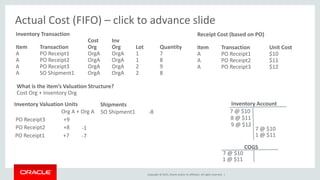

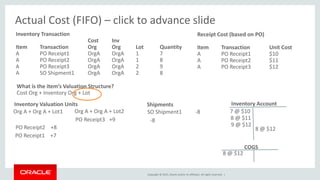

The document describes inventory transactions using the FIFO costing method. It shows receipts of item A into inventory from three purchase orders at costs of $10, $11, and $12 per unit. It also shows one shipment of 8 units from inventory. Under FIFO, the 7 units from the first receipt at $10 are shipped first, then the remaining 1 unit from the second receipt at $11. The valuation structure considers the cost organization, inventory organization, and lot.