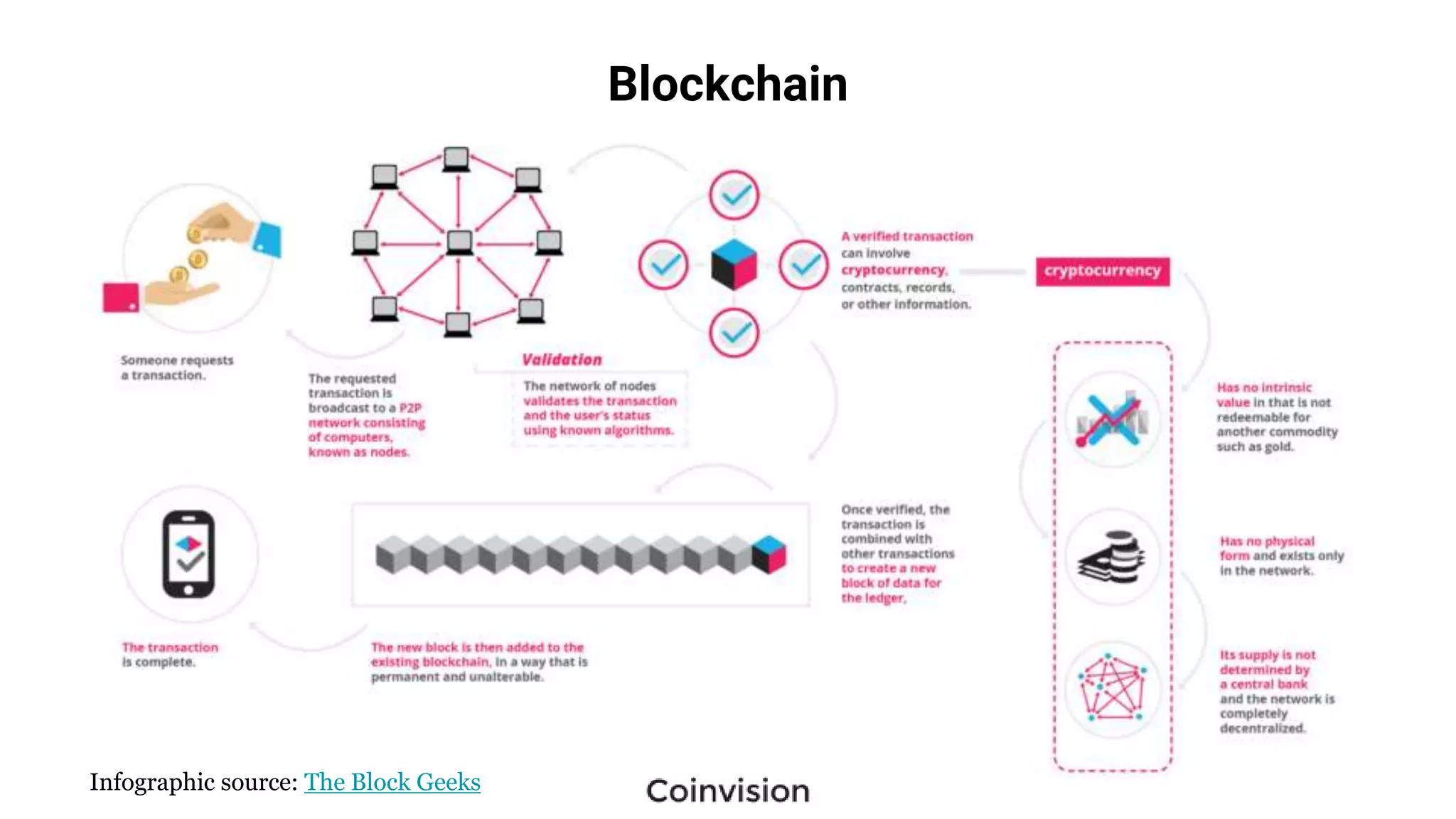

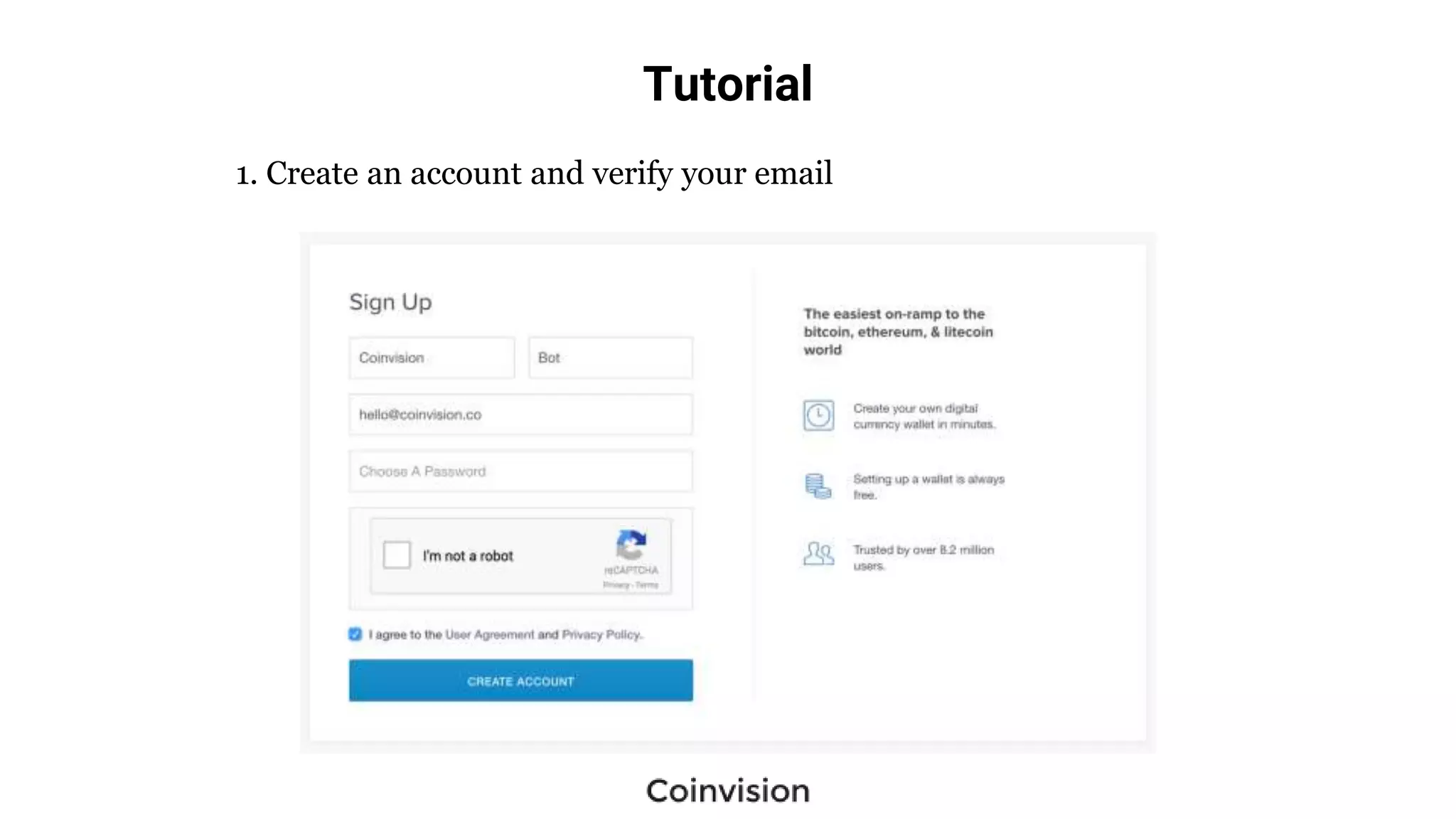

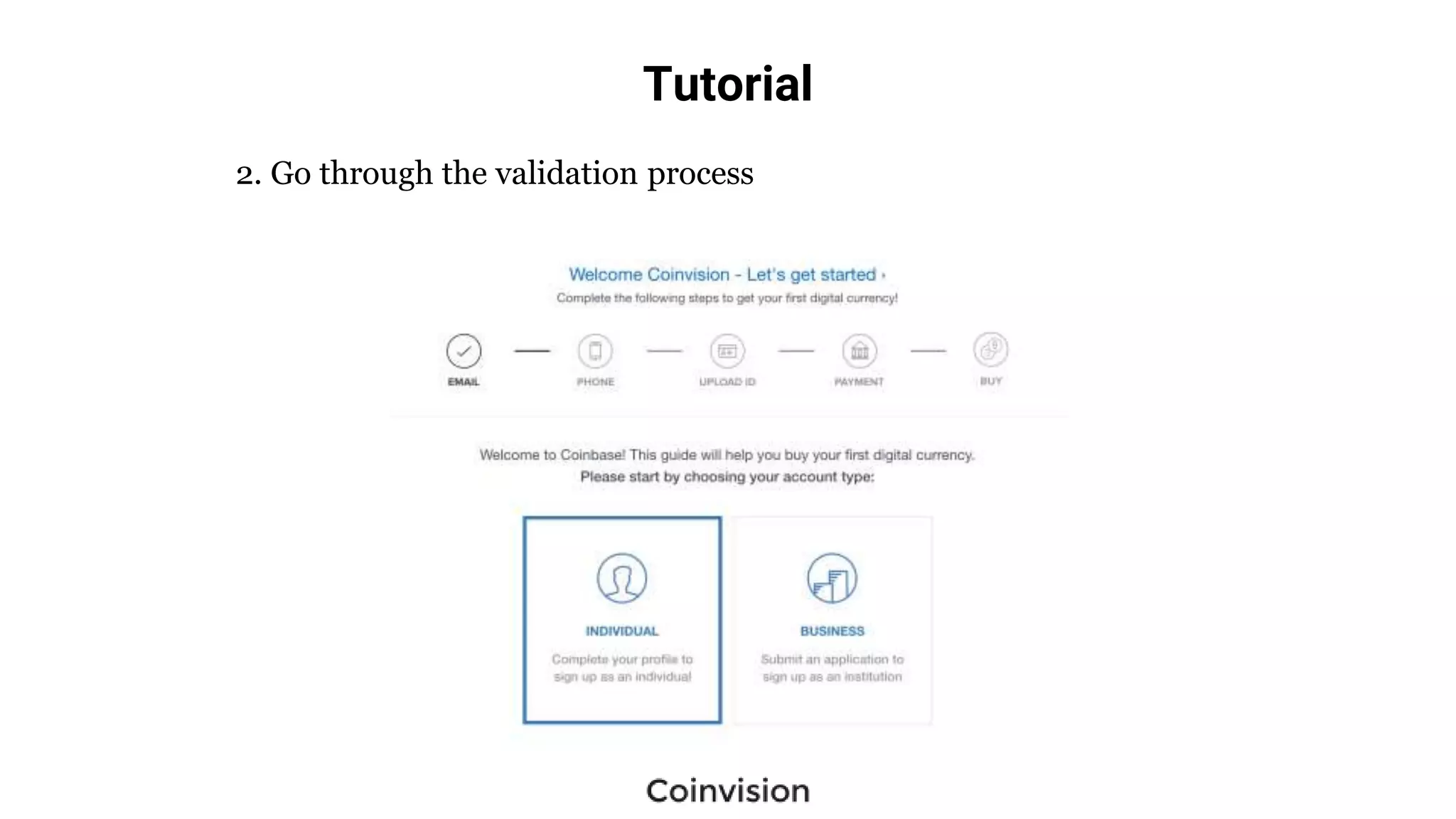

