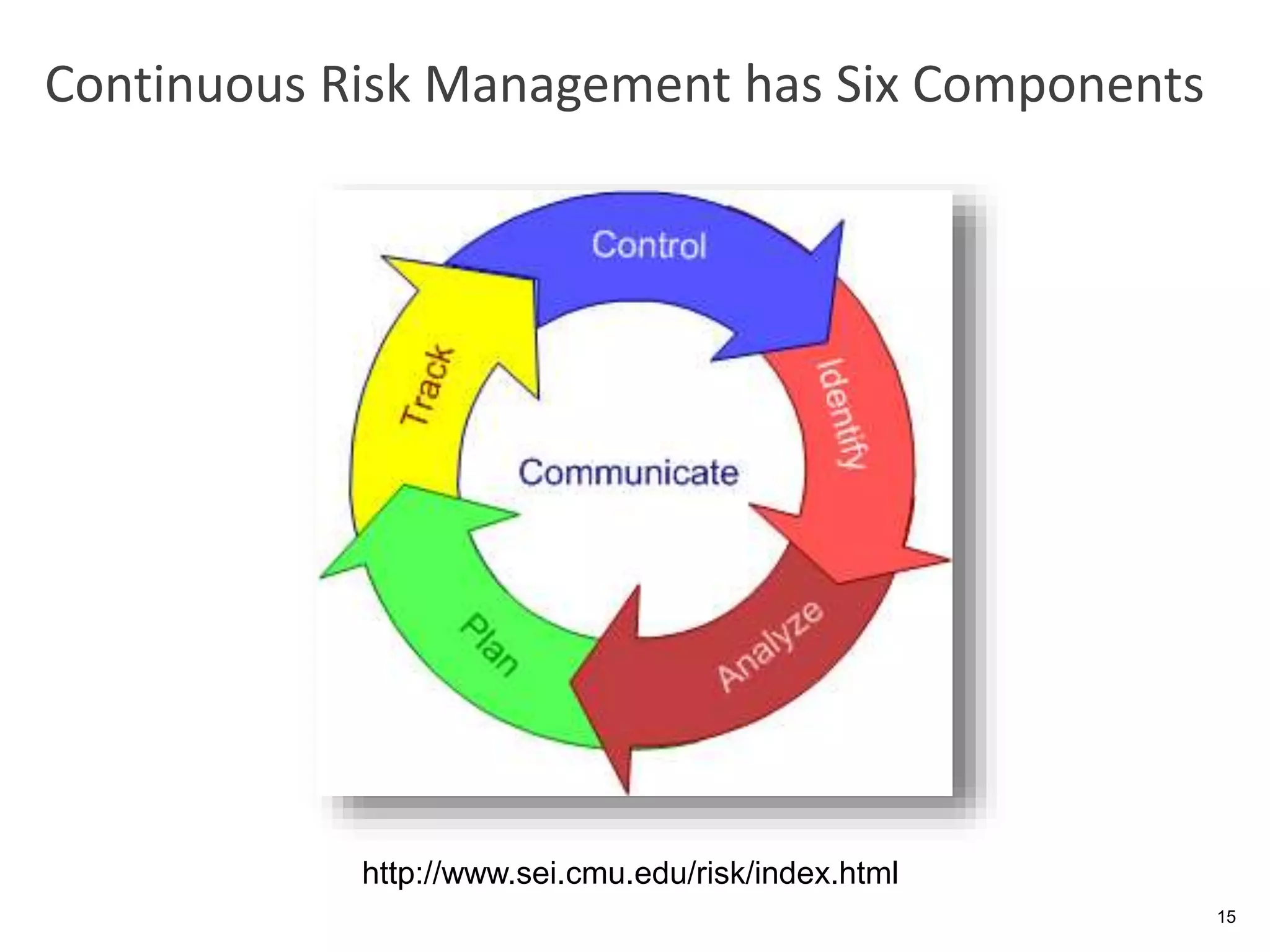

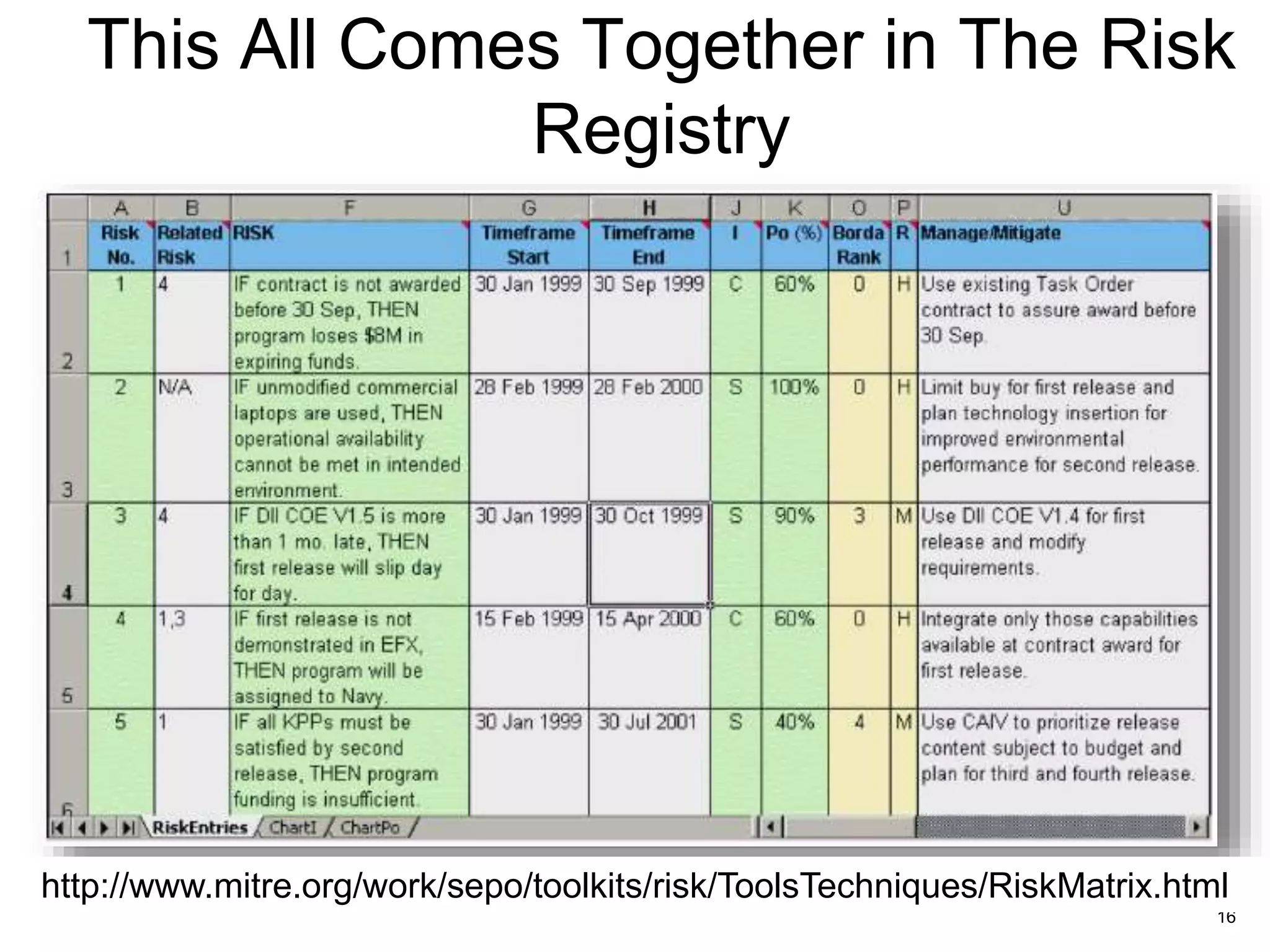

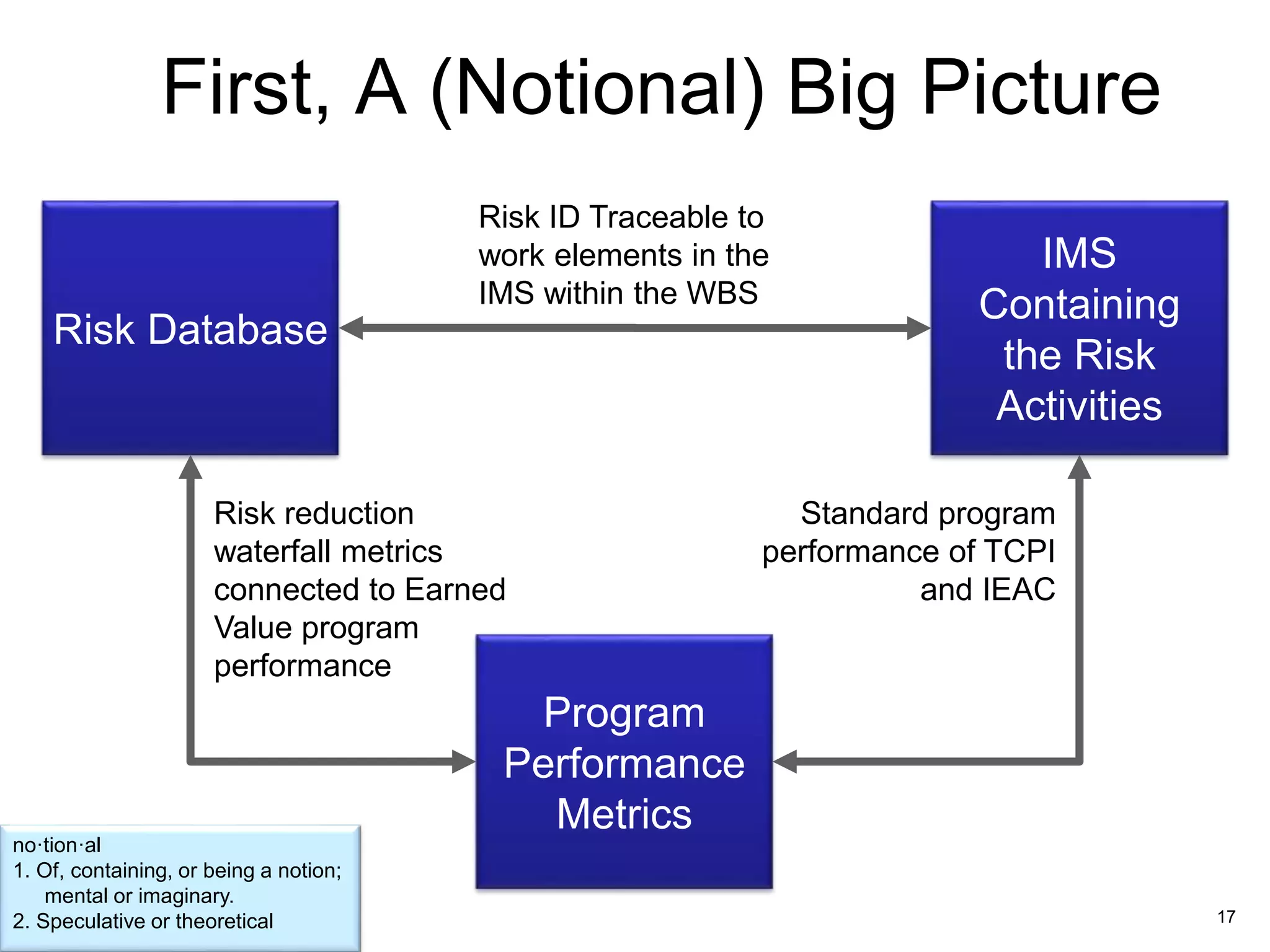

