Embed presentation

Download to read offline

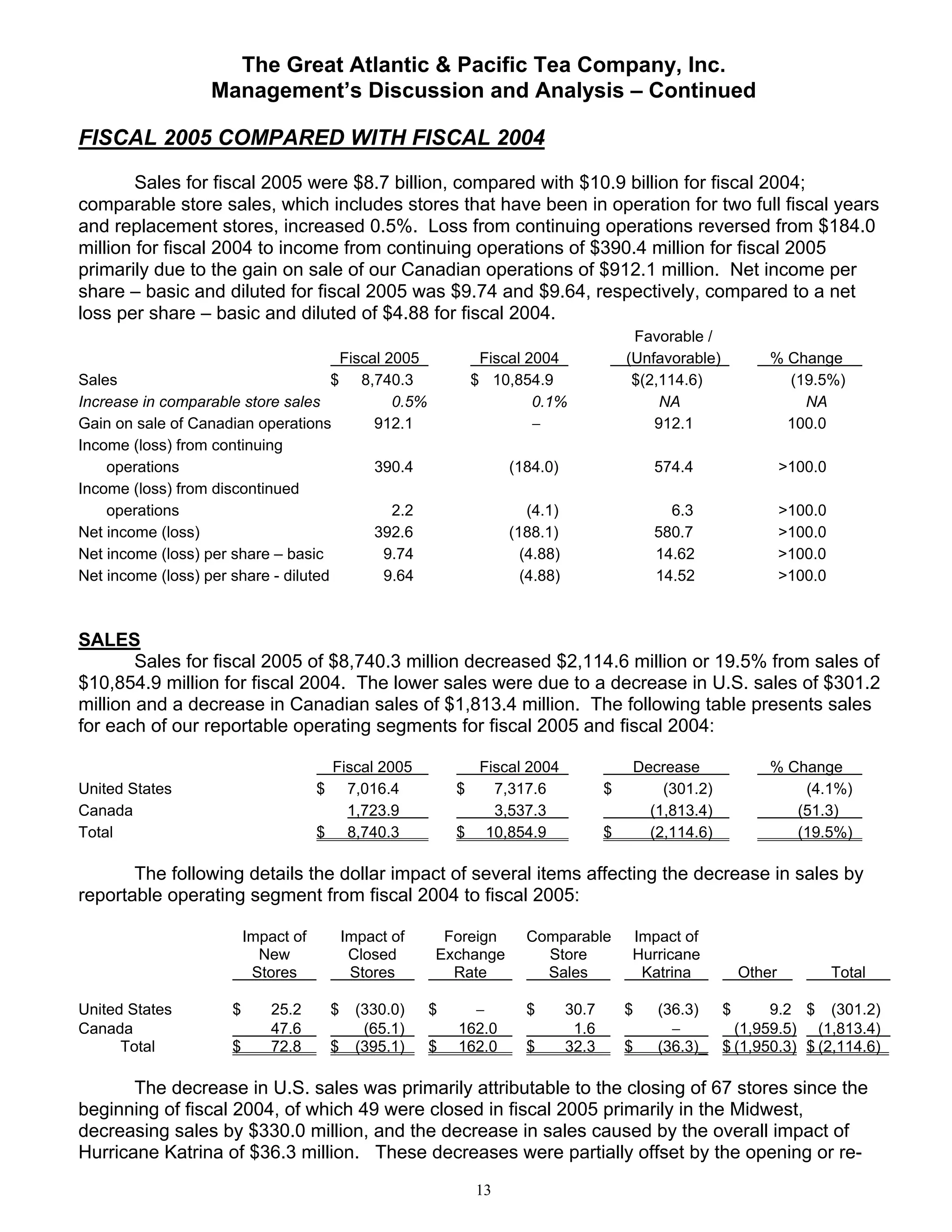

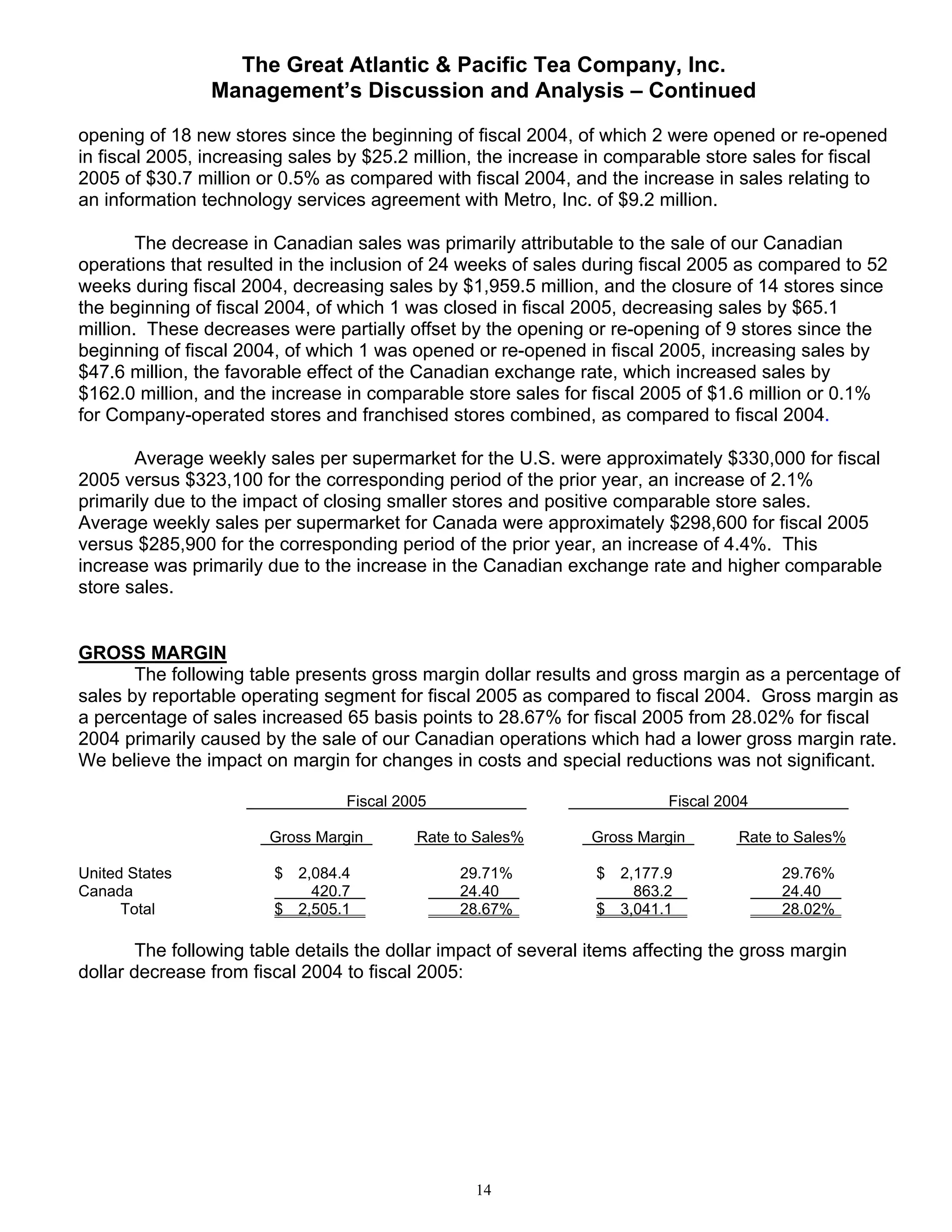

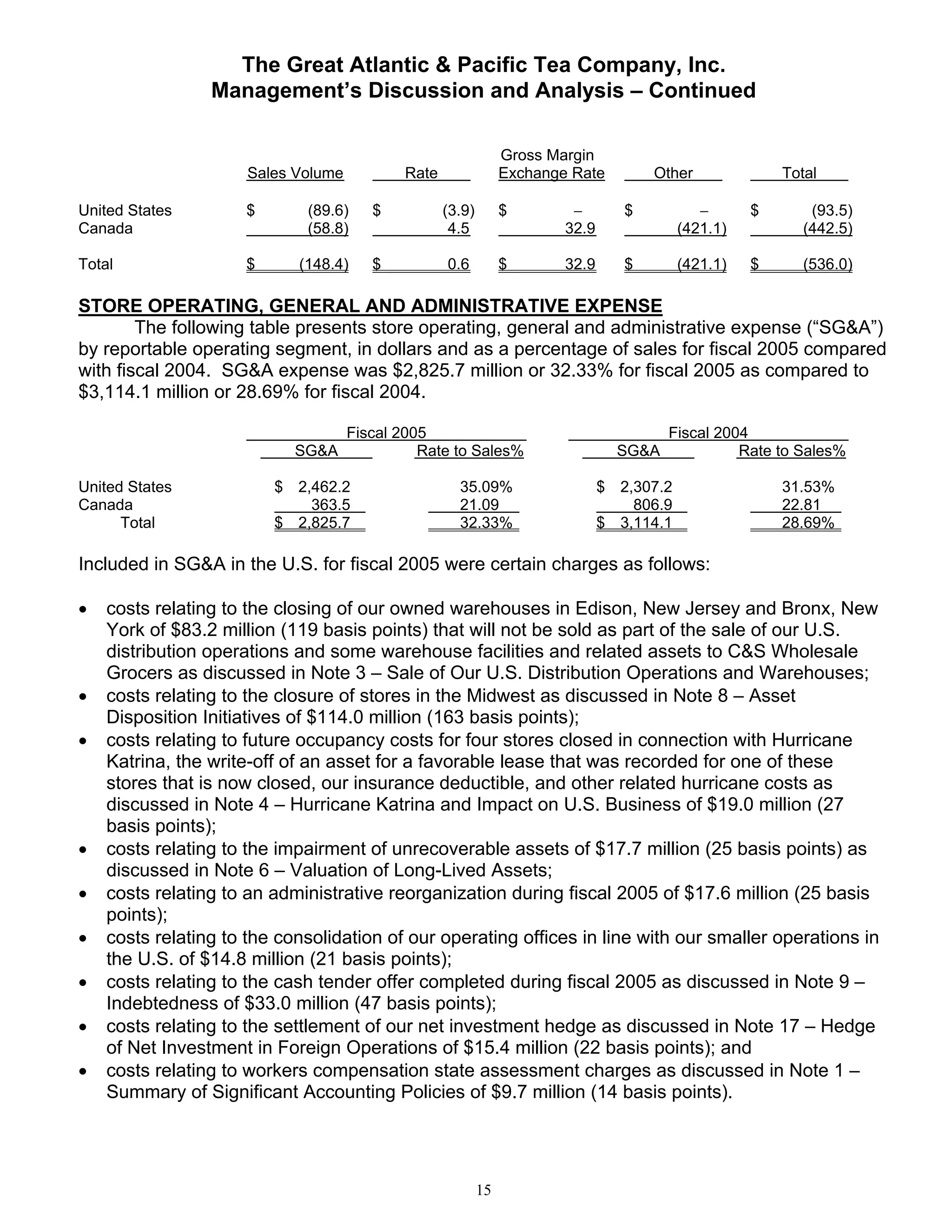

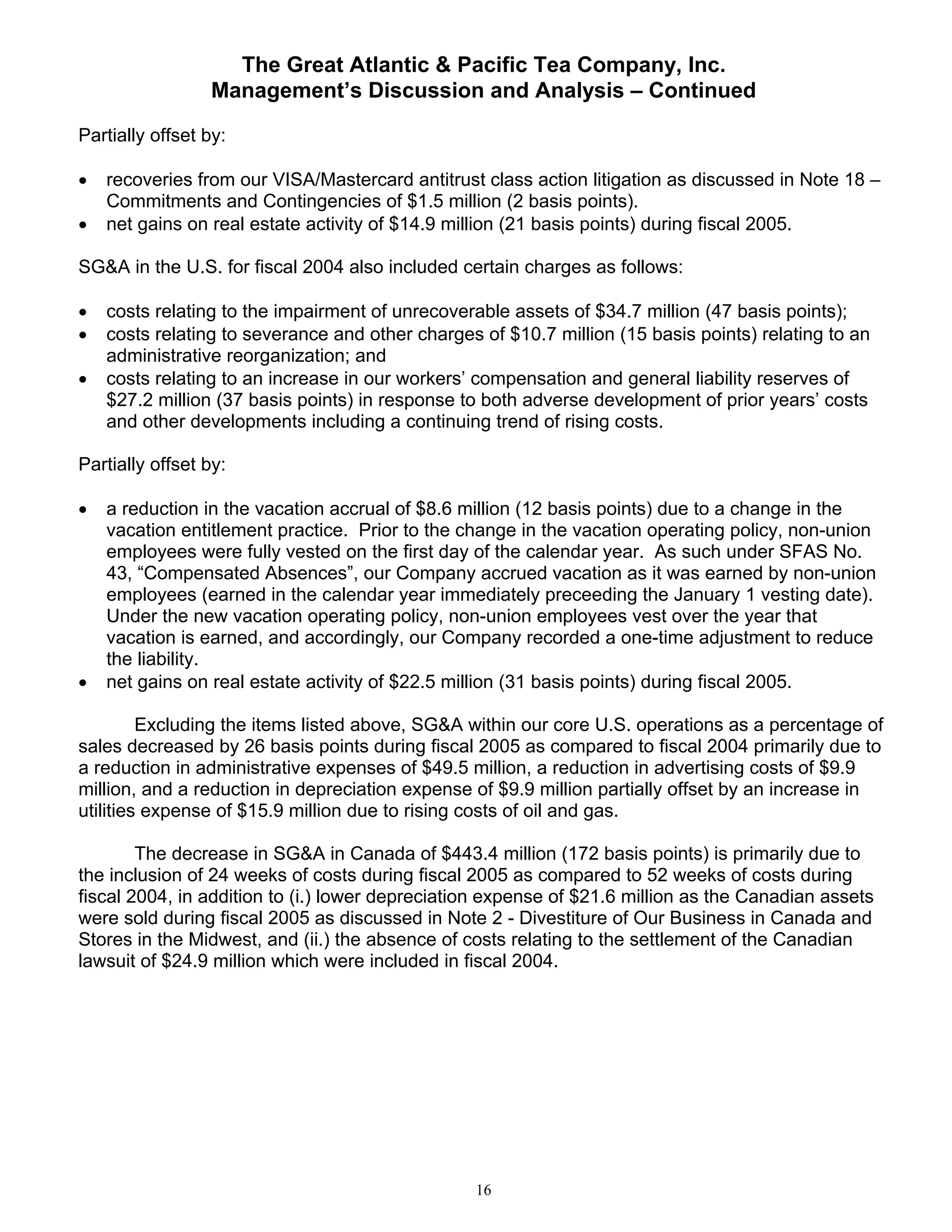

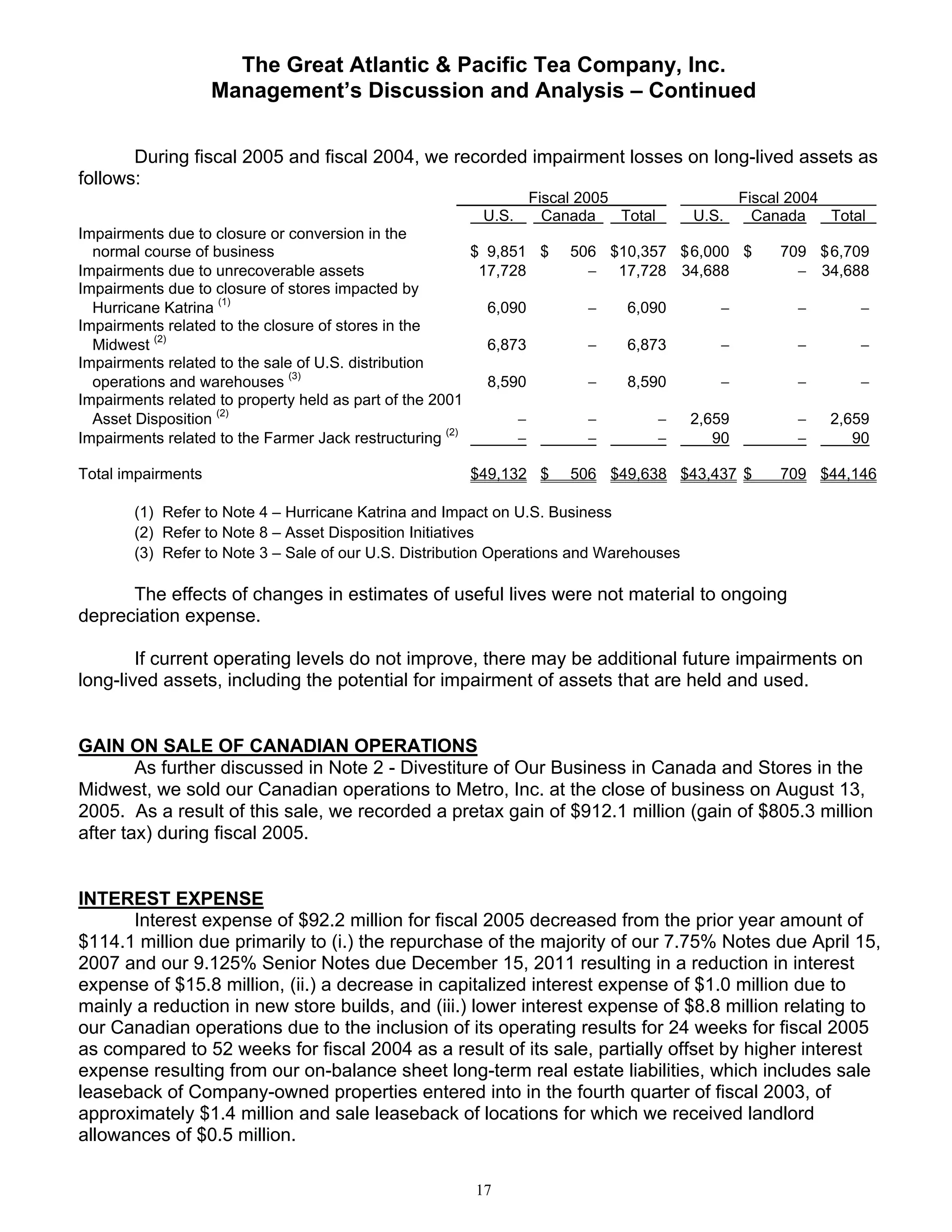

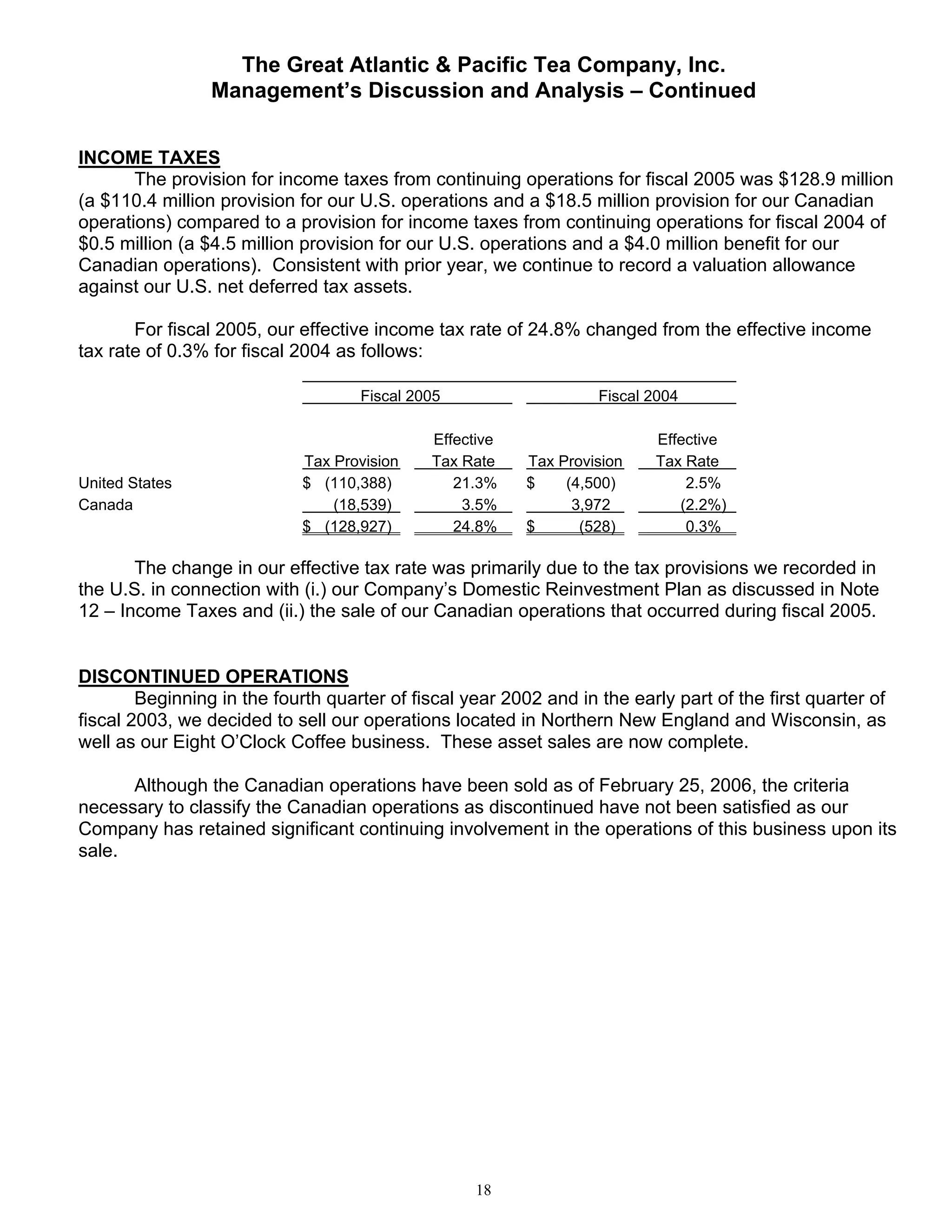

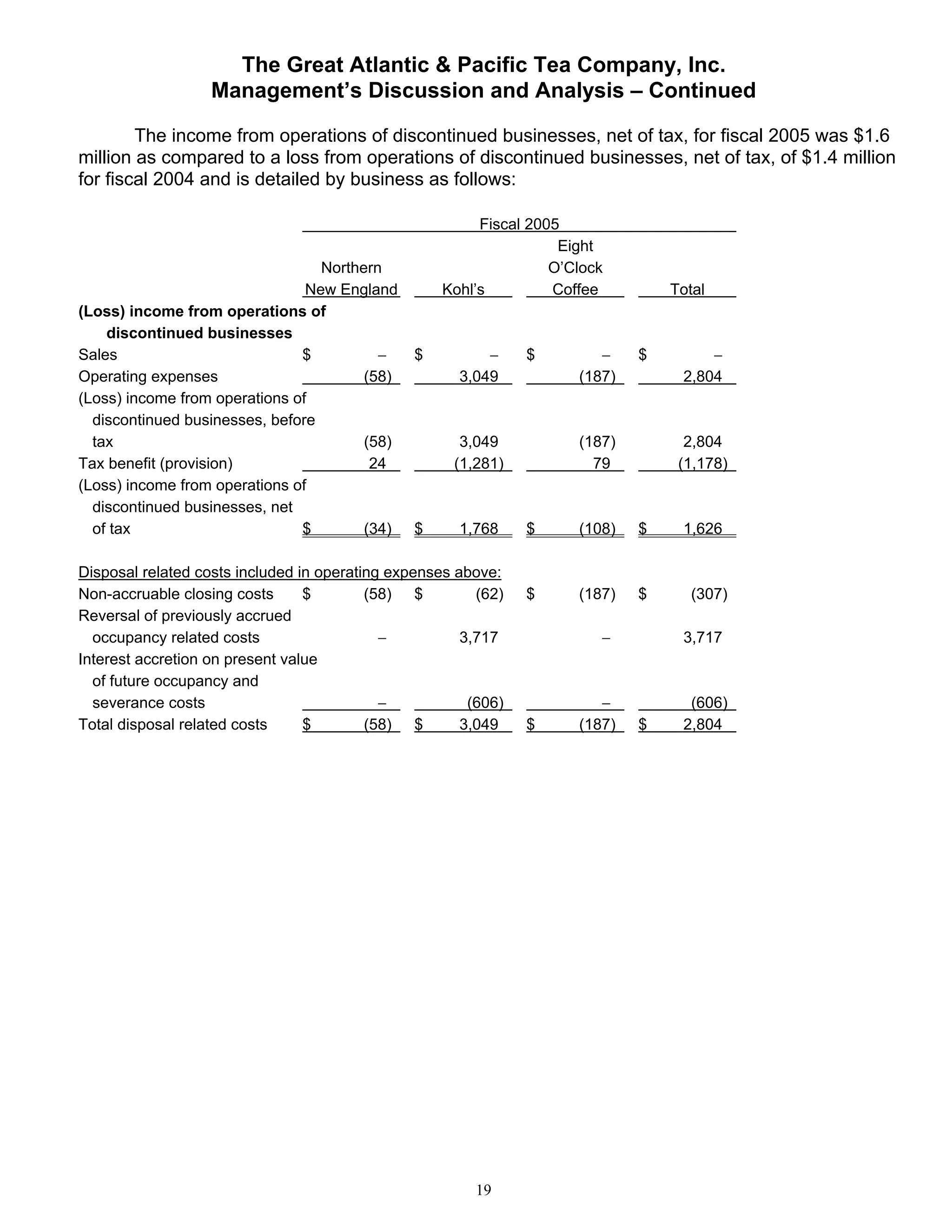

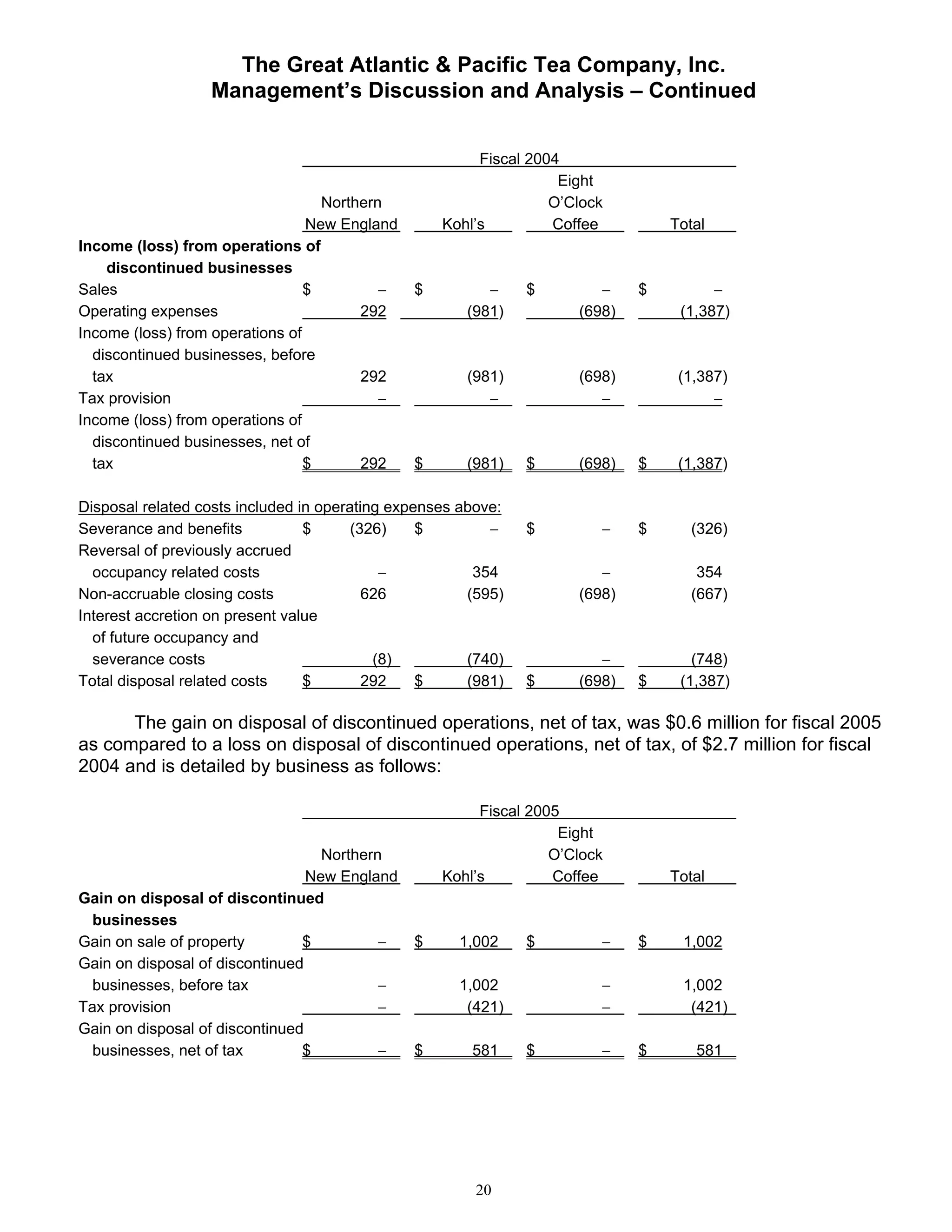

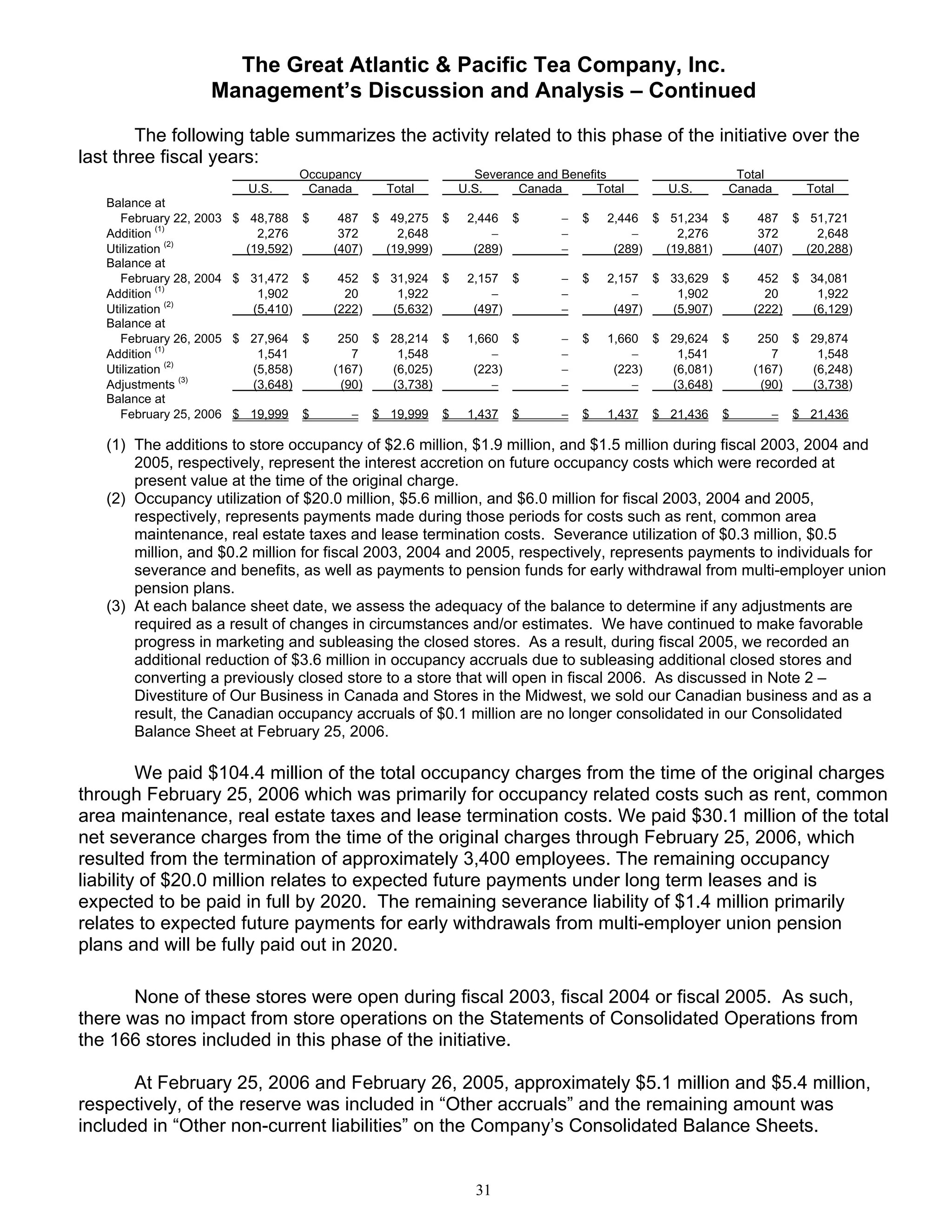

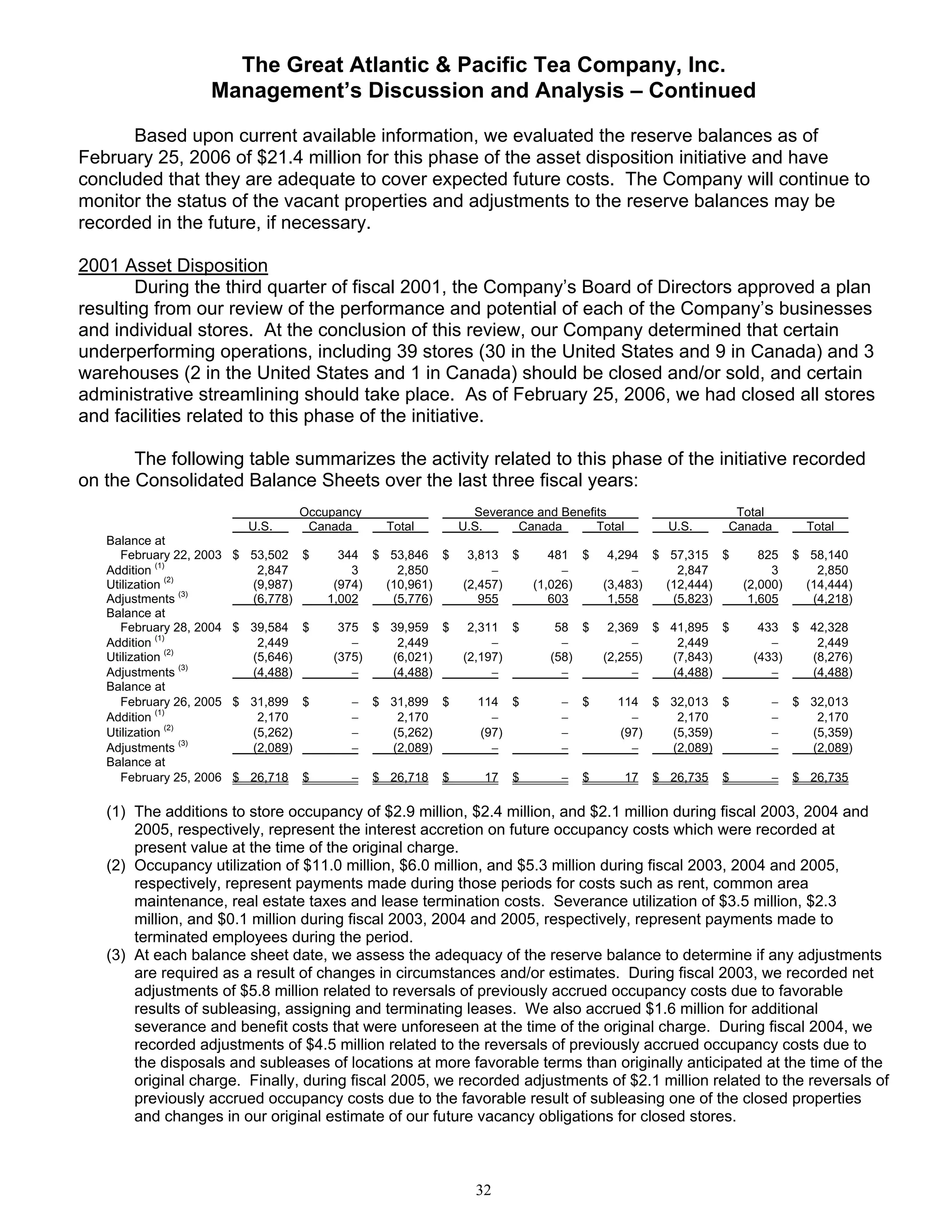

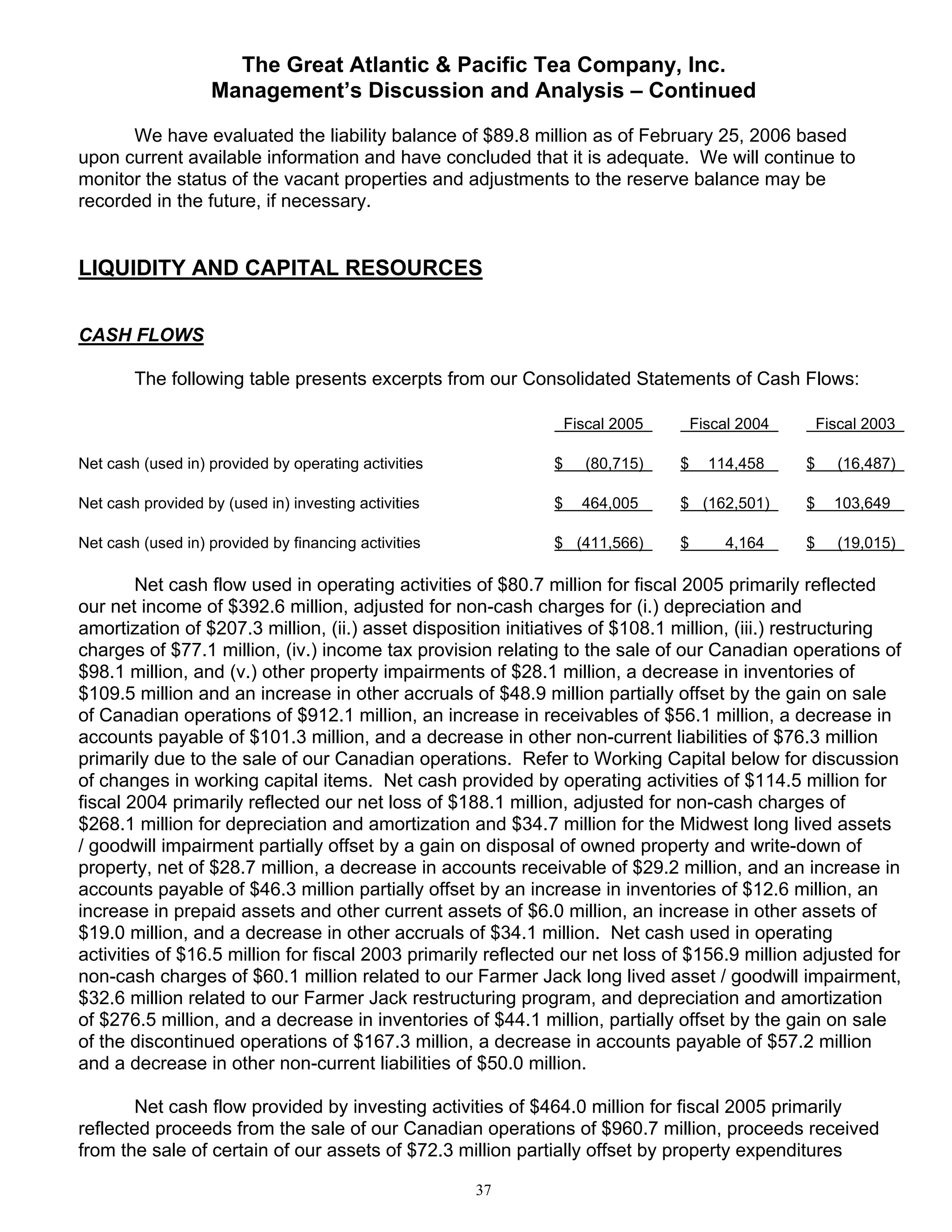

