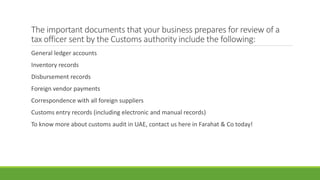

Businesses in the UAE involved in import/export must comply with customs regulations and are subject to audits by the UAE Federal Customs Authority to ensure correct tax payments. Preparation for a post-clearance audit involves contacting a customs auditor, gathering relevant documentation, and voluntarily disclosing errors to mitigate penalties. It is essential to maintain comprehensive records and be proactive in compliance to avoid fines and missed opportunities for duty savings.