This document provides a glossary of over 7,500 insurance, reinsurance, and risk management terms. It was compiled by the author over 18 months through extensive research of source materials. The glossary is in alphabetical order and includes cross-references. While not encyclopedic, it aims to be accurate and understandable for non-specialists. The author acknowledges the contributions of learned authors, institutions, and source materials in compiling this resource. Feedback is welcomed to improve future editions.

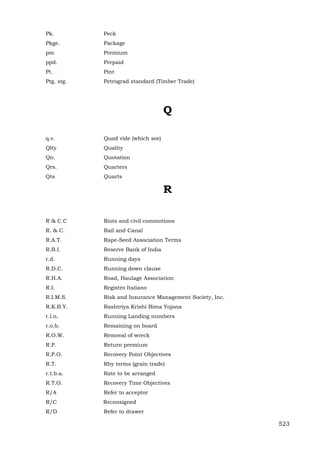

![263

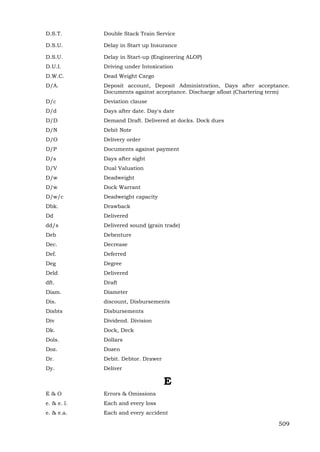

provisional liquidation of a company, in which case it may be resuscitated. Otherwise

the court will issue an order for voluntary or compulsory liquidation. (ii) The

finalization of a customs entry.

Liquidation Bond : A bond in respect of the conduct of the liquidator of a company that is

being wound up.

Liquidation of Insurer : Action undertaken the Competent Regulatory Authority to dissolve

an impaired or insolvent insurer which cannot be restored to sound financial

standing.

Liquidity : Liquidity is the ability of an individual or business to quickly convert assets into

cash without incurring a considerable loss. There are two kinds of liquidity : quick

and current. Quick liquidity refers to funds – cash, short term investments, and

government bonds – and possessions which can immediately be converted into cash

in the case of an emergency. Current liquidity refers to current liquidity plus

possessions such as real state which cannot be immediately liquidated but eventually

can be sold and converted into cash. Quick liquidity is a subset of current liquidity.

This reflects the financial stability of a company and thus their rating.

Liquor Liability Insurance : Refer : “Dram Shop Liability Insurance.”

Liquor License Bond : Insurance required by a regulatory body for those having liquor

licenses.

Listing : A list of Insurers or reinsures subscribing a contract, showing their relevant

participations. The term is applied in Direct cargo practice also to an advice given to

open cover Insurer in respect of an extraordinarily large declaration on the cover.

Litigant : One who is engaged in a lawsuit.

Litigation : The act of carrying on a law suit.

Litigation Bond : Refer : “Court Bond”.

Litigation Costs and Expenses : A liability insurance provides indemnity in respect of

litigation costs and expenses incurred in connection with a third party claim against

the insured.

Livery : In automobile insurance, the carrying of passengers for hire.

Livestock : Common farm animals

Livestock Insurance : The class of agricultural insurance that is based on the provision of

mortality cover for livestock due to named disease(s), and accidental injury.

Insurance cover is normally restricted to adult animals and may be taken out on an

individual animal or herd basis. Major Classes of insured livestock include dairy

cattle, sheep, goats, pigs, camels, etc. Refer also "Cattle Insurance."

Livestock Mortality Insurance : The equivalent of life insurance for livestock.

Livestock Transit Insurance :Insurance against accidents causing death or crippling on

shipment of livestock while in transit by rail, trust, or other similar means of

transportation.

Lloyd’s Byelaws : The primary rules made by the Council of Lloyd’s regarding the conduct

of insurance business at Lloyd’s.