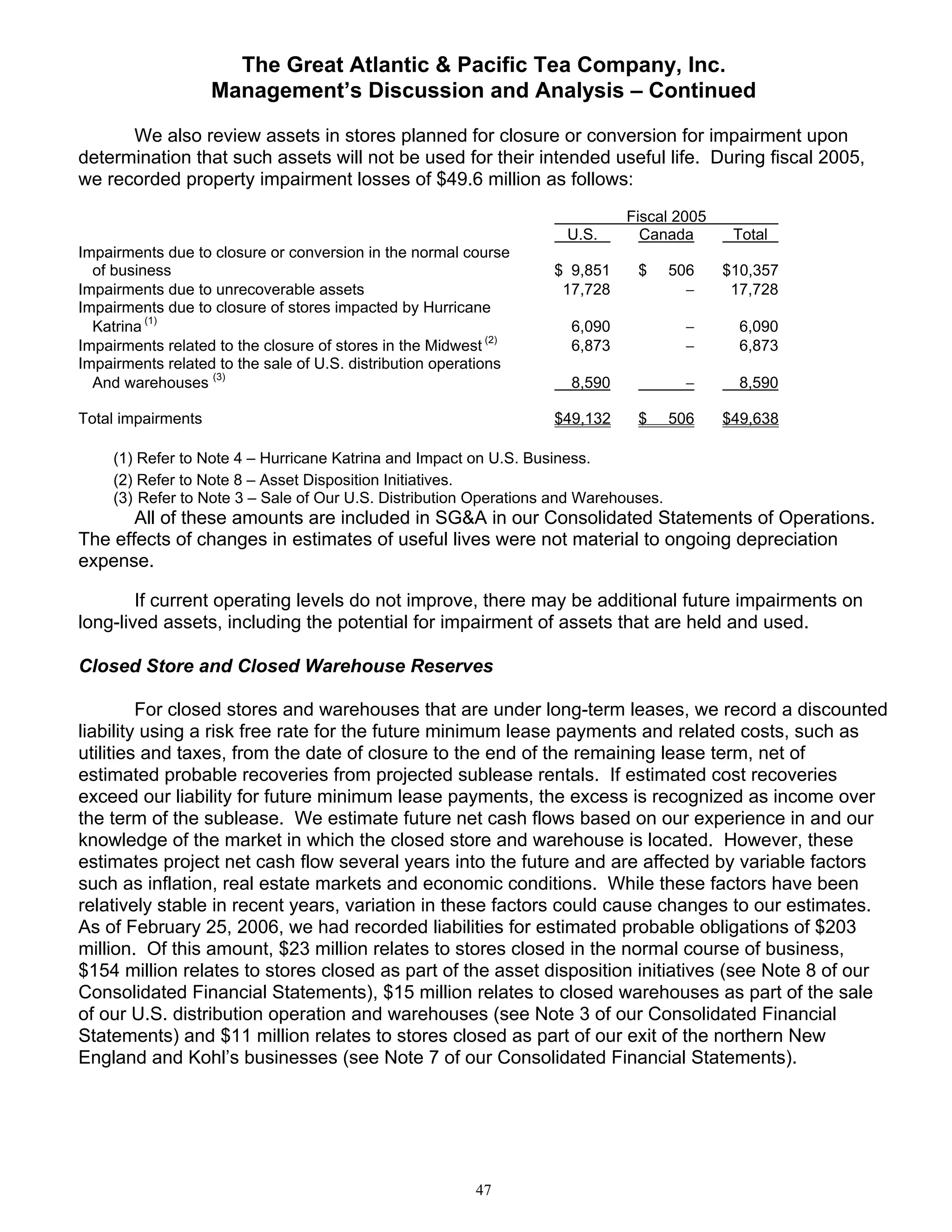

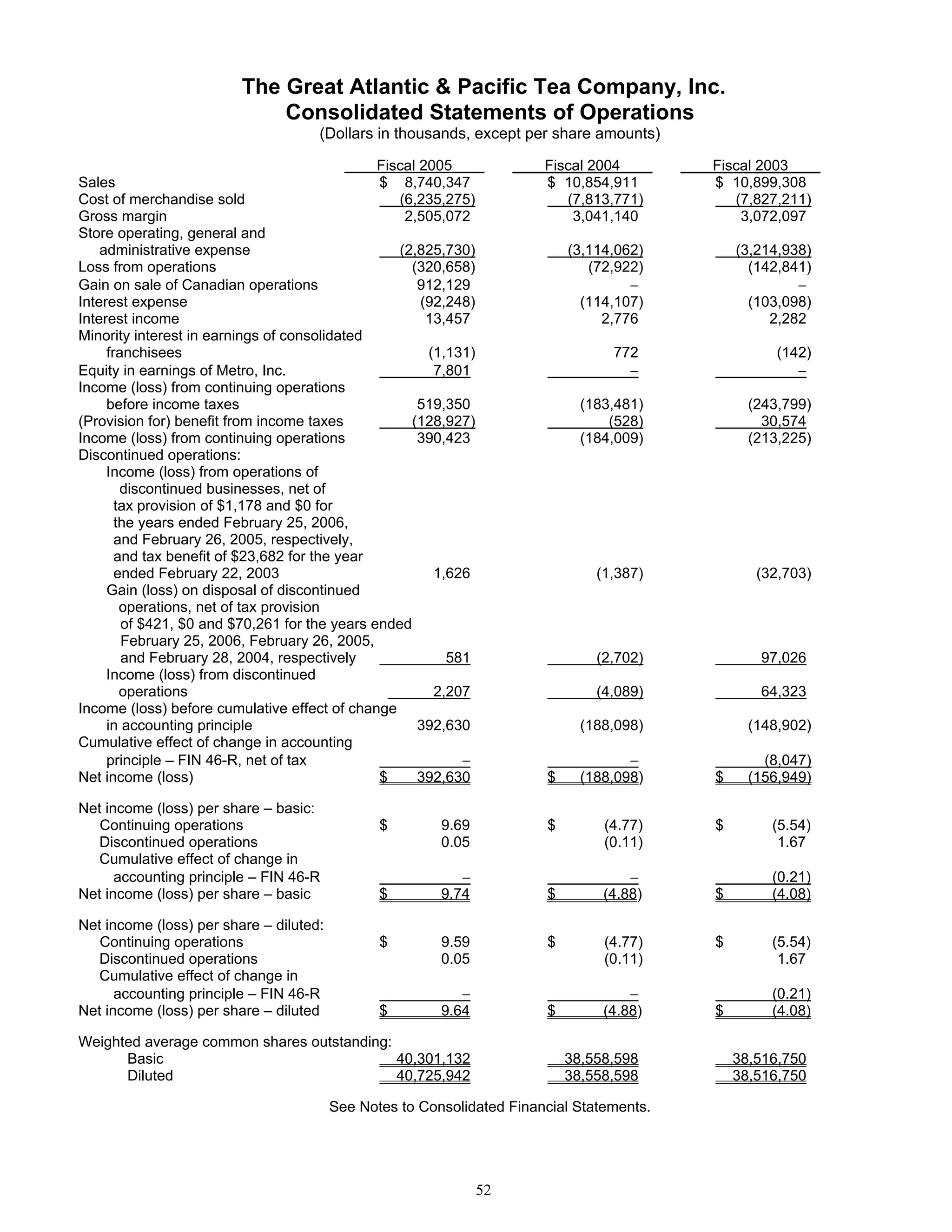

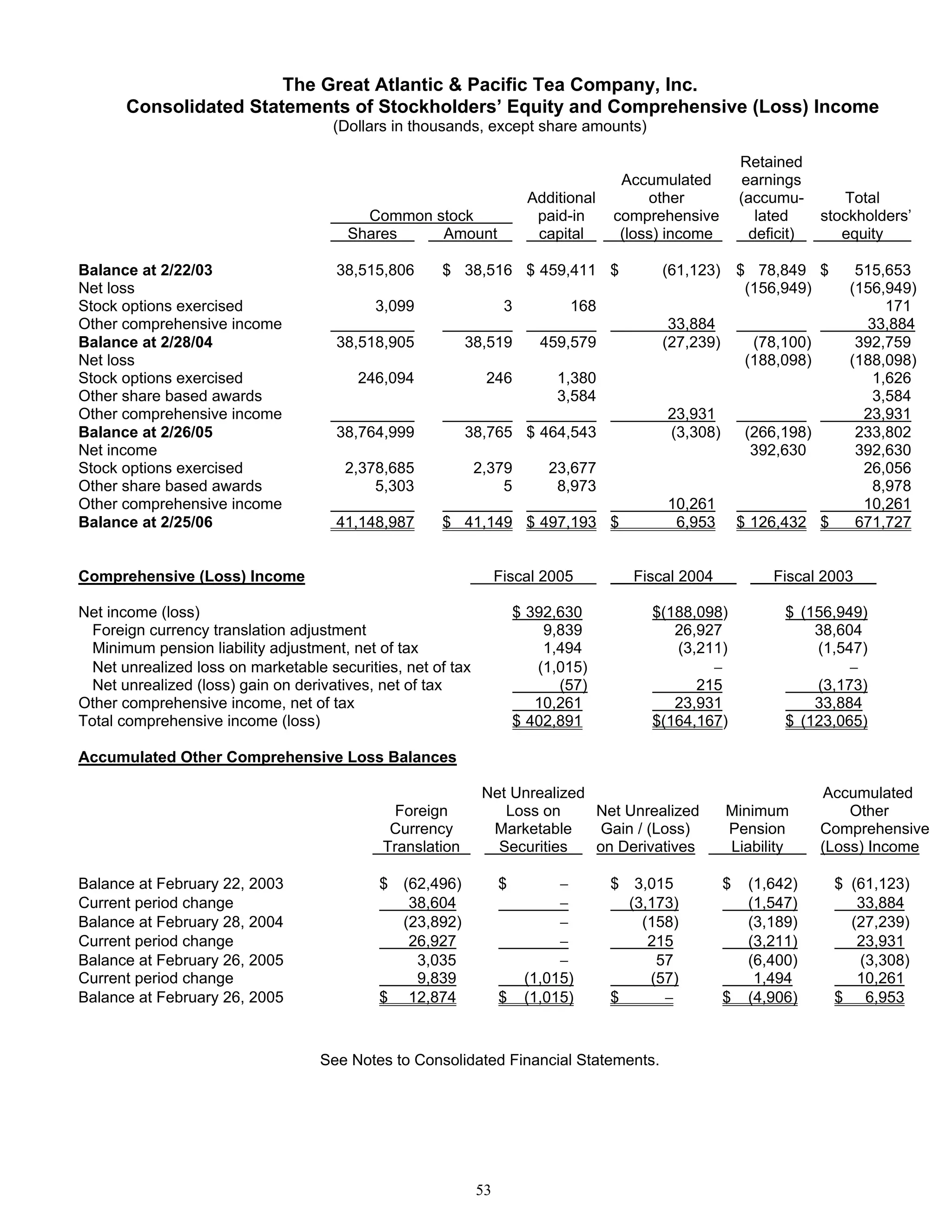

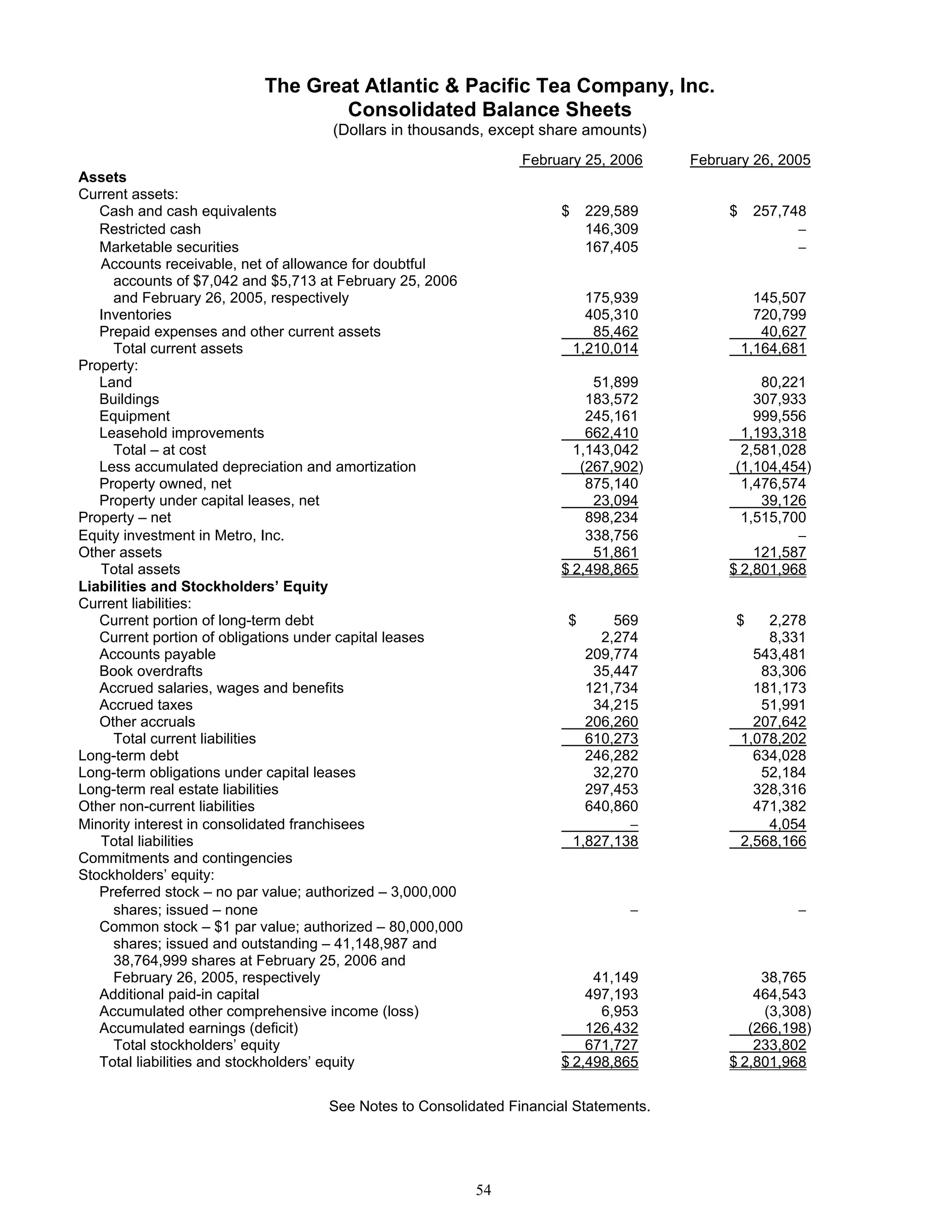

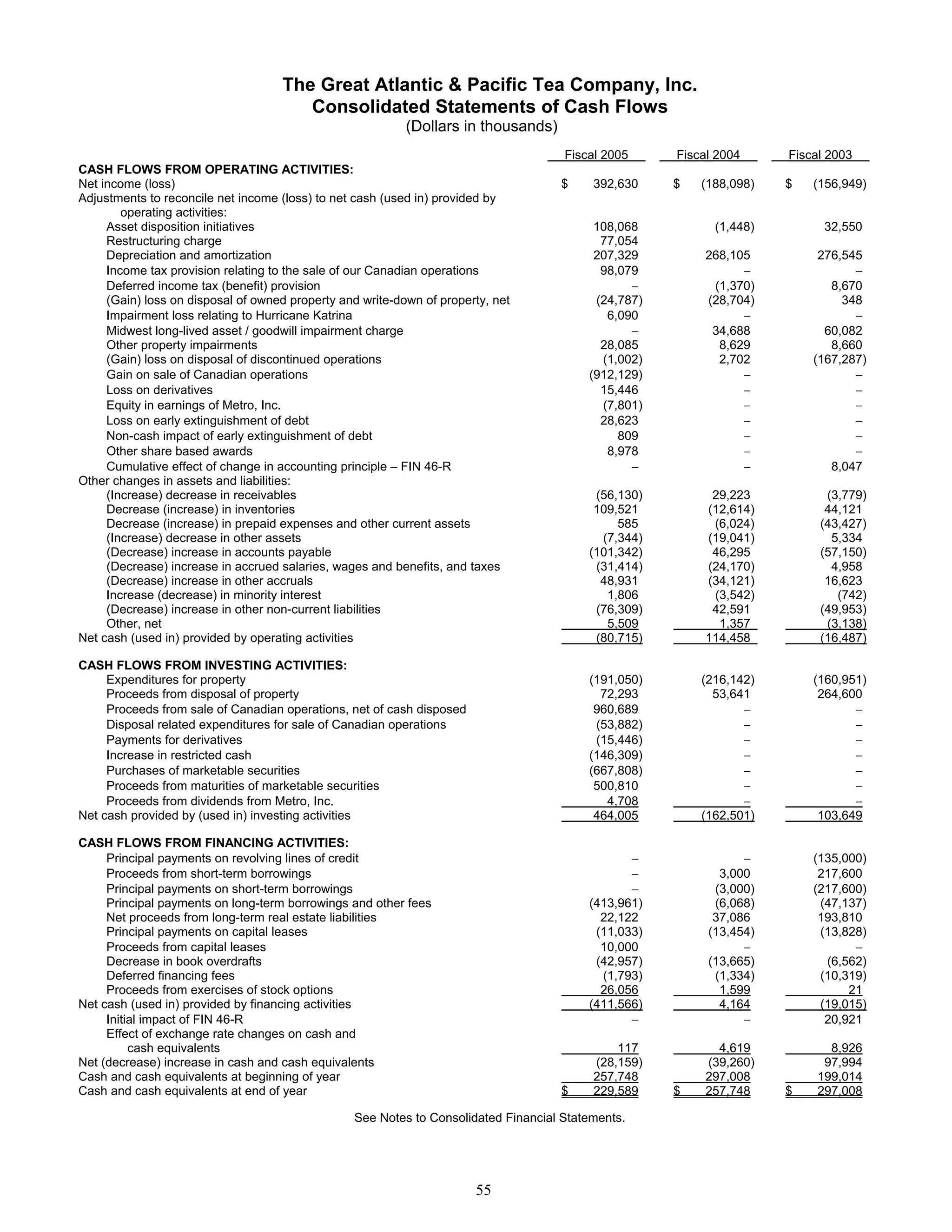

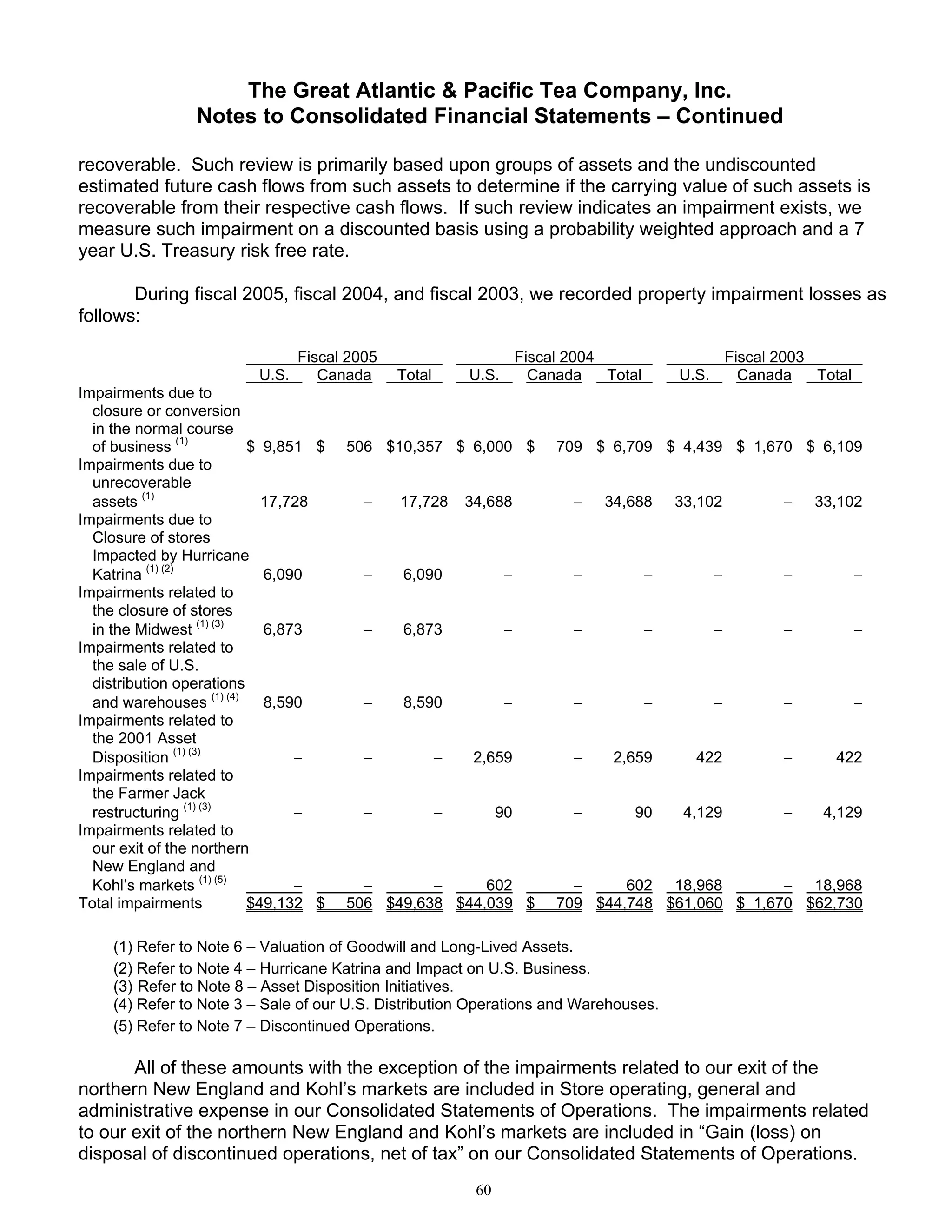

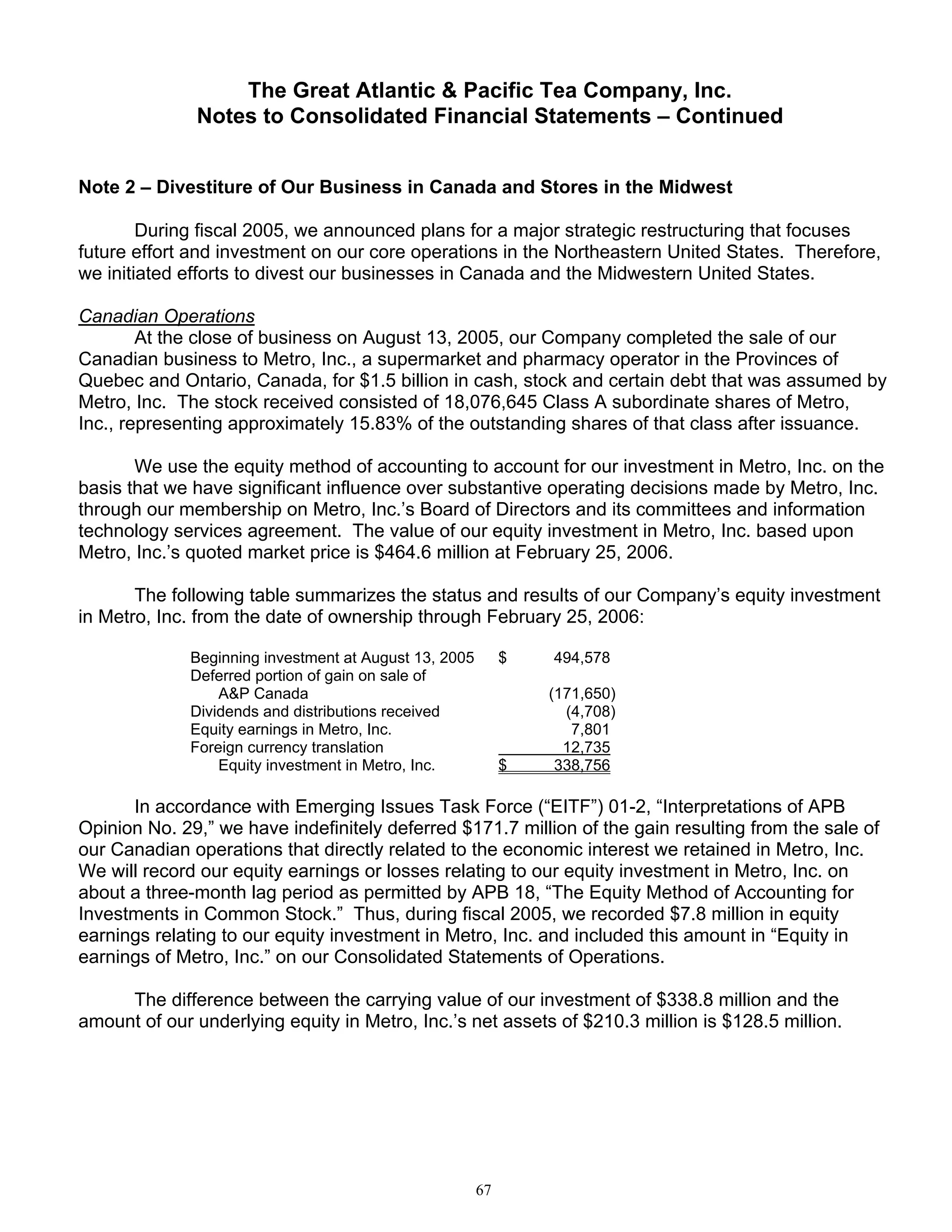

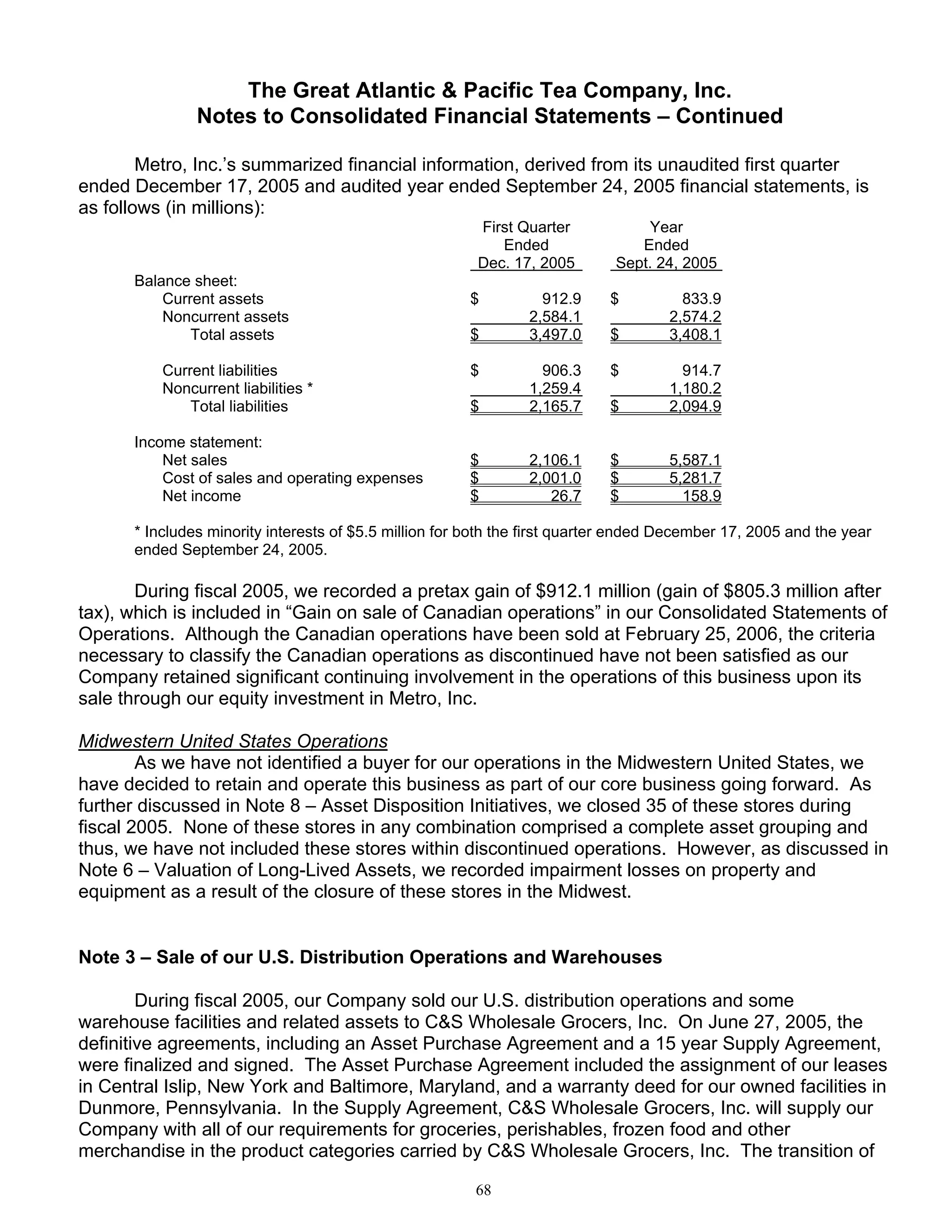

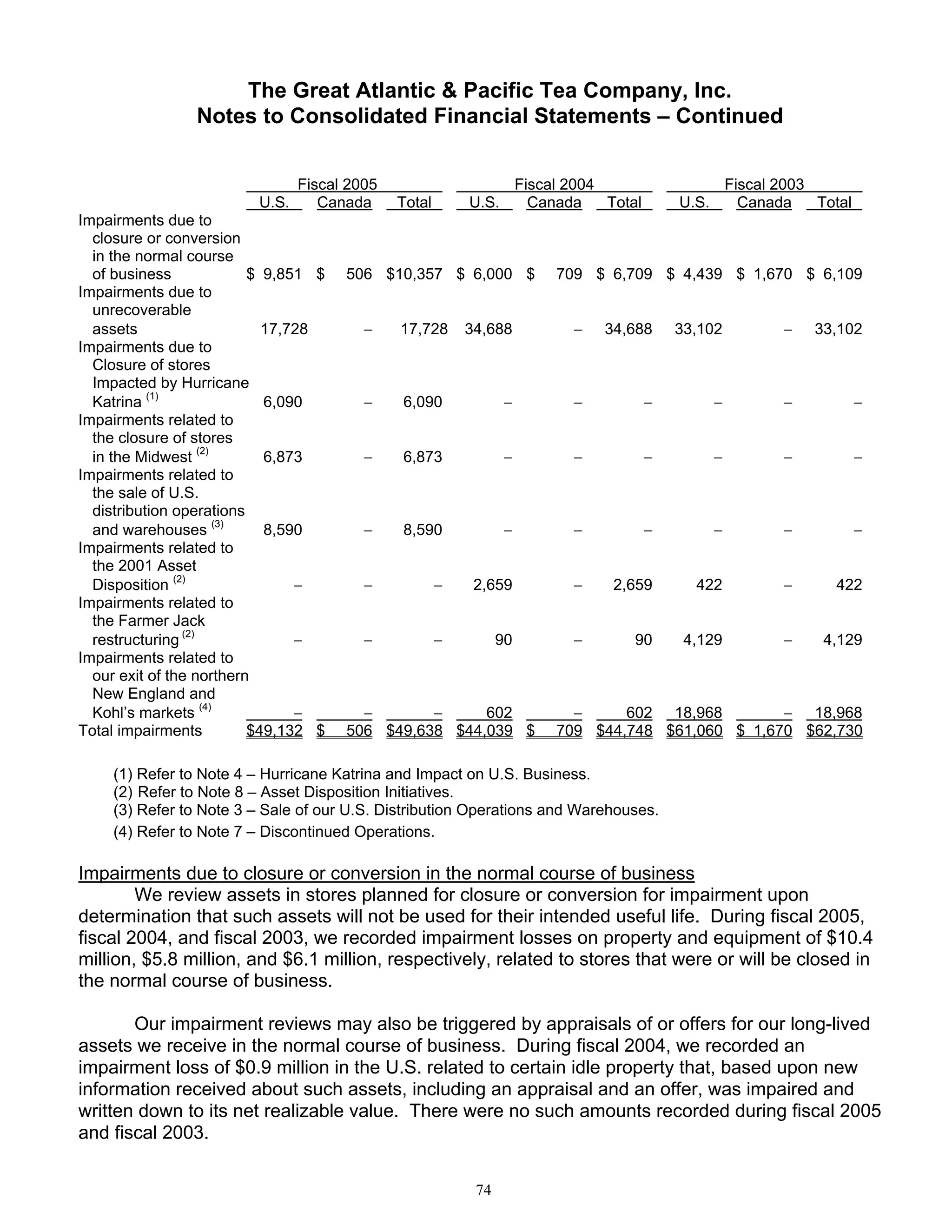

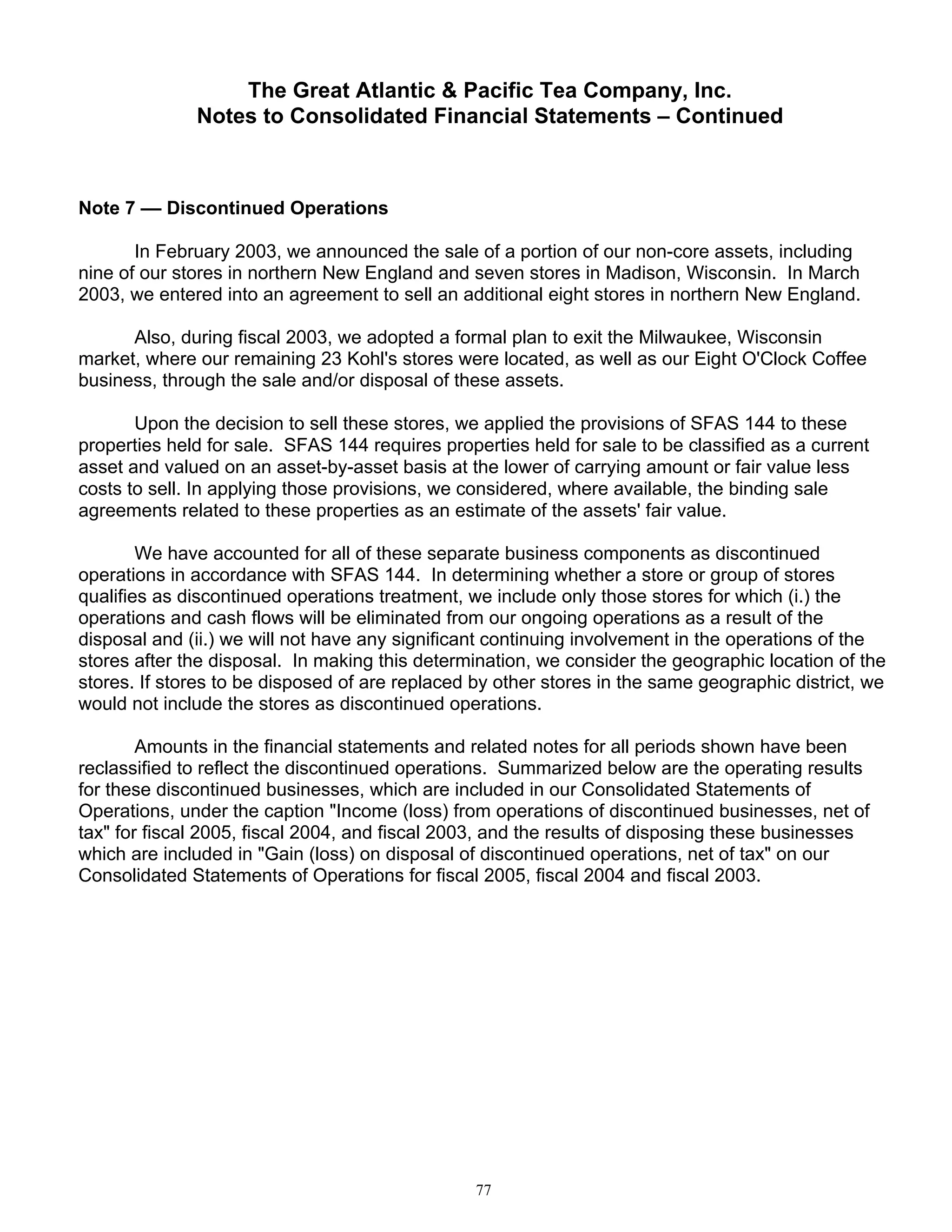

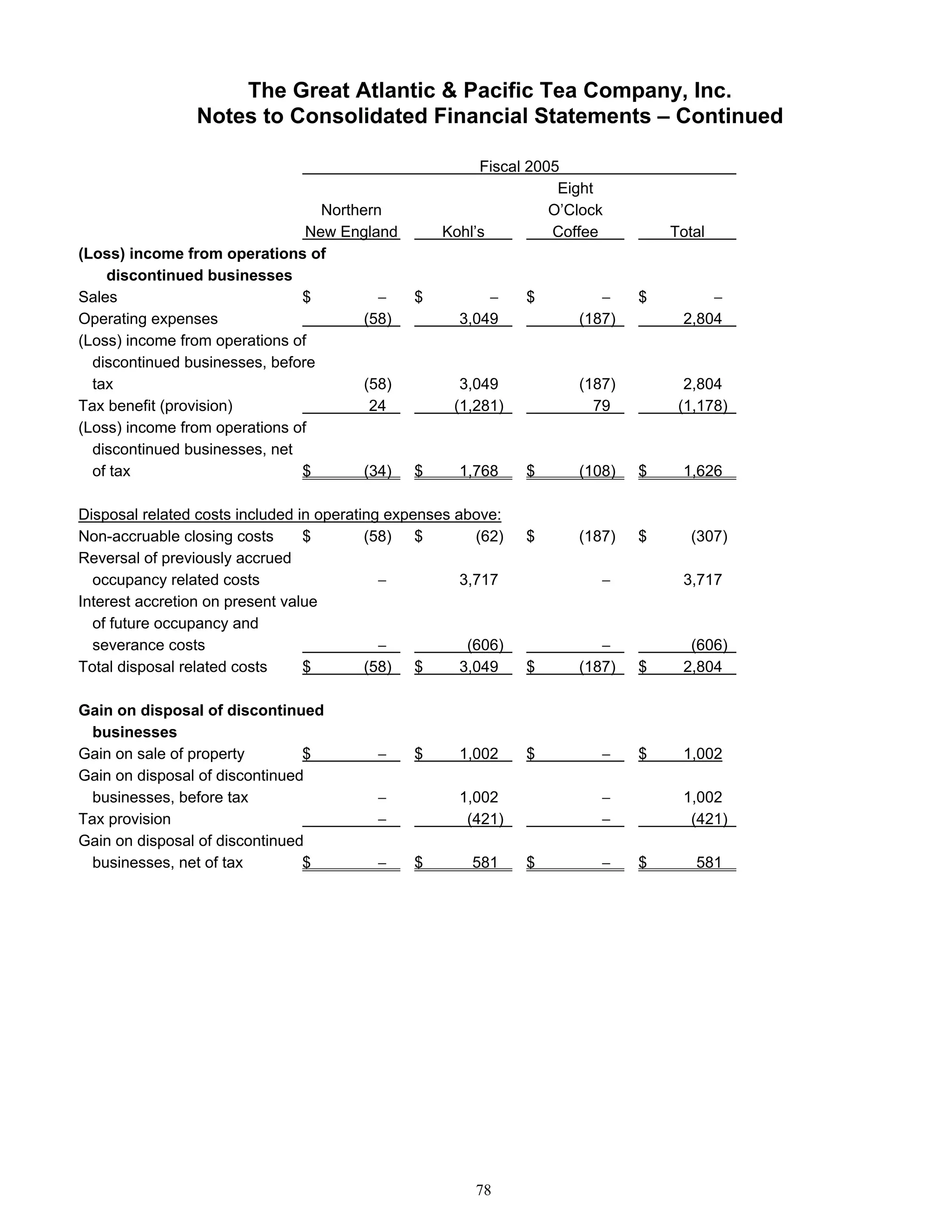

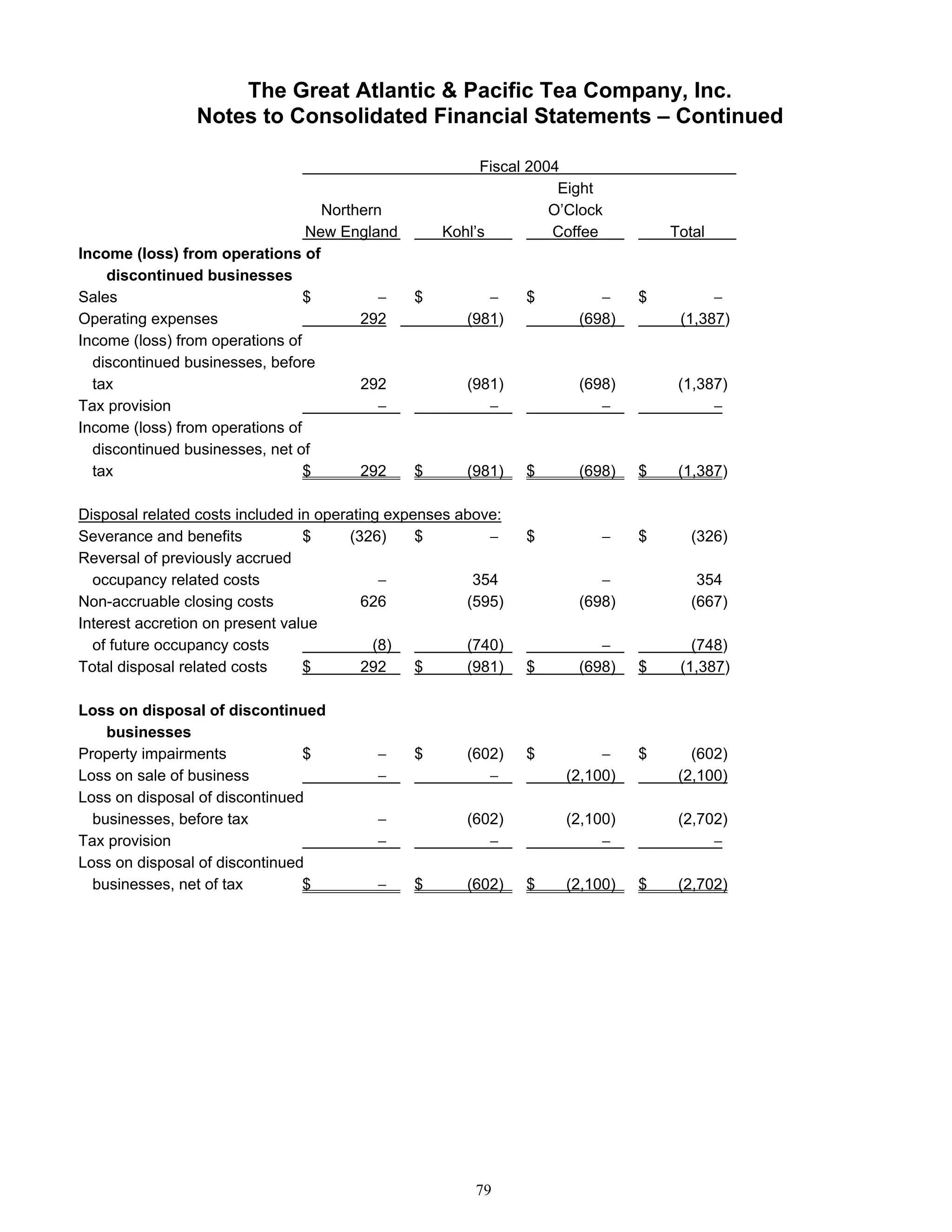