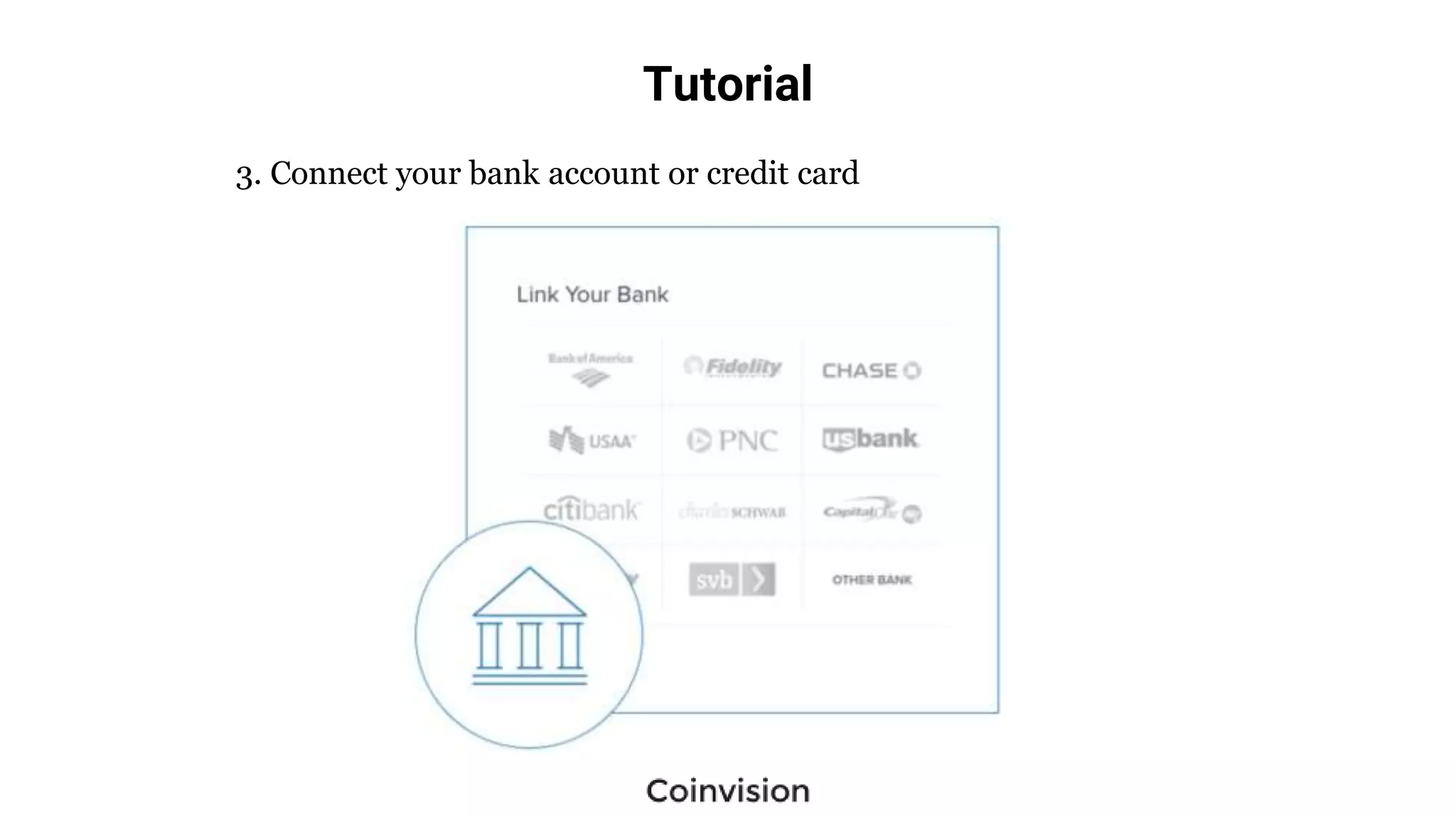

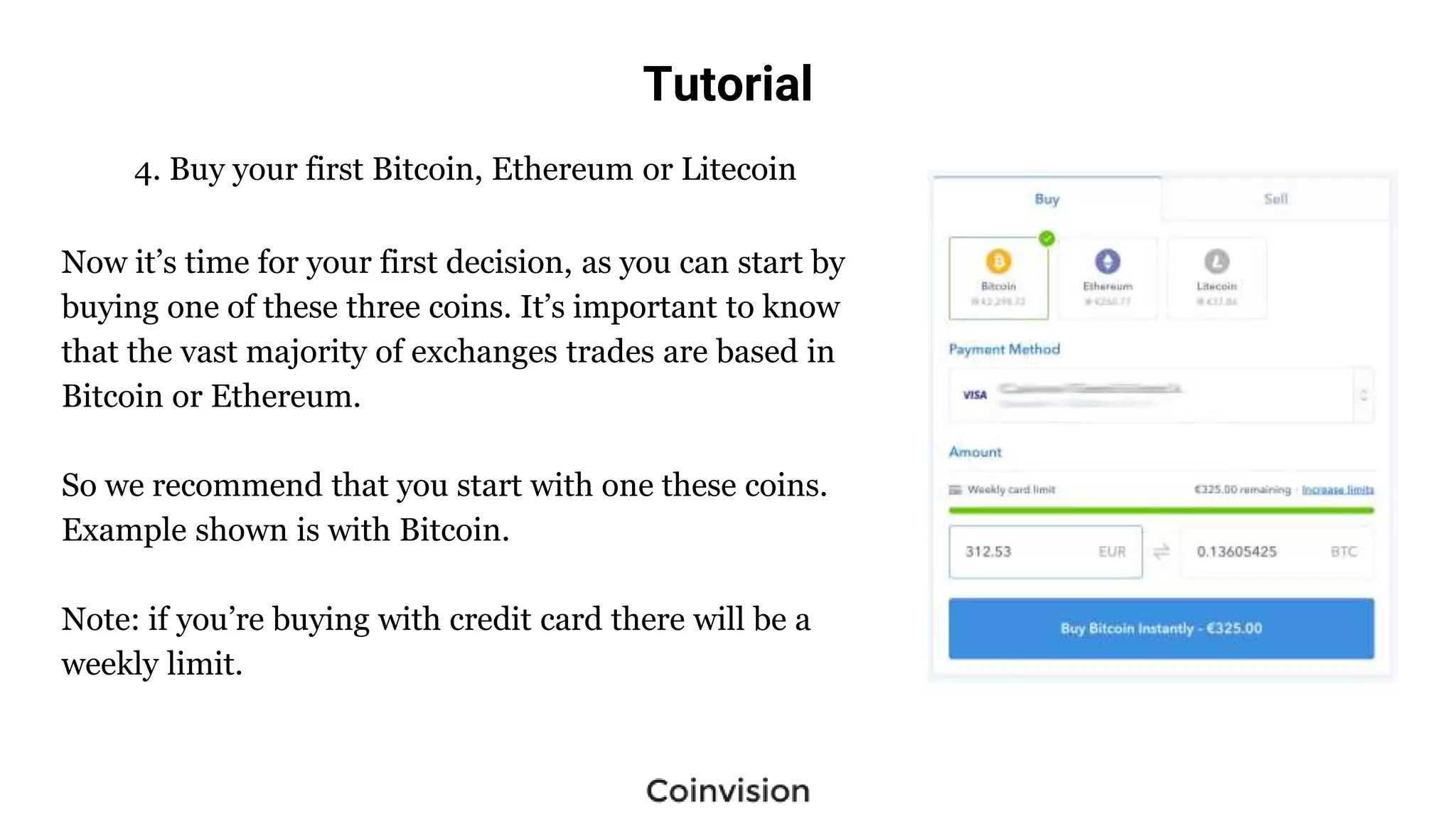

