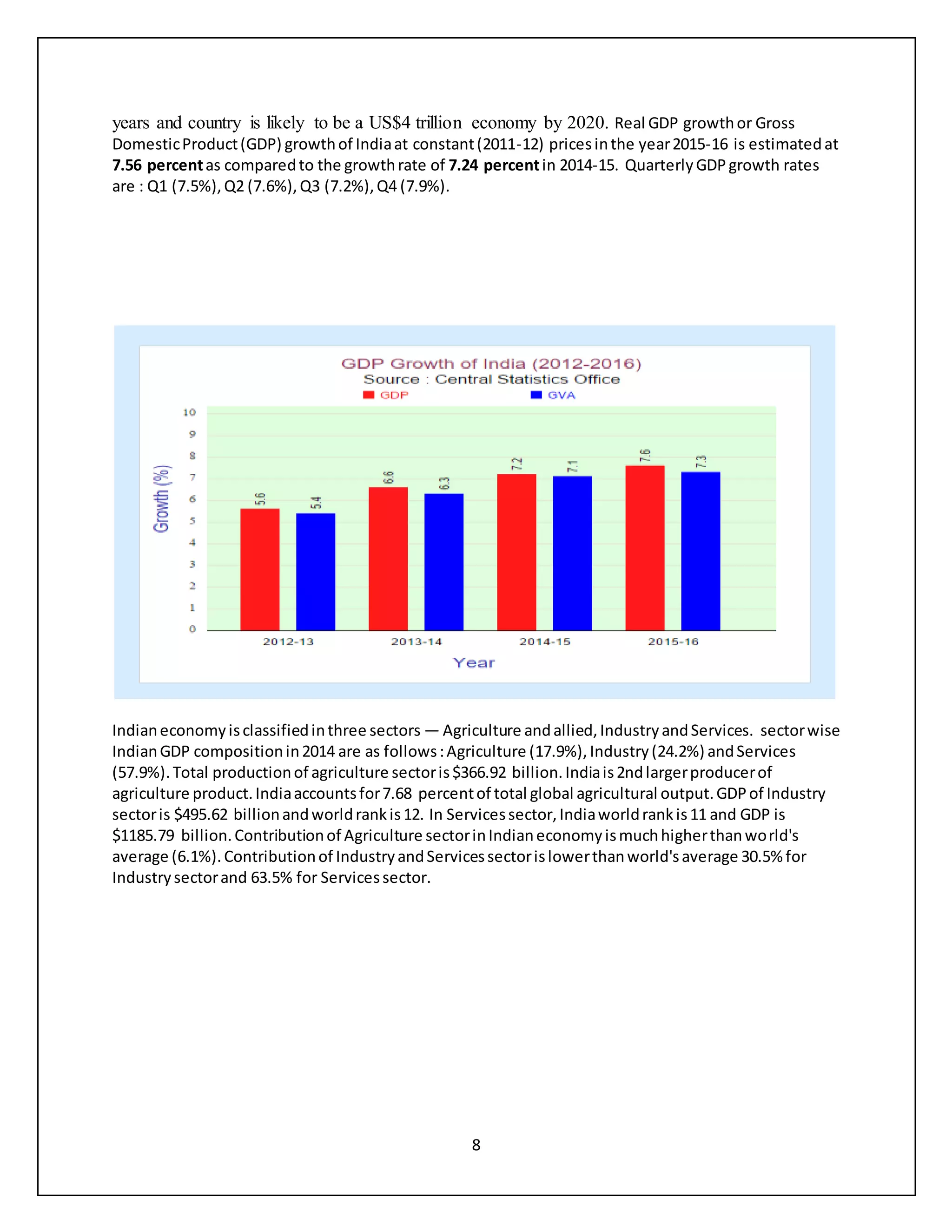

The document provides a fundamental analysis of the Indian automobile industry, focusing on two major companies, Tata Motors and Maruti Suzuki, to estimate their intrinsic values for investment decision-making. It discusses the significance of economic, industry, and company-specific factors in determining stock prices and highlights the positive outlook for the industry amid a recovering economy. The analysis employs a top-down approach, examining macroeconomic indicators, market conditions, and specific company performances to evaluate opportunities in the automotive sector.

![21

that had made it a success. The identification of these characteristics, whether quantitative or

qualitative, is referred to as company analysis. Quantitative indicators of company analysis are

the financial indicators and operational efficiency indicators. Financial indicators analysed

through the income and balance sheet statement of the company. Besides these, an analysis of

future prospects of the company should also be carried out. The budget and cash flow statement

give the investors an insight in to future functioning of the company. Future profitability and

operational efficiency can be worked out from these statements. Earnings per share (EPS) and

Dividend per share (DPS) are also useful for analysis. Besides these quantitative factors,

qualitative factors of a company also influence investment decision to a larger extent. Qualitative

factors are the management reputation, name of the company, operational plans ofthe company

for the future, and so on, as revealed in the director’s/auditor’s reports, and also the information

revealed by the management to the media. Ratios for investment purposes can be classified into

profitability ratios, turnover ratios, and leverage ratios. Profitability ratios are the most popular

ratios since investors prefer to measure the present profit performance and use this information to

forecast the future strength of the company.