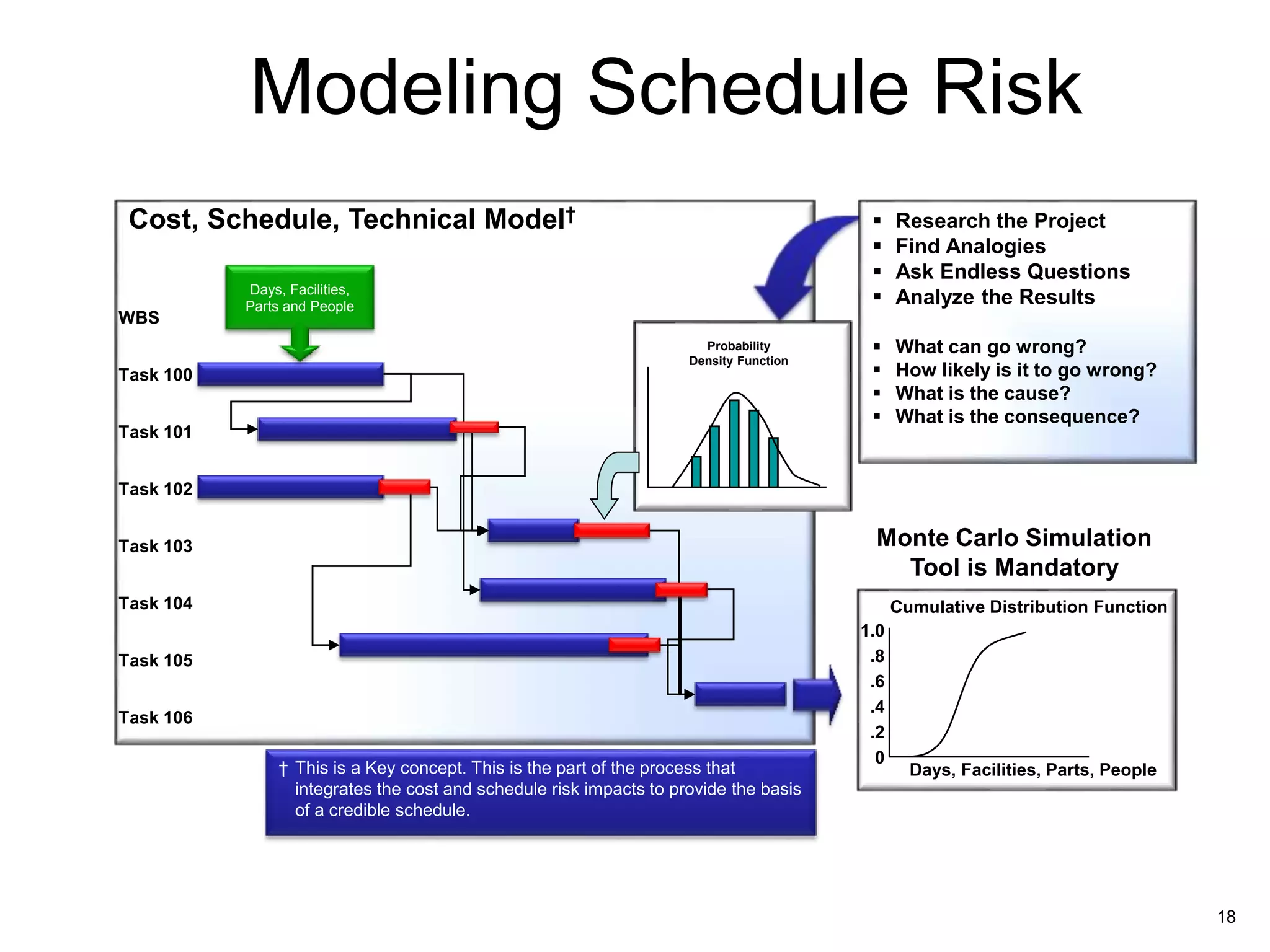

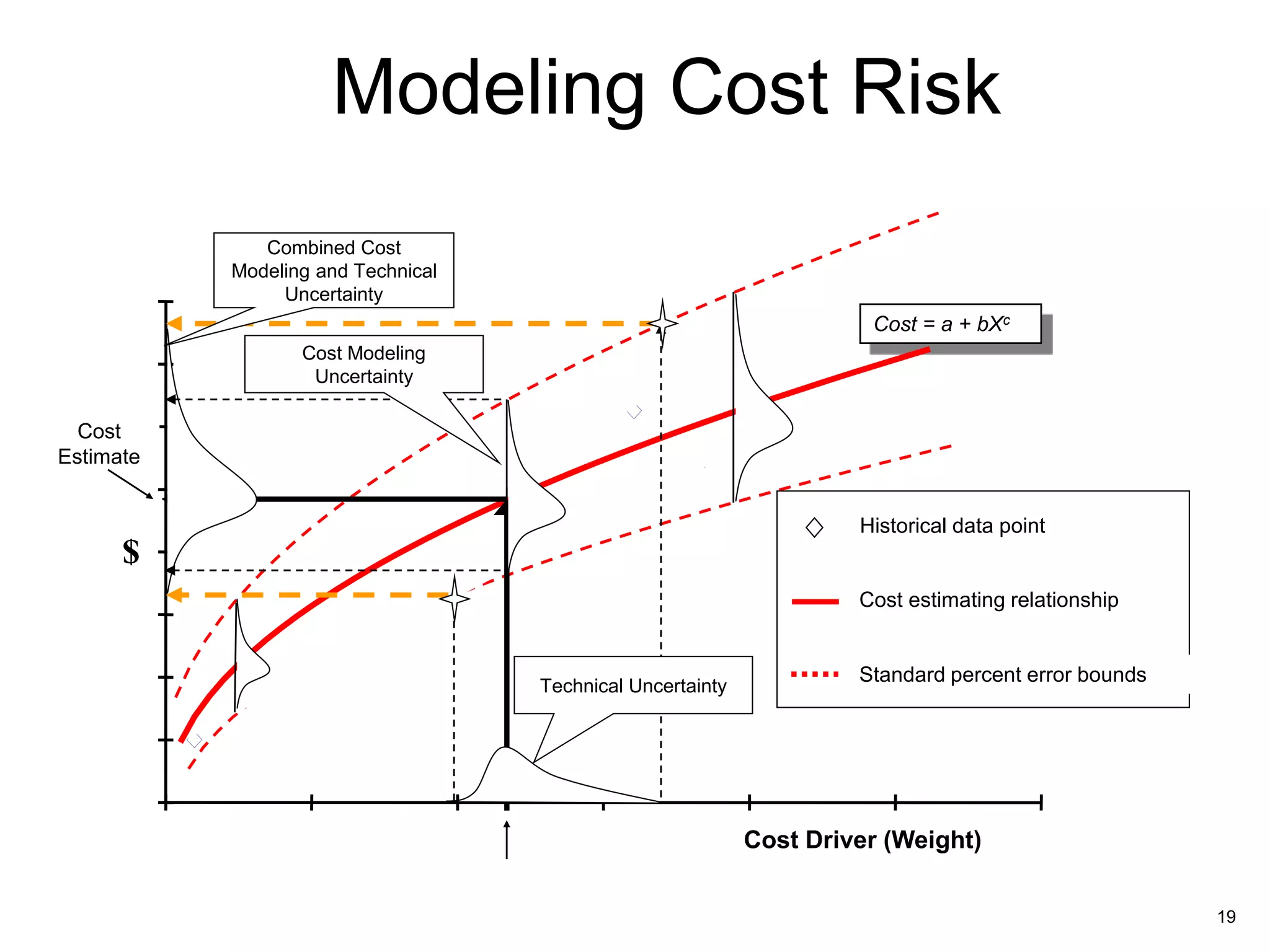

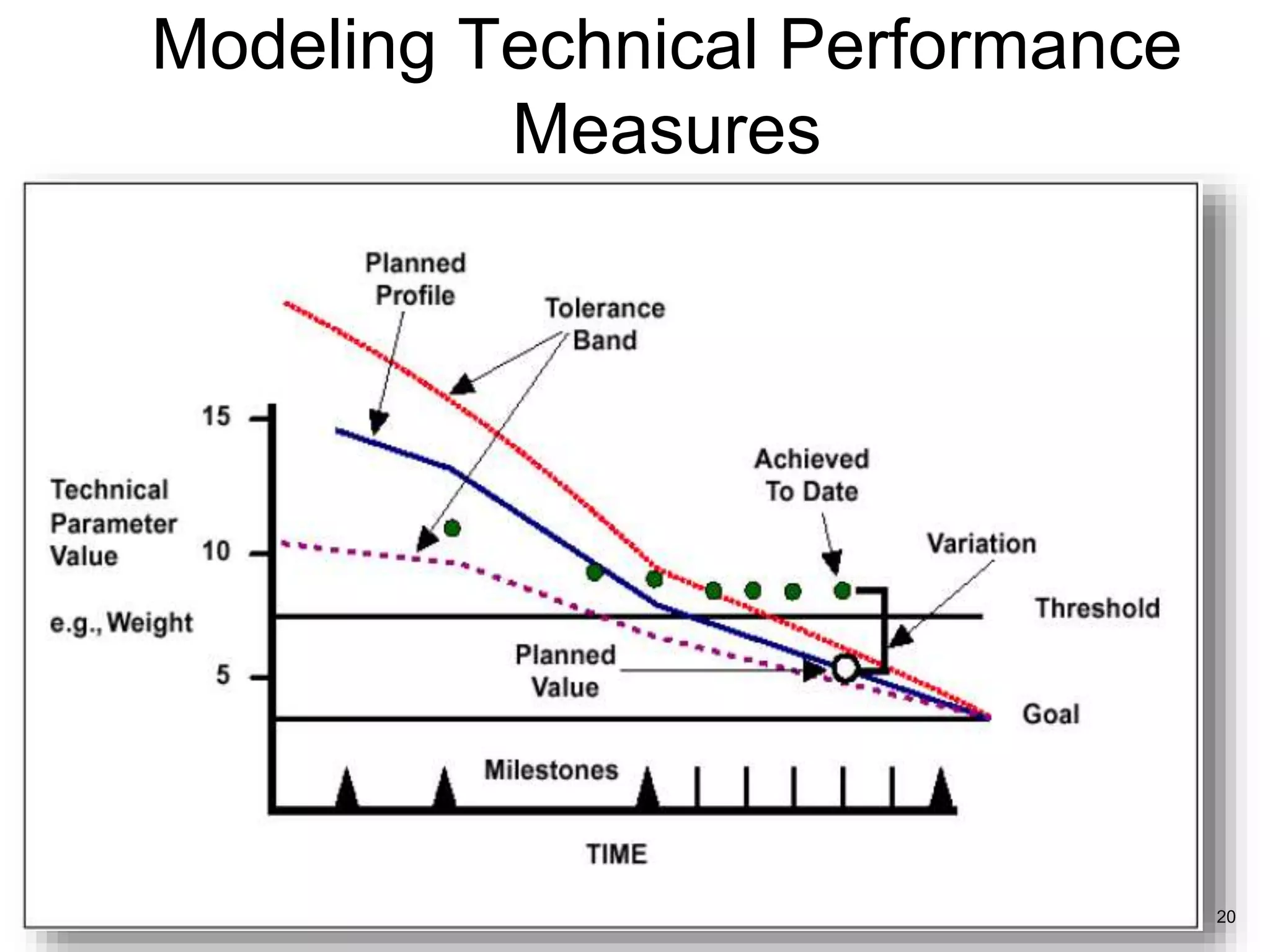

