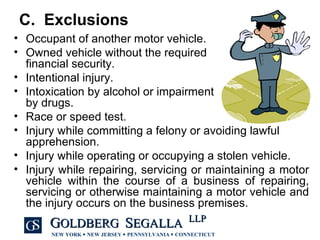

The document provides an overview of New York's no-fault law, which aims to streamline compensation for individuals injured in motor vehicle accidents by offering first-party benefits without the need for tort litigation. Key topics include eligibility for benefits, types of coverage, exclusions, notice requirements, and the process for filing claims and handling disputes. Additionally, it outlines the responsibilities of both insurers and insured individuals in the claims process, emphasizing the importance of timely communication and compliance with regulatory requirements.

![New York No-Fault Law: Understanding New York's No-Fault System Paul D. McCormick, Esq. Goldberg Segalla LLP 665 Main Street / Suite 400 Buffalo, New York 14203-1425 716.566.5466 Fax: 716.566.5401 Email: [email_address] Website: www.goldbergsegalla.com](https://image.slidesharecdn.com/gsbuffalo479878v1understandingnewyorknofault-123913502728-phpapp02/75/Understanding-New-York-No-Fault-1-2048.jpg)

![Understanding New York No-Fault Paul D. McCormick, Esq. Goldberg Segalla LLP 665 Main Street / Suite 400 Buffalo, New York 14203-1425 716.566.5466 Fax: 716.566.5401 Email: [email_address] Website: www.goldbergsegalla.com](https://image.slidesharecdn.com/gsbuffalo479878v1understandingnewyorknofault-123913502728-phpapp02/85/Understanding-New-York-No-Fault-32-320.jpg)