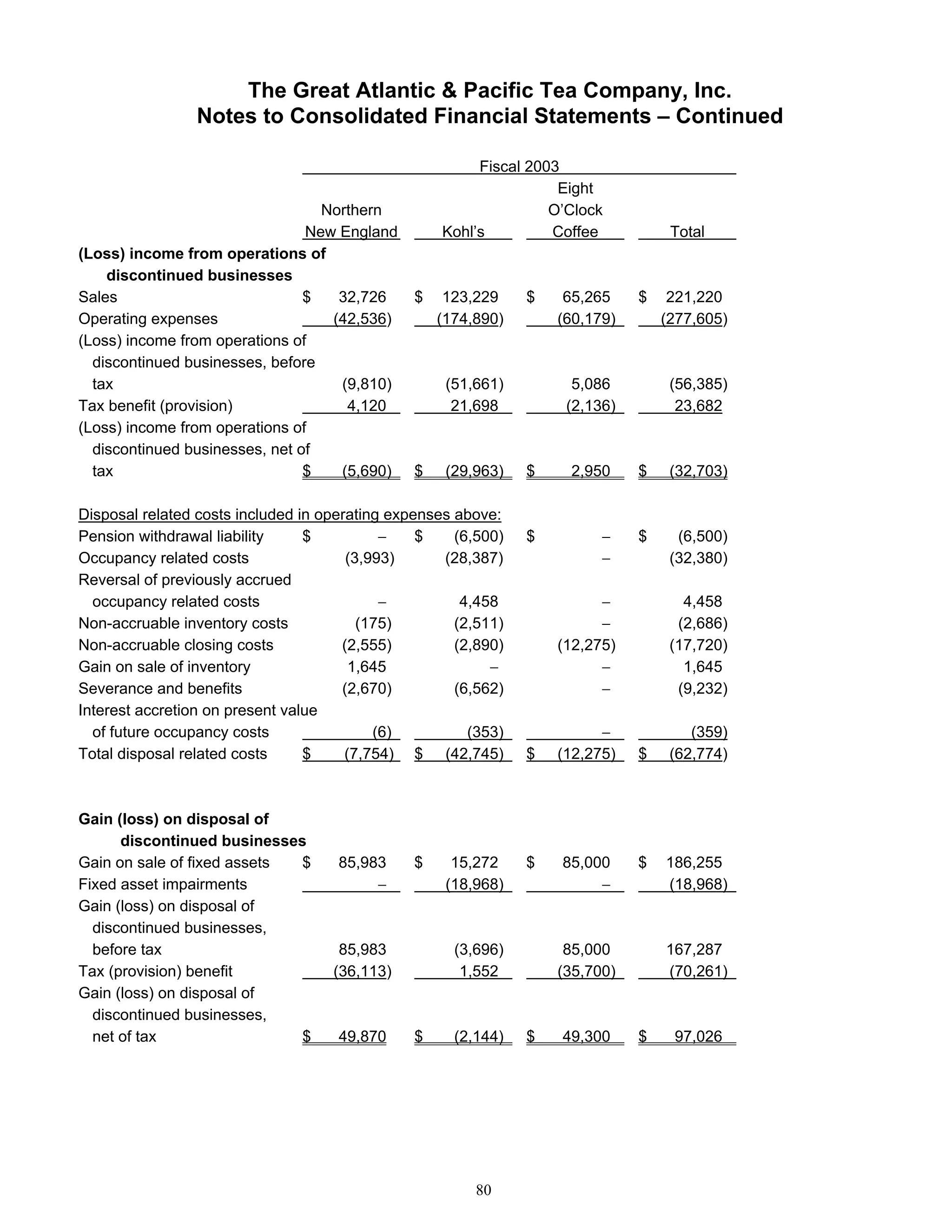

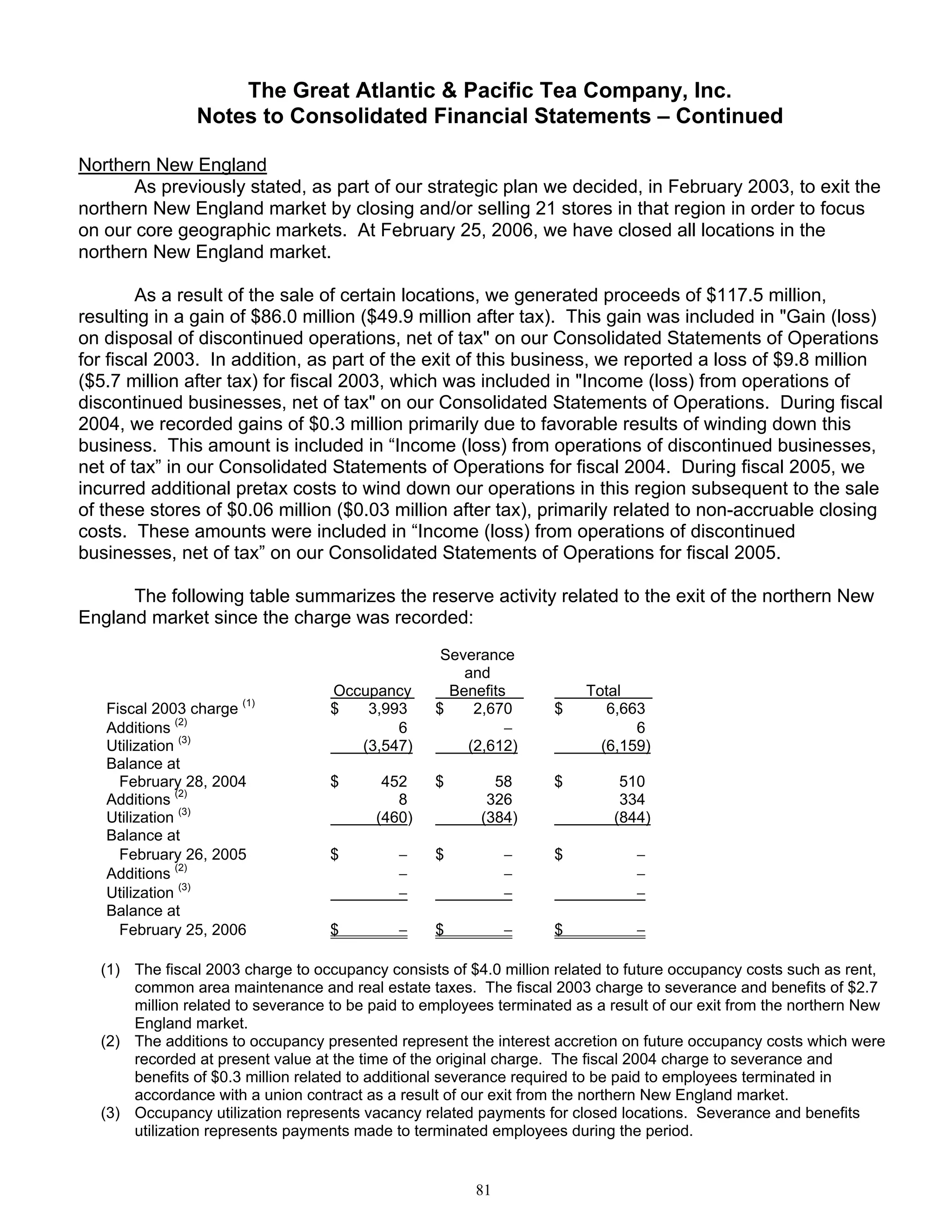

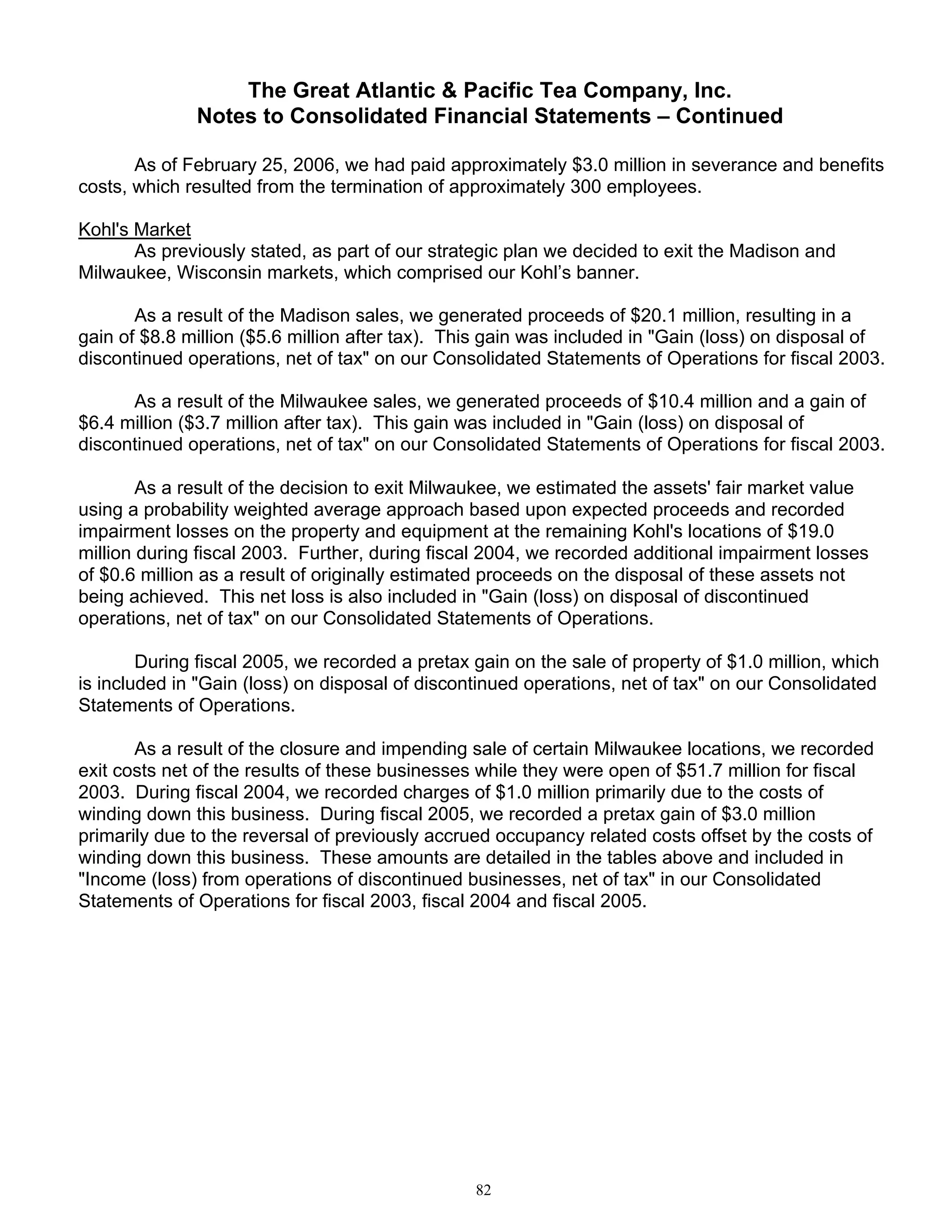

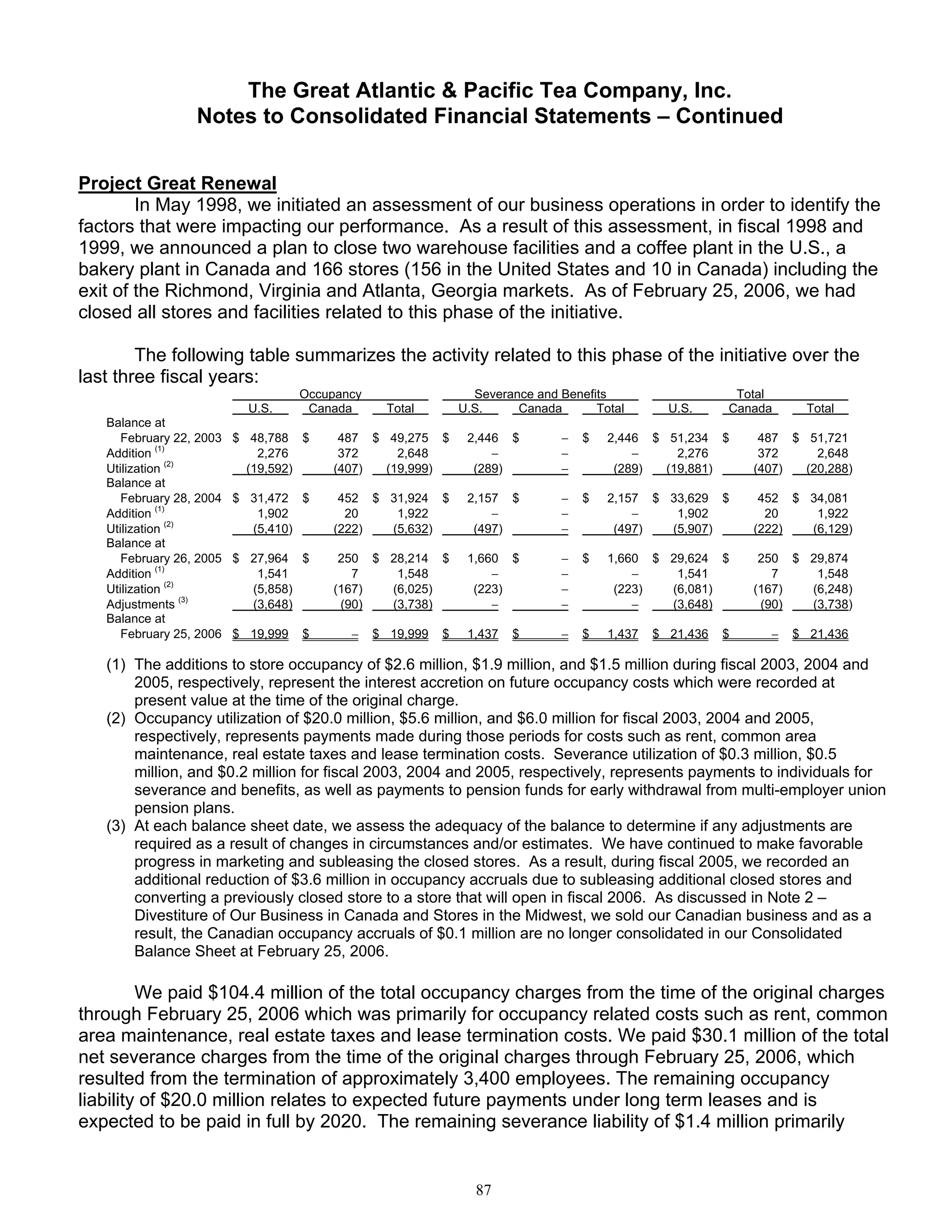

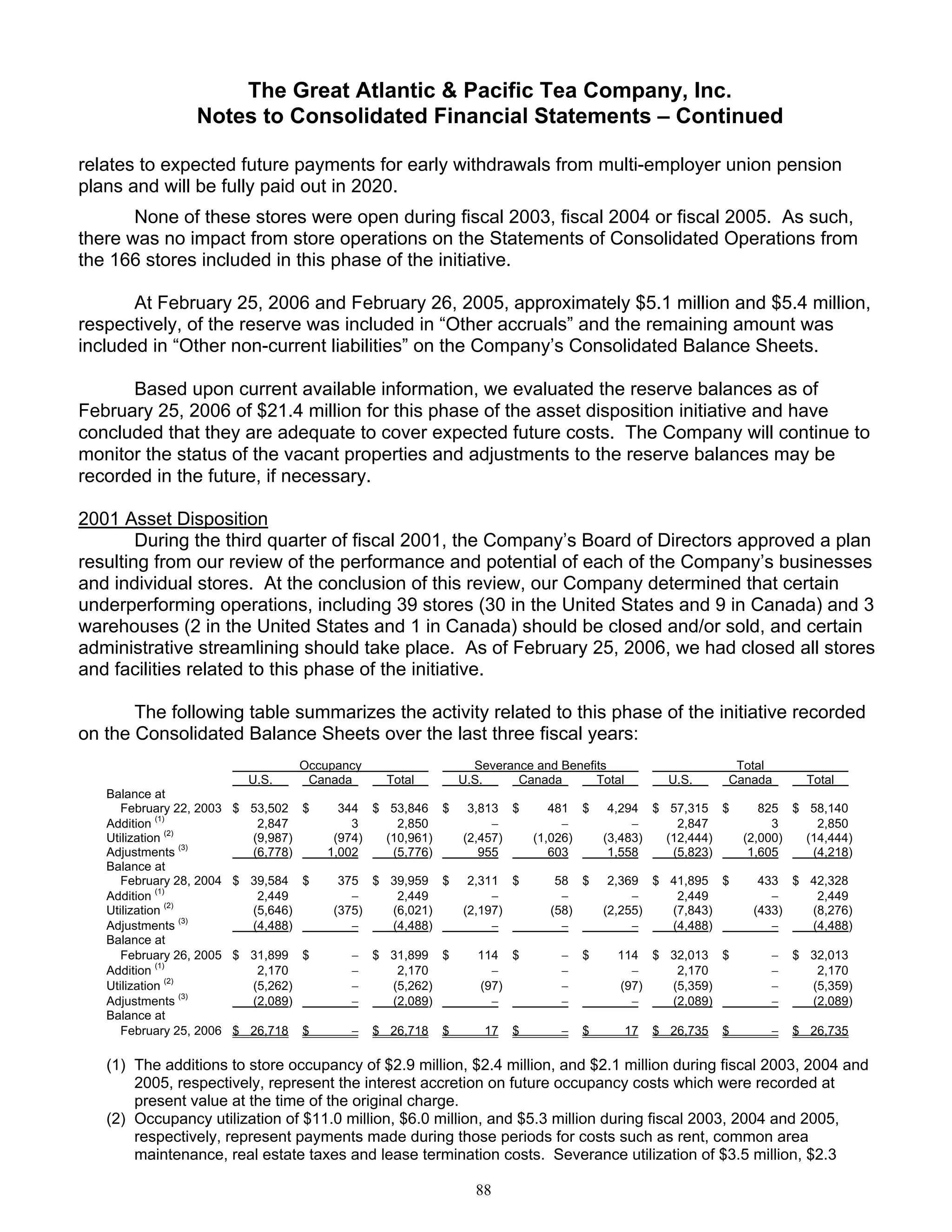

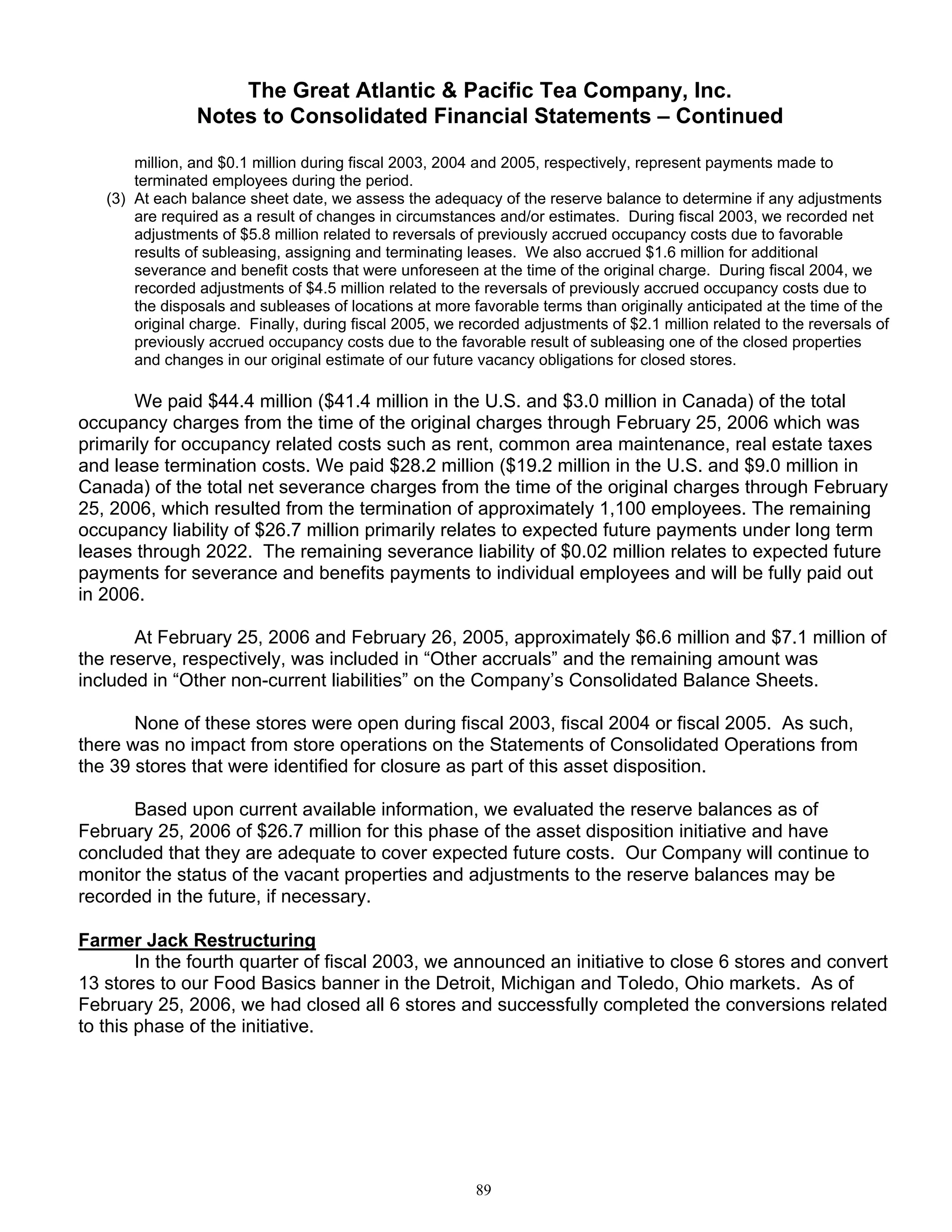

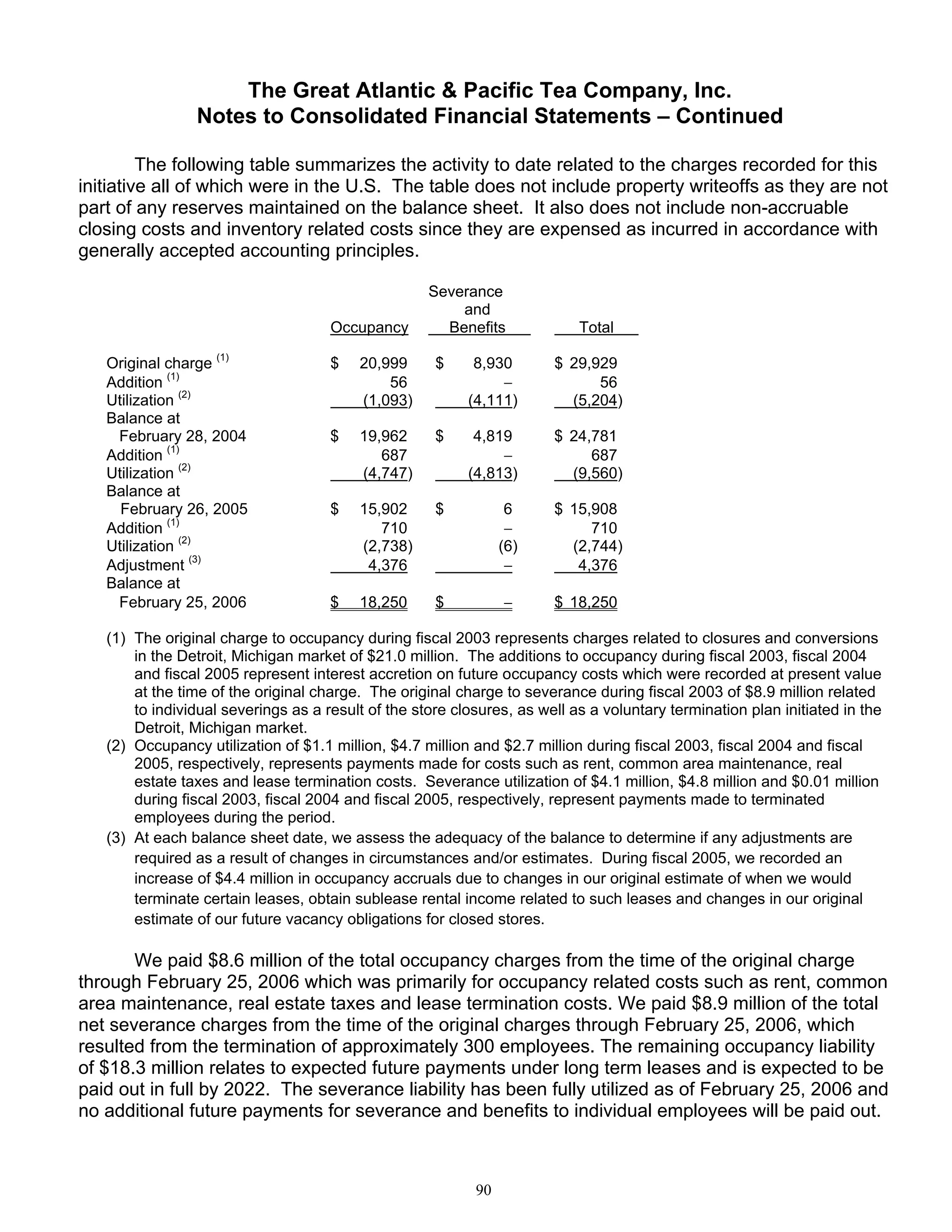

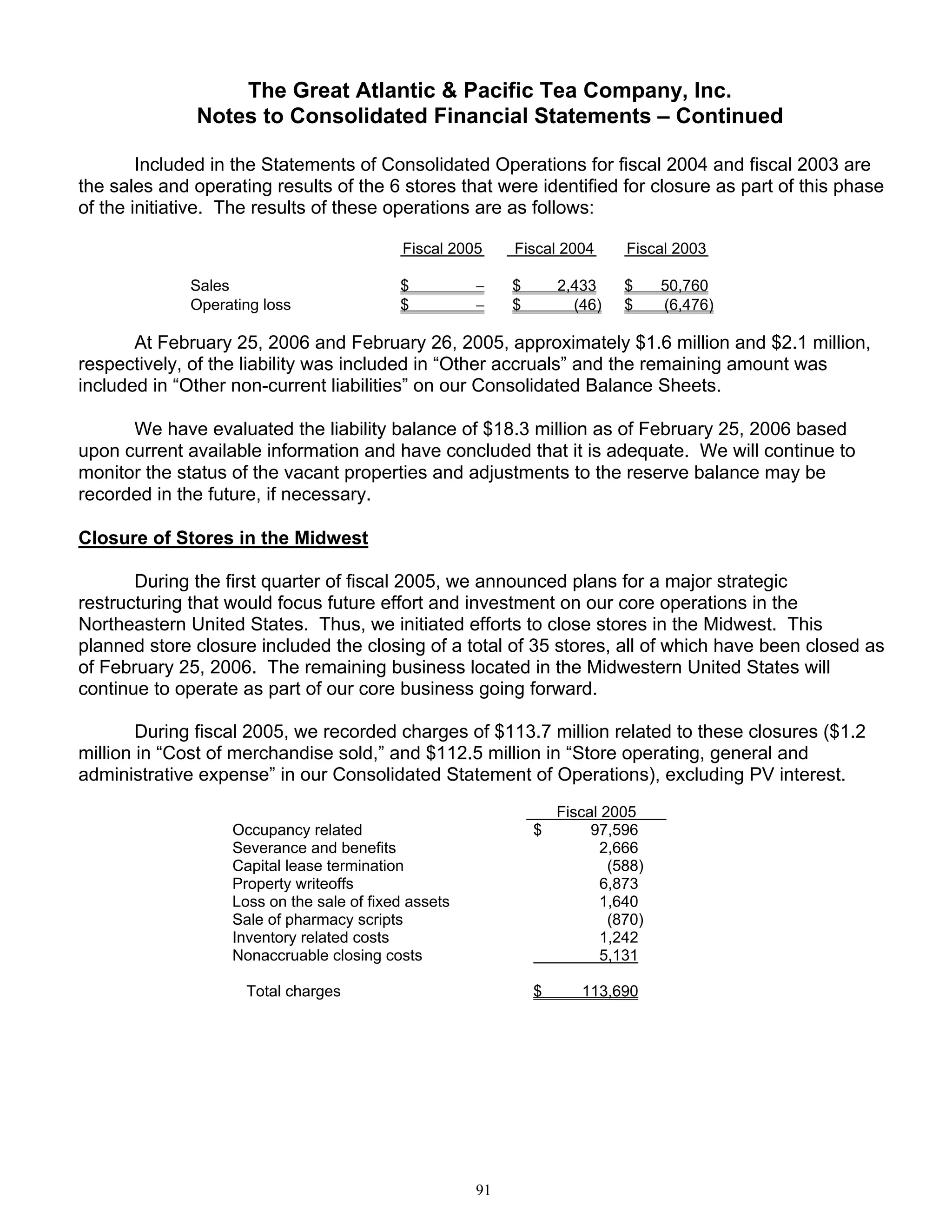

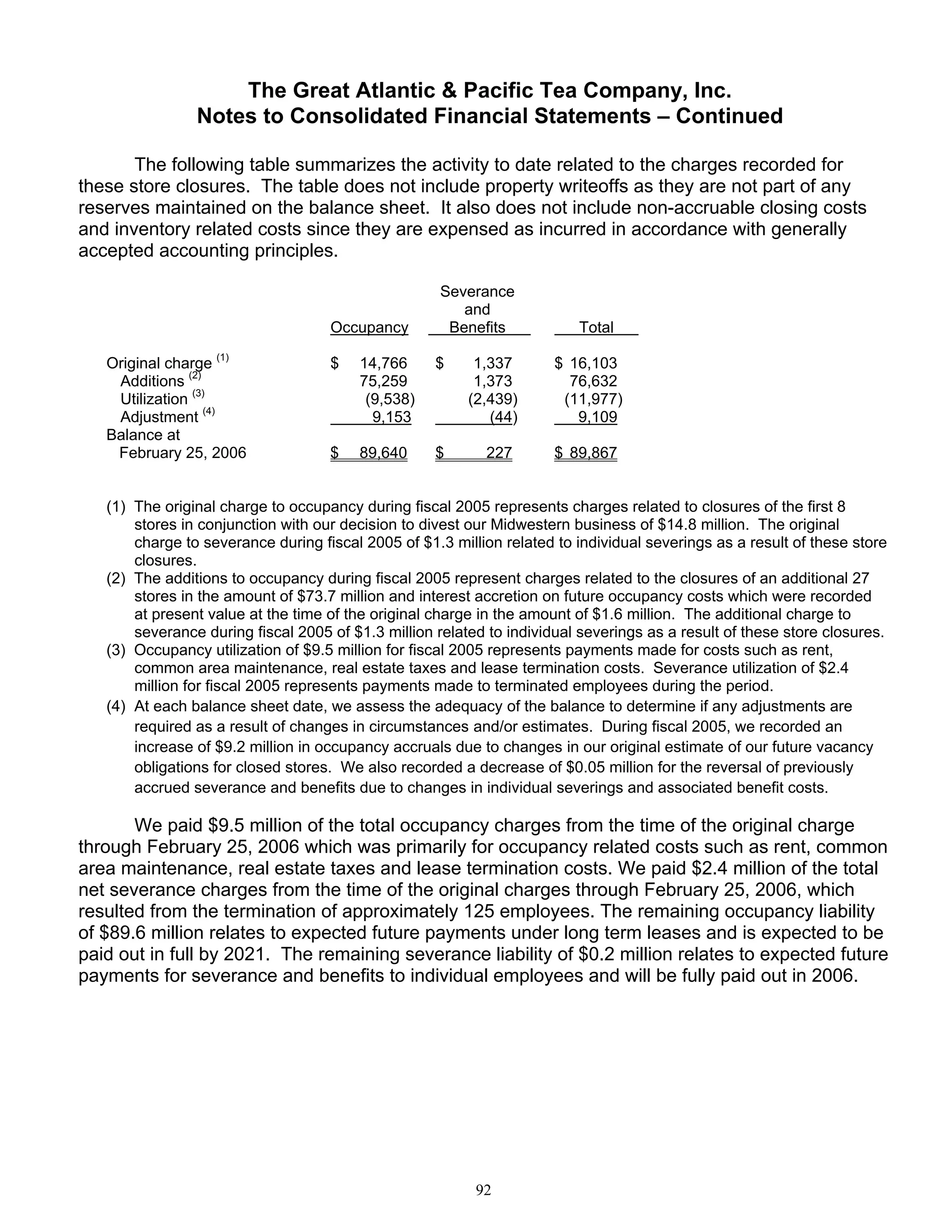

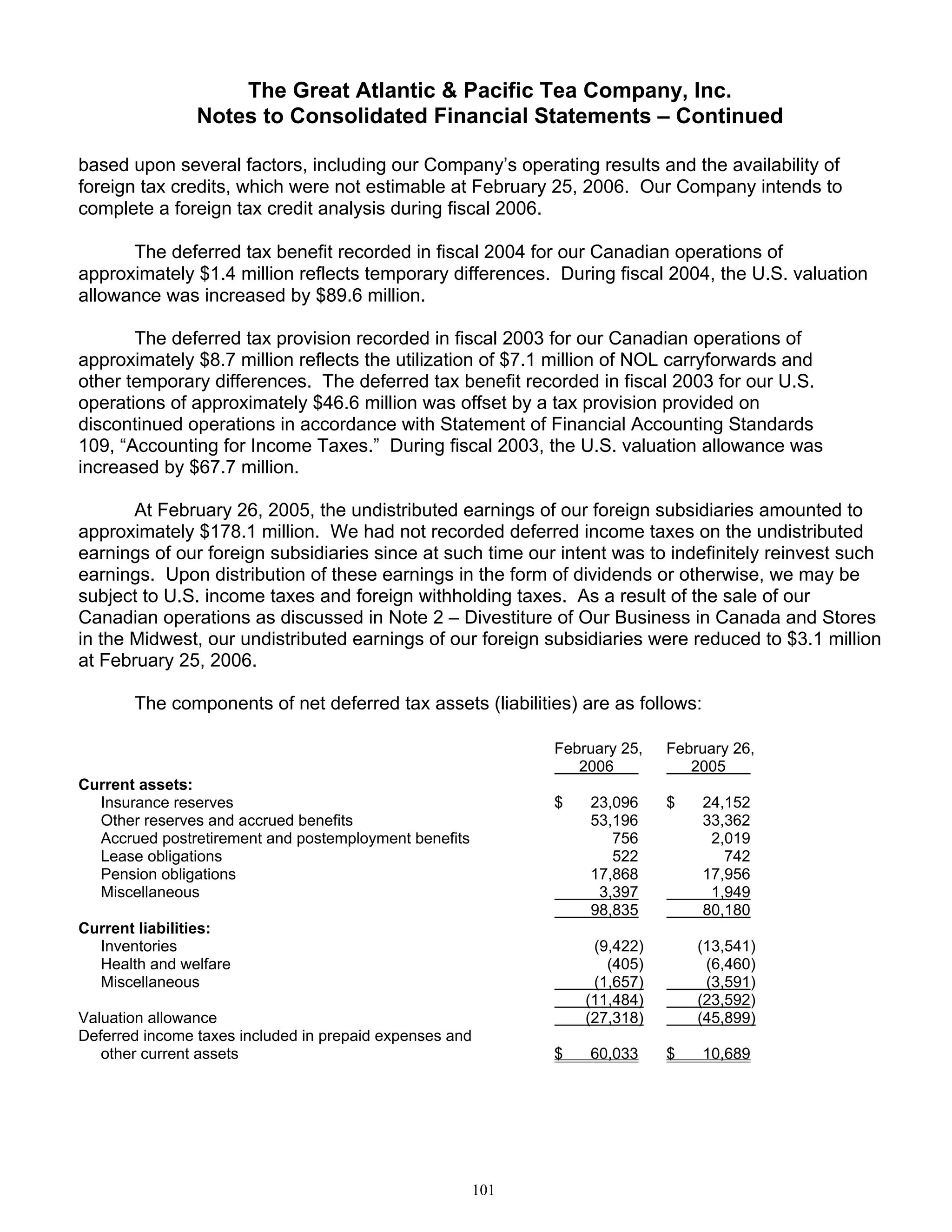

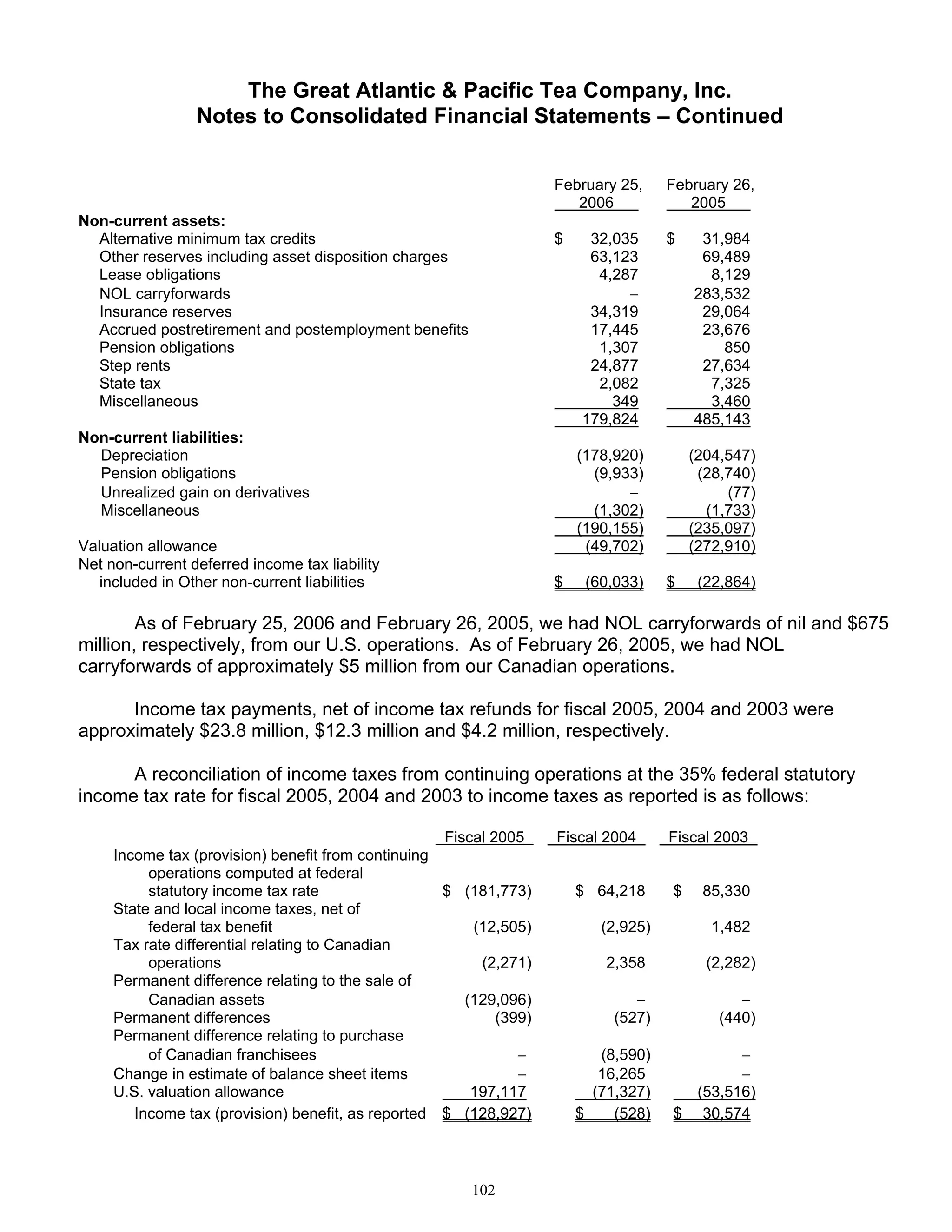

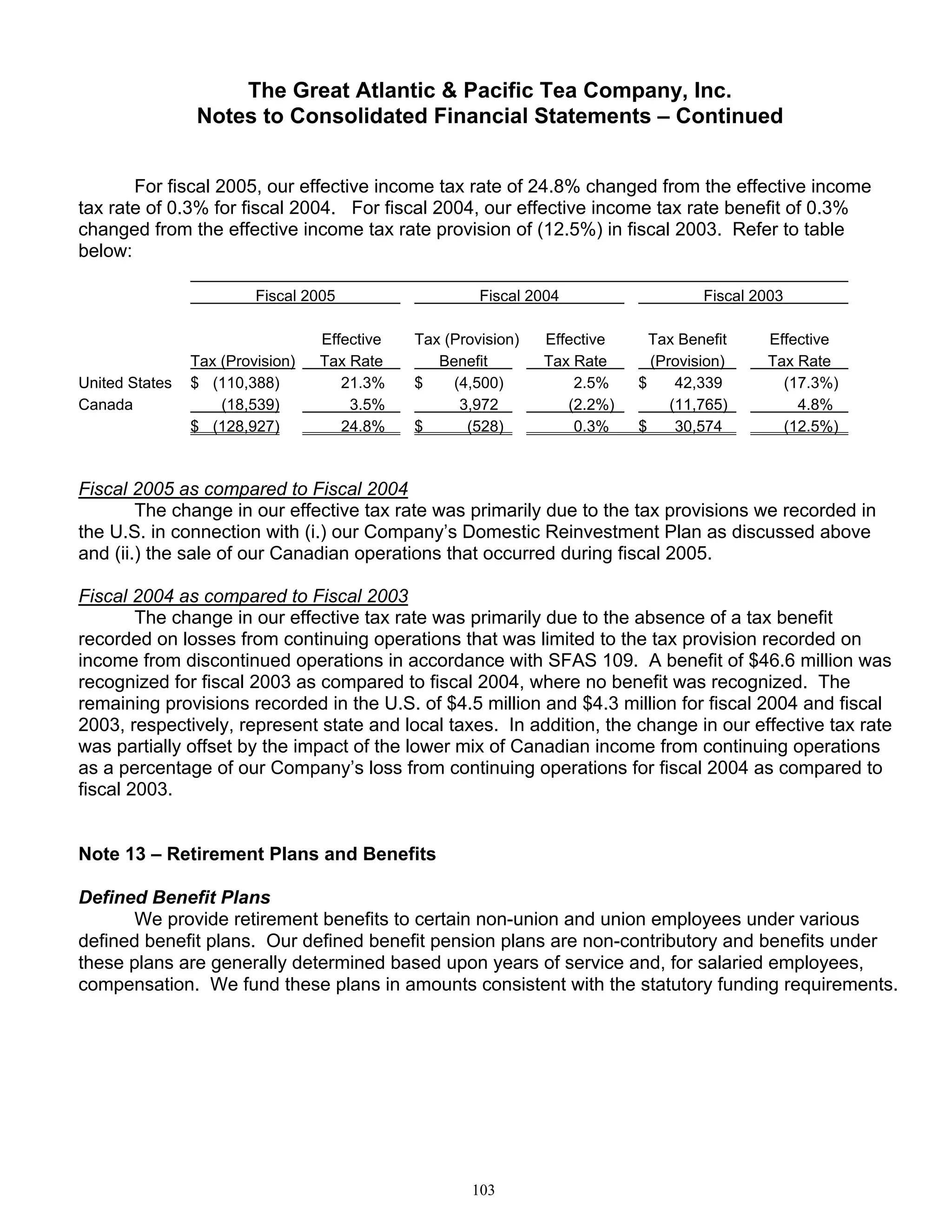