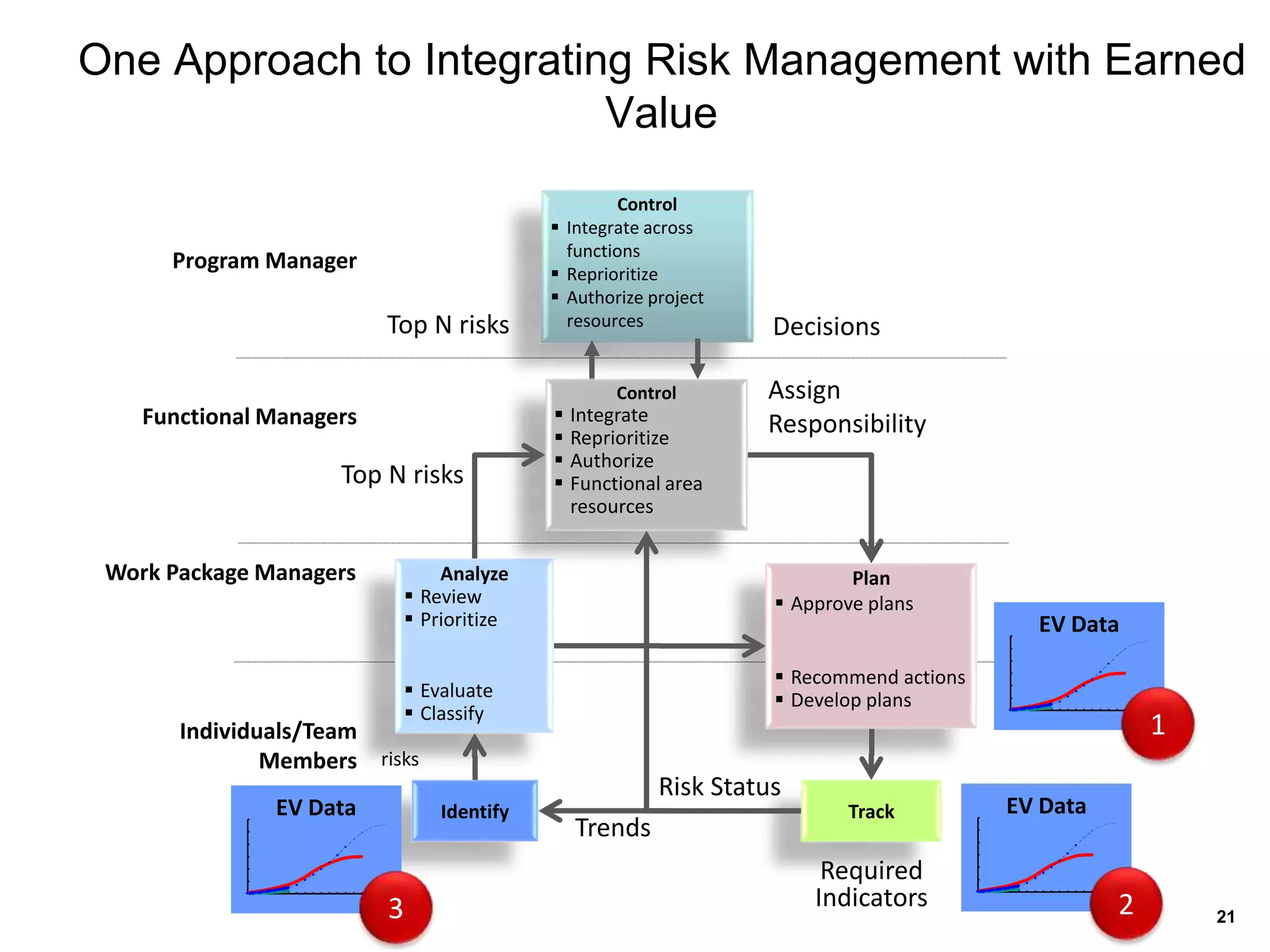

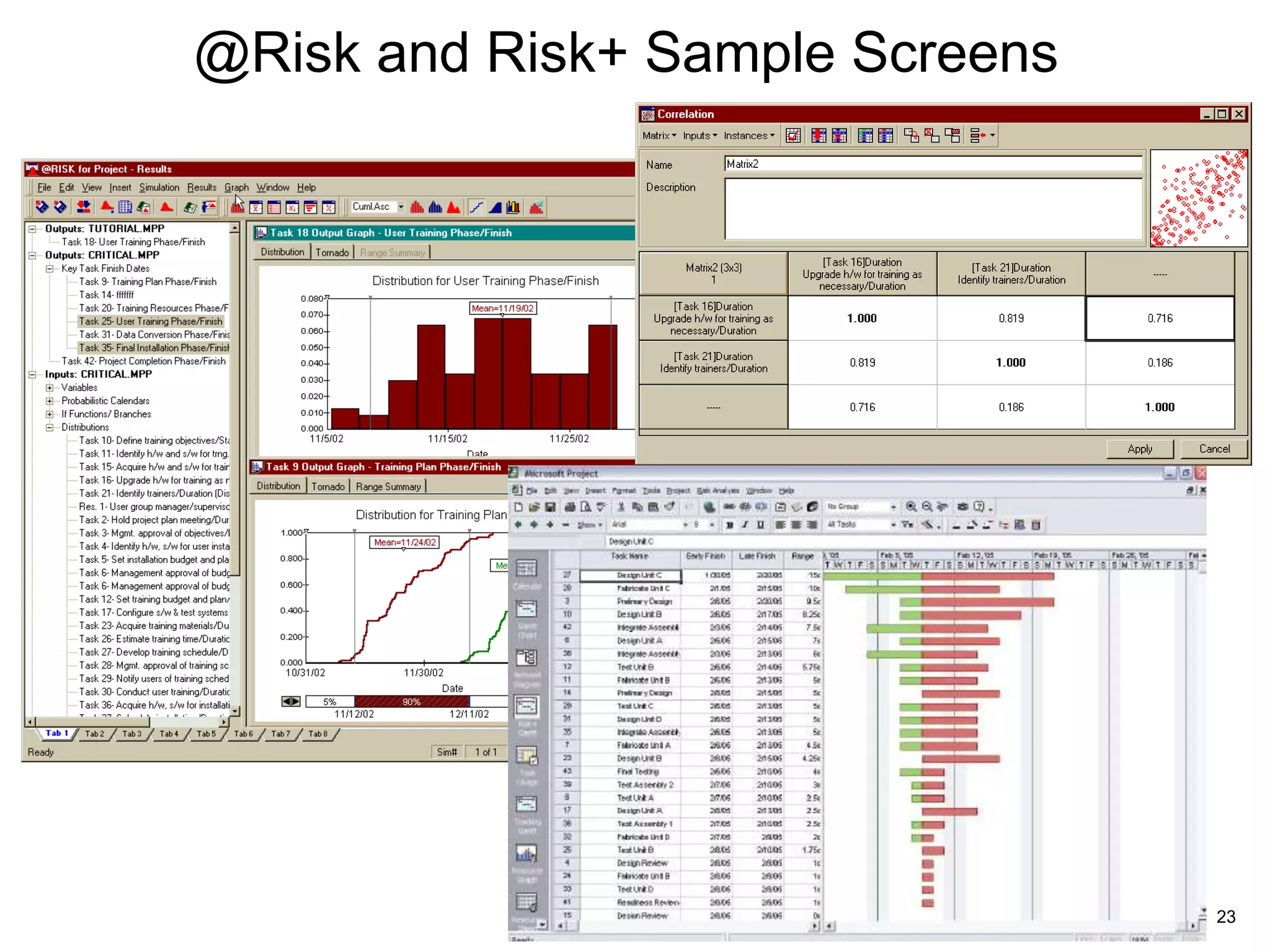

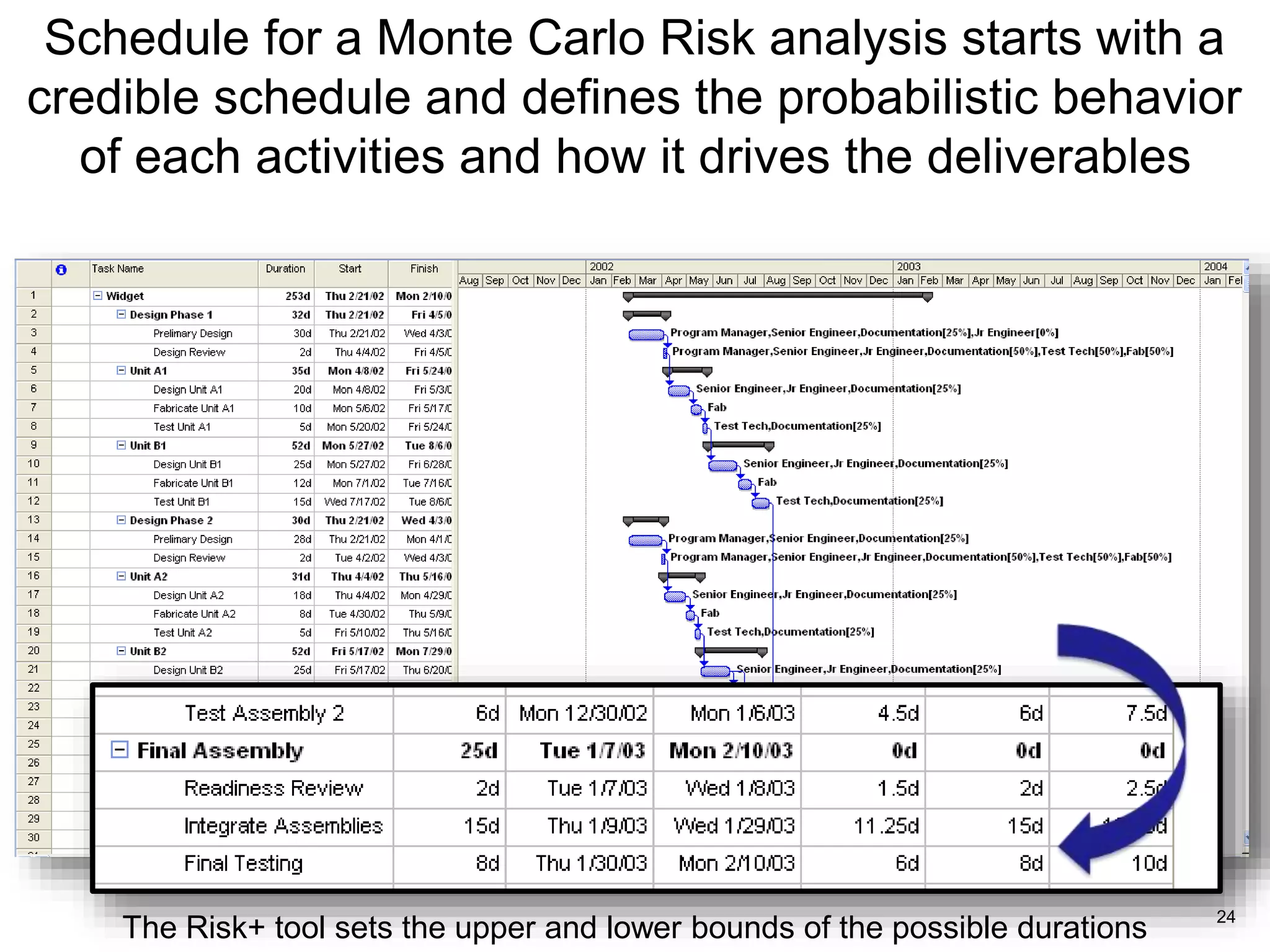