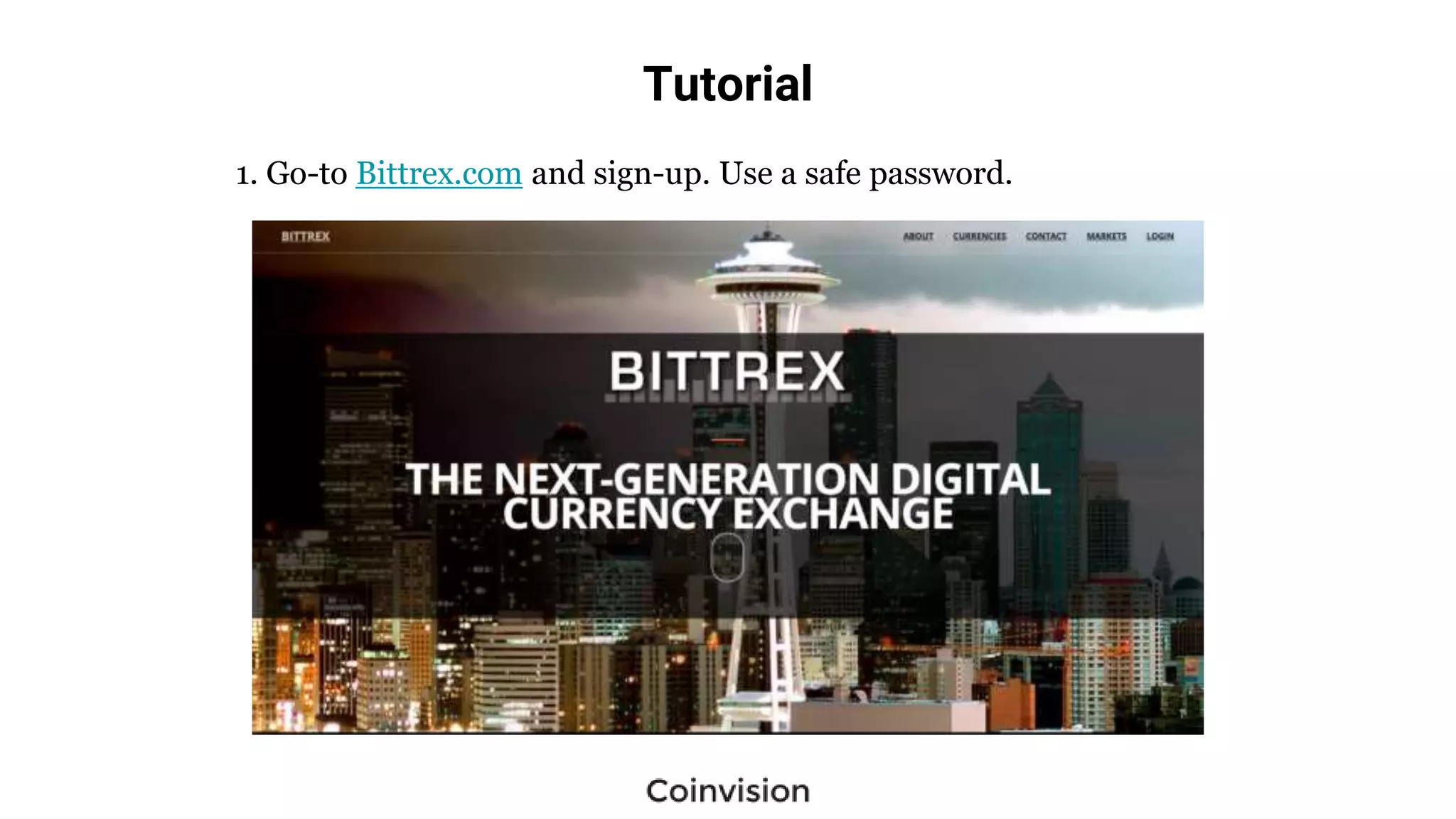

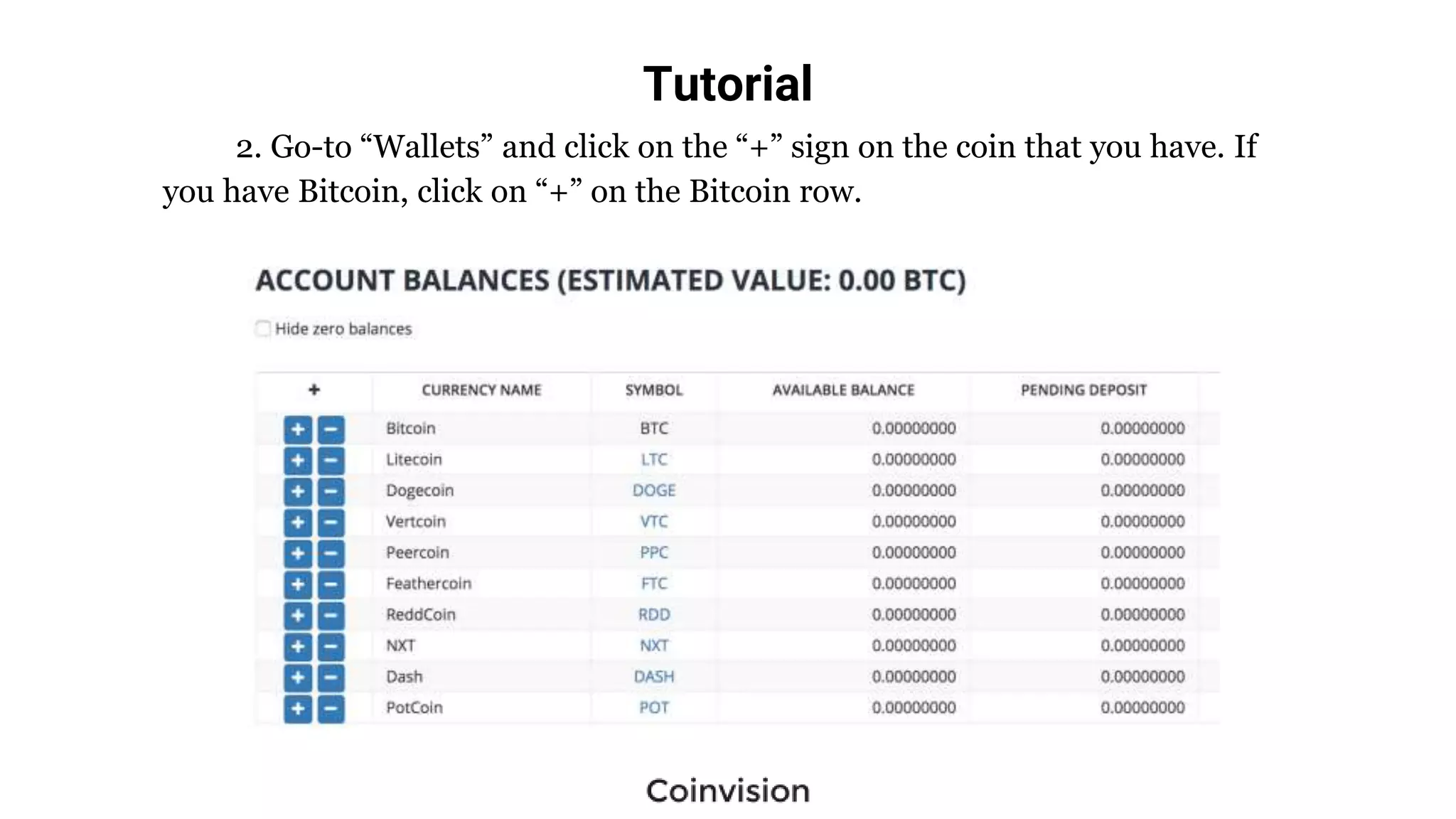