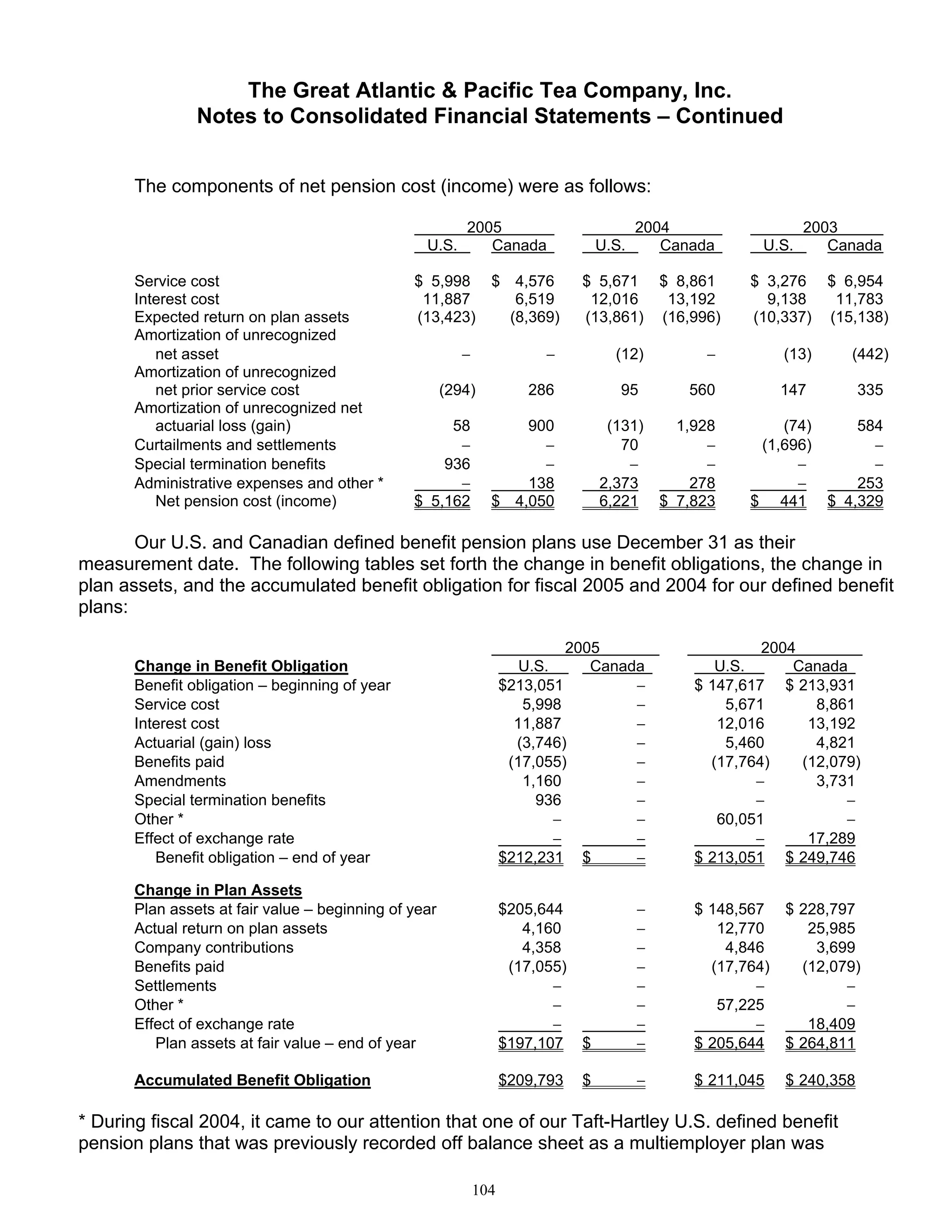

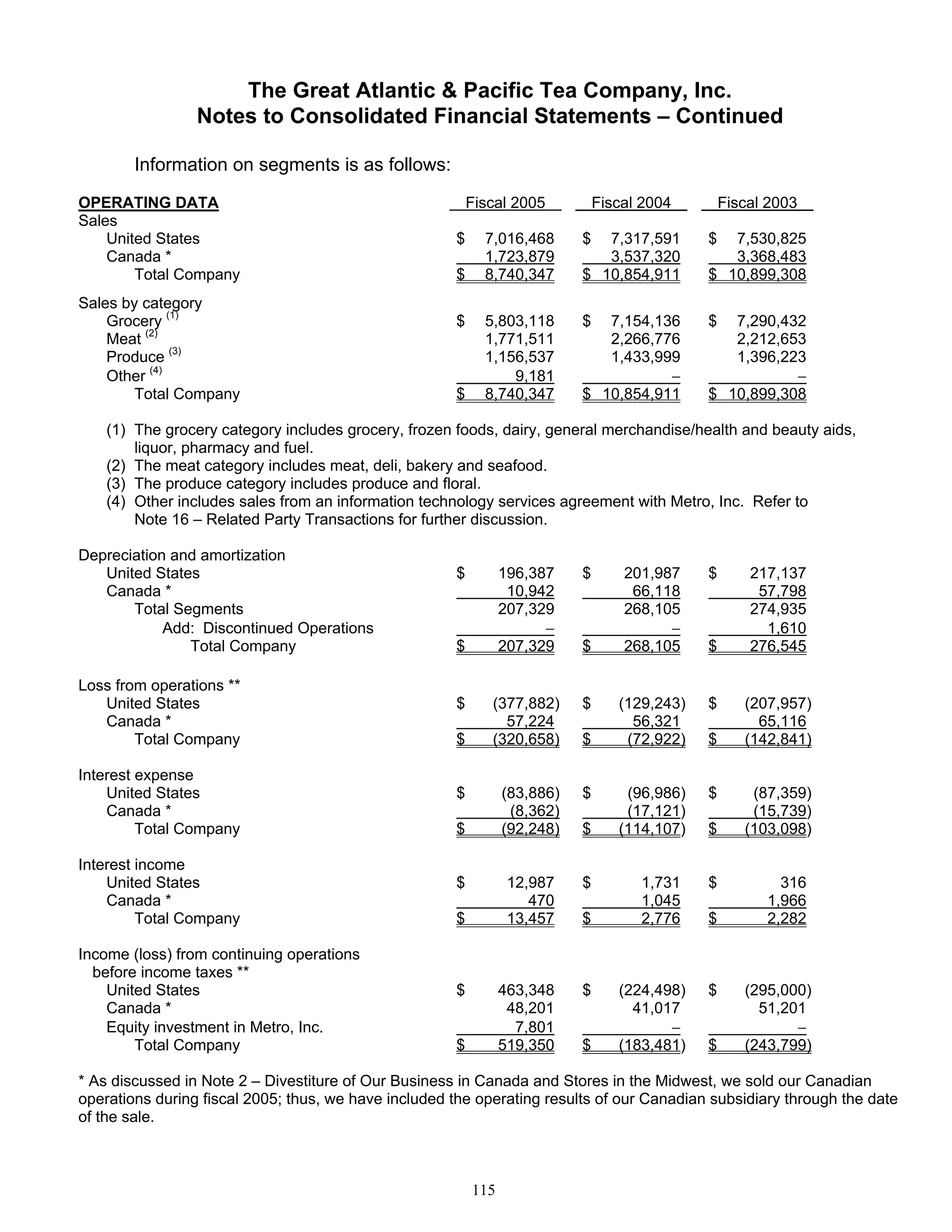

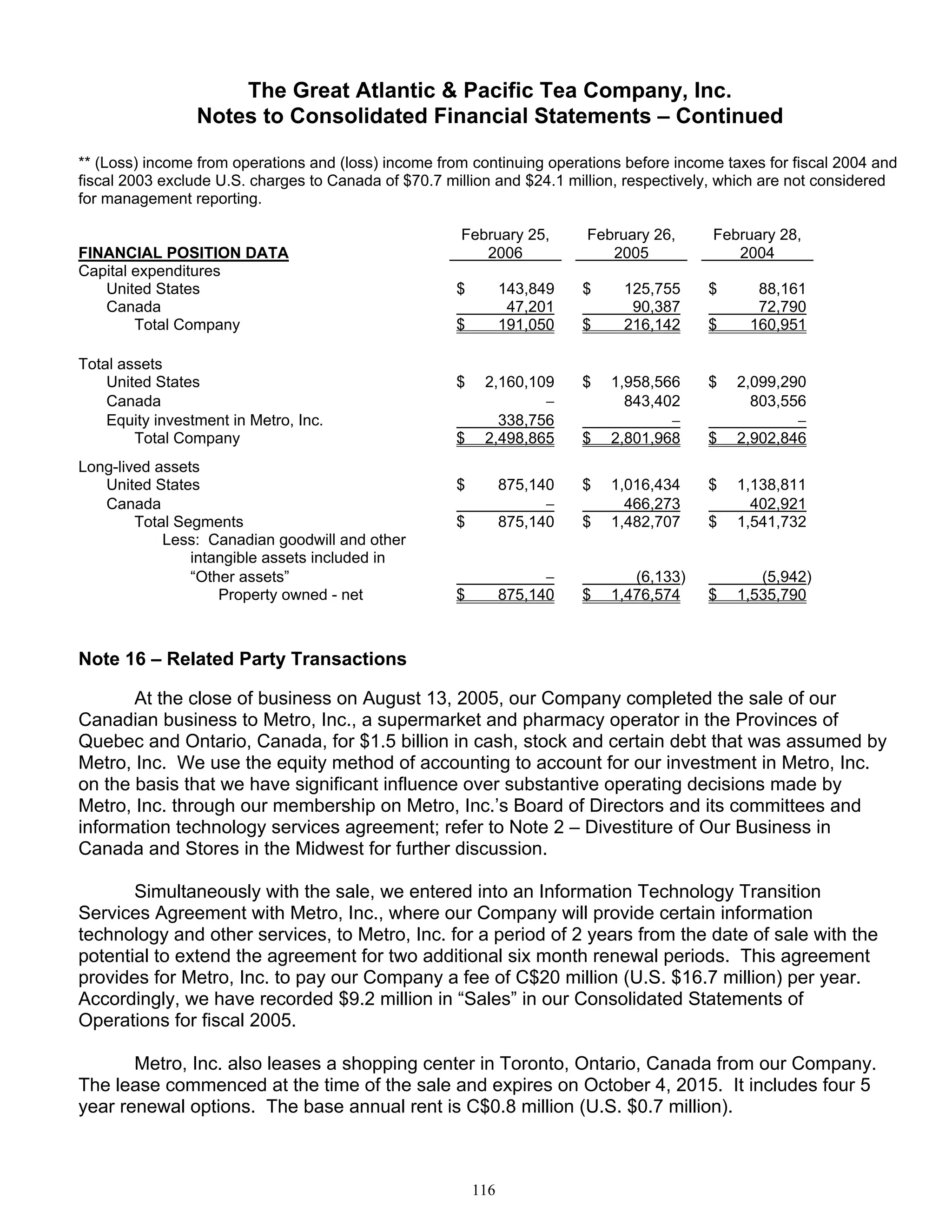

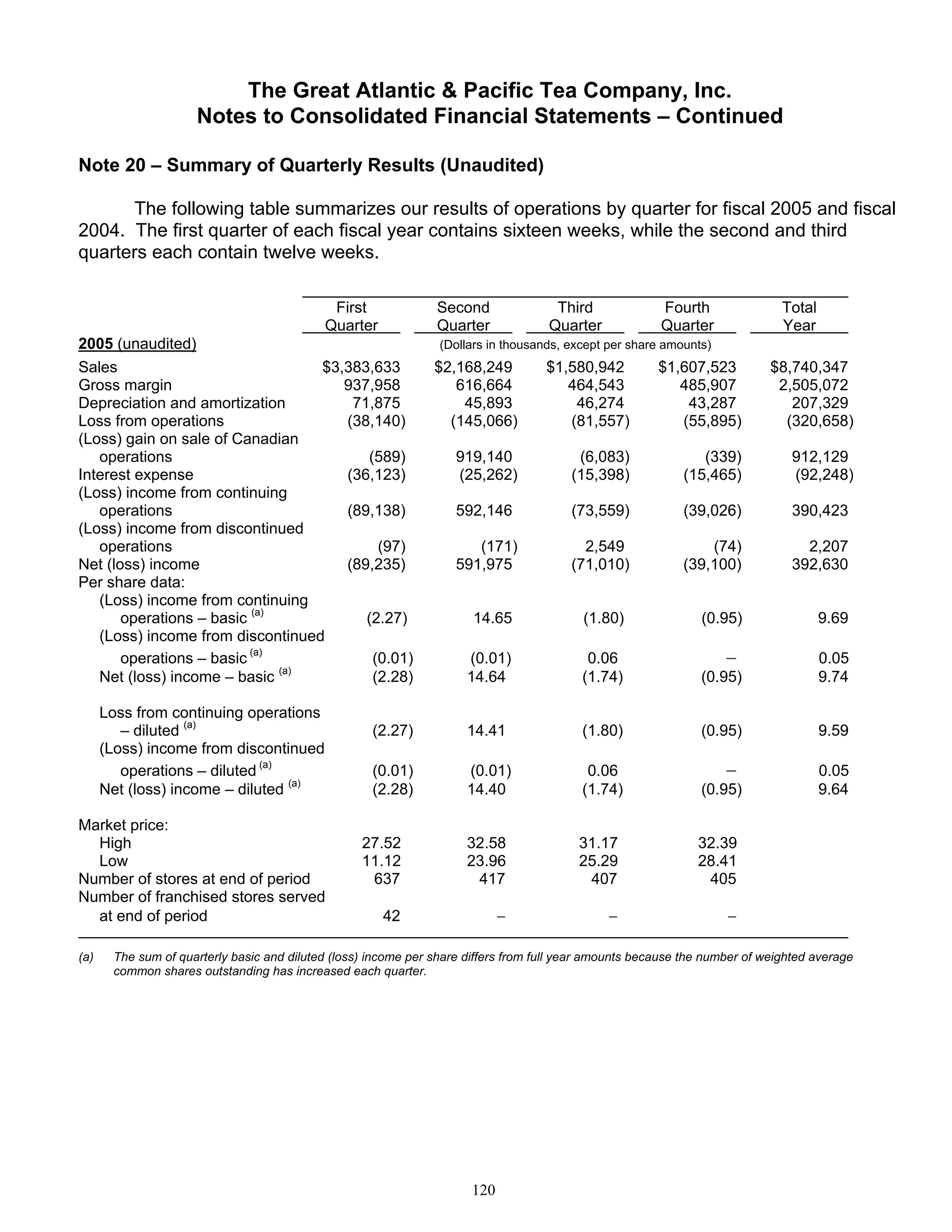

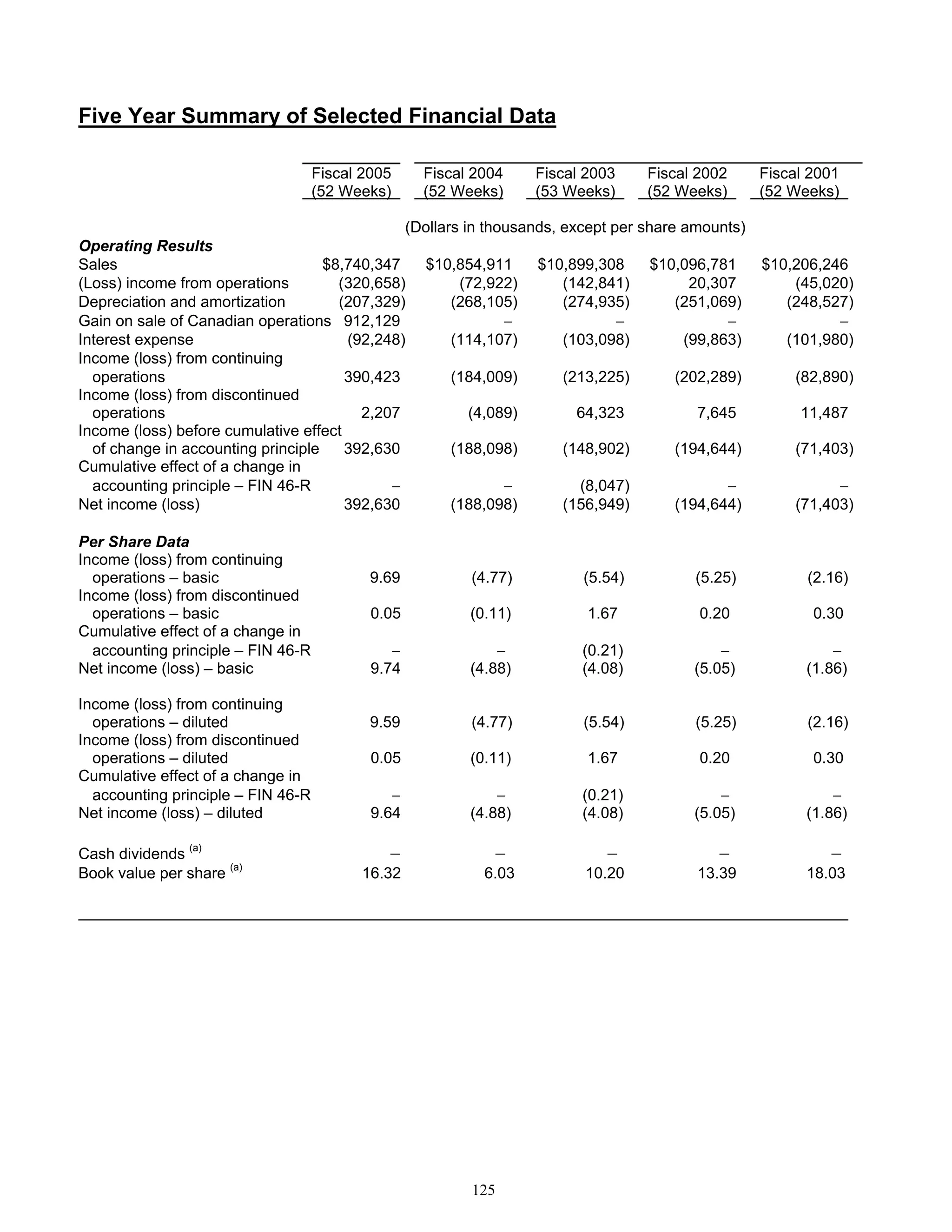

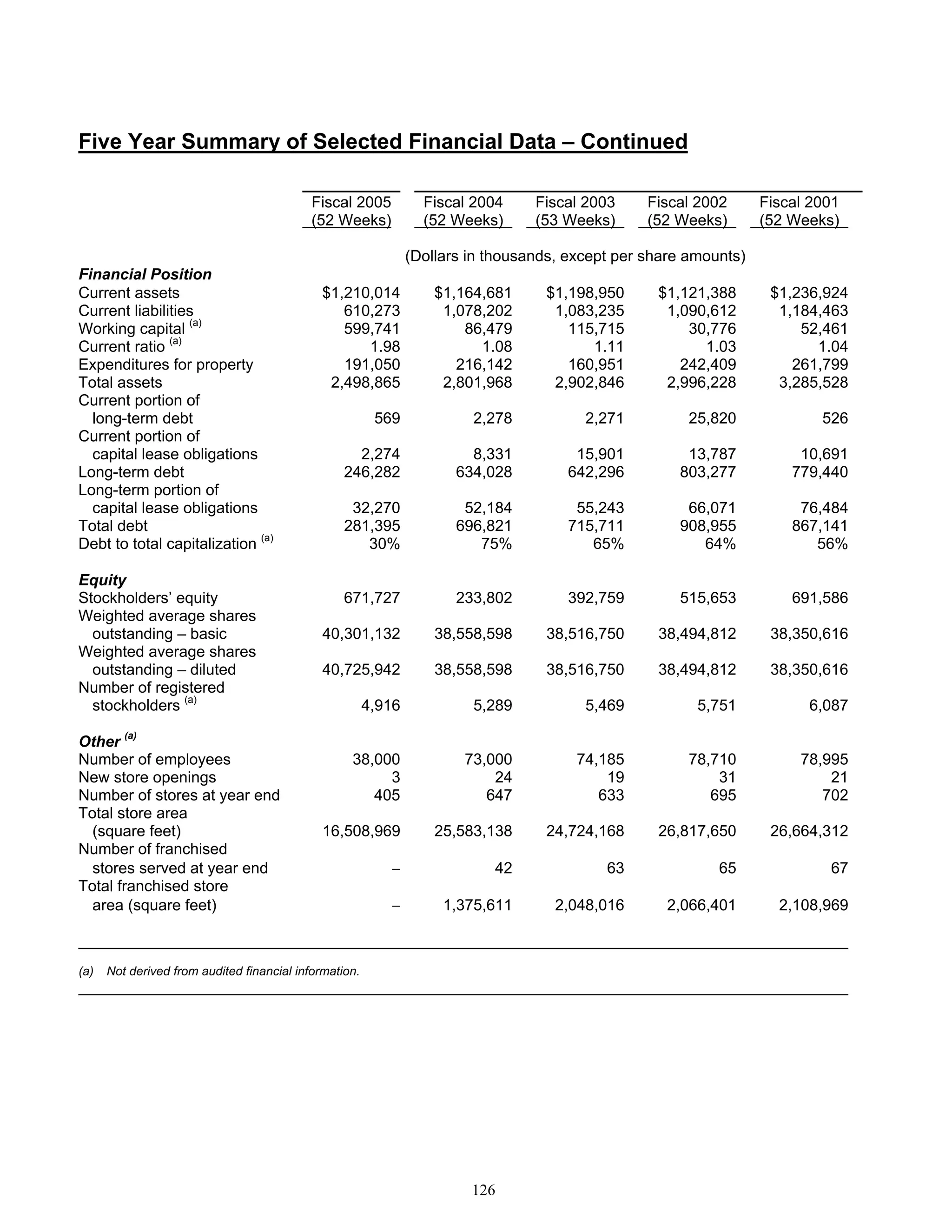

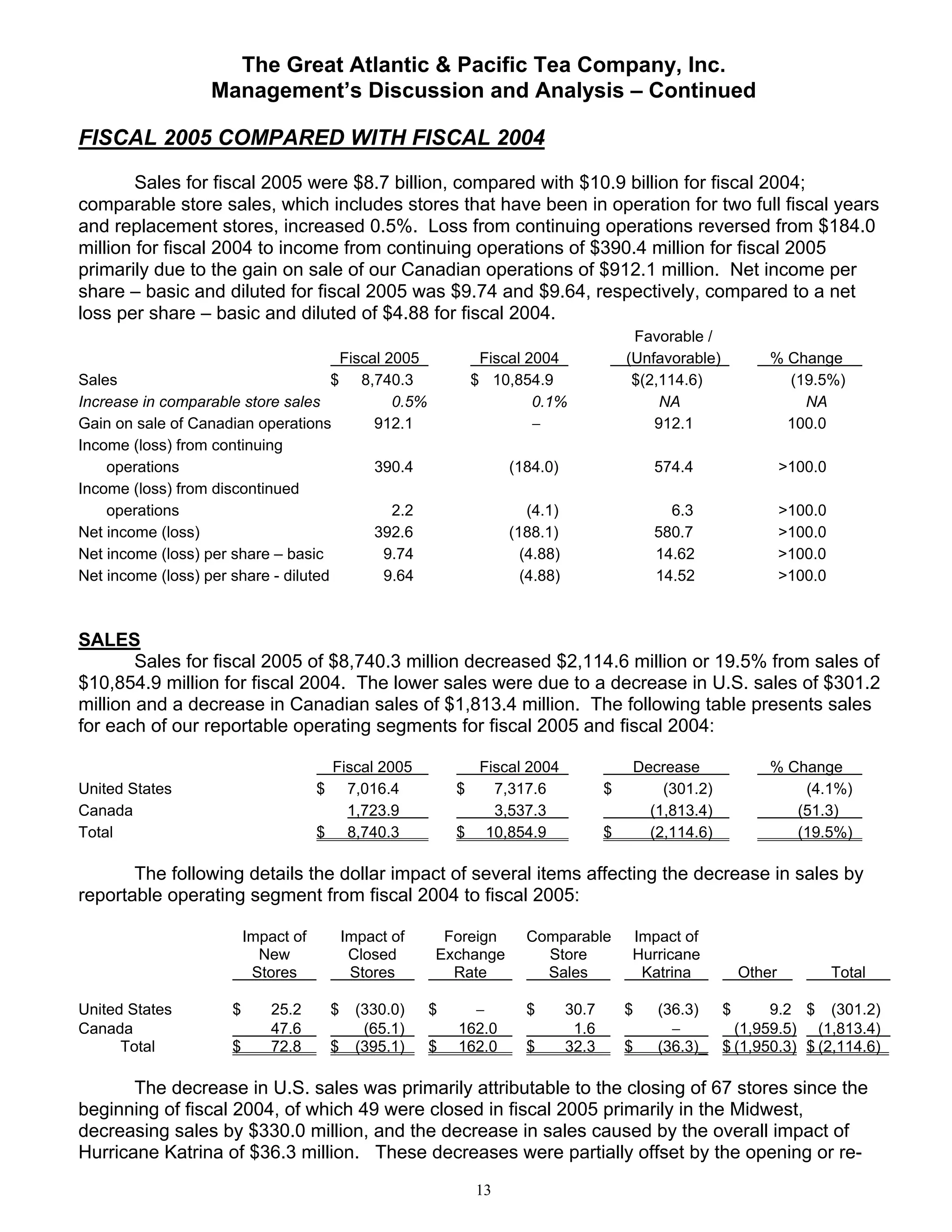

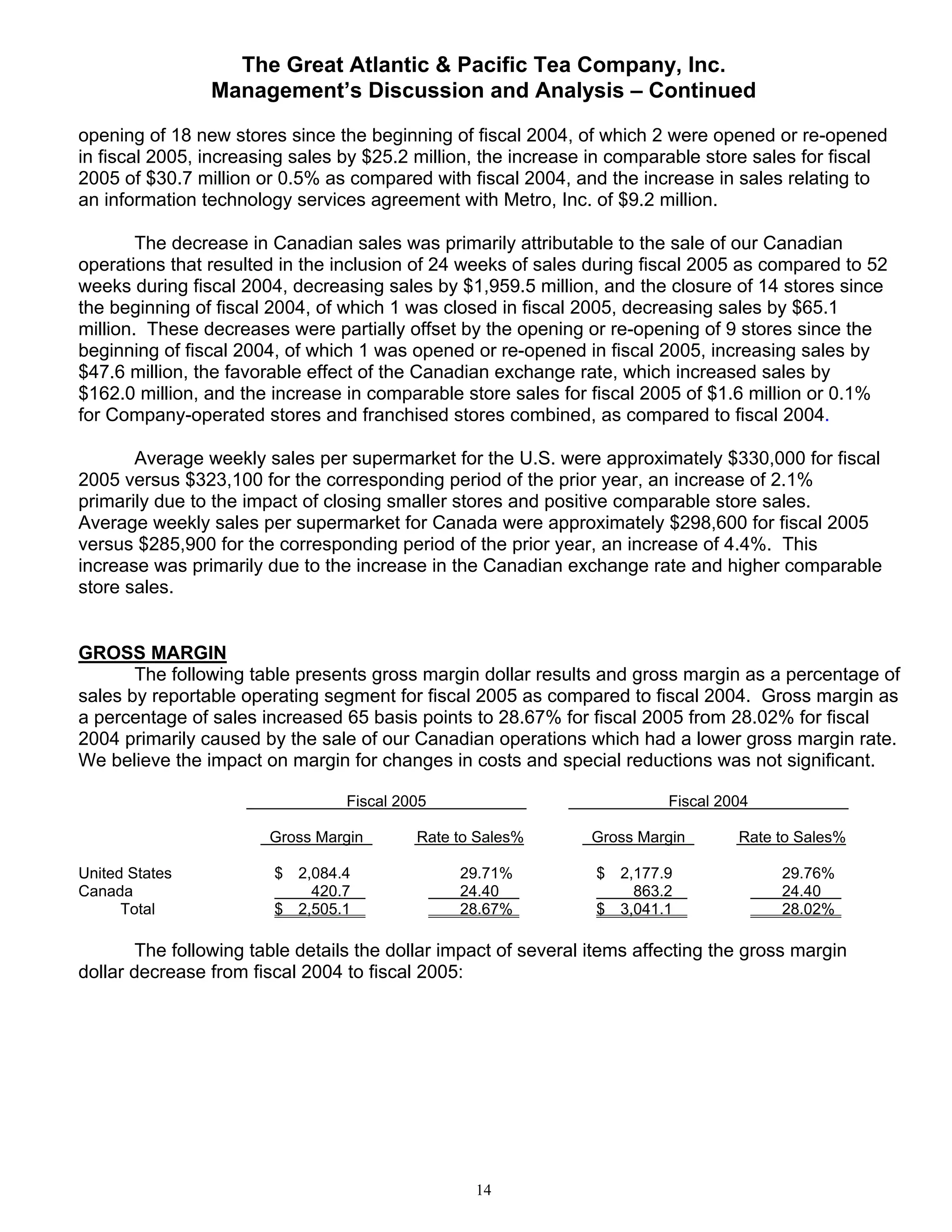

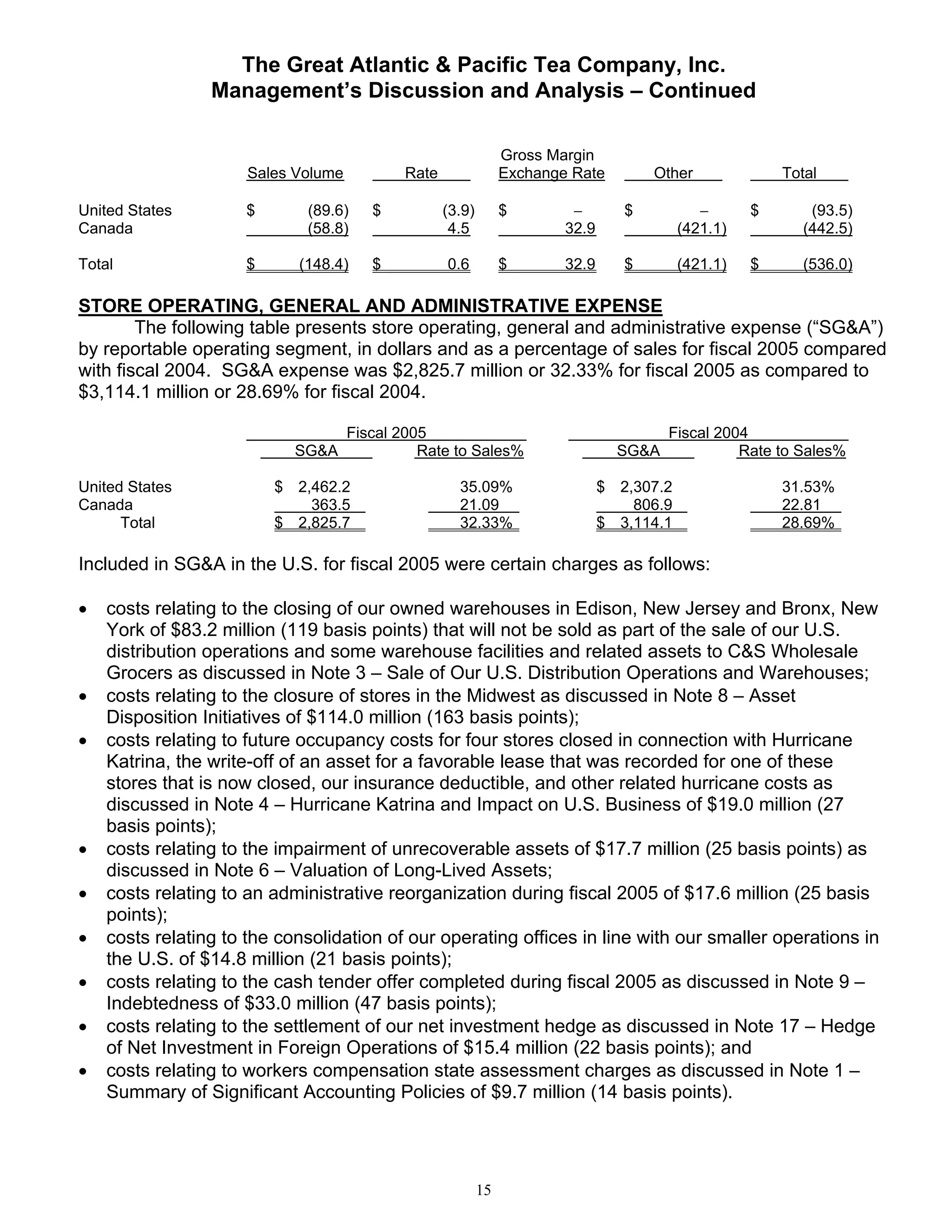

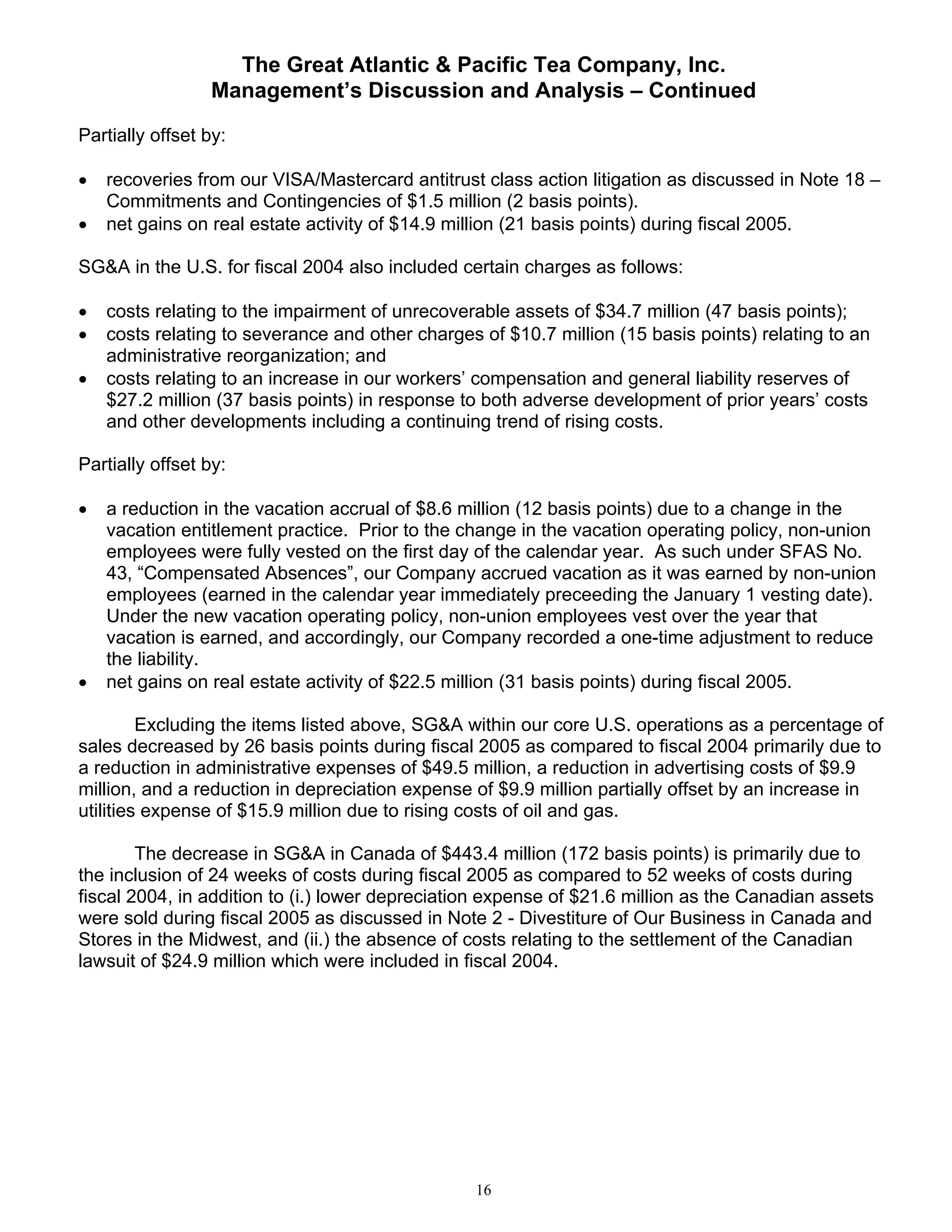

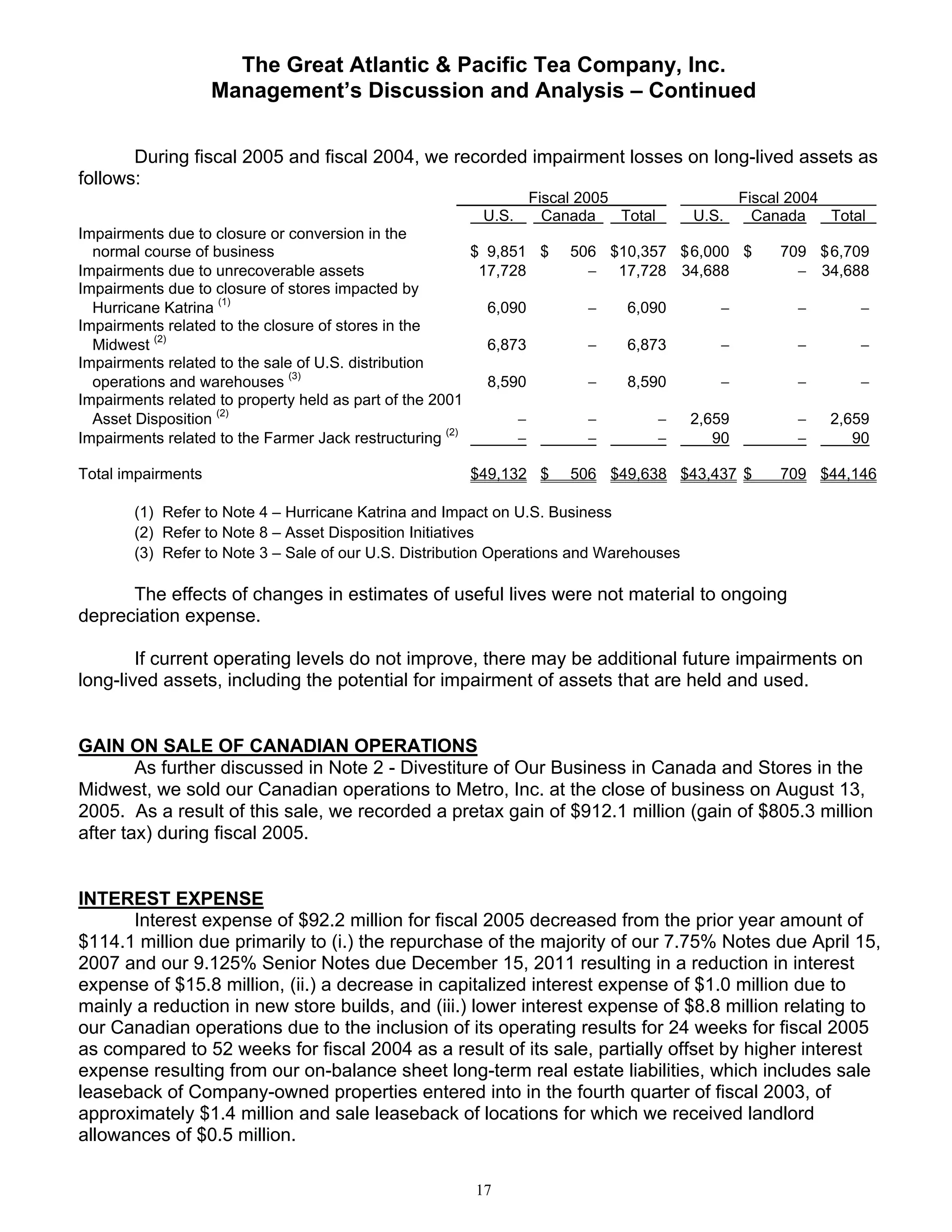

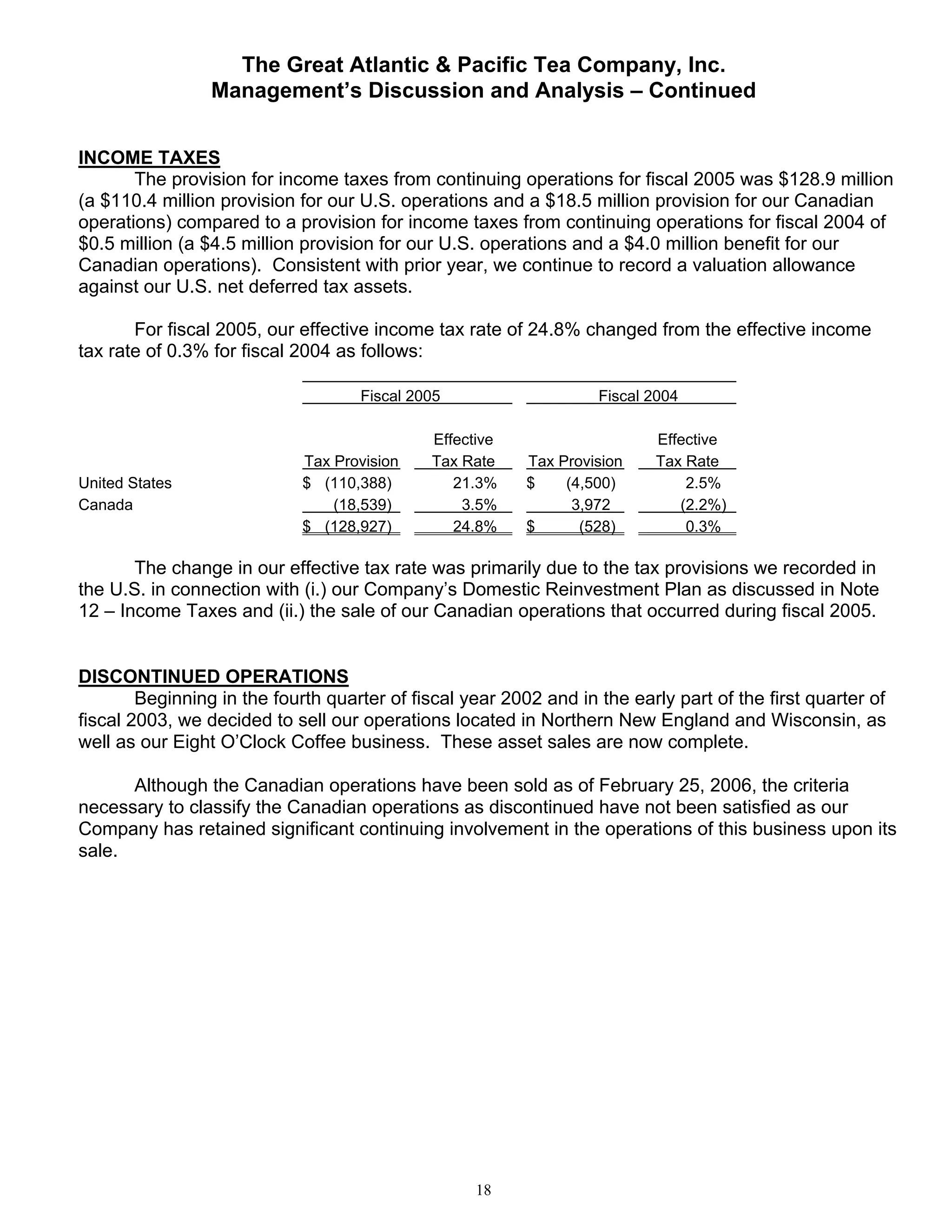

