Insurance Law on Reinsurance Insurance Code of the Philippines

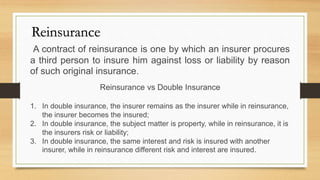

- 1. A contract of reinsurance is one by which an insurer procures a third person to insure him against loss or liability by reason of such original insurance. Reinsurance Reinsurance vs Double Insurance 1. In double insurance, the insurer remains as the insurer while in reinsurance, the insurer becomes the insured; 2. In double insurance, the subject matter is property, while in reinsurance, it is the insurers risk or liability; 3. In double insurance, the same interest and risk is insured with another insurer, while in reinsurance different risk and interest are insured.

- 2. •A gets B to insure his building against fire for P10 Million. •B (insurer) can get C (reinsurer) to reinsure him for P5 Million out of the P10 Million insurance in favor of A. Thus, B’s liability shall be limited to P5 Million. While C, the reinsurer has to give the insurer the other P5 M.

- 3. AVON INSURANCE PLC, et al vs. COURT OF APPEALS G.R. No. 97642, August 29, 1997, TORRES, JR., J. Yupangco Cotton Mills engaged to secure with Worldwide Security and Insurance Co. Inc., several of its properties under Policy No. 20719 for a coverage of P100,000,000.00 and under Policy No. 25896, also for P100,000,000.00. Both contracts were covered by reinsurance treaties between Worldwide Surety and Insurance and several foreign reinsurance companies, including the petitioners. The reinsurance arrangements had been made through international broker C.J. Boatwright and Co. Ltd., acting as agent of Worldwide Surety and Insurance. Within the respective effectivity periods of the 2 policies, the properties therein insured were razed by fire. Partial payments were made by Worldwide Surety and Insurance and some of the reinsurance companies. Worldwide Surety and Insurance, in a Deed of Assignment, acknowledged a remaining balance of P19,444,447.75 still due Yupangco Cotton Mills, and assigned to the latter all reinsurance proceeds still collectible from all the foreign reinsurance companies. Thus, in its interest as assignee and being the original insured, Yupangco Cotton Mills instituted this collection suit against the petitioners. In a Petition for Certiorari filed with the CA, petitioners submitted that respondent Court has no jurisdiction over them, being all foreign corporations not doing business in the Philippines with no office, place of business or agents in the Philippines. The CA found the petition devoid of merit. Hence, this petition.

- 4. Whether or not Petitioners, being foreign corporations not doing business in the Philippines, are subject to the jurisdiction of Philippine courts. RULING NO. To qualify the petitioners business of reinsurance within the Philippine forum, resort must be made to established principles in determining what is meant by doing business in the Philippines. A foreign corporation, is one which owes its existence to the laws of another state, and generally, has no legal existence within the state in which it is foreign. It was held that corporations have no legal status beyond the bounds of the sovereignty by which they are created. Nevertheless, it is widely accepted that foreign corporations are, by reason of state comity, allowed to transact business in other states and to sue in the courts of such fora. In the Philippines, before a foreign corporation can transact business, it must first obtain a license to transact business here and secure the proper authorizations under existing law. The purpose of the law for the same is to subject the foreign corporations doing business in the Philippines to the jurisdiction of the courts. Indeed, if a foreign corporation does not do business here, there would be no reason for it to be subject to the State's regulation. In so far as the State is concerned, such foreign corporation has no legal existence. Therefore, to subject such corporation to the courts' jurisdiction would violate the essence of sovereignty. As we have found, there is no showing that petitioners had performed any act in the country that would place it within the sphere of the court's jurisdiction.

- 5. Read: COMMUNICATION and INFORMATION SYSTEM v. MARK SENSING AUSTRALIA, ET AL G.R. No. 192159, January 25, 2017 • Where an insurer obtains reinsurance, except under automatic reinsurance treaties, he must communicate all the representations of the original insured, and also all the knowledge and information he possesses, whether previously or subsequently acquired, which are material to the risk. (Sec 98, ICP) What must be communicated by the insured to Insurer? a. All the representation of the original insured; b. All the knowledge and information he possesses, whether previously or subsequently acquired, which are material to the risk. Exception: When two or more insurance companies agree in advance that each will reinsure a part of any line of insurance taken by the other (automatic reinsurance treaty).

