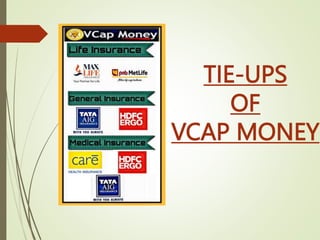

VCAP Money provides value management solutions and is a business partner of Motilal Oswal Financial Services. It has tie-ups with major life, general, and medical insurance providers in India such as Max Life Insurance, PNB MetLife, Tata AIG General Insurance, HDFC ERGO General Insurance, Tata AIG Health Insurance, HDFC ERGO Health Insurance, and Care Health Insurance. These insurance companies offer a wide range of products like life insurance, health insurance, and property and casualty insurance policies to individuals and corporates in India.