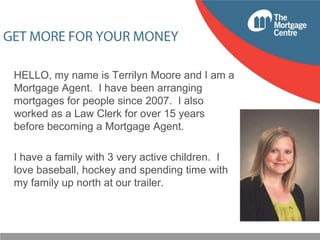

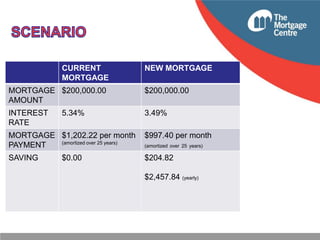

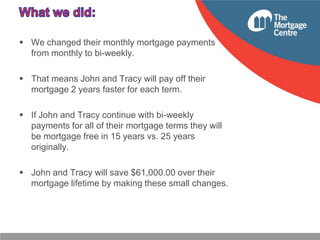

Terrilyn Moore has been a mortgage agent since 2007 and previously worked as a law clerk for 15 years. She is active in her local community as a member of the Brantford Chamber of Commerce and volunteer for a hockey team. Moore provides tips on how to pay off a mortgage faster by saving thousands each year, avoiding common mistakes, choosing the right mortgage product, and getting more value. She uses an example of a family who saved over $60,000 in interest by switching to bi-weekly payments and refinancing their mortgage. Moore encourages working with a trusted mortgage advisor as a partner to become mortgage-free.