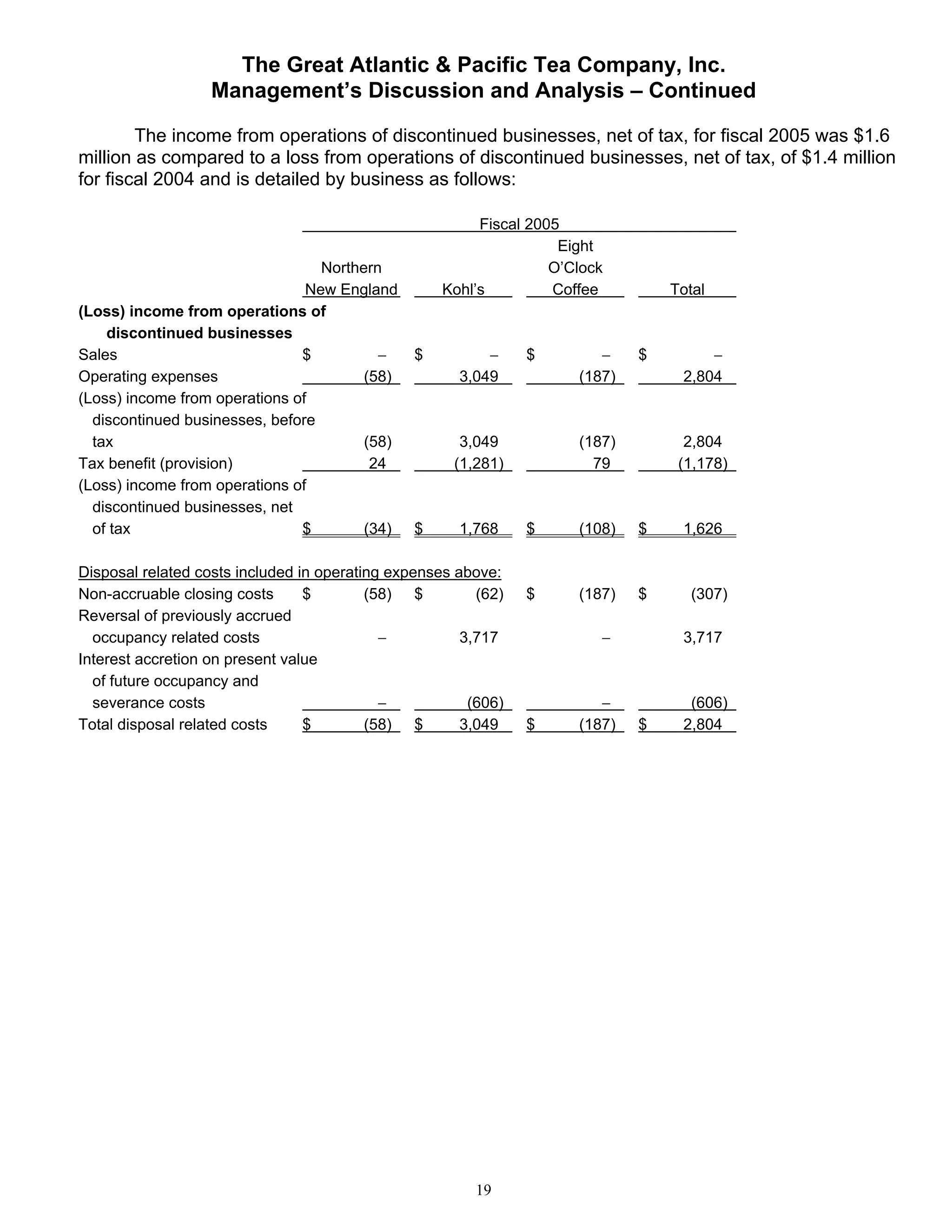

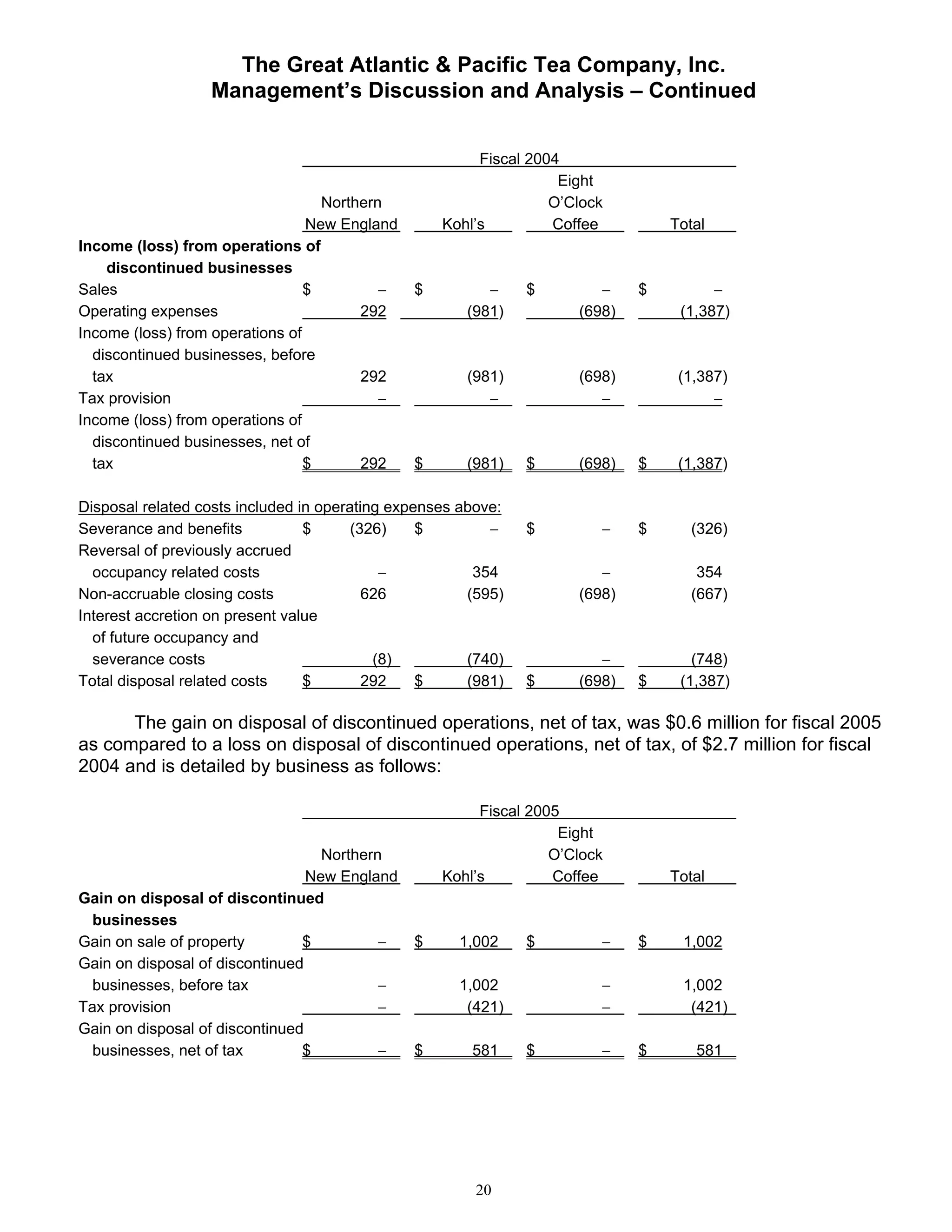

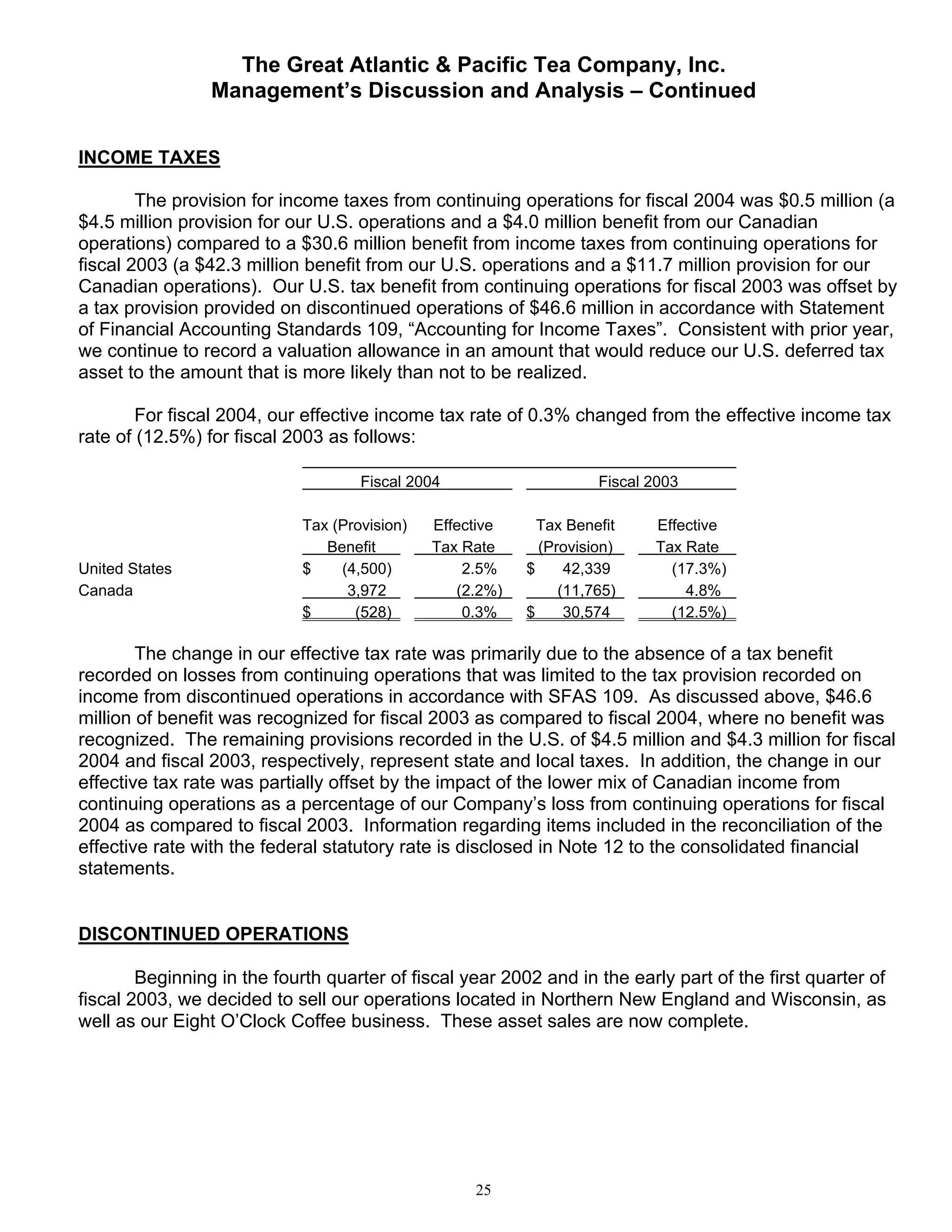

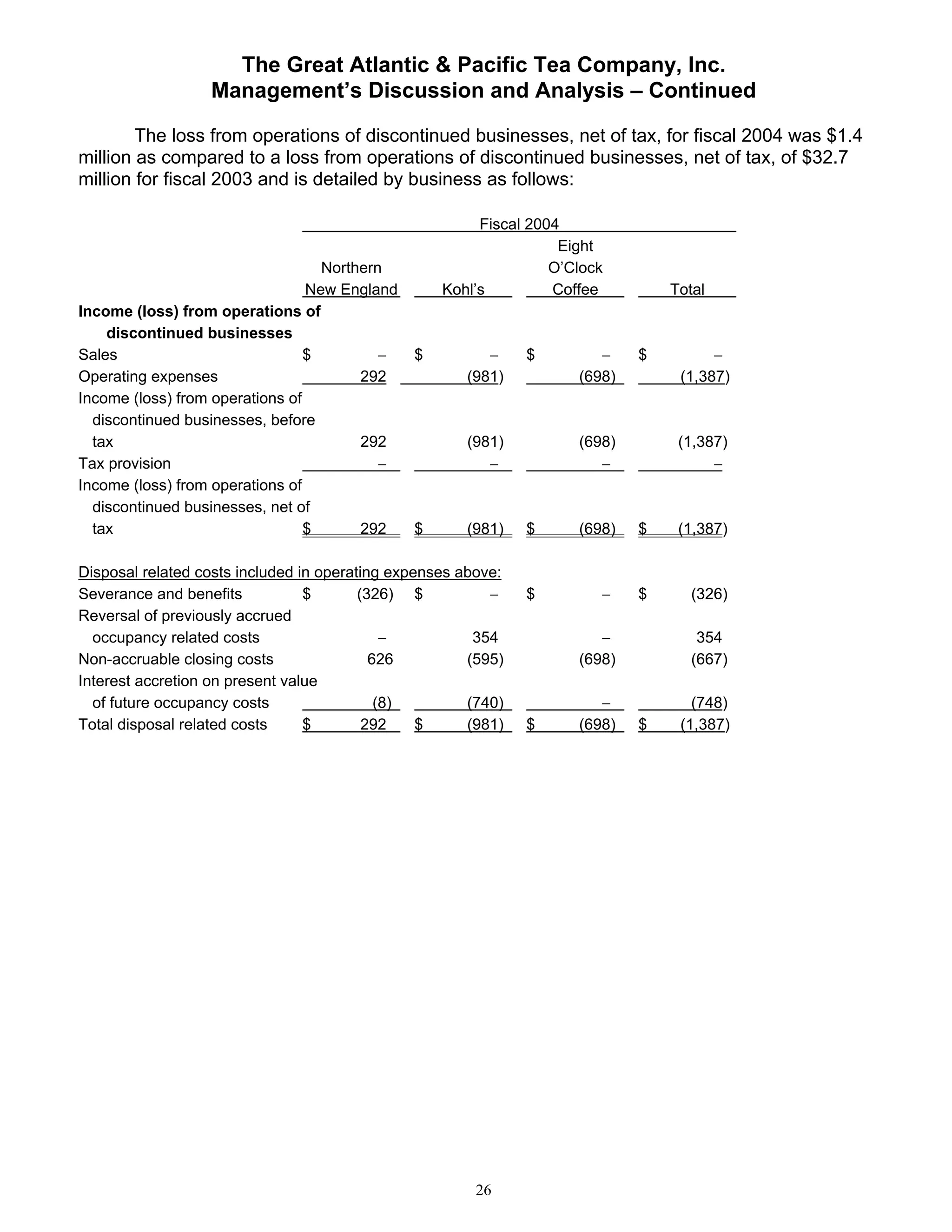

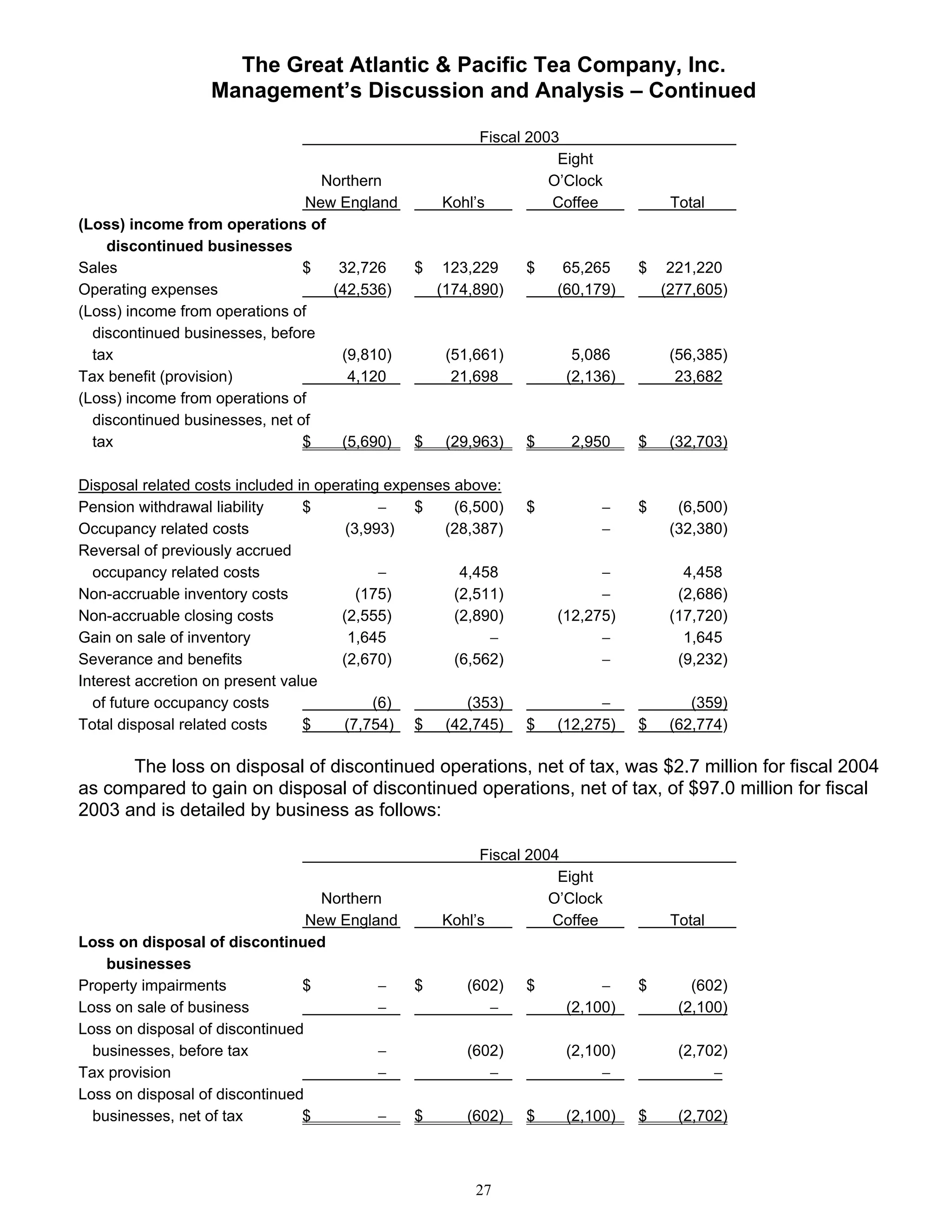

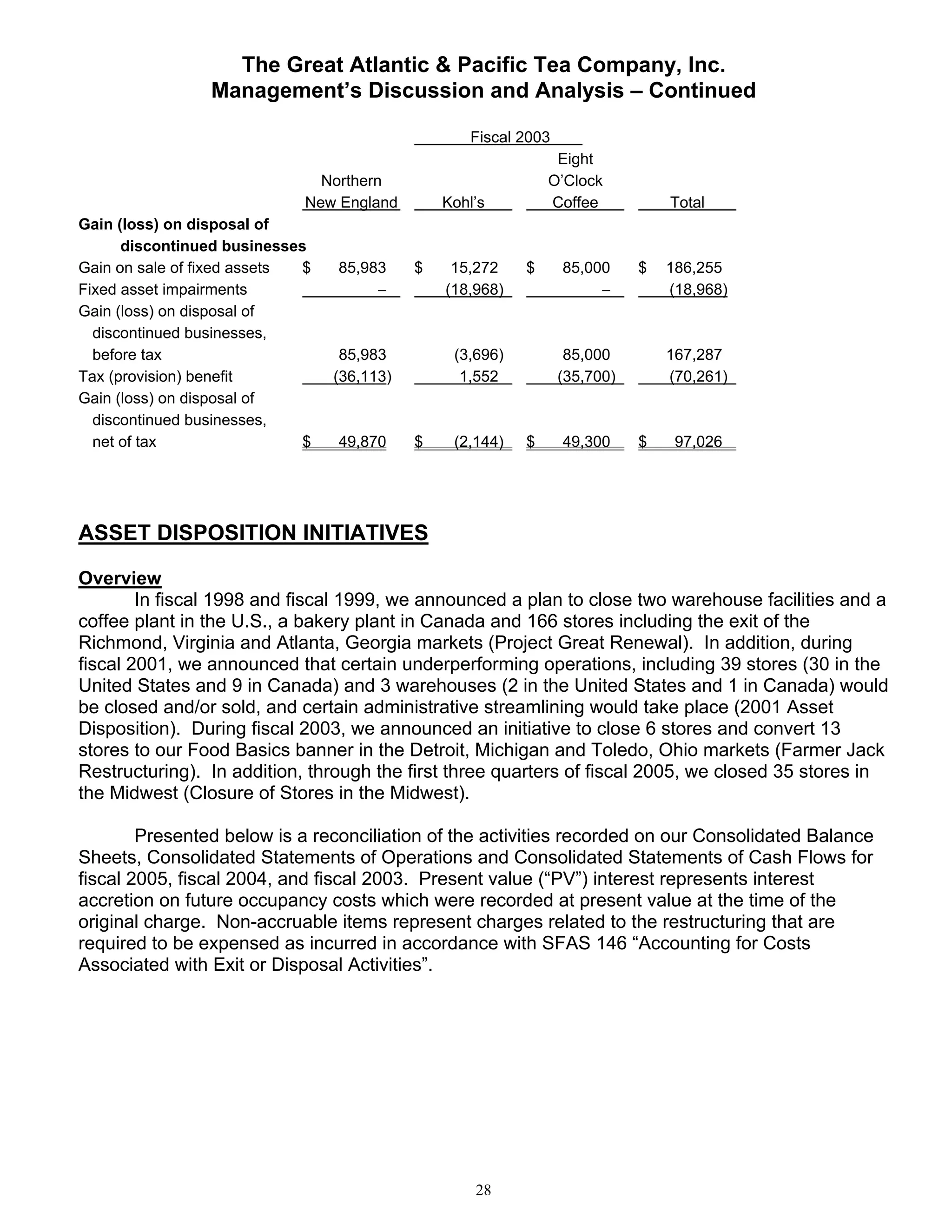

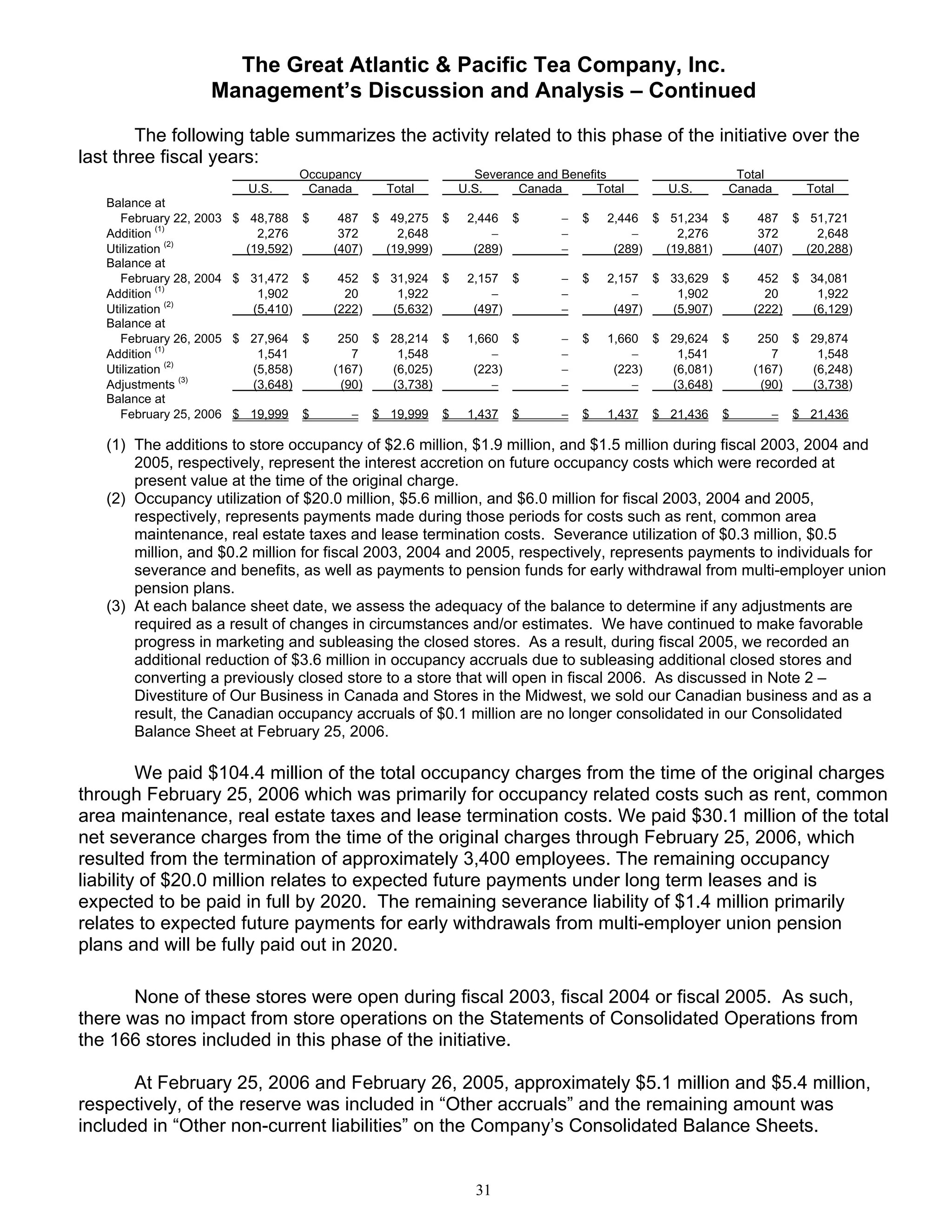

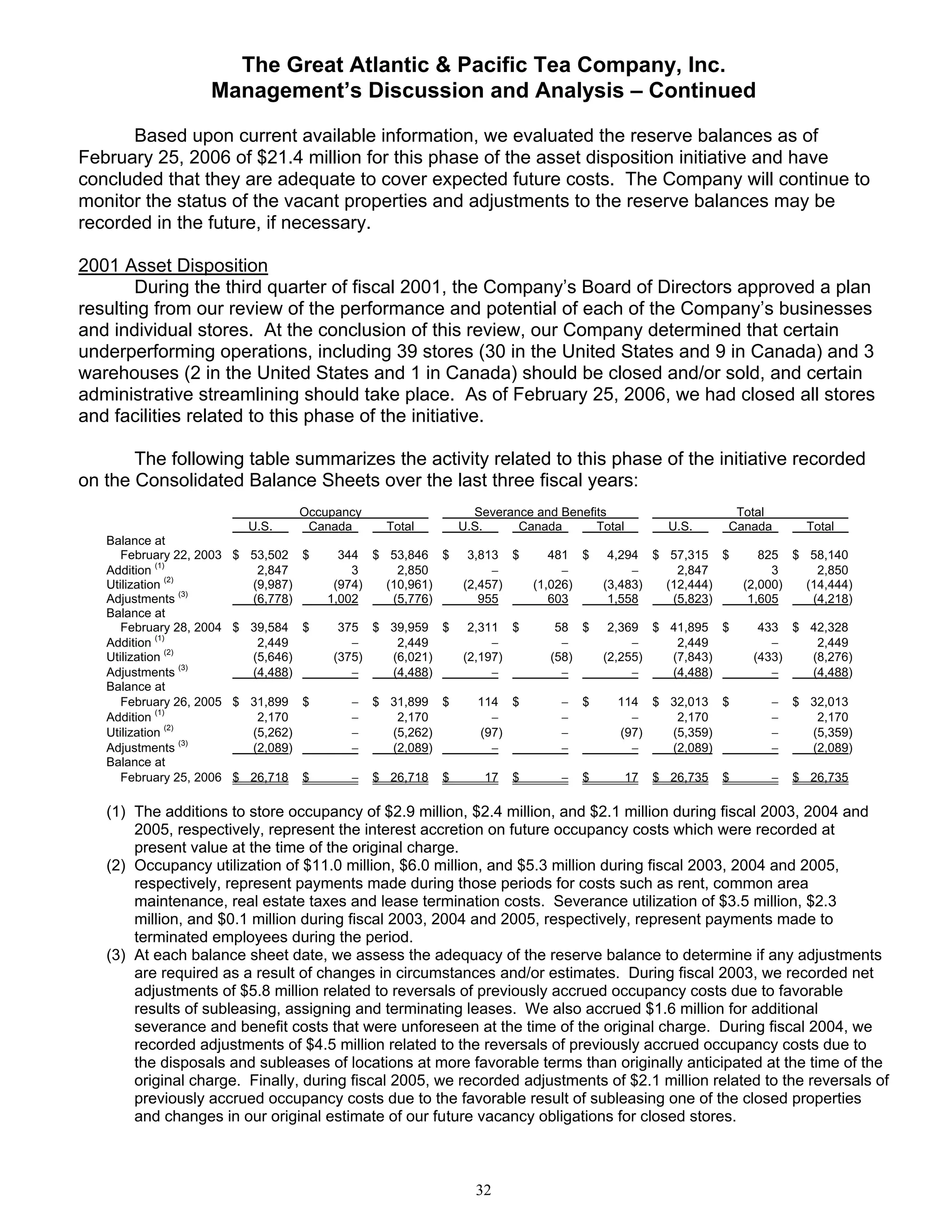

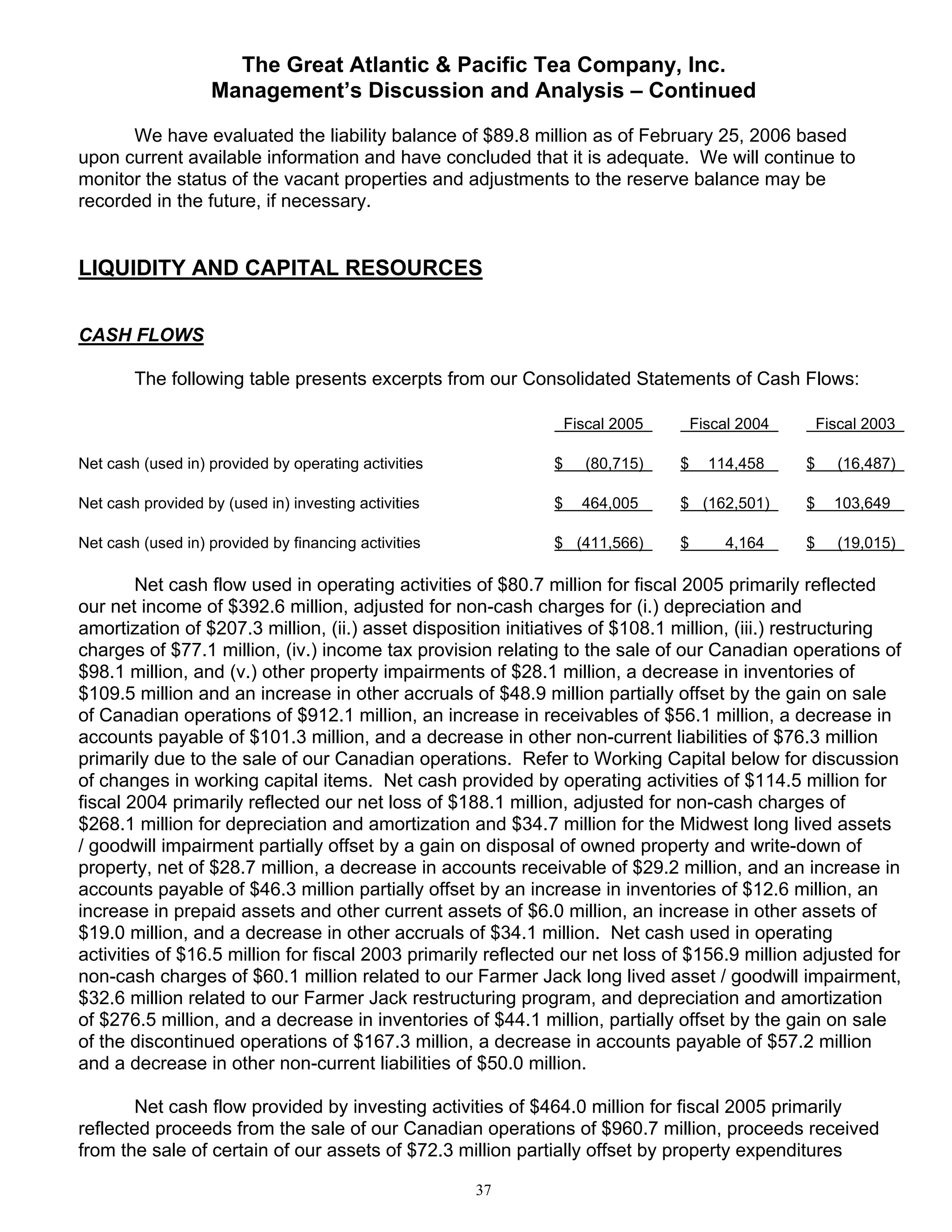

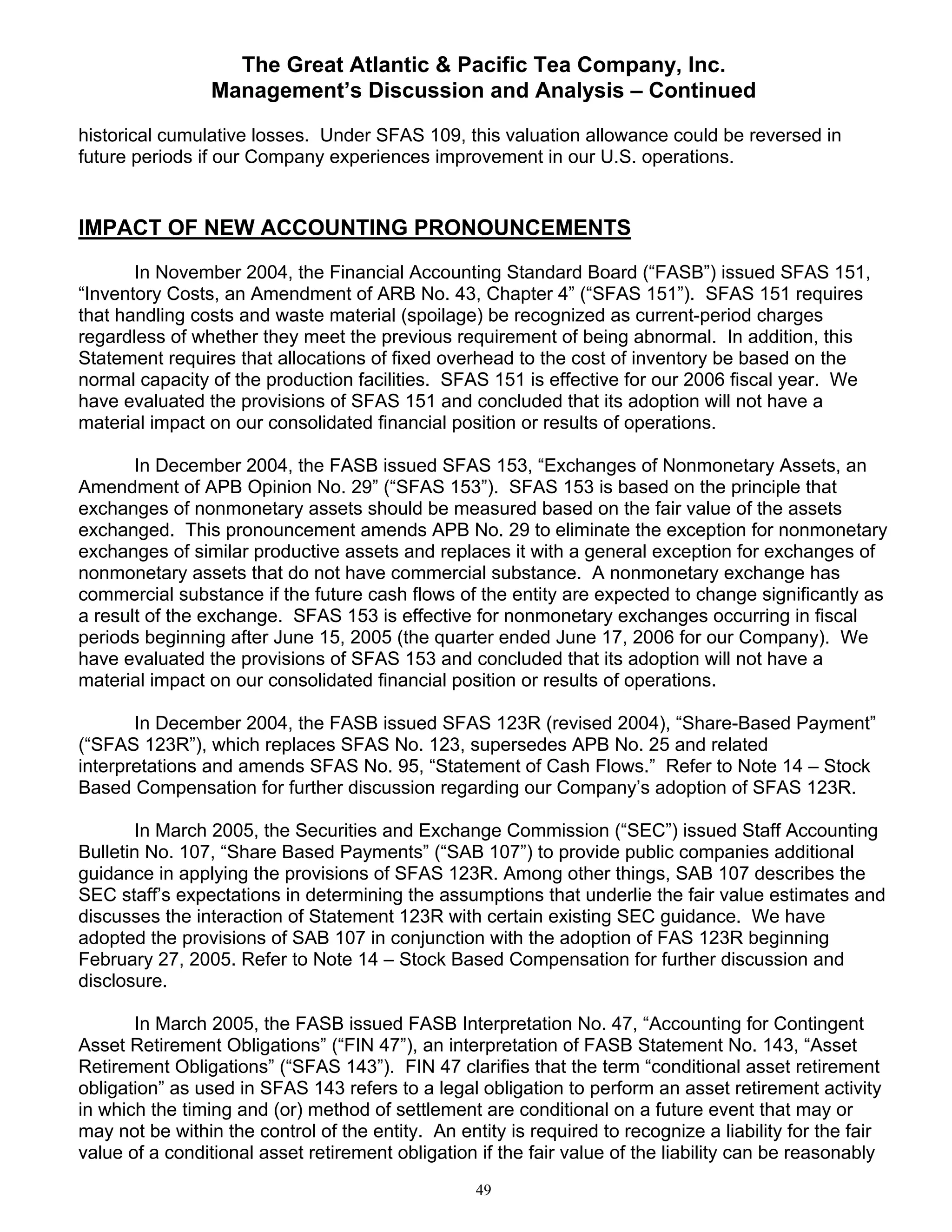

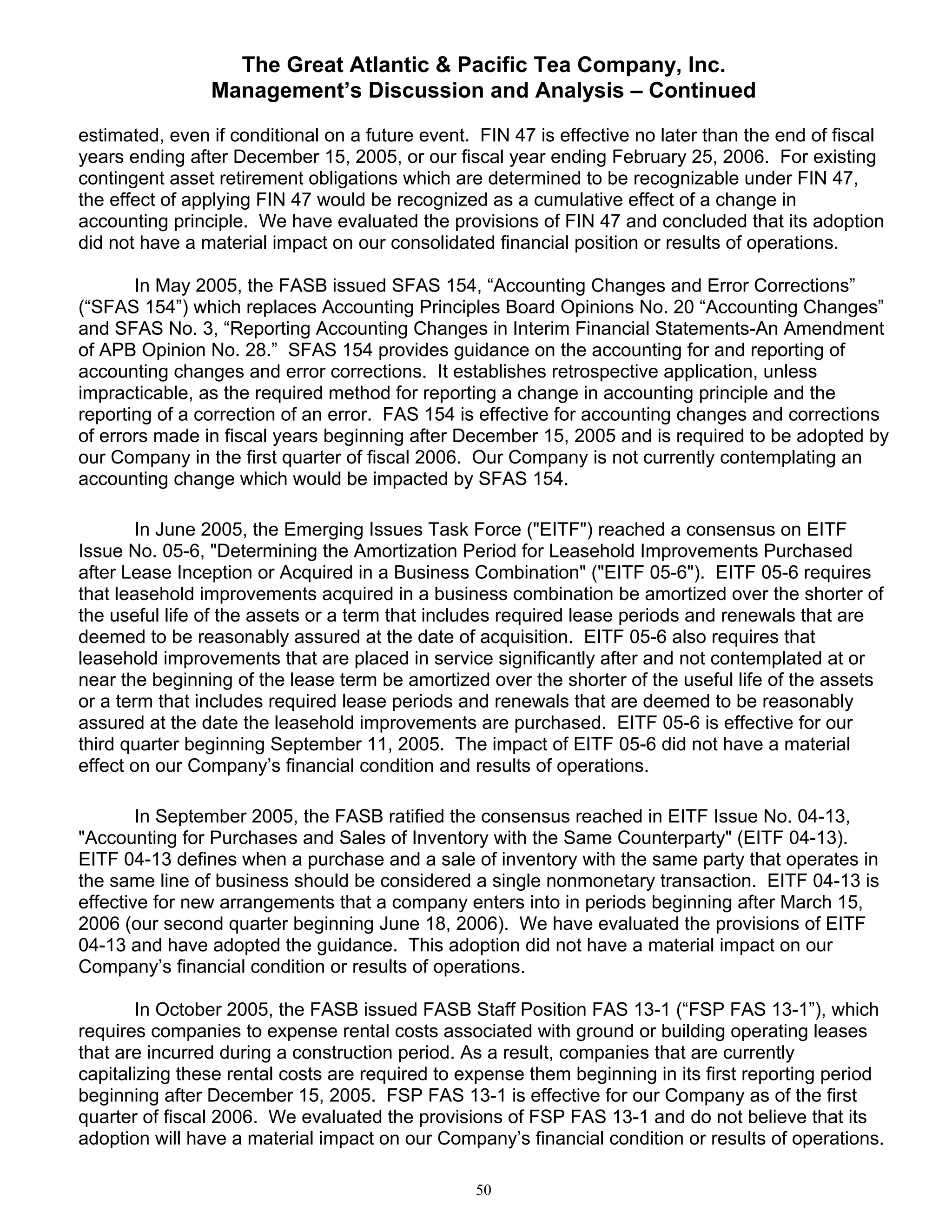

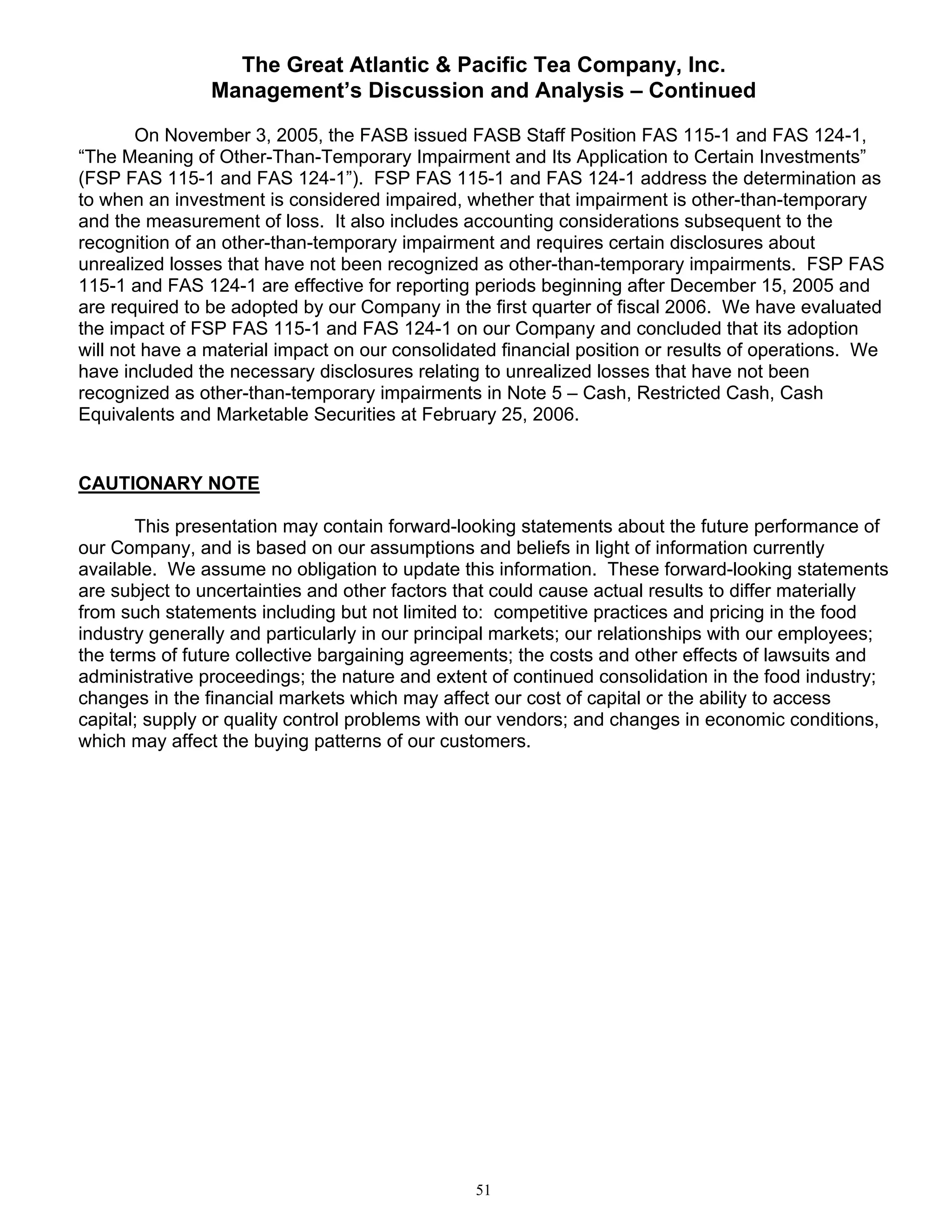

