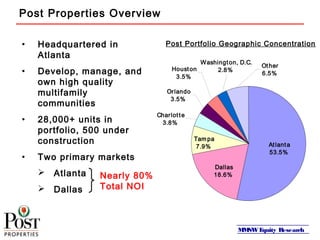

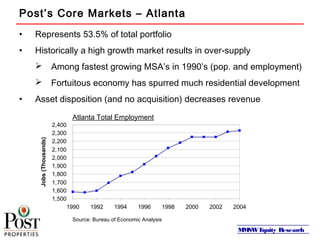

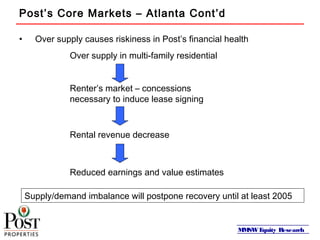

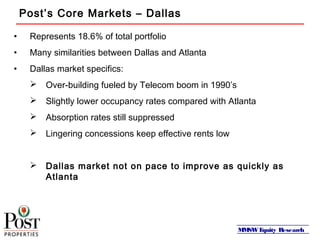

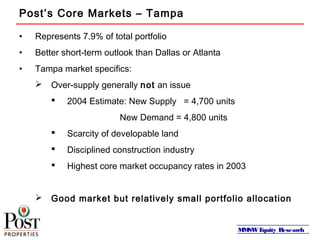

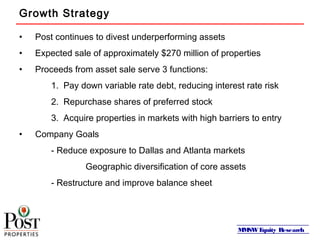

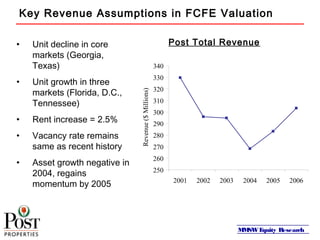

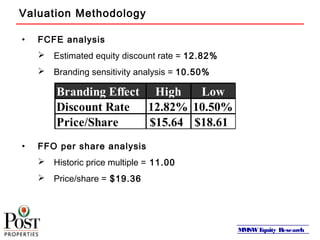

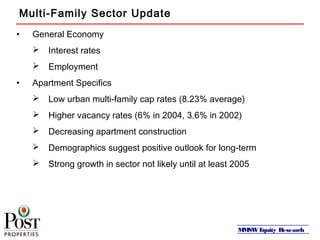

The document provides an investment analysis of Post Properties, Inc. by MMSW Equity Research. It recommends selling Post Properties due to oversupply issues in its core Atlanta and Dallas markets, which will reduce revenue from asset sales and dispositions. While Post aims to diversify geographically and improve its balance sheet, these strategies are not expected to significantly impact financials within 12 months. The analysis cites risks to earnings and dividends from continued NOI declines and high leverage. Based on revenue and FCFE assumptions, the report estimates Post's value at $15.64 per share.