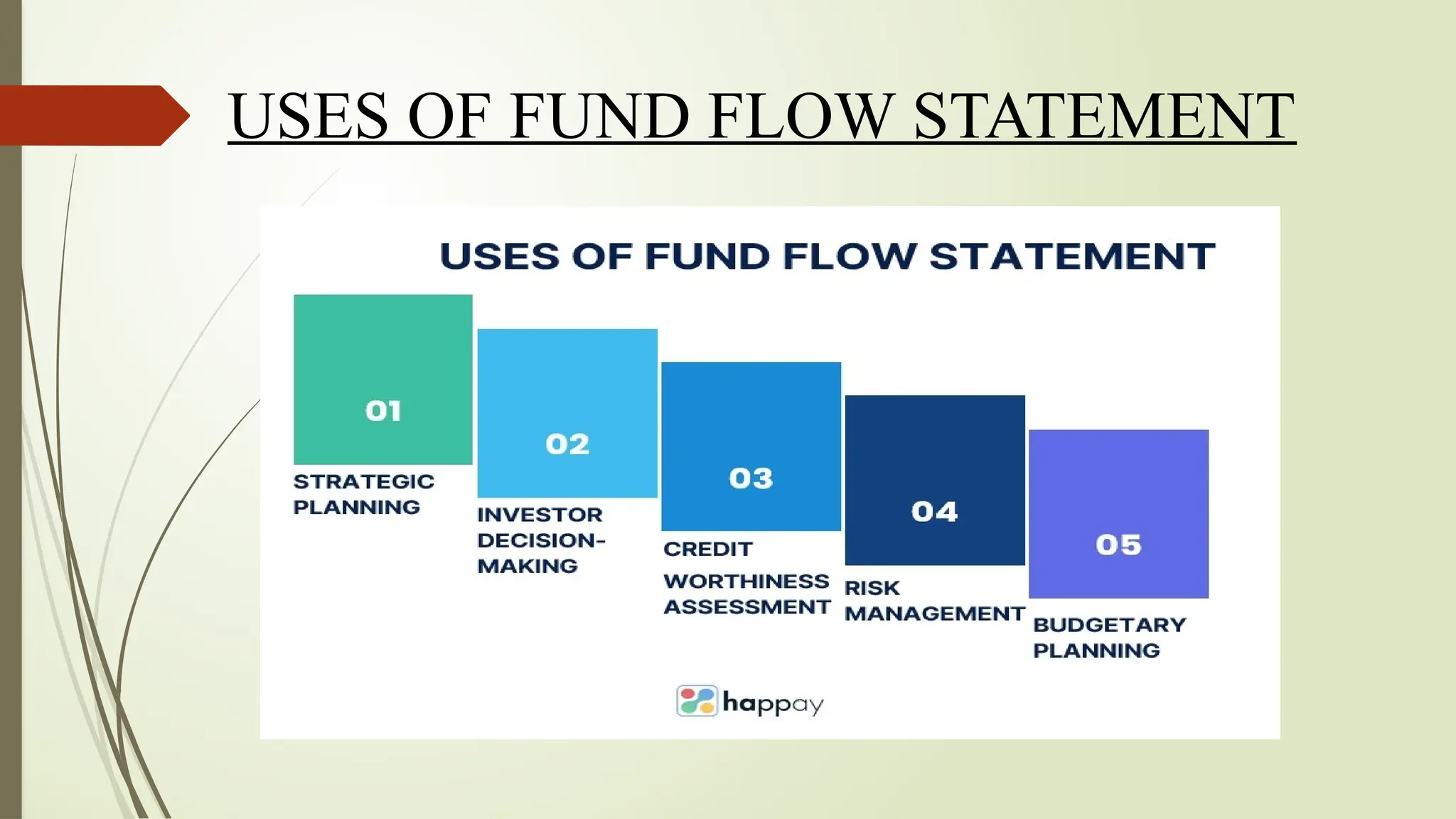

The document explains the concept and significance of fund flow, which tracks cash movements in and out of financial assets over specific periods, focusing on liquidity, capital utilization, trend analysis, strategic decision-making, and financial performance evaluation. It details the uses of the fund flow statement for strategic planning, investor decision-making, creditworthiness assessment, risk management, and budgetary planning. The document also outlines the steps involved in preparing a fund flow statement to provide insights into an organization's financial dynamics.