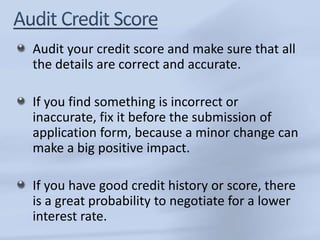

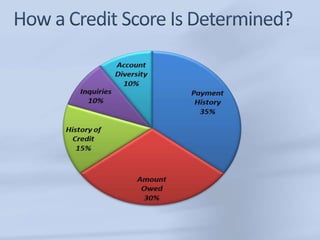

Homeowners most commonly refinance their mortgages when interest rates drop. To refinance successfully, homeowners should audit their credit score to ensure accuracy, improve their credit score or debt-to-income ratio if needed, and understand their budget to ensure any payment changes from refinancing are appropriate. Refinancing from an adjustable to a fixed-rate mortgage can also provide more flexibility and stability.