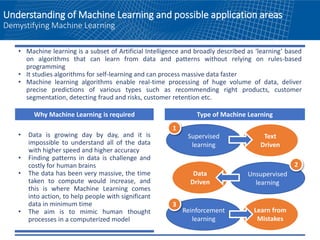

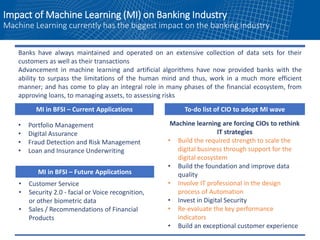

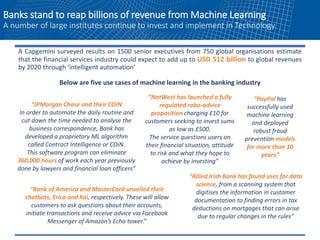

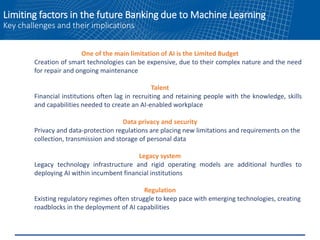

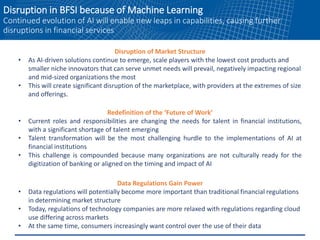

Machine learning is having a major impact on the banking sector by enabling banks to process huge volumes of data faster and more accurately to make predictions. It is being used across banking for applications like fraud detection, risk management, loan underwriting, portfolio management, and customer service. While machine learning provides benefits, banks face challenges around limited budgets, talent shortages, data privacy and security issues, and legacy systems. The continued evolution of AI is expected to further disrupt the banking industry through redefining job roles, increasing the importance of data regulations, and disrupting market structure.