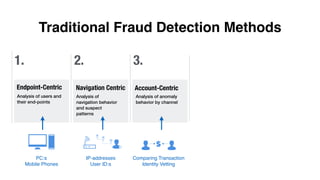

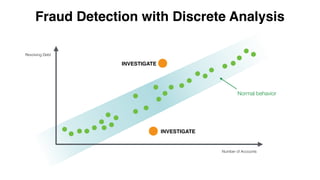

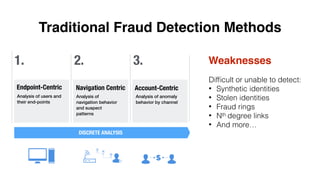

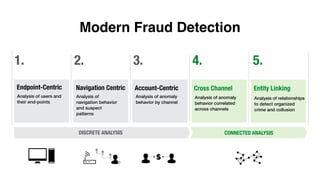

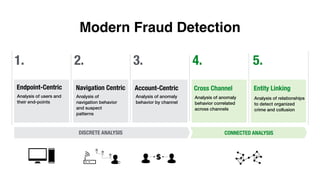

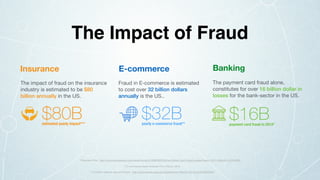

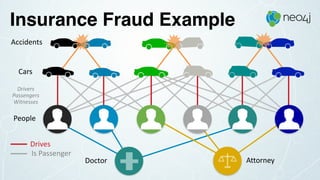

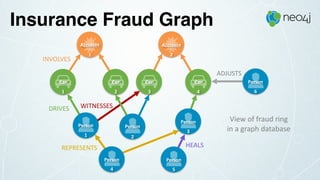

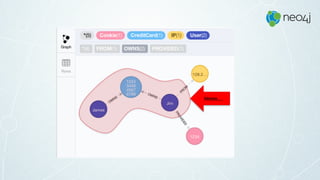

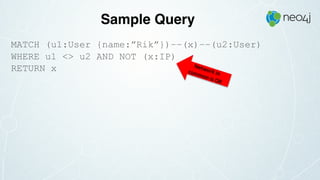

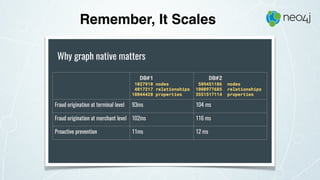

This document discusses how graph databases can help detect fraud. It outlines traditional discrete fraud detection methods and their weaknesses in detecting complex fraud schemes. A graph database approach allows for connected analysis across entities and relationships to better identify organized fraud, stolen identities, and other difficult to detect patterns. The document provides examples of insurance fraud detection using a graph database to visualize related individuals, vehicles, businesses and events.