While manual fare collection may feel like a thing of the past, many public transport networks still depend on it.

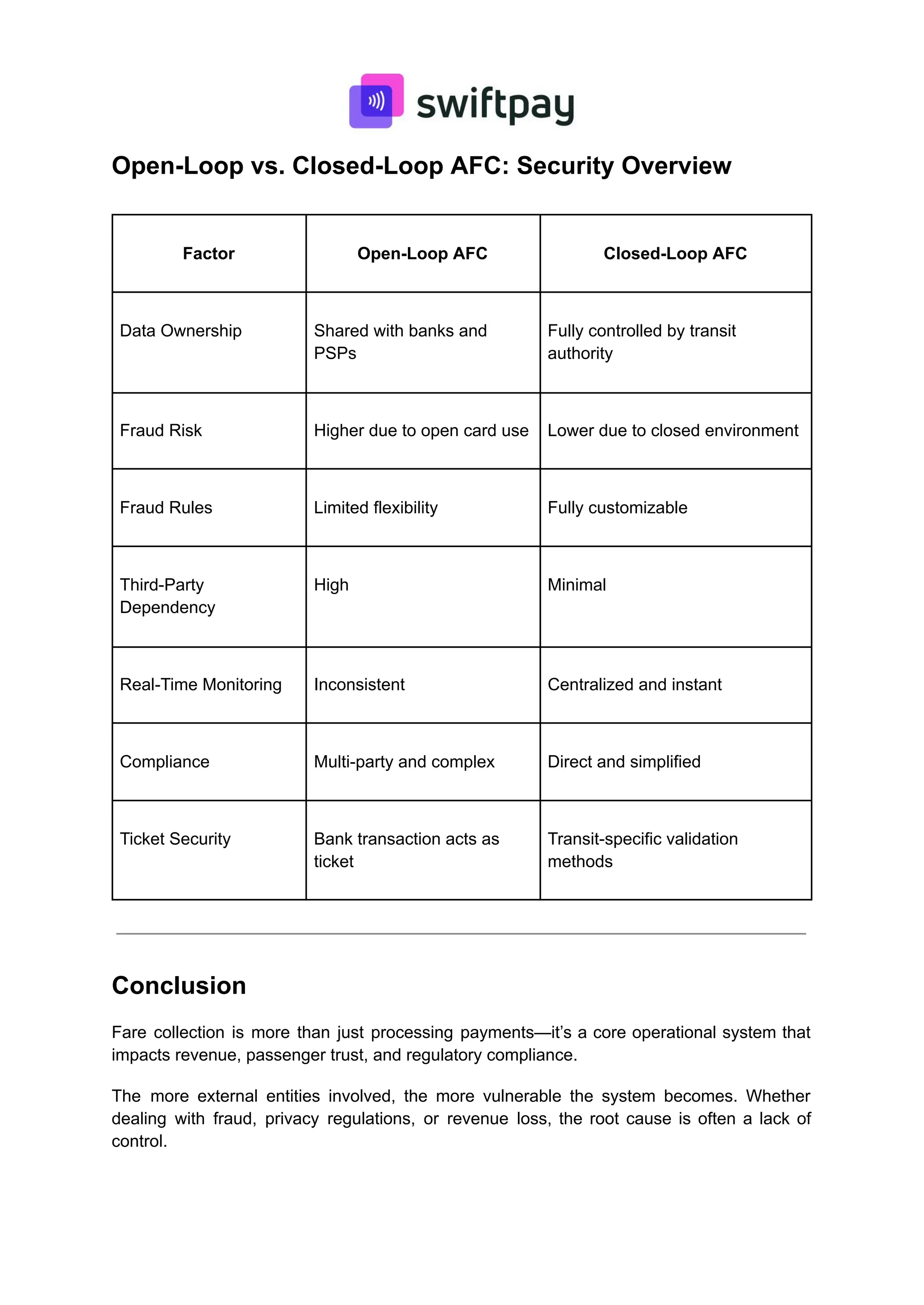

In contrast, cities in developed regions often operate fully automated fare collection (AFC) systems—yet most of them still use open-loop payments.

The problem? Security often remains the weakest link.

From ticket fraud and revenue losses to data leaks and compliance gaps, the risks are only increasing as transit systems digitize without retaining full control. A single breach can erode public trust and leave operators on the defensive.

Closed-loop automated fare collection systems offer a way to counter these challenges—not just as a payment method, but as a secure, long-term infrastructure for transit authorities seeking greater control and reliability.

Let’s examine the weaknesses of current systems and how closed-loop AFC addresses them.