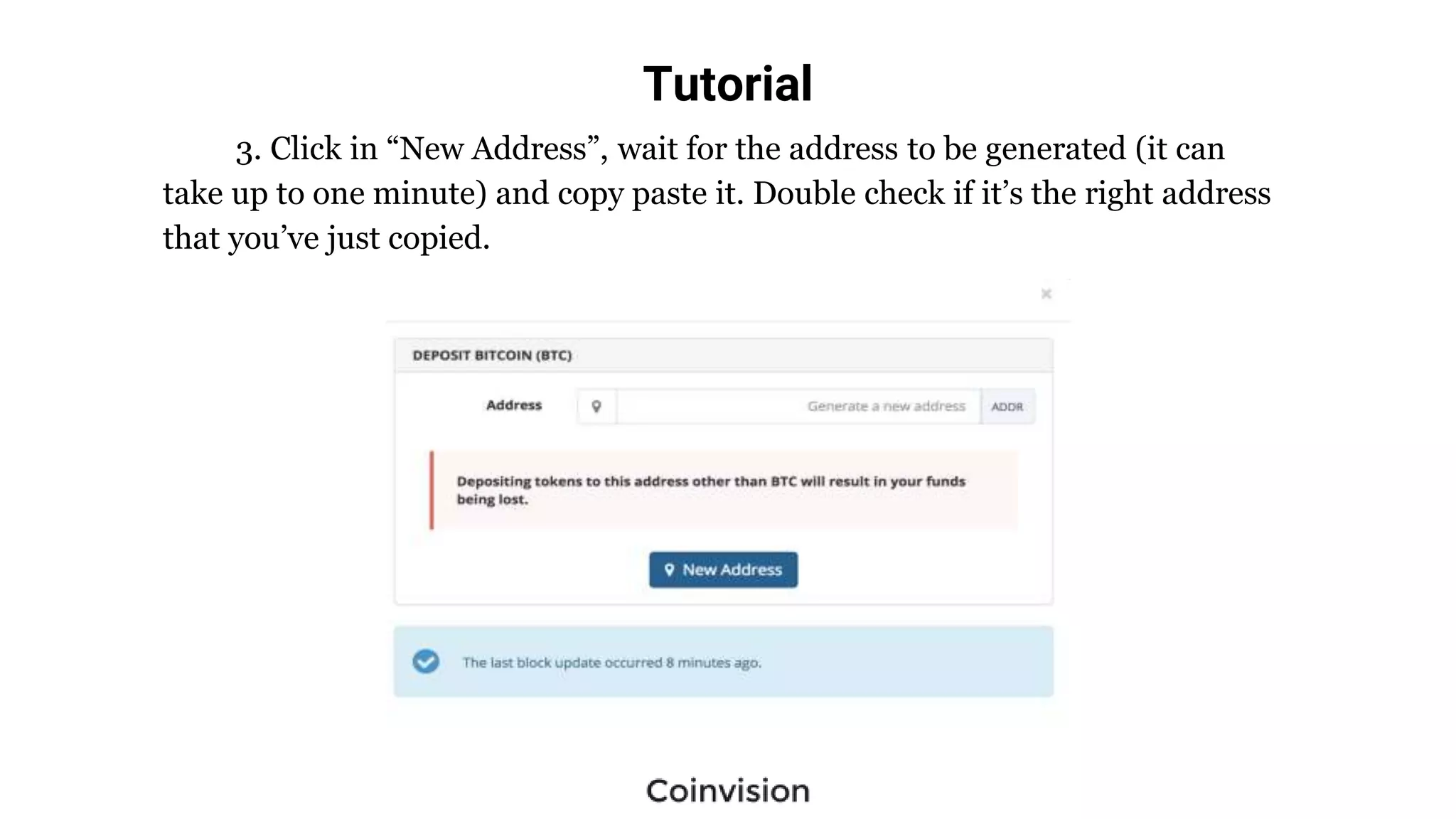

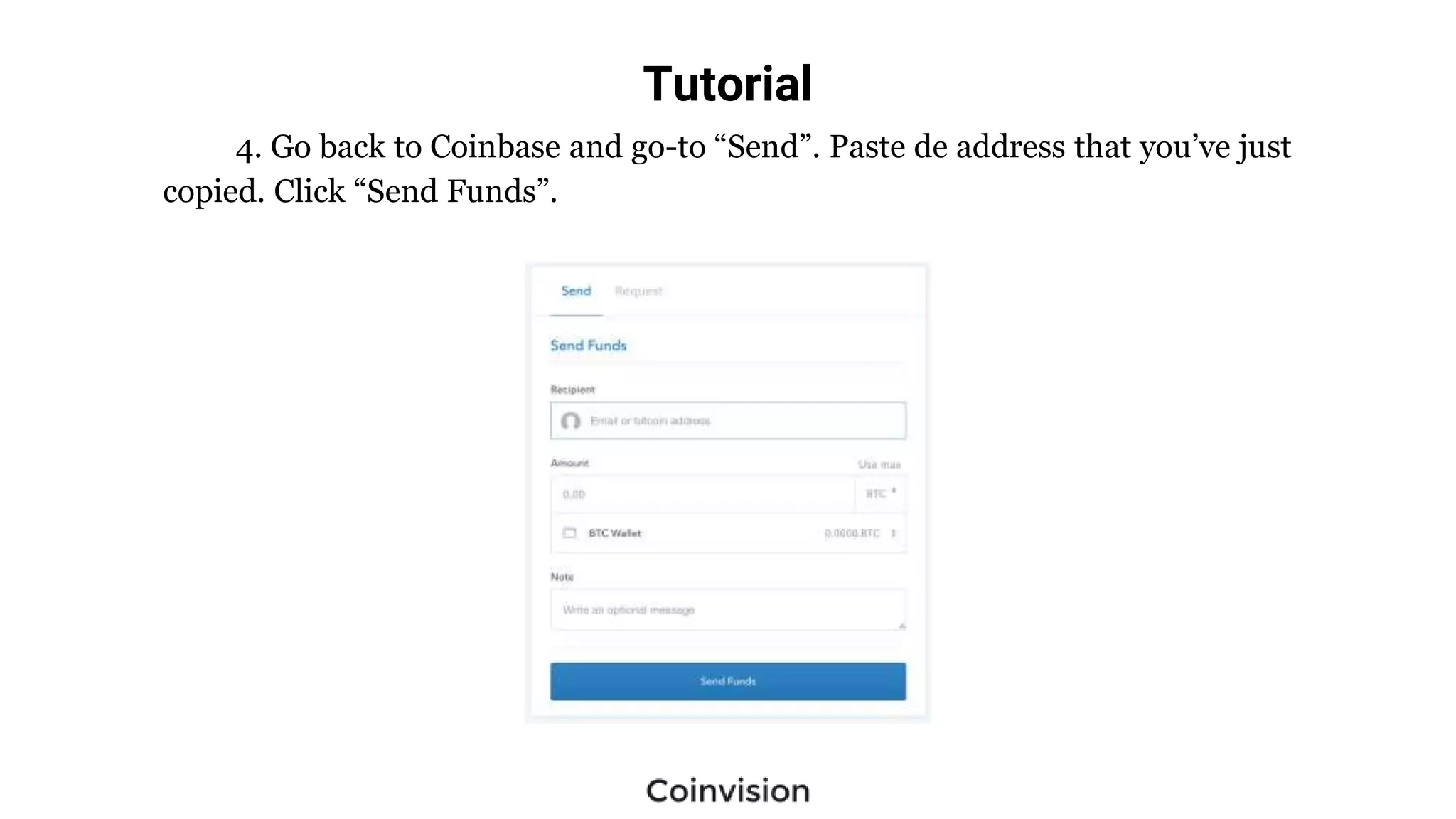

This document provides a five-step guide for newcomers to invest in cryptocurrency, covering key concepts such as blockchain, bitcoin, and ethereum. It emphasizes the importance of understanding the terminology, selecting credible exchanges like Coinbase and Bittrex, and conducting thorough research on coins before investing. Additionally, it introduces tools like CoinMarketCap and Ledger Wallet to enhance trading and security in the cryptocurrency market.