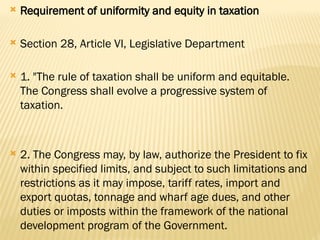

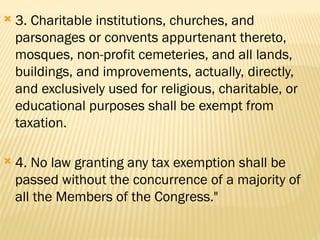

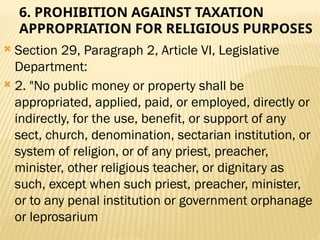

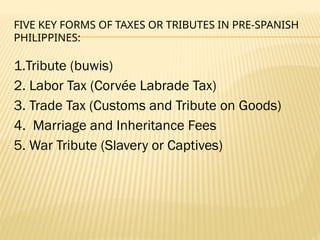

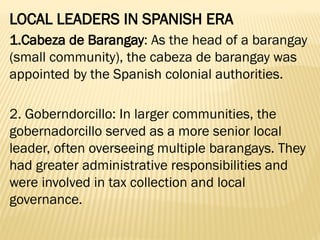

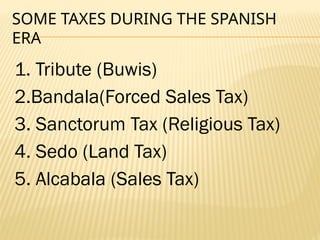

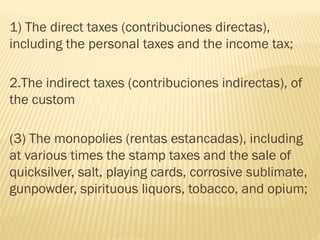

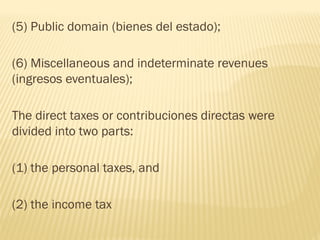

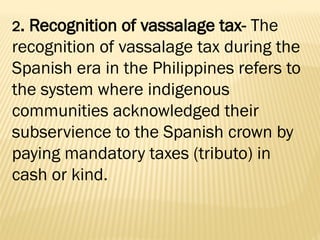

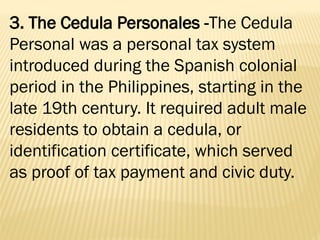

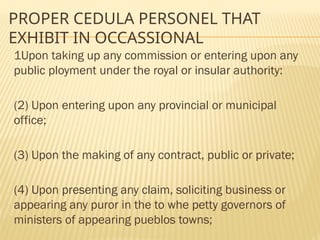

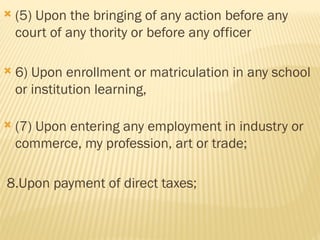

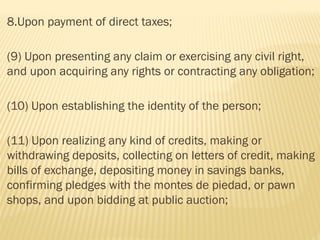

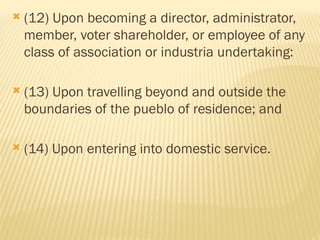

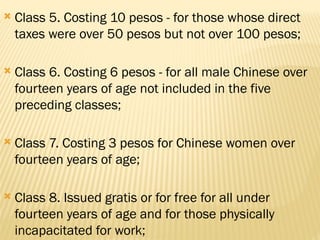

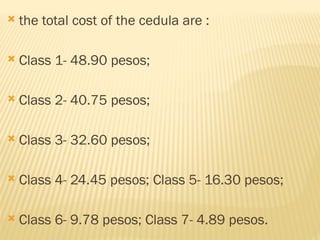

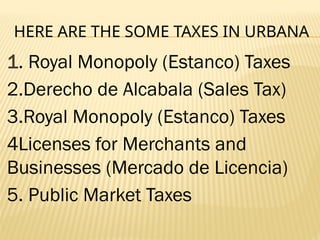

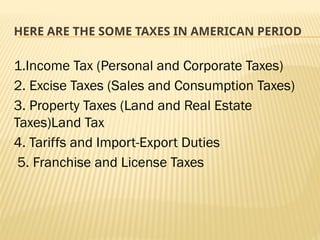

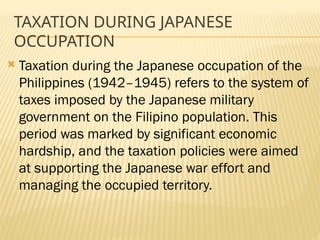

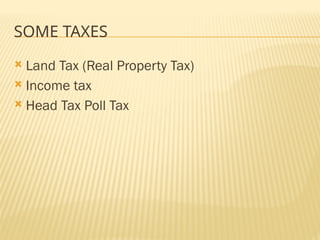

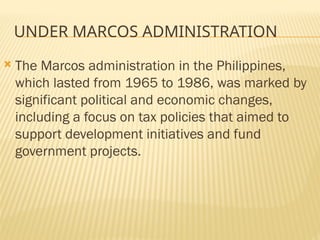

The document outlines the historical development and characteristics of taxation in the Philippines, defining taxes as enforced contributions levied by the state for public purposes. It details the evolution of taxation from the pre-Spanish era through various colonial periods, highlighting key taxes, tax systems, and legislative provisions. Additionally, it discusses the importance and power of taxation in government funding and societal welfare, along with constitutional limitations and reforms across different administrations.