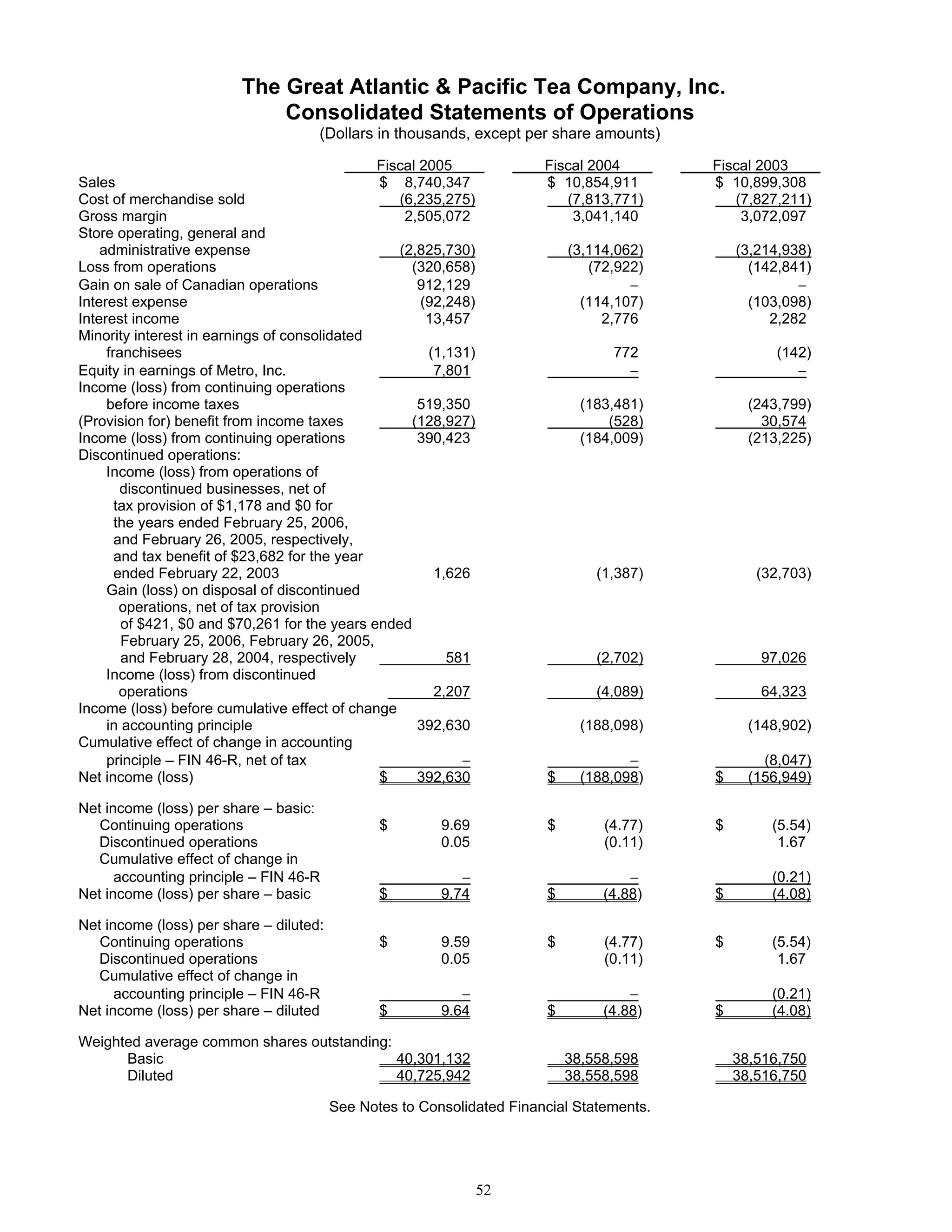

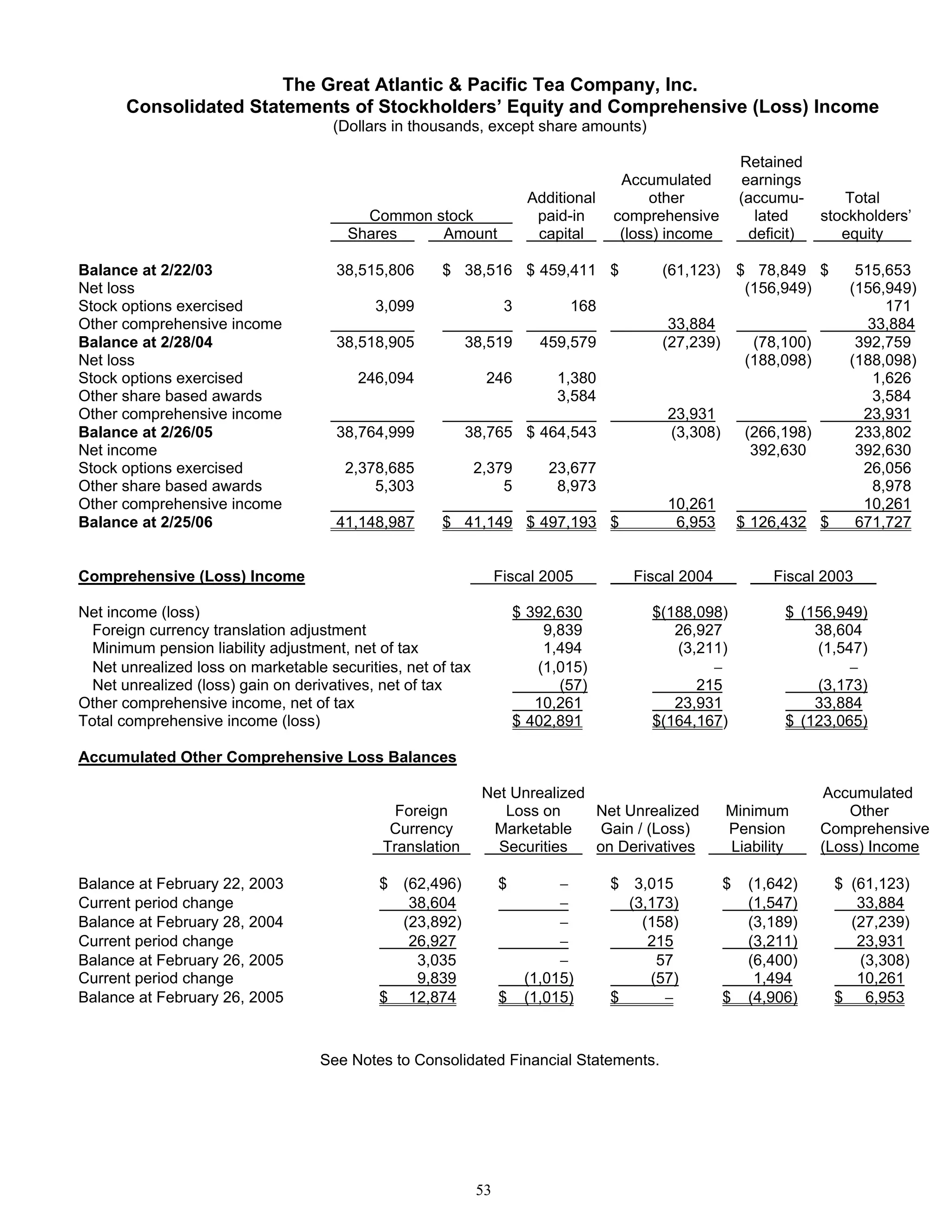

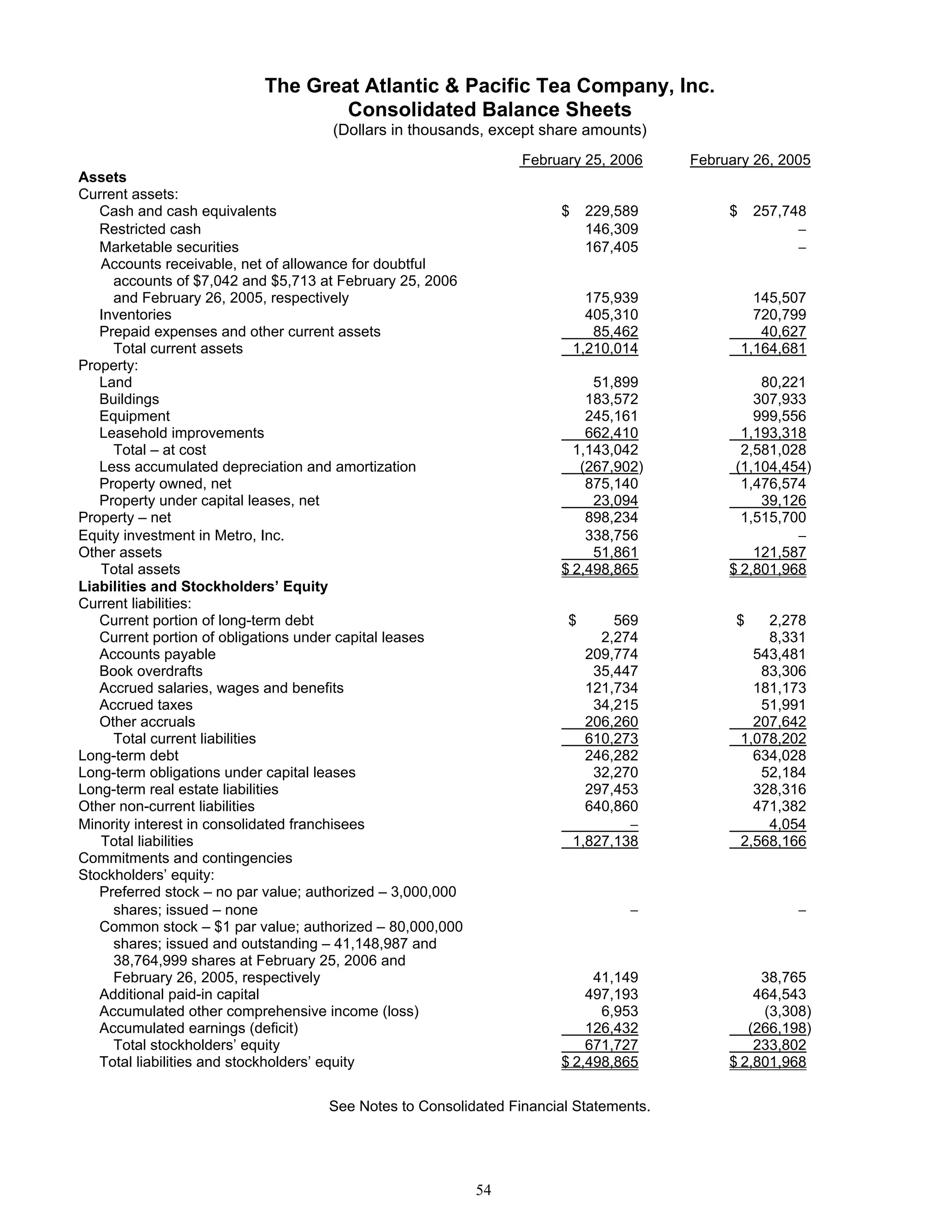

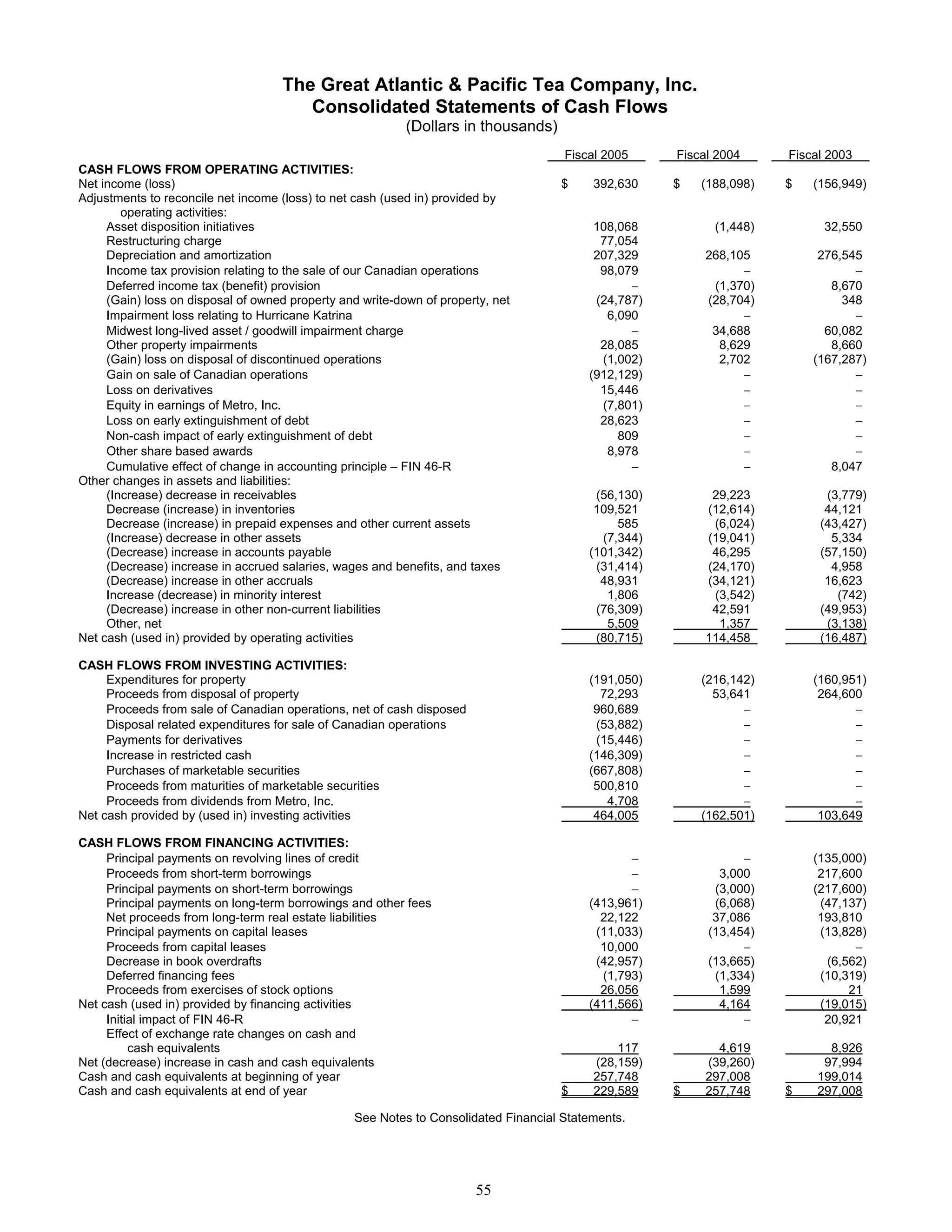

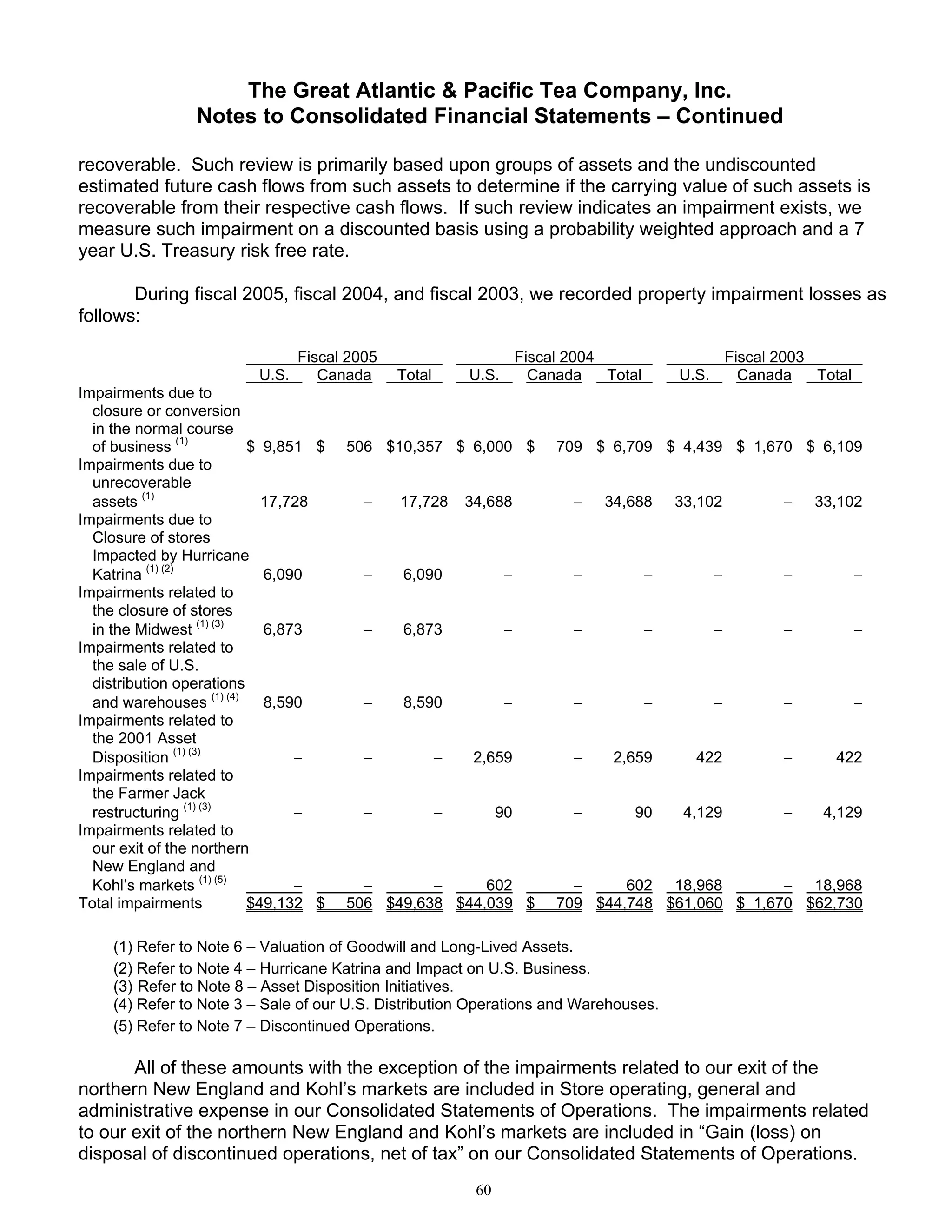

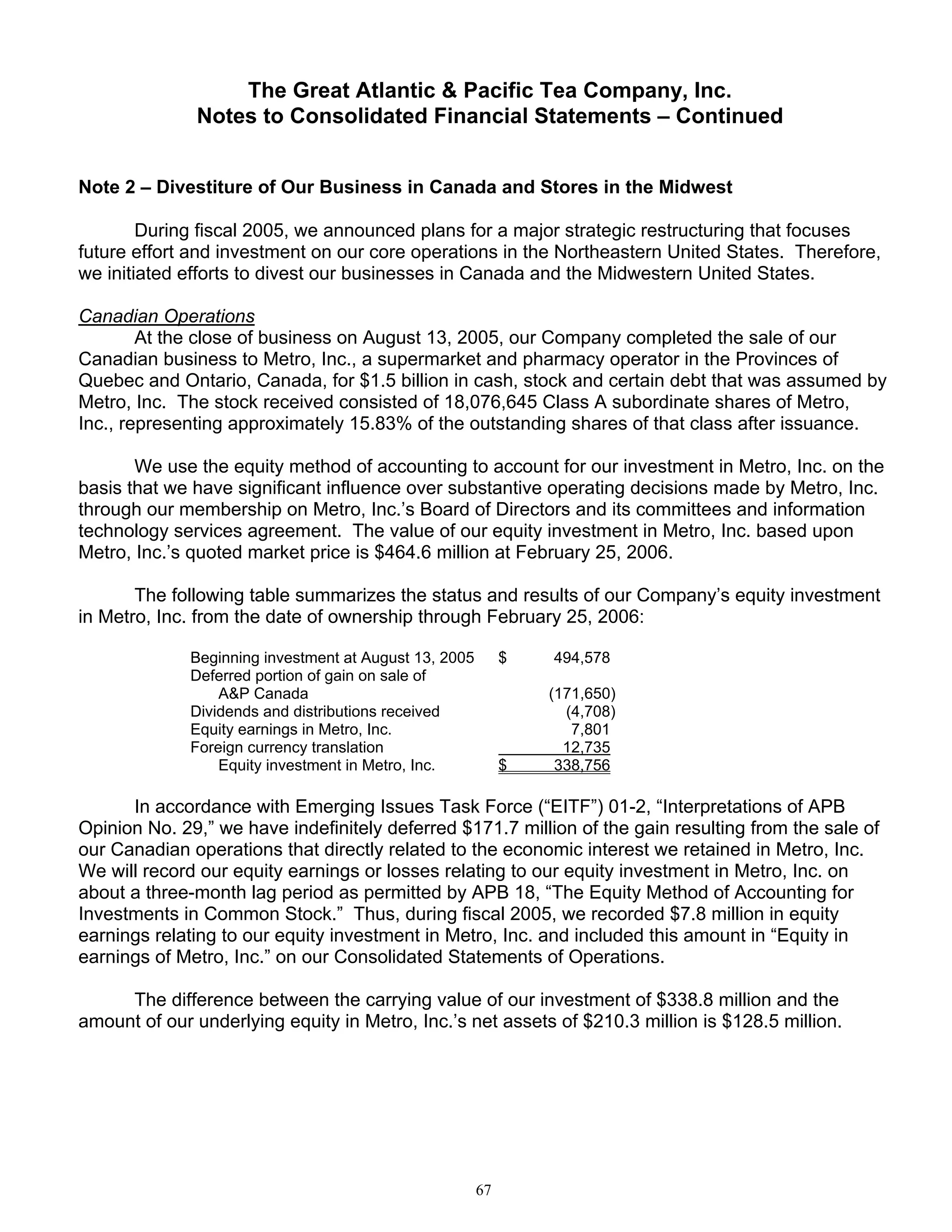

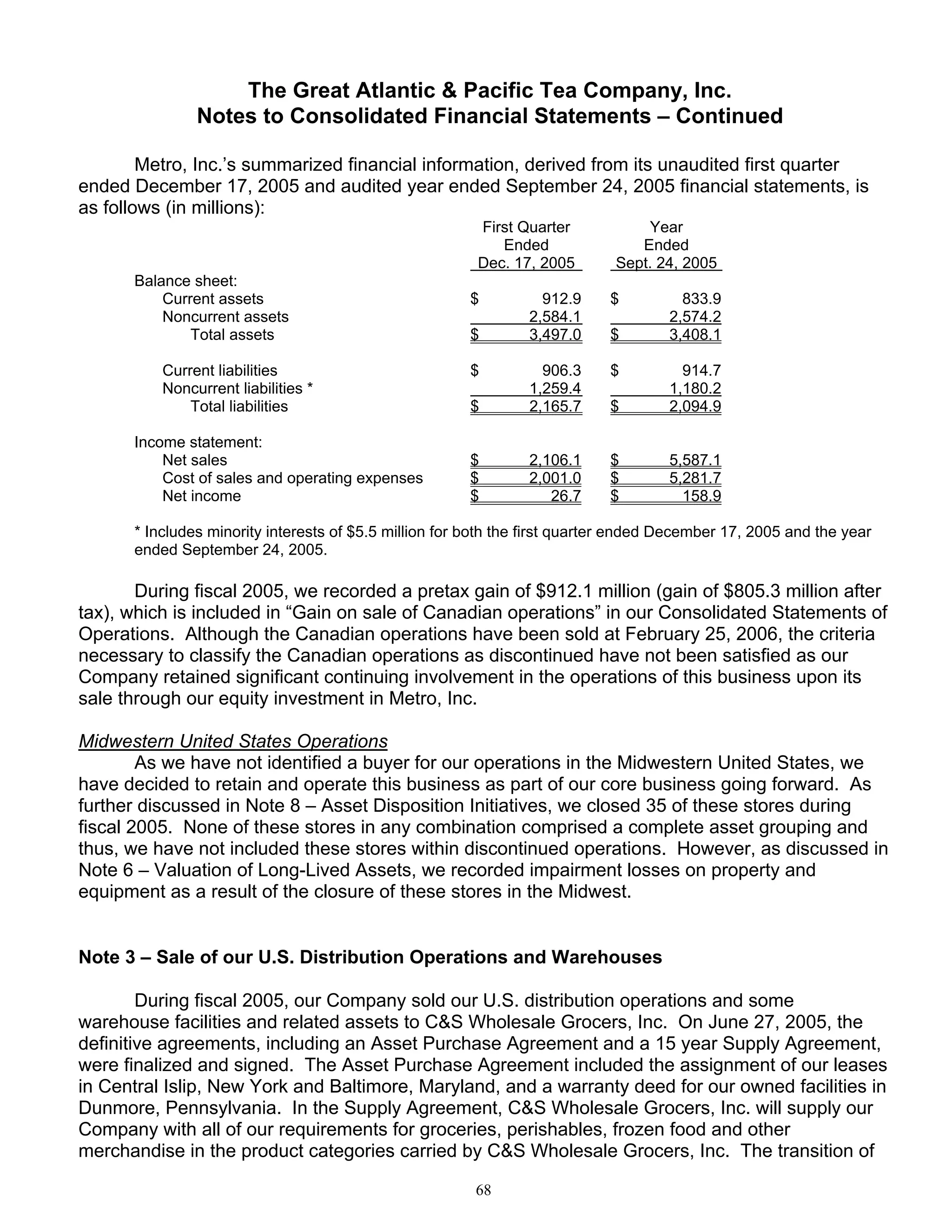

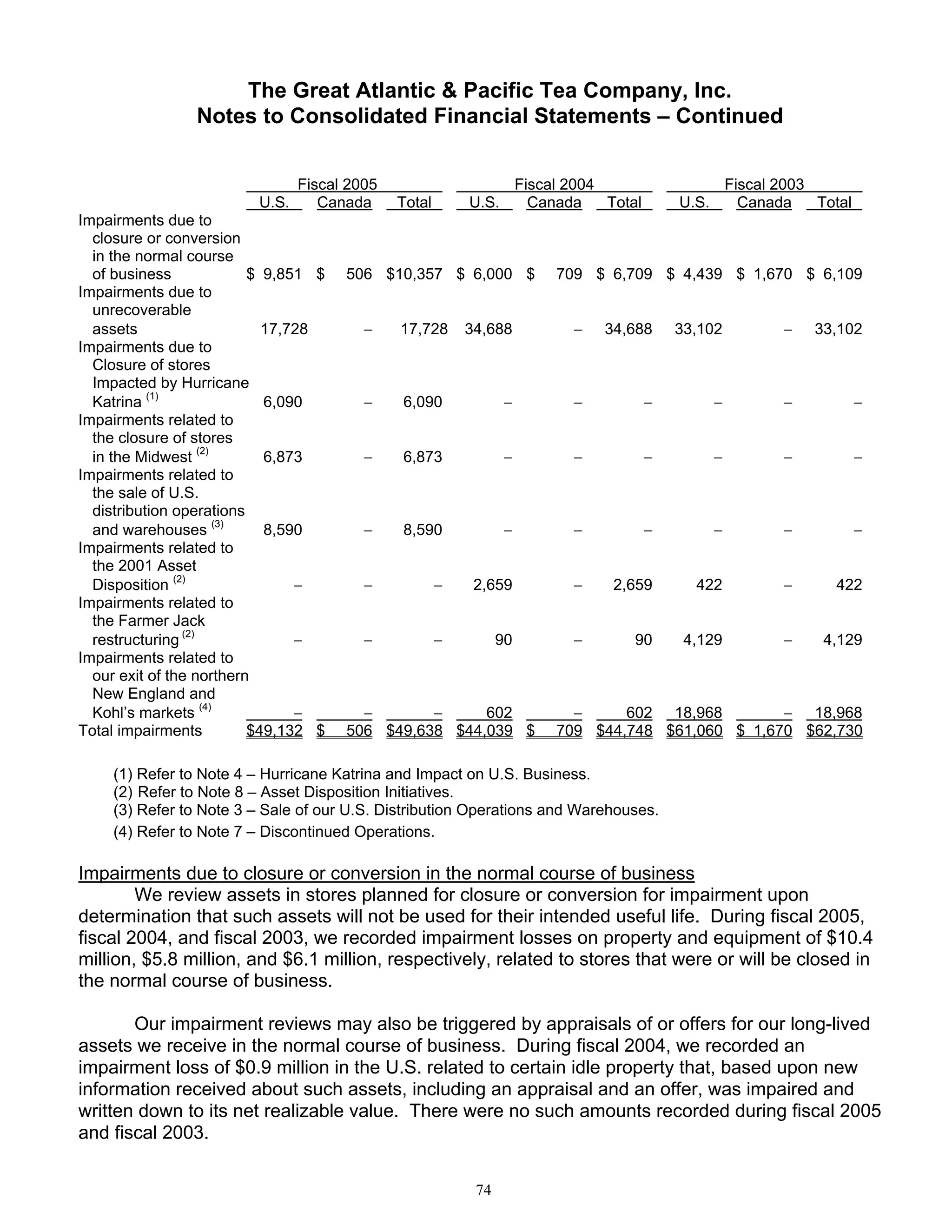

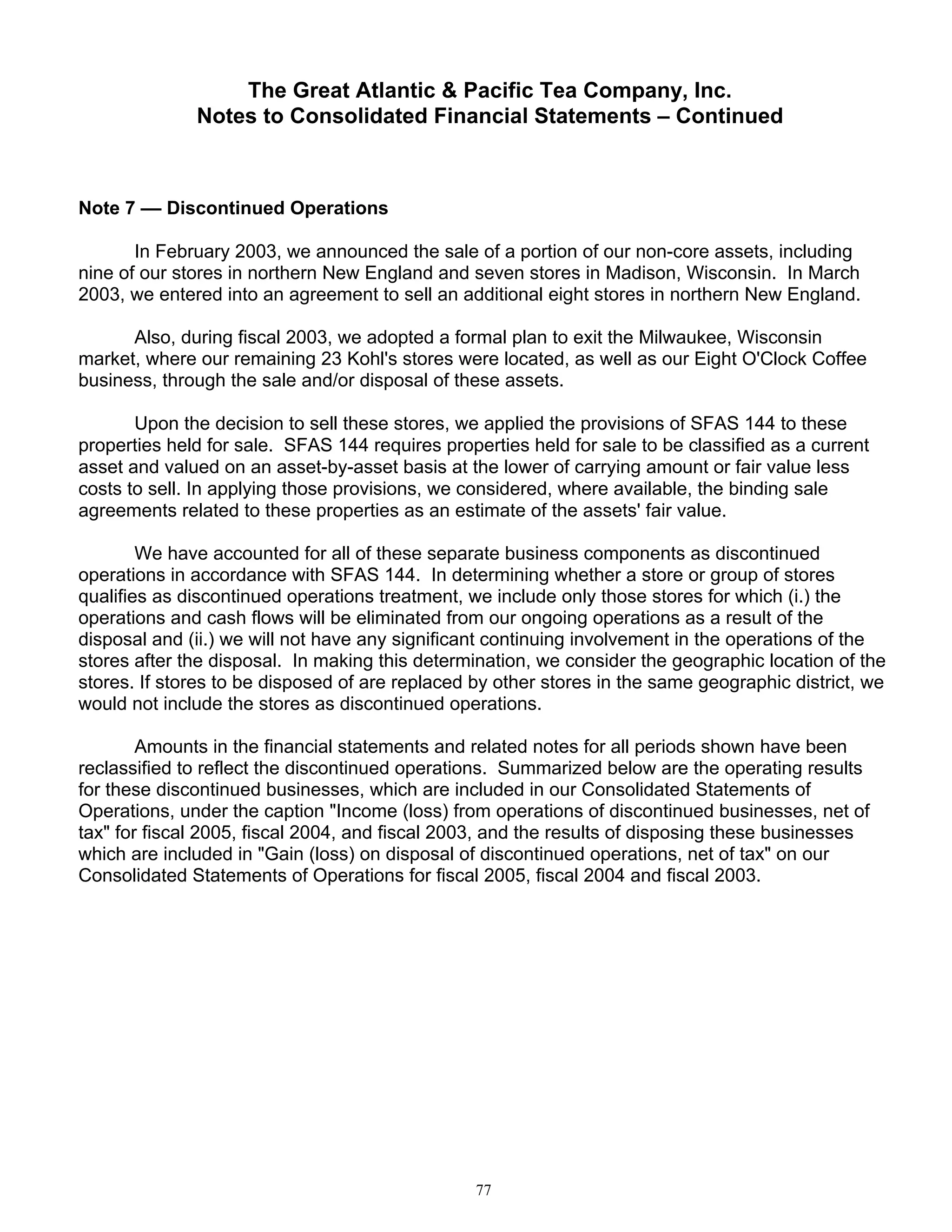

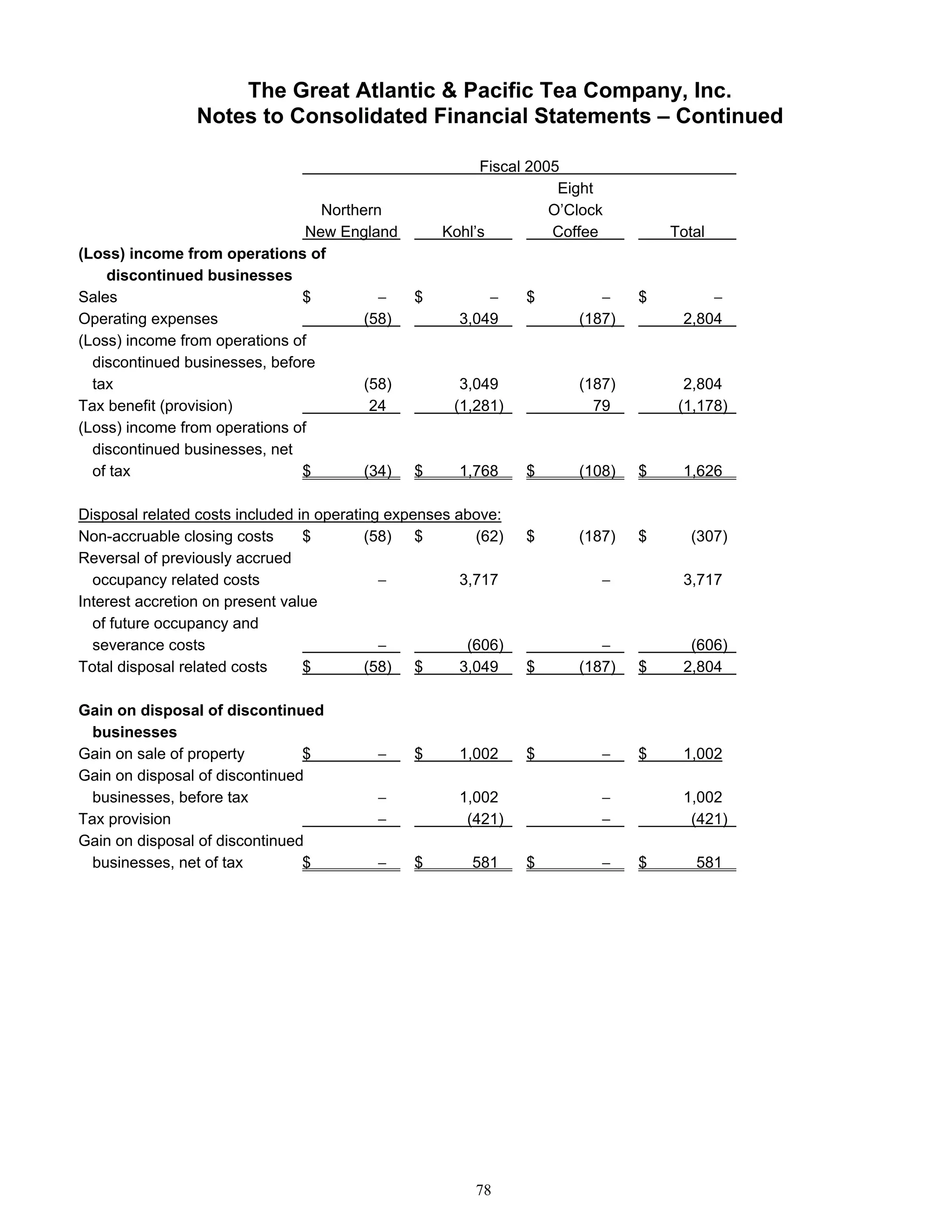

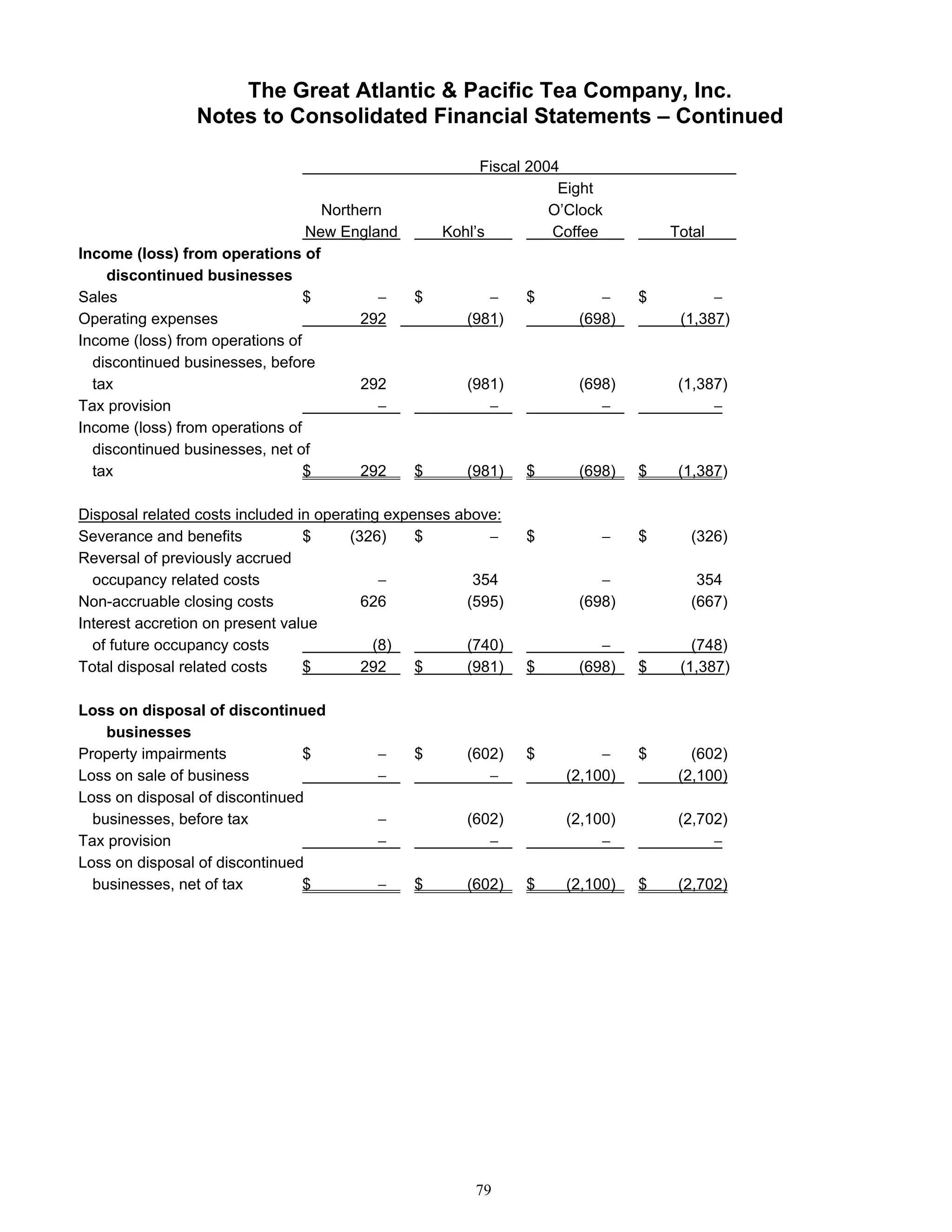

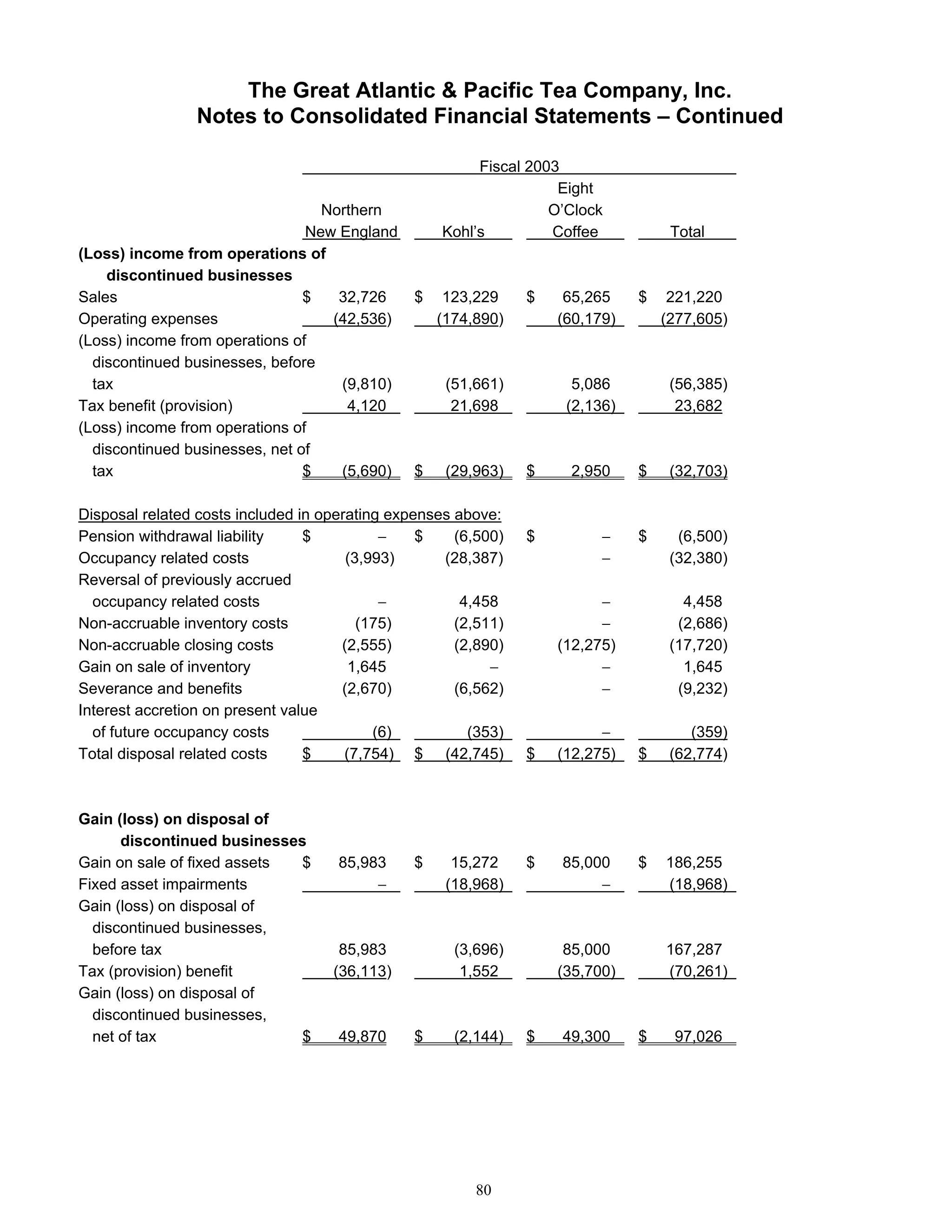

