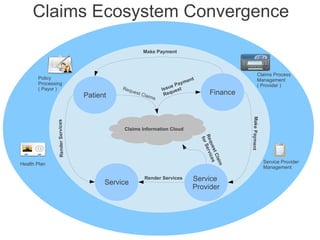

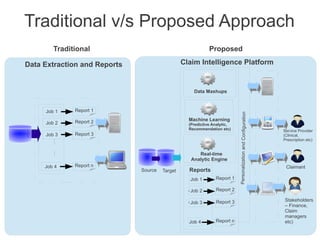

The document proposes a claims intelligence platform that will provide personalized insight and actionable intelligence to stakeholders like patients, providers, and payors. It will analyze claims data using machine learning and predictive analytics to generate real-time reports and recommendations. This will enable continuous process improvement by accelerating decision making, emphasizing proactive care, enabling new business models focused on value and outcomes, improving customer and provider relationships, and translating knowledge into practice.