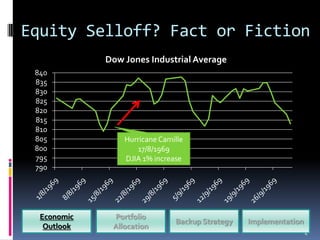

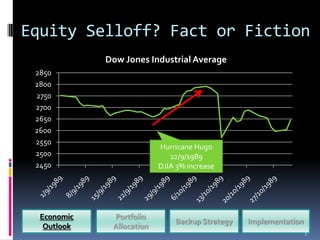

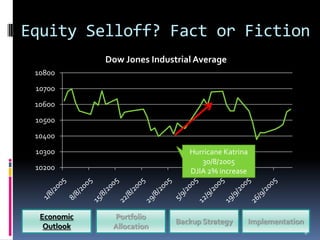

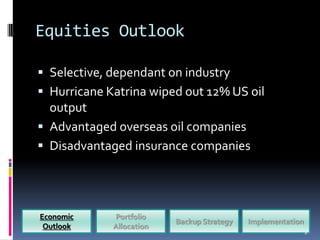

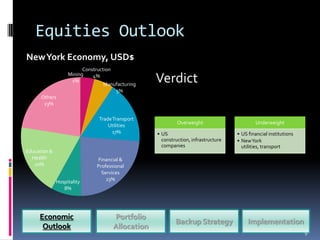

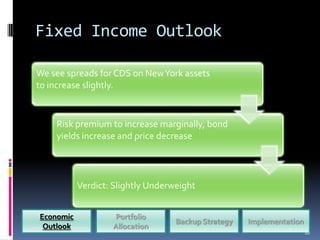

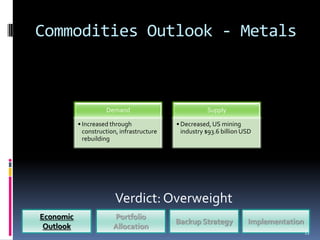

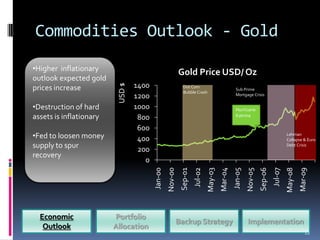

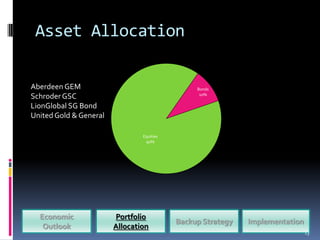

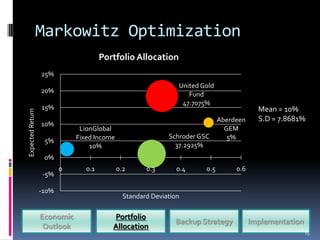

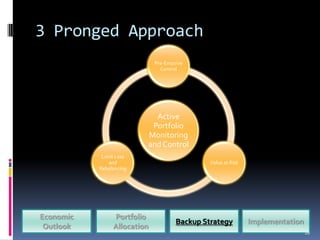

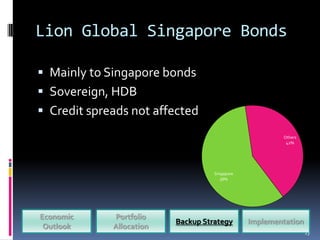

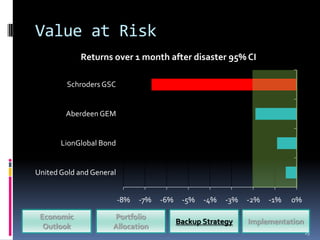

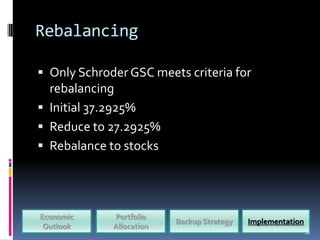

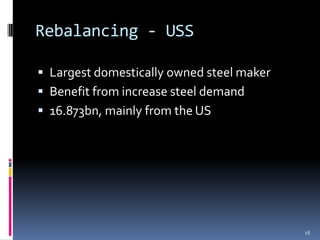

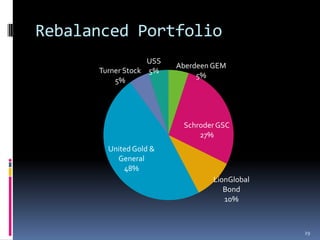

This document outlines a portfolio management strategy for braving economic storms like hurricanes. It begins with an economic outlook analysis and then discusses portfolio allocation, backup strategies, and implementation. The backup strategy section describes using leading economic indicators to forecast disasters, value at risk analysis to estimate potential losses, and guidelines for rebalancing to limit losses. Specific holdings are then analyzed for their exposure to disasters, with recommendations to reduce exposure to financials but increase exposure to construction and metals companies expected to benefit from rebuilding. The portfolio is rebalanced to reflect these views.