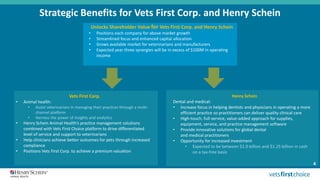

Henry Schein will spin off and merge its animal health business with Vets First Choice, creating a new animal health innovator called Vets First Corp. The transaction will provide strategic benefits to both companies by allowing Henry Schein to focus on dentistry and medicine, while positioning Vets First Corp. for growth in the veterinary market through an integrated technology-enabled platform. The transaction is expected to close by the end of 2018.