- 6. • A reinsurance is presumed to be a contract of indemnity against liability, and not merely against damage: Hence: When the reinsured becomes liable under the original policy, he may obtain payment from the reinsurer even before paying the loss of the original insured. But he cannot claim more than the amount of reinsurance. • The original insured has no interest in a contract of reinsurance. (Sec 100, ICP)

- 7. Kinds of Insurance Marine Insurance

- 8. Marine Insurance includes: (a) Insurance against loss of or damage to: (1) Vessels, craft, aircraft, vehicles, goods, freights, cargoes, merchandise, effects, disbursements, profits, moneys, securities, choses in action, instruments of debts, valuable papers, bottomry, and respondentia interests and all other kinds of property and interests therein, in respect to, appertaining to or in connection with any and all risks or perils of navigation, transit or transportation, or while being assembled, packed, crated, baled, compressed or similarly prepared for shipment or while awaiting shipment, or during any delays, storage, transhipment, or reshipment incident thereto, including war risks, marine builder’s risks, and all personal property floater risks; (2) Person or property in connection with or appertaining to a marine, inland marine, transit or transportation insurance, including liability for loss of or damage arising out of or in connection with the construction, repair, operation, maintenance or use of the subject matter of such insurance (but not including life insurance or surety bonds nor insurance against loss by reason of bodily injury to any person arising out of ownership, maintenance, or use of automobiles);

- 9. (3) Precious stones, jewels, jewelry, precious metals, whether in course of transportation or otherwise; and (4) Bridges, tunnels and other instrumentalities of transportation and communication (excluding buildings, their furniture and furnishings, fixed contents and supplies held in storage); piers, wharves, docks and slips, and other aids to navigation and transportation, including dry docks and marine railways, dams and appurtenant facilities for the control of waterways. (b) Marine protection and indemnity insurance, meaning insurance against, or against legal liability of the insured for loss, damage, or expense incident to ownership, operation, chartering, maintenance, use, repair, or construction of any vessel, craft or instrumentality in use of ocean or inland waterways, including liability of the insured for personal injury, illness or death or for loss of or damage to the property of another person.

- 10. • Goods and Merchandise in marine policy includes all articles which are carried on the ship for commercial purposes. They do not include the clothing of the passengers or the crew unless shipped as part of the cargo, nor food or other provisions intended for the consumption of the passengers, unless these are expressly included in the policy. • Freightage signified all the benefits derived by the owner, either from the chartering of the ship for its employment for the carriage of his own goods or those of others. It will however, not be covered by a marine policy unless so expressly indicated therein. • The insurer is liable for all losses proximately caused by the perils covered by the marine policy.

- 11. • The phrase Perils of the sea embraces those casualties due to the violent action of the winds or waves. • Perils of the sea includes shipwreck, foundering, stranding, collision, and every specie of damage done to the ship or goods at sea by the violent action of the winds and waves. • The rusting of a cargo of steel pipes in the course of voyage is a peril of the sea. (Read Cathay Insurance Co. vs CA)

- 12. • Perils of the ship are losses or damages resulting from: a. The natural and inevitable action of the sea; b. Ordinary wear and tear of the ship; c. The negligent failure of the ship’s owner to provide the vessel with proper equipment to convey the cargo under ordinary conditions. • A marine policy usually covers perils of the sea only and not perils of the ship. • Inchmaree clause in marine insurance is a provision in the policy that the insurance shall cover loss or damage to the hull or machinery through the negligence of the masters, charters, mariners, engineers, or pilots or through explosions, bursting of boilers or through any latent defect in the hull or machinery not resulting from want of due diligence.

- 13. The owner of a ship has in all cases an insurable interest in it, even when it has been chartered by one who covenants to pay him its value in case of loss: Provided, That in this case the insurer shall be liable for only that part of the loss which the insured cannot recover from the charterer.