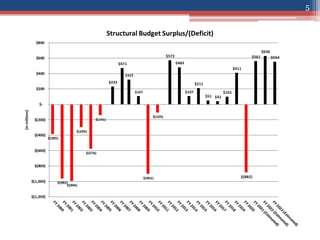

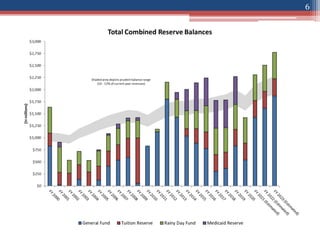

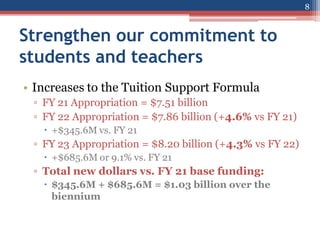

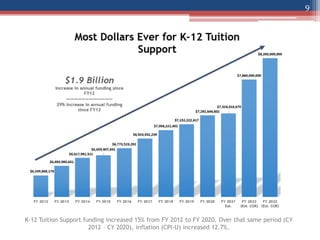

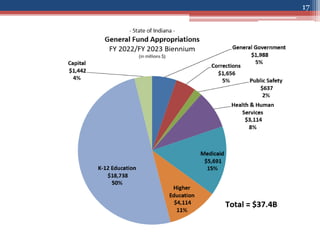

The FY 22/23 budget prioritizes a balanced state budget while investing in education, small businesses, law enforcement, health, and infrastructure, allocating significant funds for K-12 education, economic recovery, and public safety. Notable investments include $1.9 billion for education, $500 million for regional economic development, and various health initiatives. The budget also emphasizes strategic infrastructure investments and maintains healthy reserves to protect taxpayers and ensure financial stability.