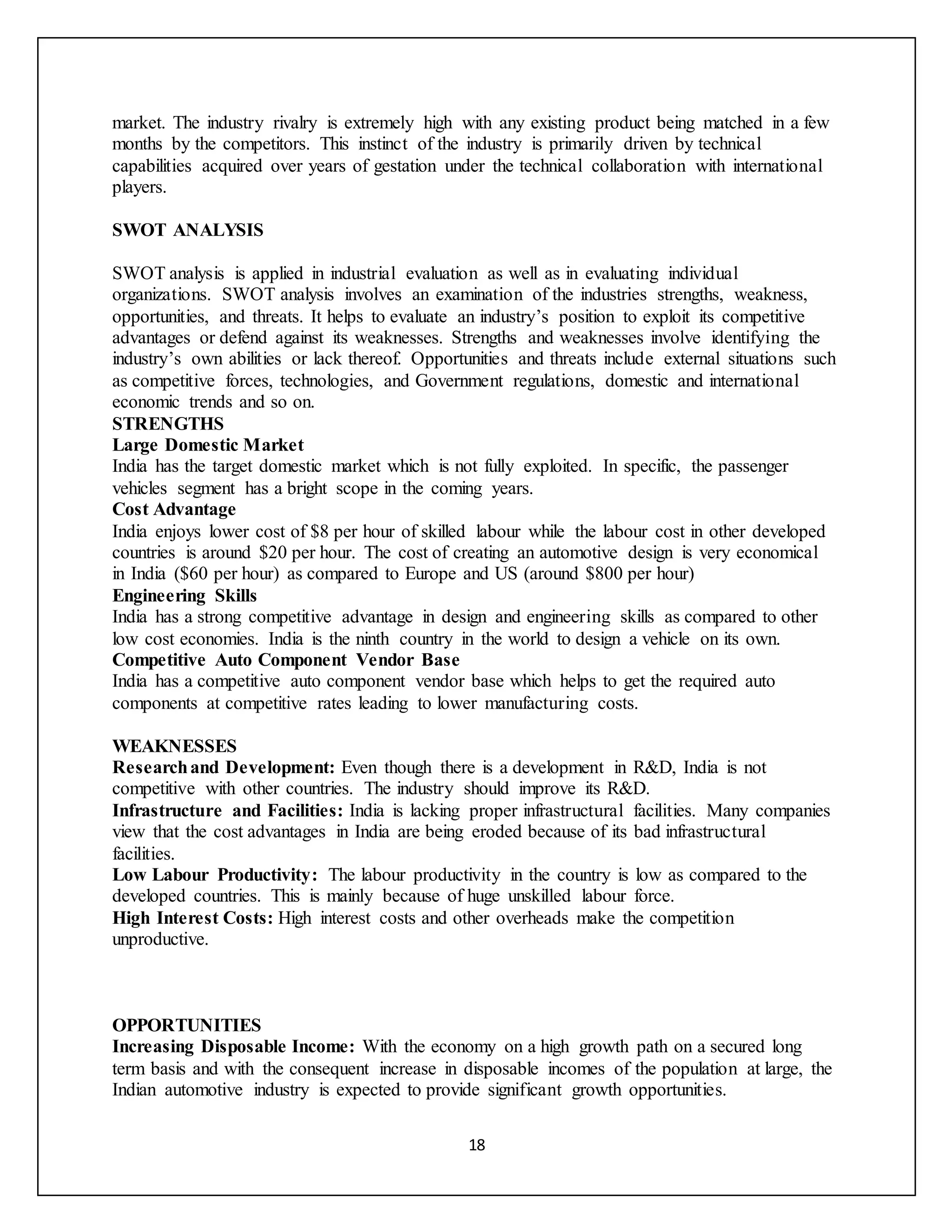

Estimation of Intrinsic Value

Finally, we will also compared their performance using various ratios for the period under

consideration.

Based on fundamental analysis intrinsic value of share is computed .

VALUATION OF FIRM :

(VALUE is aggregate of future income )

CAPITALISATION METHOD (V) = FUTURE INCOME / COST OF CAPITAL

GORDONS MODEL : VALUATION = D1/(K-g)

WHEN CFs are constant :

V= CF/(1+i) + CF/(1+i)^2 + CF/(1+i)^3 ….. =CF/I

CFs has constant growth :

V= DCF(1+g)/(1+i) + DCF(1+g)^2/(1+i)^2 + DCF(1+g)^3/(1+i)^3 …

=CF1/(K-g)

FCFF = CF – CAPITAL EXPENDITURE (CE)

FCFF= EBIT(1-t) +deprecation – increase in NCWC – CE

FCFF = NOPAT –(CE- deprecation) – increase in NCWC

EQUITY = V-D [V=E+D ]

VALUE PER SHARE (INTRINSIC VALUE) = E/ N (Where N= No of outstanding

share )](https://image.slidesharecdn.com/fundamentalanalysisisthestudyofeconomic-180616160819/75/Fundamental-analysis-21-2048.jpg)