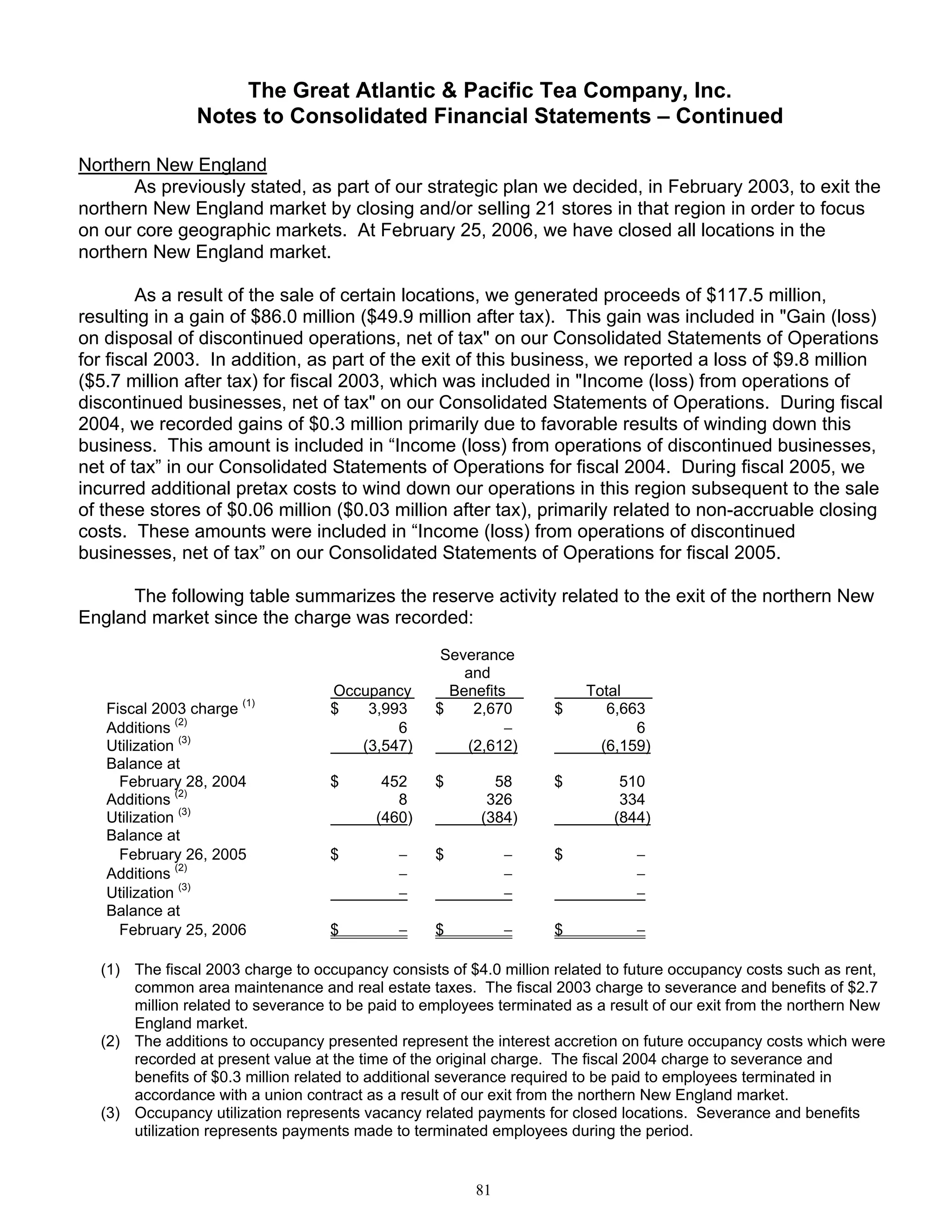

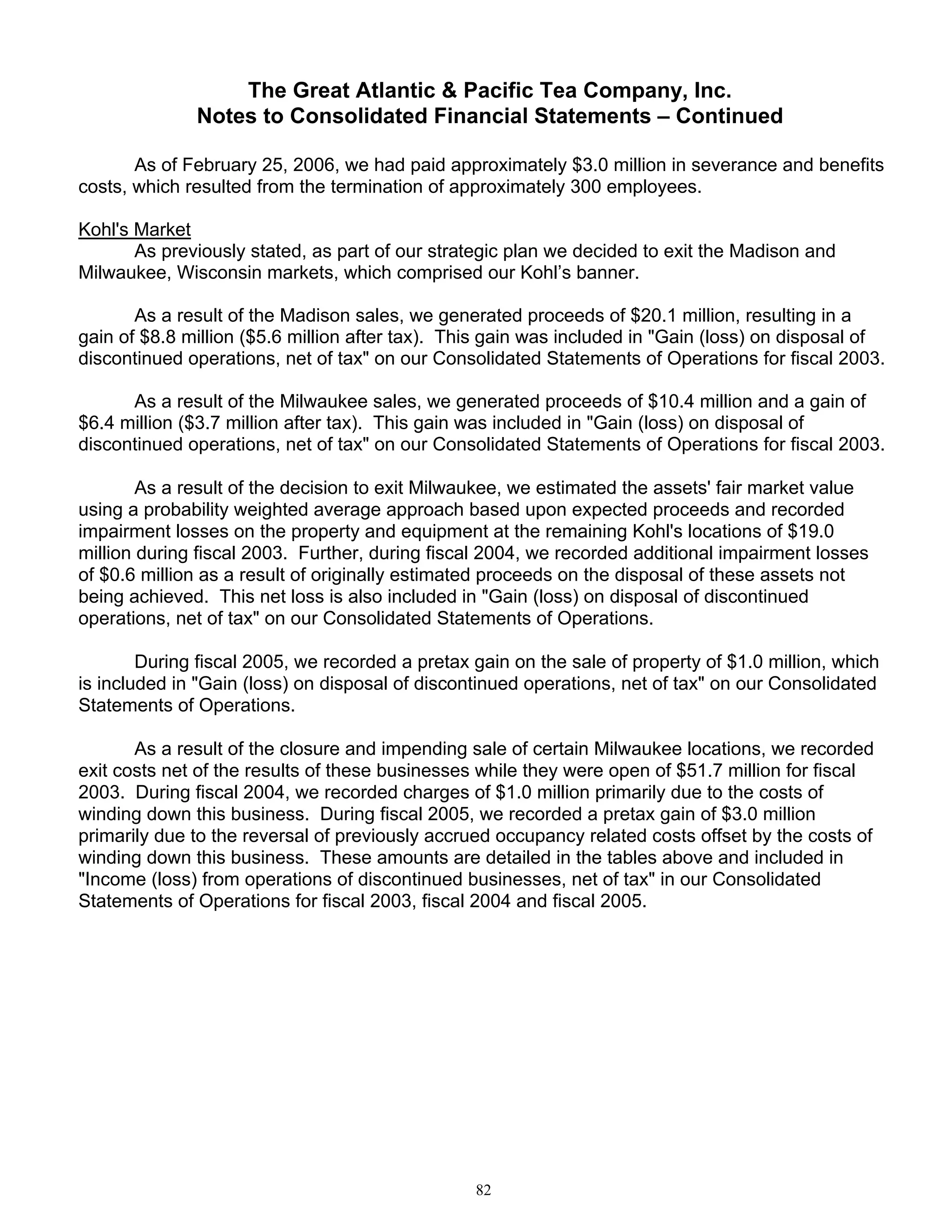

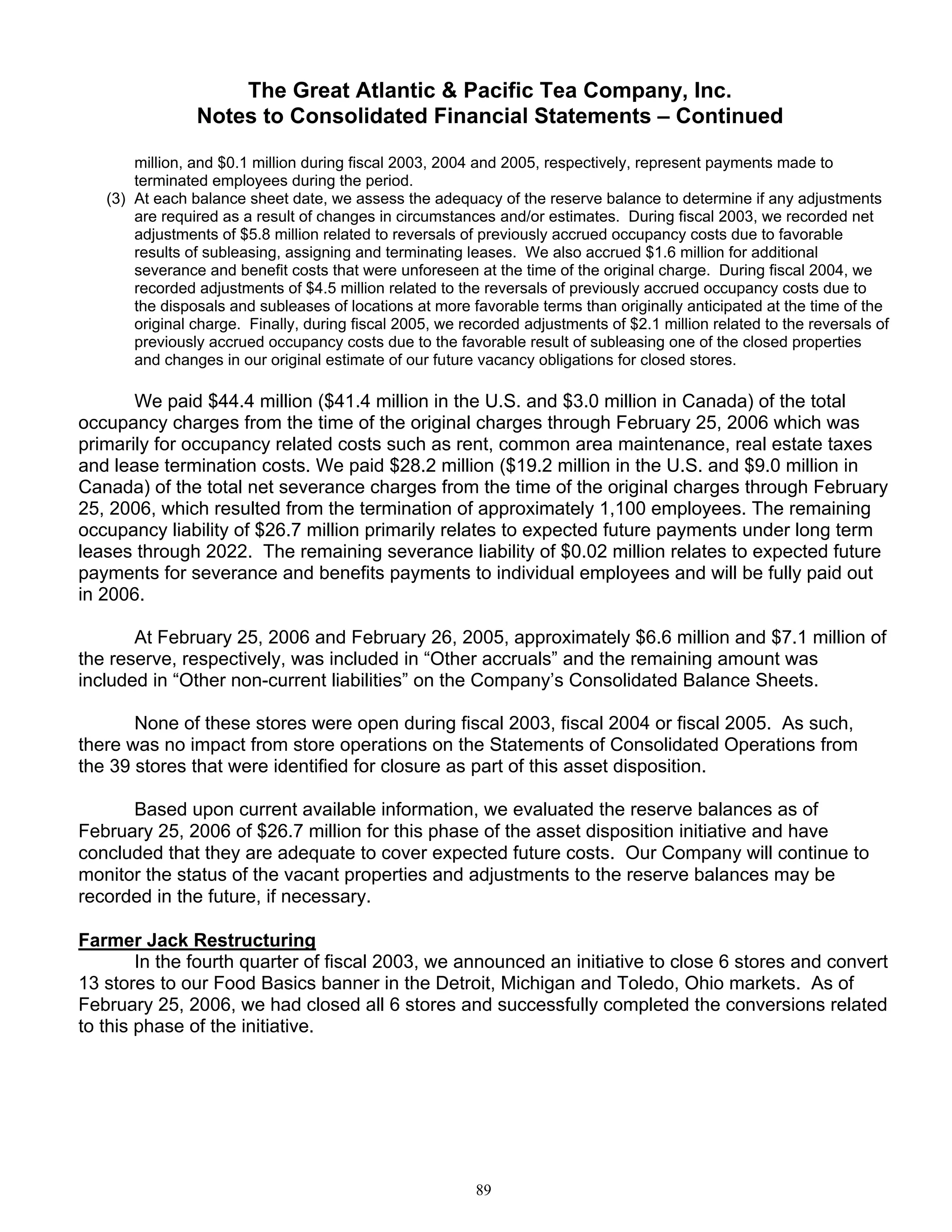

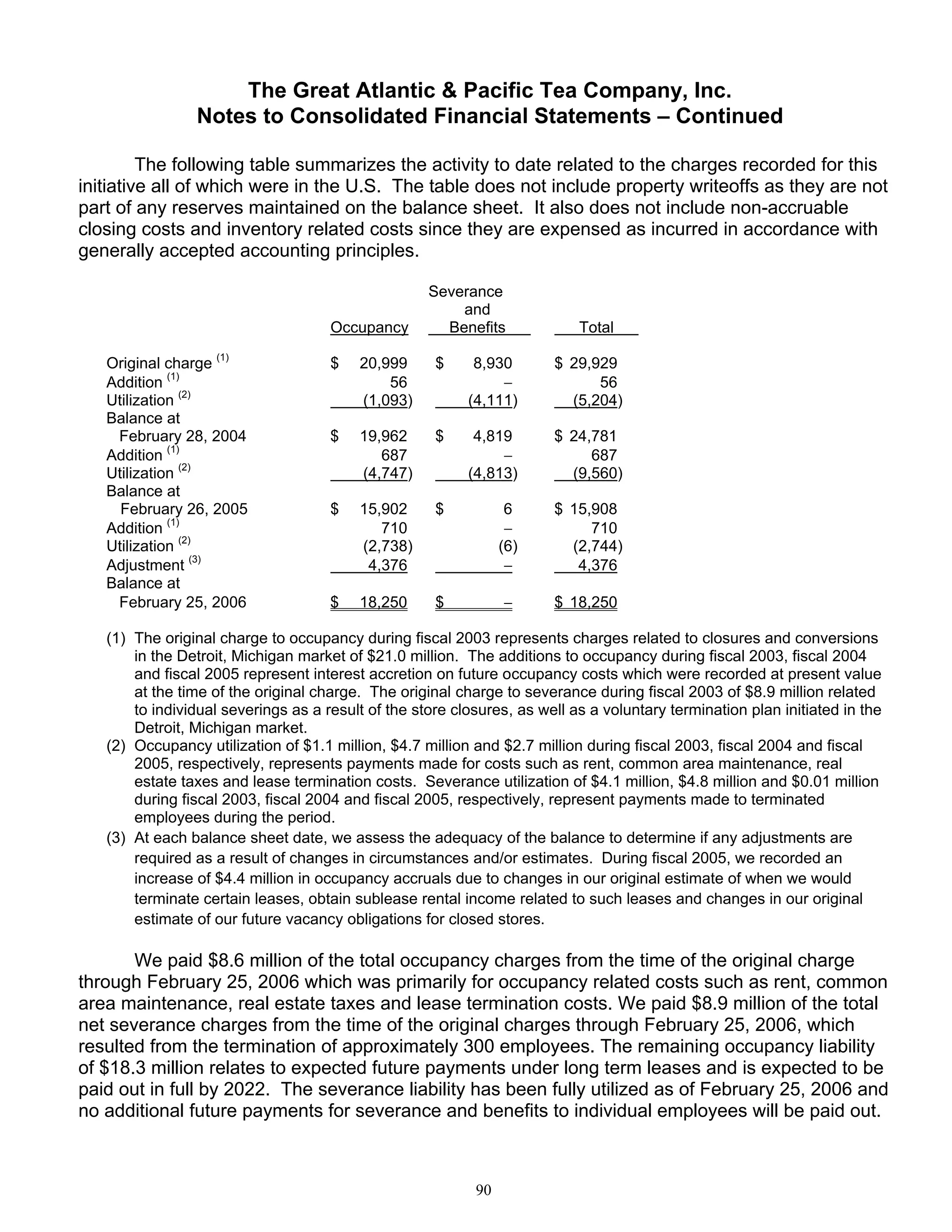

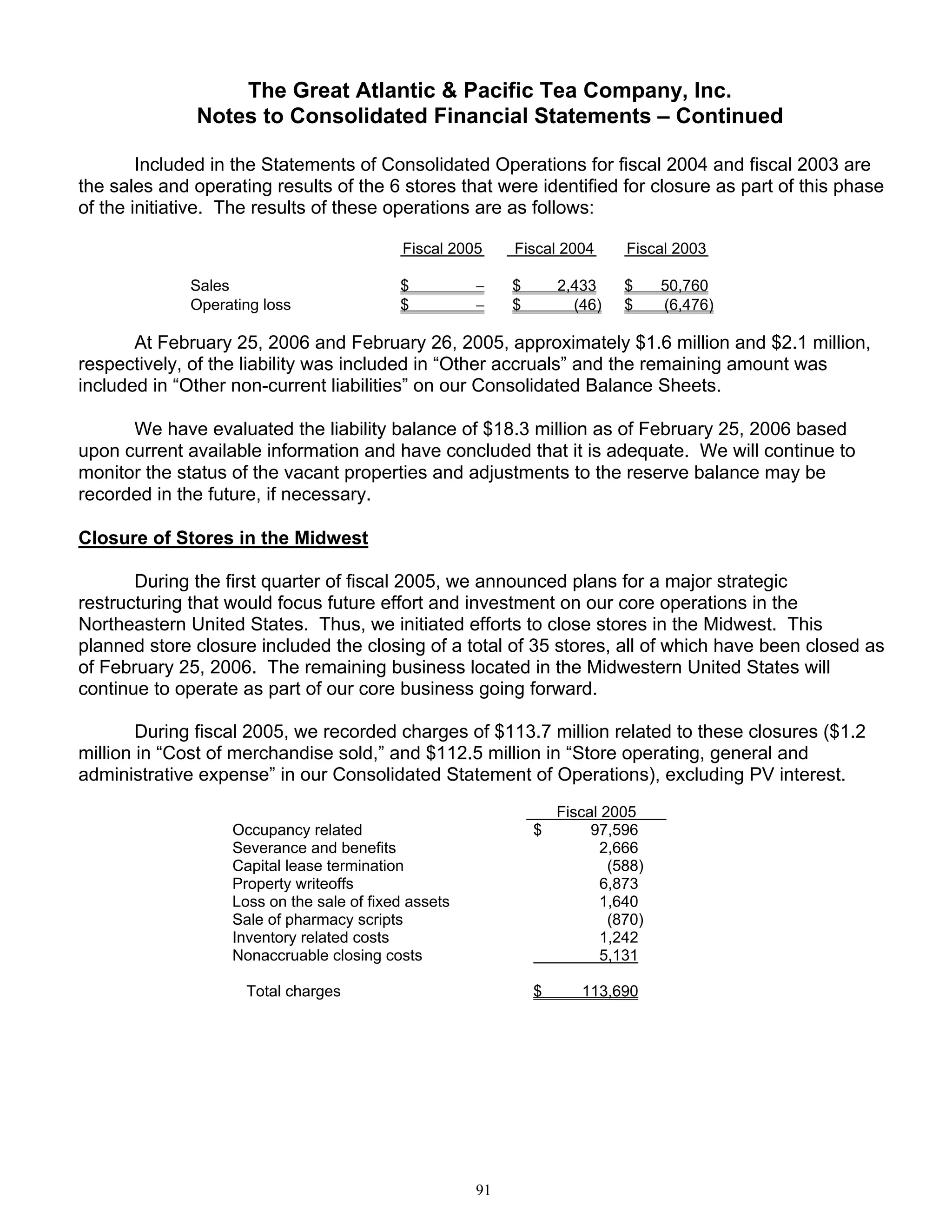

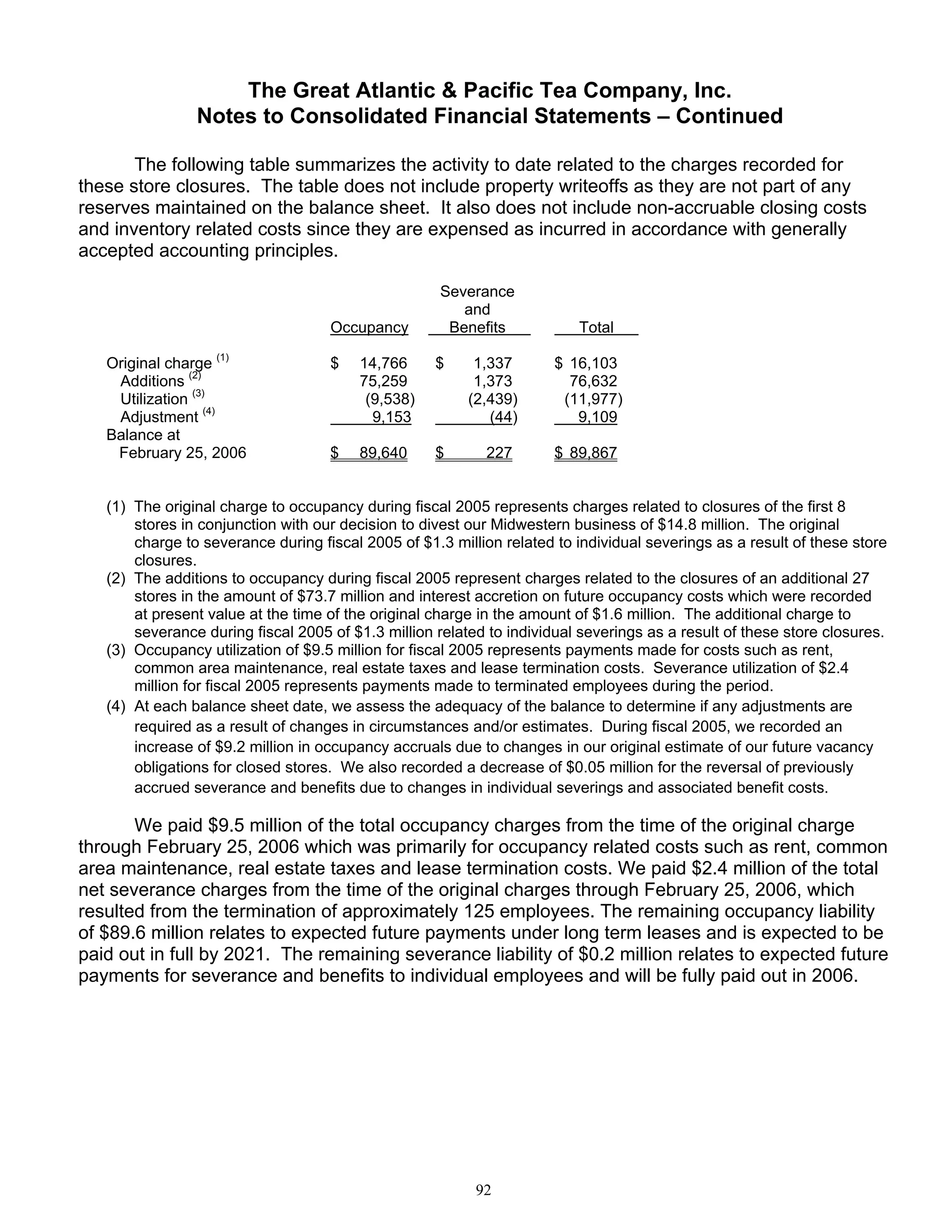

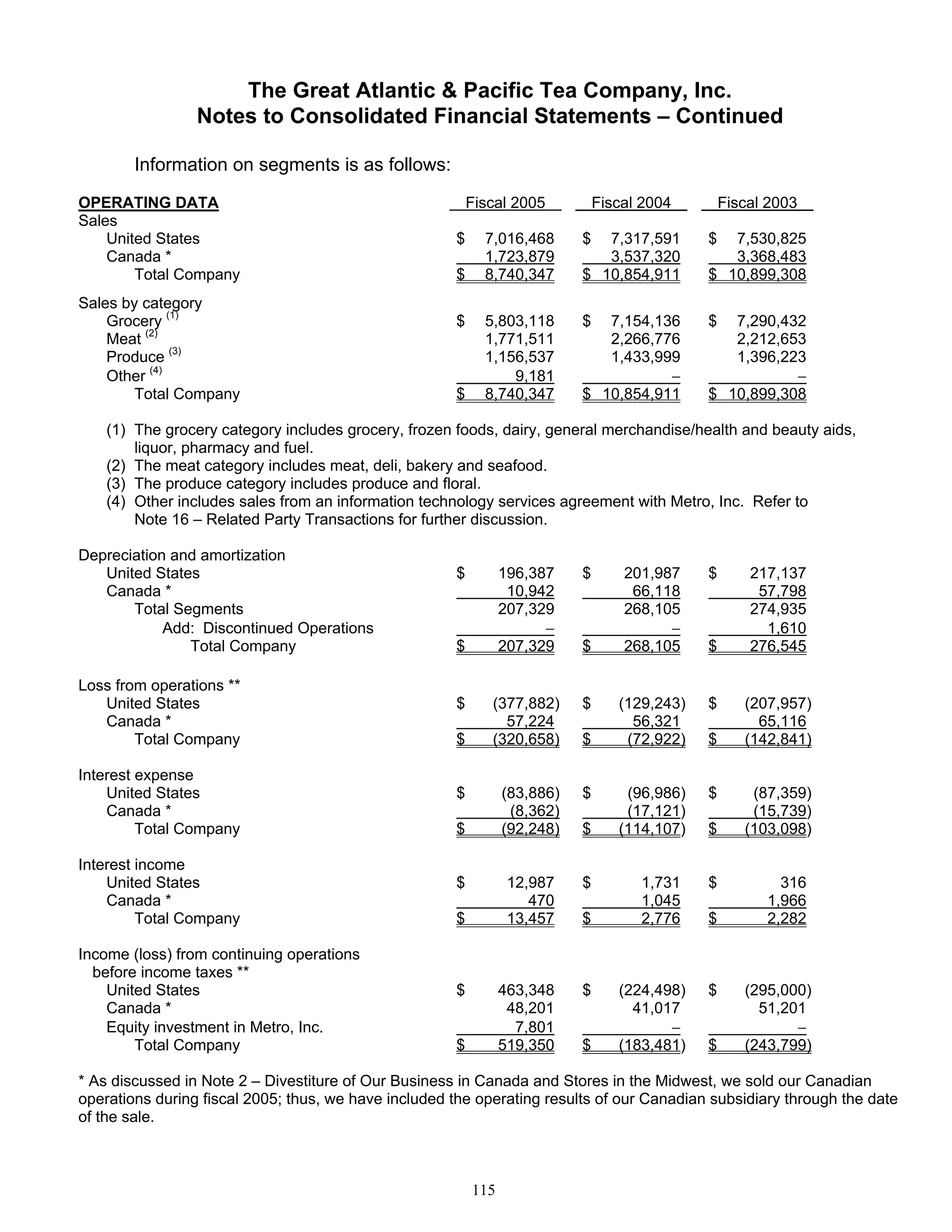

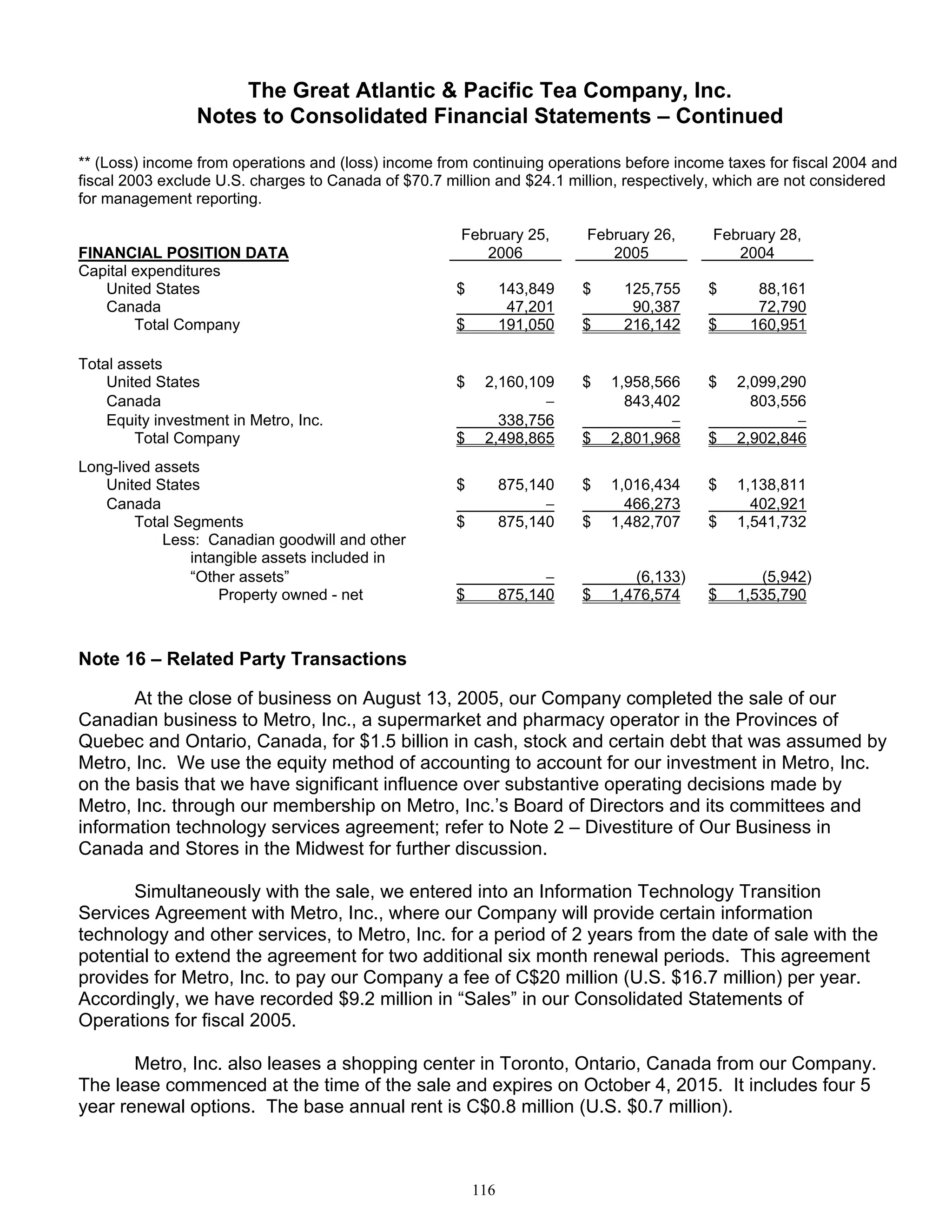

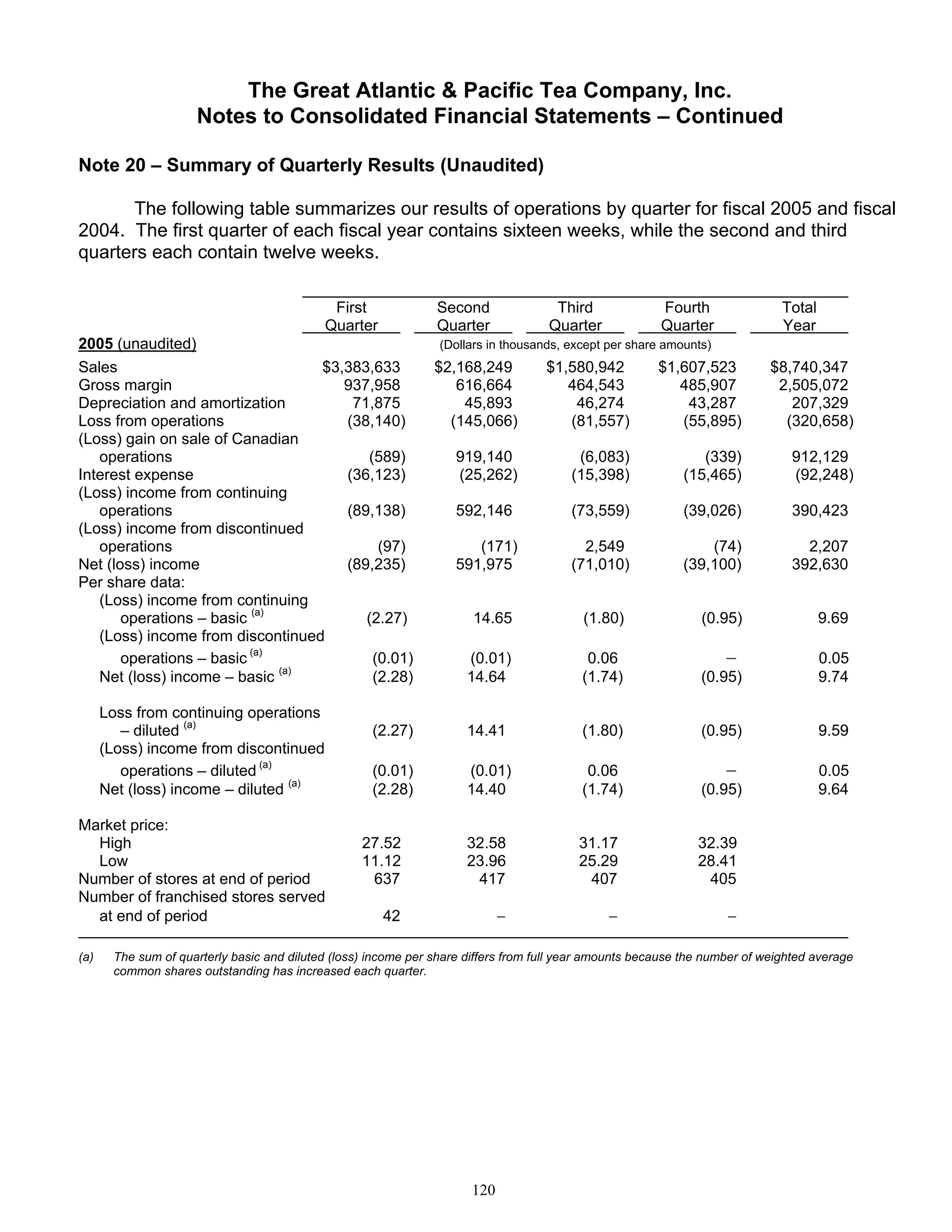

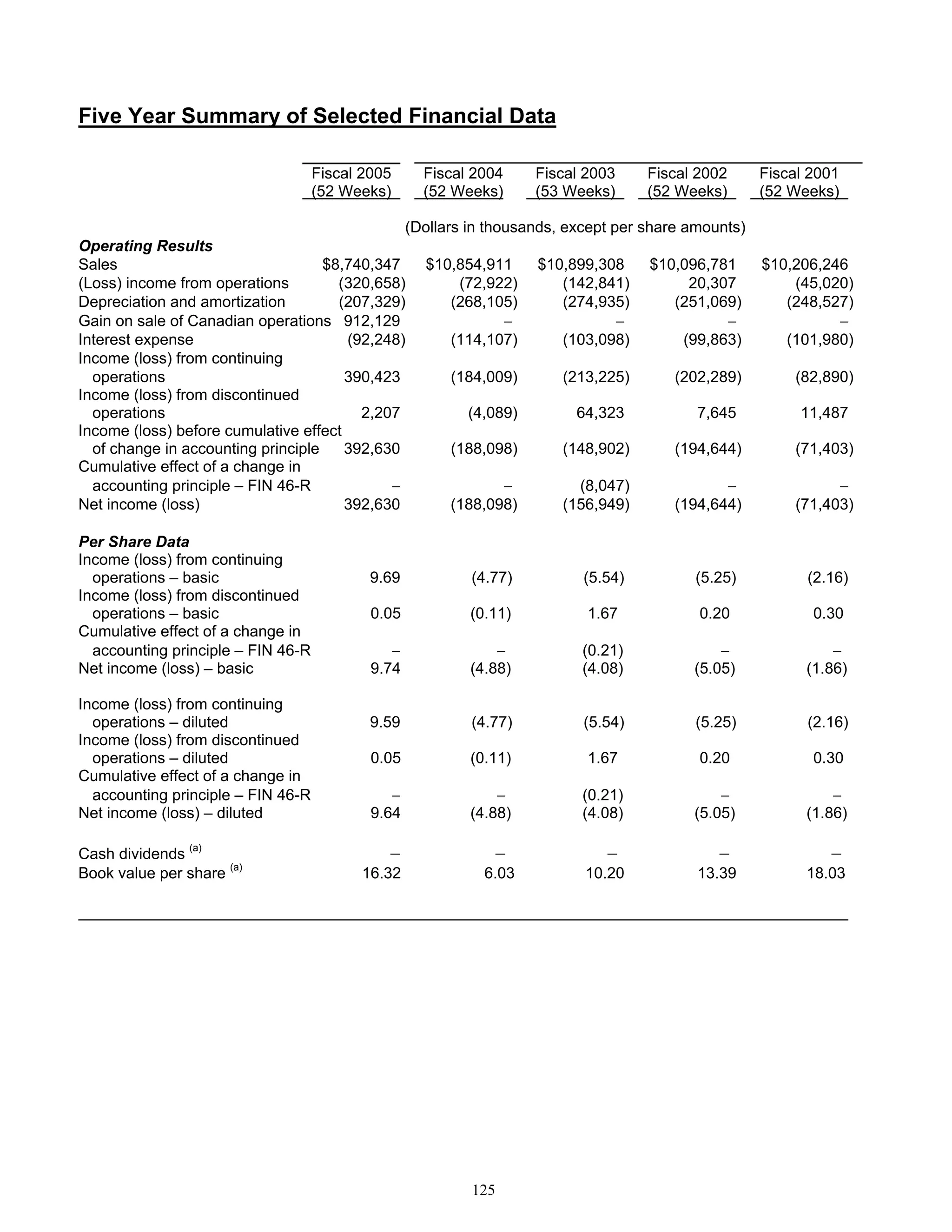

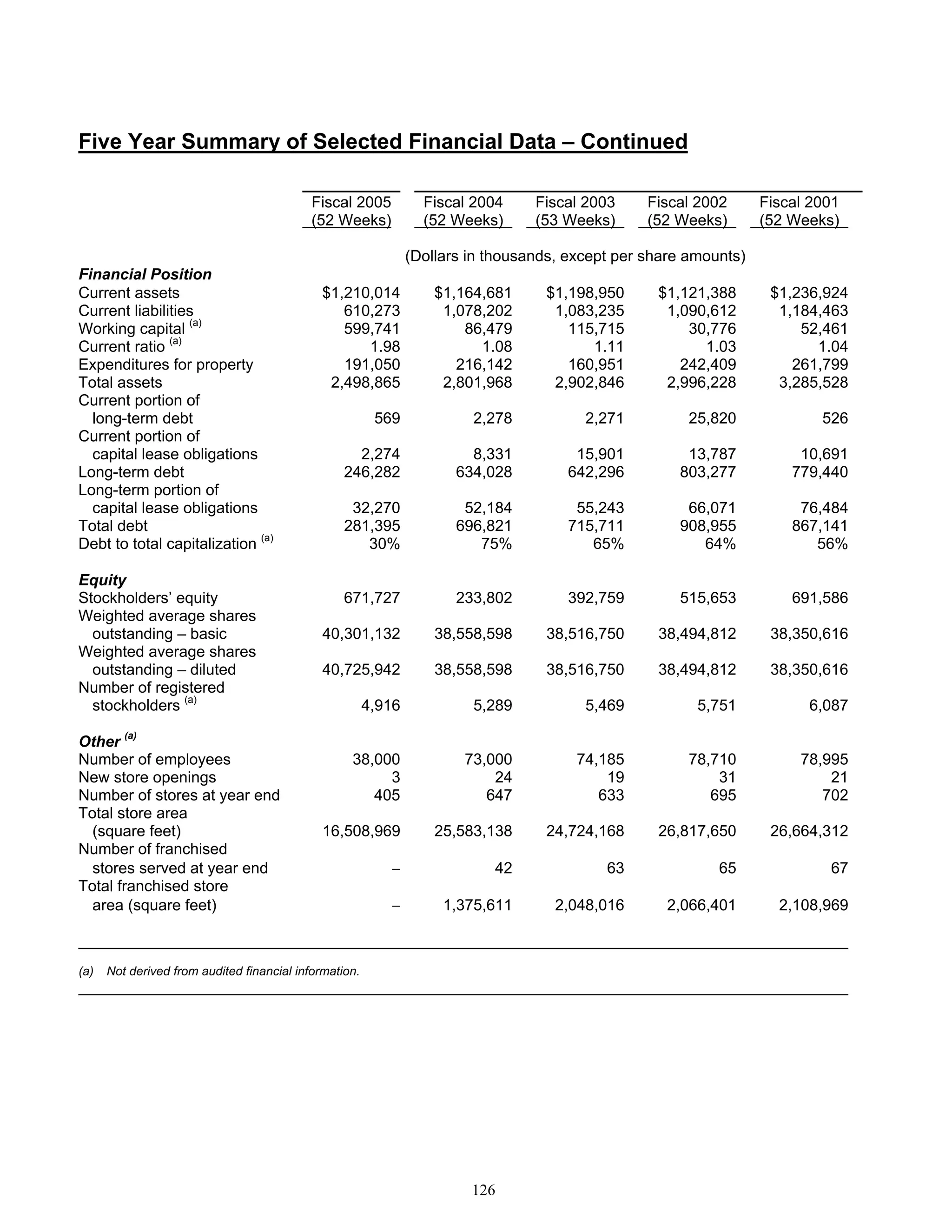

This document is the annual report of The Great Atlantic & Pacific Tea Company (A&P) for fiscal year 2005. It includes letters to stockholders from the Executive Chairman and President/CEO. The Chairman's letter discusses the sale of the Canadian business, leadership changes, cost reductions, and improved second half results in 2005. The CEO letter outlines the strategic plan to improve results through 2007 by building sales profitably through lower costs and upgraded stores, reducing costs, and improving 75% of stores by 2008 under three new formats.