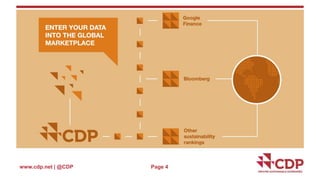

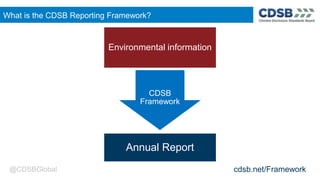

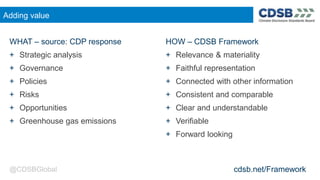

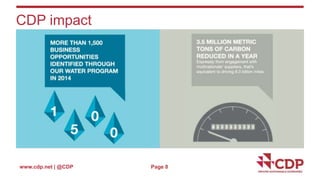

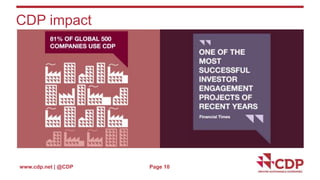

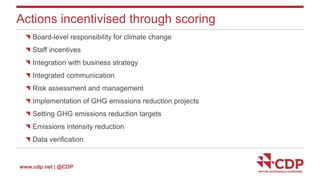

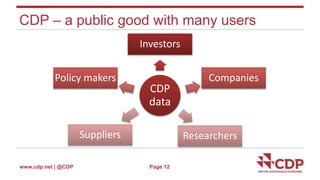

The document discusses how CDP (Carbon Disclosure Project) and the Climate Disclosure Standards Board (CDSB) drive change toward sustainable business practices and climate-related financial reporting. CDP collects environmental data from over 5,000 companies on behalf of investors and purchasers, and scores companies' responses to incentivize emission reductions, target setting, and other climate-friendly actions. The CDSB framework provides guidance for companies to report high-quality, decision-useful environmental information to investors and stakeholders. It aims to make climate-related risks and opportunities more transparent within mainstream annual reports. Both CDP and CDSB work to integrate climate considerations into core business strategies and financial decision-making.