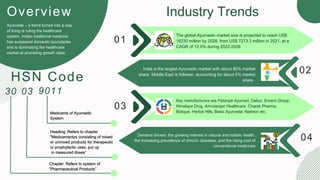

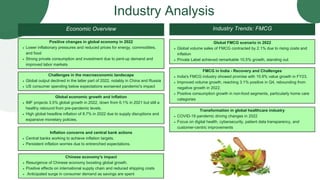

The document provides an overview of the Ayurvedic medicines market and analyzes Amrutanjan Health Care Limited's potential entry into export markets. Some key points:

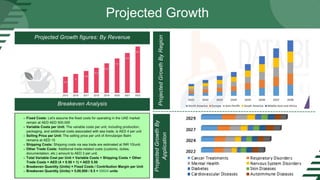

- The global Ayurvedic market is projected to reach $16 billion by 2028, growing at 12% annually, led by India with 80% market share.

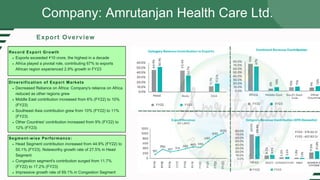

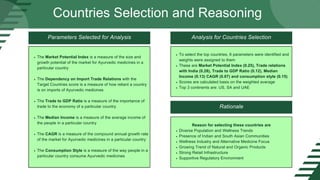

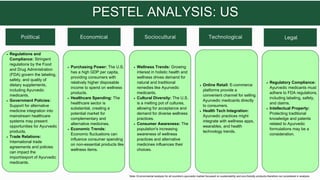

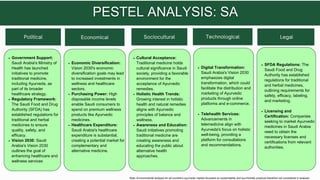

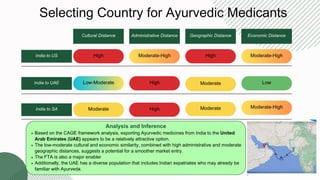

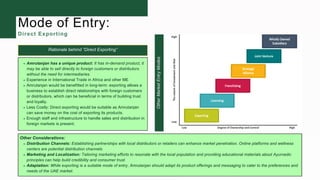

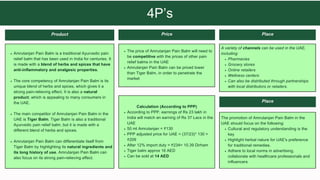

- Amrutanjan is an Indian manufacturer of Ayurvedic products that sees potential to expand exports. It analyzes the United Arab Emirates, United States, Saudi Arabia, and other countries as target markets.

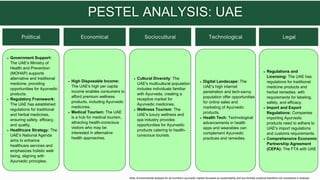

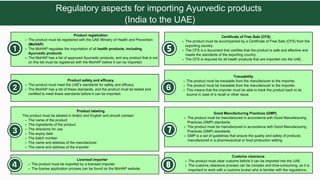

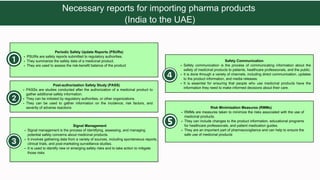

- A PESTLE analysis finds the UAE presents a favorable regulatory environment for Ayurvedic products and cultural acceptance of traditional