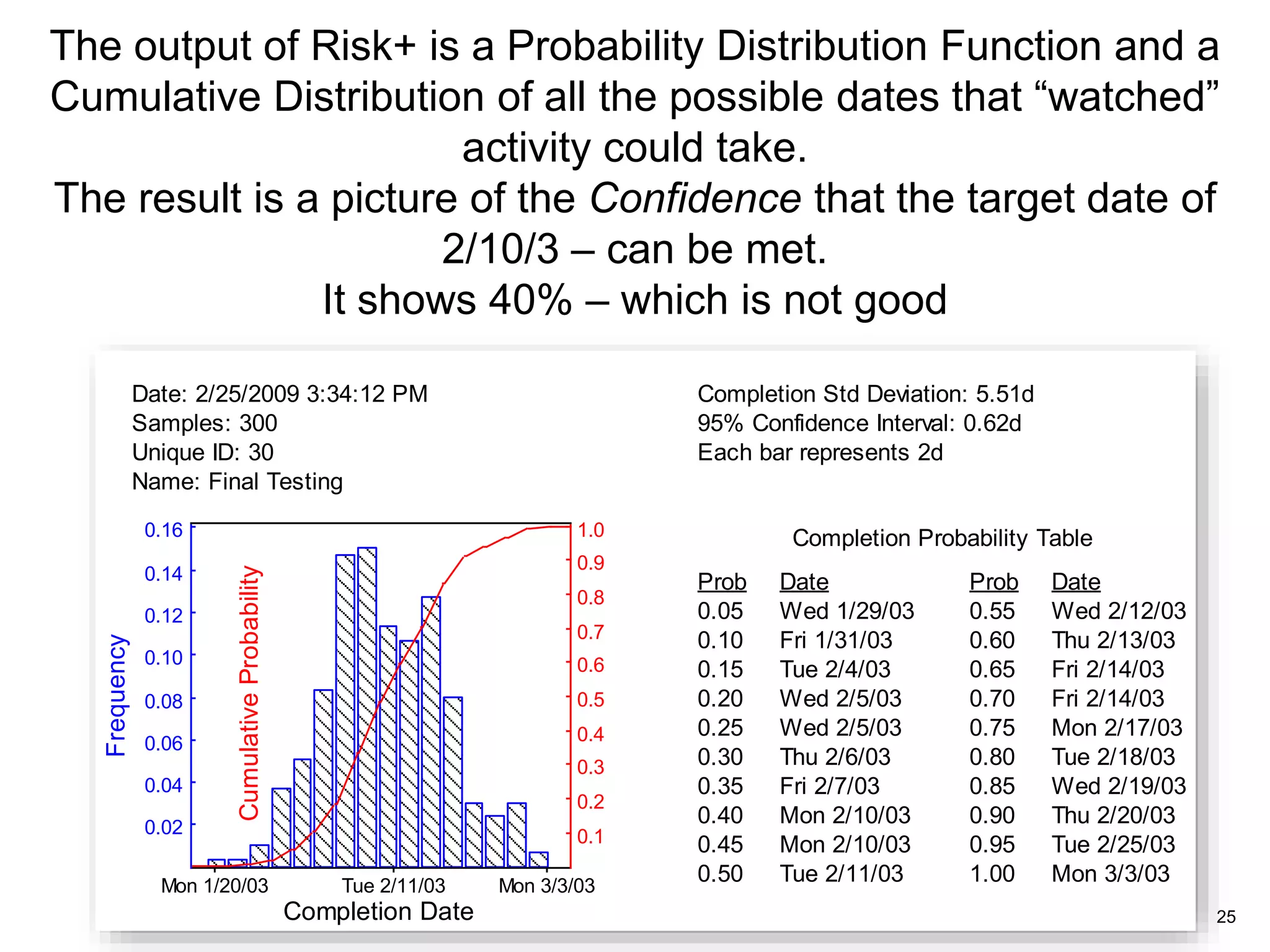

The document discusses the integration of cost, schedule, technical performance, and risk management in project management, emphasizing the importance of these elements being inseparable and managed under a well-defined process. It covers methodologies like Earned Value Management (EVM) and Monte Carlo simulations for risk analysis, highlighting the need for clear communication and structured risk assessment plans. The text outlines the consequences of poor risk management practices and provides actionable insights for enhancing project performance by effectively managing uncertainties.