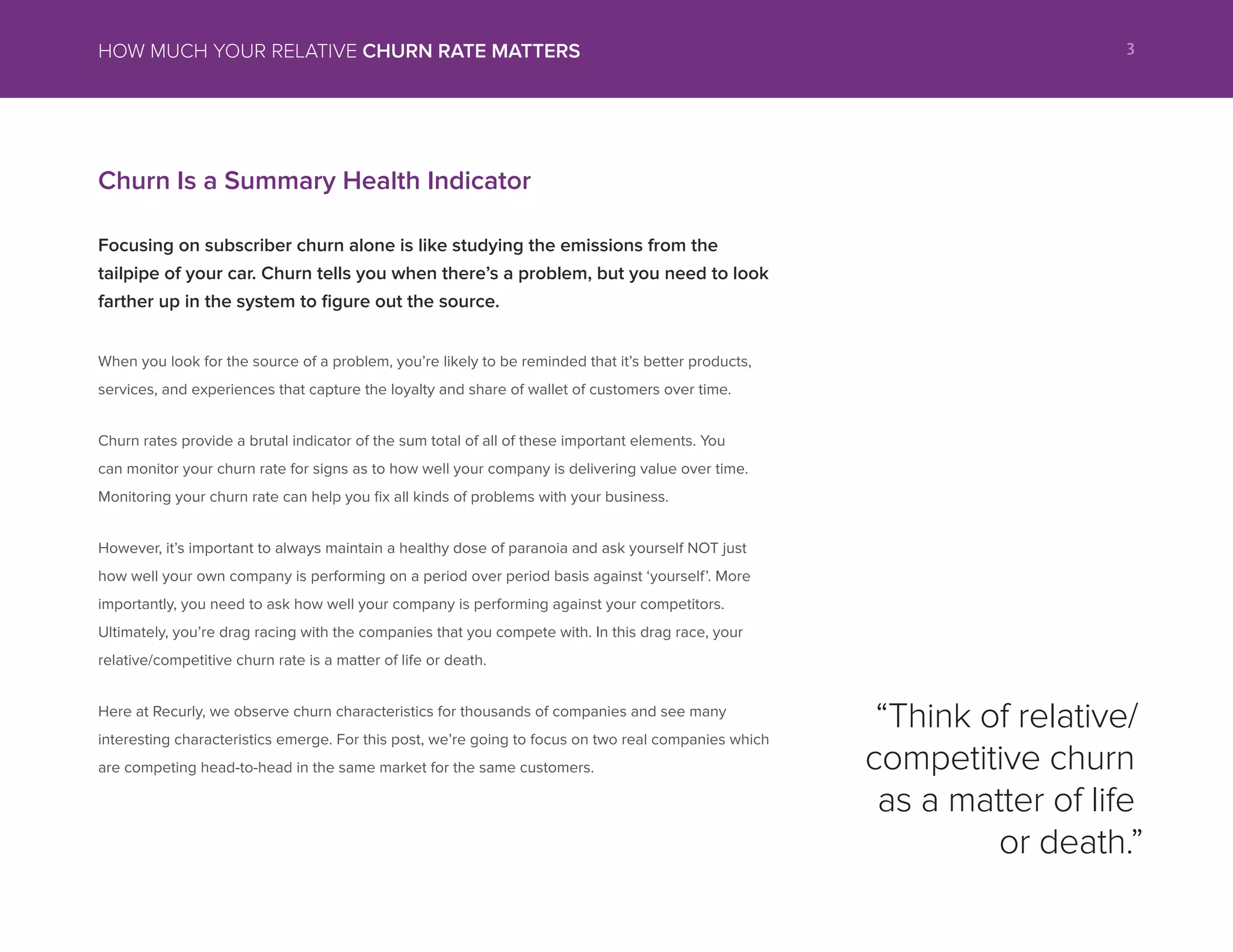

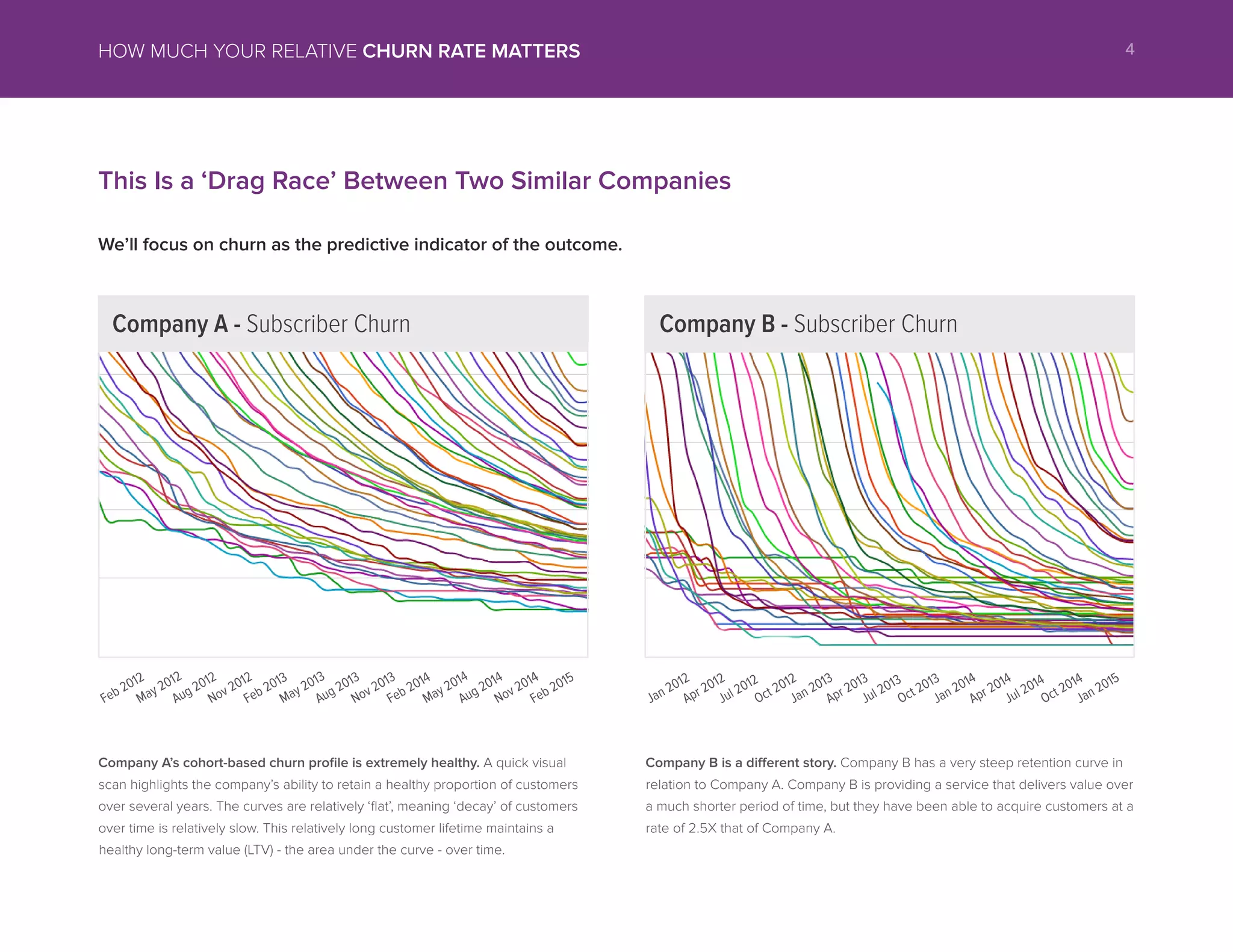

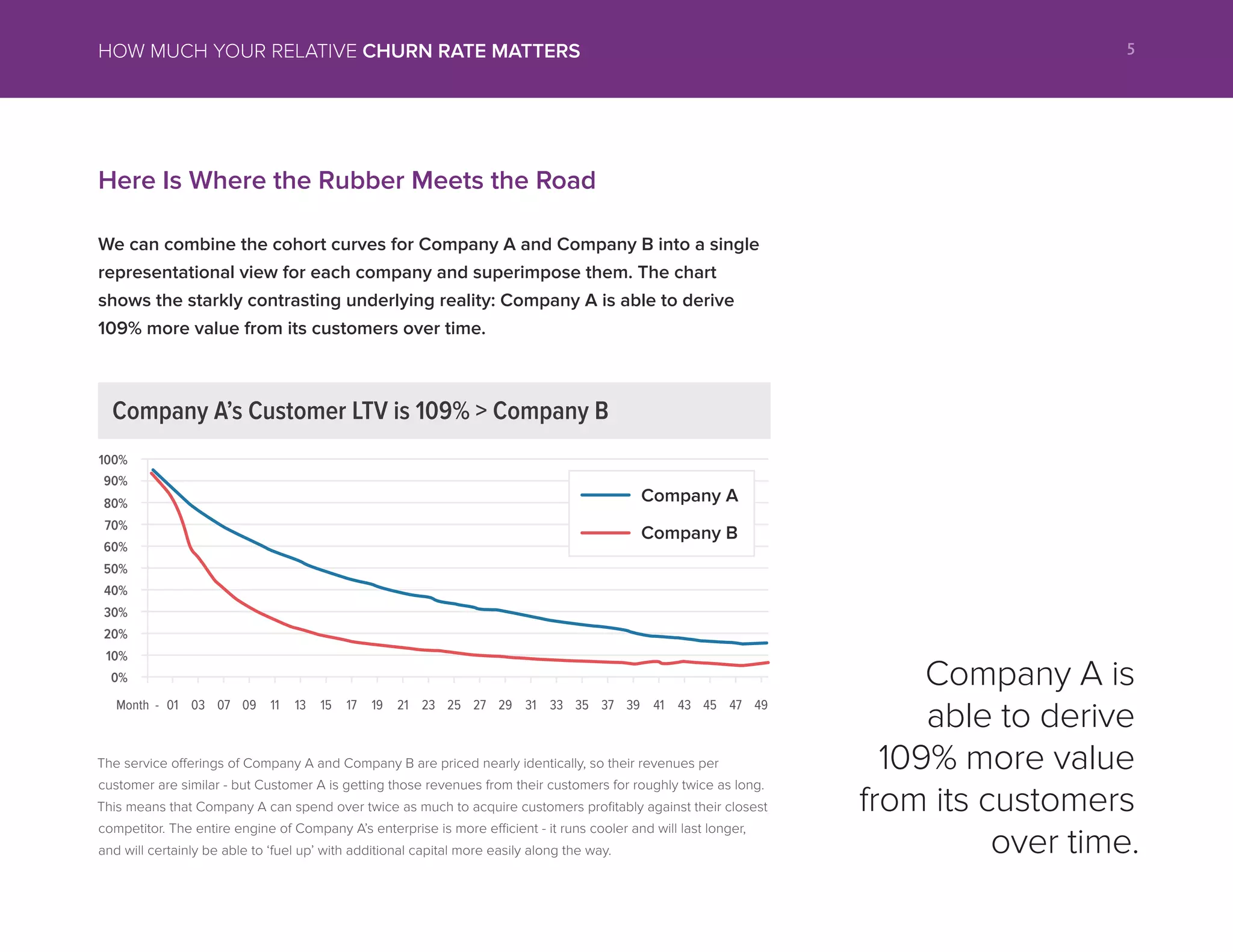

The document discusses the importance of relative churn rates in assessing business health, particularly for subscription-based companies. It contrasts two companies, one with a healthy churn profile and another with high customer acquisition but steep churn, illustrating how customer retention impacts long-term value. Monitoring churn in comparison to competitors is crucial for understanding business performance in a competitive market.