Lloyd’s Society of Lloyd’s [*] The Society incorporated by Lloyd’s Act 1871 by the name of

Lloyd’s.](https://image.slidesharecdn.com/2b20832d-f590-4e0d-8f1d-c775ca8792ec-161112085217/85/E-book-263-320.jpg)

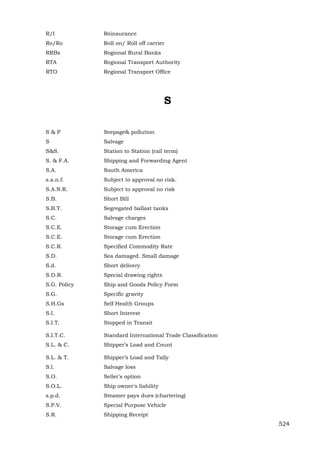

![269

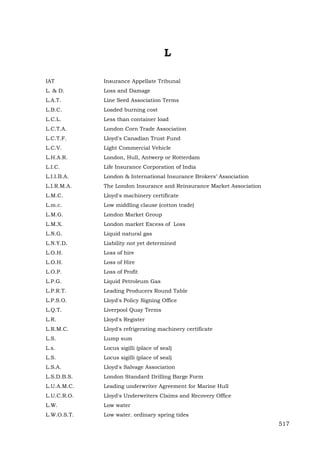

Lloyd’s Syndicate [*] : A member or group of members underwriting insurance business at

Lloyd’s through the agency of a managing agent or a substitute agent to which a

syndicate number is assigned by the Council. Except where it is expressly otherwise

provided the several groups of members to which in different years a particular

syndicate number is assigned by or under the authority of the Council shall be

treated as the same syndicate, notwithstanding that they may not comprise the same

members with the same individual participations. [*] = Syndicate allocated capacity =

In relation to a syndicate, the aggregate of the member’s syndicate premium limits of

all the members for the time being of the syndicate.

Lloyd’s Syndicate Business Forecast : A statement of the expected range of results of each

open year of account of a syndicate that is submitted to Lloyd’s by its managing

agent in mid-year together with the managing agent’s expectations for the next year

of account.

Lloyd’s Syndicate Business Plan : A plan of the underwriting of a given syndicate for a

given year of account that is prepared by the managing agent of a syndicate and

submitted to Lloyd’s for approval in advance of the commencement of underwriting

for that year of account.

Lloyd’s Syndicate Number : The unique identifying number assigned to a syndicate by the

Council of Lloyd’s.

Lloyd’s Syndicate Pseudonym : A series of letters used to identify a syndicate which

together with its number are contained in the underwriting stamp of the syndicate.

Lloyd’s Syndicate Reinsurance : The reinsurance of a syndicate by one or more reinsurers.

Such reinsurance can only be arranged by a Lloyd’s broker.

Lloyd’s Syndicate Stamp : This term may refer to – (a) a document which lists the names of

the members of a syndicate for a given year of account and the amount of each

member’s overall premium limit that is allocated to that syndicate; (b) the syndicate

allocated capacity of a syndicate; or (c) the underwriting stamp of a syndicate.

Lloyd’s Syndicate, Mixed : A syndicate which is made up of Names and/or MAPAs and

corporate members.

Lloyd’s Tenderer : A member that seeks to sell some or all of his underwriting capacity in a

capacity auction.

Lloyd’s Underwriting Agent : A person who acts as an agent for an underwriting member

of Lloyd’s (a) as a member’s agent who acts in all respects for the member, other than

in managing the underwriting syndicate, and/or (b) as a managing agent, who

manages the affairs of the syndicate.

Lloyd’s Working member: A member who occupies himself principally with the conduct of

business at Lloyd’s by a Lloyd’s broker or underwriting agent, or a member who has

retired but who immediately before his retirement occupied himself in this way.

Lloyd’s Written Line : The amount of a risk that an underwriter is willing to accept on

behalf of the members of the syndicate or company for which he underwrites. This is

commonly expressed as a percentage of the sum insured which is written on the

broker’s placing slip. If, on completion of the broking exercise, the written lines

exceed 100% then, absent some contrary instruction, they will be signed down by the

broker, which is to say they will be reduced proportionately so that they total 100%.

Lloyd’s Xchanging : An outsource provider of policy, premium and claims processing

services to the Lloyd’s market and others. These services are delivered via its

operating subsidiaries, Ins-Sure Services and Xchanging claims services.](https://image.slidesharecdn.com/2b20832d-f590-4e0d-8f1d-c775ca8792ec-161112085217/85/E-book-269-320.jpg)