FS Flier

•

0 likes•58 views

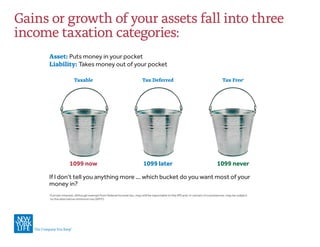

The document discusses different types of investment buckets and their tax treatment: 1) Taxable bucket - Gains or growth are taxed annually as ordinary income. 2) Tax-deferred bucket - Taxes are deferred until money is withdrawn, such as a 401(k). 3) Tax-free bucket - Earnings grow tax-free, such as a Roth IRA. The document asks what percentage of money the recipient wants in each bucket and if they want to redistribute some of the money.

Report

Share

Report

Share

Download to read offline

Recommended

Information On Property Tax Lien Investing

Earn Attractive Annual Yields by Investing in Tax Liens and Deeds purchased by Commercial Equity Partners, Ltd. Your funds are invested through the purchase of Property Tax Liens throughout the United States.

Tax avoidance

Tax avoidance is finding legal loopholes to minimize tax payments, unlike evasion which is illegal. The document discusses various tax avoidance schemes like Double Irish Dutch Sandwich and tax havens. It focuses on the MasterCard tax saga where MasterCard avoided paying taxes in India through its interface processors located in tax havens. Countries establish tax havens to attract foreign investment and companies benefit from low or no taxes through them.

Pension liberation mail on sunday 22.3.15

Pension fraud and pension liberation causing chaos and misery. But there is so much more to come when pension "freedoms" open the floodgates to the fraudsters. Not just the usual suspects, but whole armies of opportunists ready to scam the unwary victims who will lose their pensions. Hundreds of Ark victims are now receiving tax demands, only a few months after Stephen Ward of Premier Pension Solutions (the principal promoter and administrator behind Ark) claimed "Ark is history".

Tax Lien Certificate Investment Basics

Tax lien certificates are a centuries-old investment vehicle that allows investors to purchase liens on properties with delinquent taxes. If a property owner fails to pay their annual property taxes, the local government can place a lien on the property and sell tax lien certificates to immediately collect revenue. The purchaser of a certificate receives the lien and interest, and gets the property title if taxes go unpaid for an extended time. Thousands of properties change hands each year this way. Tax lien certificates offer a safe and secure investment because the local government handles the process and guarantees payment of the original investment plus interest.

Stamp Duty Advice

At Stamp Duty Advice, we make claiming a Stamp Duty Land Tax (SDLT) refunds efficient and straightforward. When you contact us, one of our specialist consultants will review your SDLT return and advise if you are due a refund or about to overpay HMRC. Our service runs on a no claim, no fee basis, and all for a transparent fixed fee where applicable. Our advisers can review your circumstance to include any exemptions, discounts or reliefs that might apply to you, ensuring that you only pay the legally required amount.

Case alert Trinity Mirror Plc

- Grant Thornton UK LLP is a member firm of Grant Thornton International Ltd (GTIL) that provides assurance, tax, and advisory services. GTIL and member firms are separate legal entities not liable for each other.

- This publication is intended as guidance only and Grant Thornton cannot be held responsible for any loss resulting from relying on the information herein.

- The document provides contact information for Grant Thornton representatives in Scotland, London, and the Southeast of England.

Case Alert: Trinity Mirror PLC

The principle of proportionality is an unwritten concept of European law. In simple terms and in a VAT context, the principle is intended to ensure that, when dealing with taxpayers, Member State's actions go no further than what is necessary to achieve the objective being pursued.

The objective of the Default Surcharge regime in the UK is to ensure that taxpayers not only submit their VAT returns on time but also pay any VAT due on time.

The First-tier Tribunal found that the surcharge in this case was disproportionate. However, the Upper Tribunal has allowed HMRC's appeal. In the circumstances, the First-tier's decision was wrong in law.

February update 2016

Bill Donaldson, President of CMI, was a guest speaker on a radio talk show for two weeks to discuss alternative Roth conversions and demand for precious metals. He discovered a way to do Roth conversions using alternative assets at a 25% cost compared to higher taxes from traditional conversions. Listeners can access a podcast of the radio interview on his discovery of getting tax-free income from IRAs. Donaldson invites callers to contact him for more information on how these alternative Roth conversions can help people gain advantages for their retirement funds.

Recommended

Information On Property Tax Lien Investing

Earn Attractive Annual Yields by Investing in Tax Liens and Deeds purchased by Commercial Equity Partners, Ltd. Your funds are invested through the purchase of Property Tax Liens throughout the United States.

Tax avoidance

Tax avoidance is finding legal loopholes to minimize tax payments, unlike evasion which is illegal. The document discusses various tax avoidance schemes like Double Irish Dutch Sandwich and tax havens. It focuses on the MasterCard tax saga where MasterCard avoided paying taxes in India through its interface processors located in tax havens. Countries establish tax havens to attract foreign investment and companies benefit from low or no taxes through them.

Pension liberation mail on sunday 22.3.15

Pension fraud and pension liberation causing chaos and misery. But there is so much more to come when pension "freedoms" open the floodgates to the fraudsters. Not just the usual suspects, but whole armies of opportunists ready to scam the unwary victims who will lose their pensions. Hundreds of Ark victims are now receiving tax demands, only a few months after Stephen Ward of Premier Pension Solutions (the principal promoter and administrator behind Ark) claimed "Ark is history".

Tax Lien Certificate Investment Basics

Tax lien certificates are a centuries-old investment vehicle that allows investors to purchase liens on properties with delinquent taxes. If a property owner fails to pay their annual property taxes, the local government can place a lien on the property and sell tax lien certificates to immediately collect revenue. The purchaser of a certificate receives the lien and interest, and gets the property title if taxes go unpaid for an extended time. Thousands of properties change hands each year this way. Tax lien certificates offer a safe and secure investment because the local government handles the process and guarantees payment of the original investment plus interest.

Stamp Duty Advice

At Stamp Duty Advice, we make claiming a Stamp Duty Land Tax (SDLT) refunds efficient and straightforward. When you contact us, one of our specialist consultants will review your SDLT return and advise if you are due a refund or about to overpay HMRC. Our service runs on a no claim, no fee basis, and all for a transparent fixed fee where applicable. Our advisers can review your circumstance to include any exemptions, discounts or reliefs that might apply to you, ensuring that you only pay the legally required amount.

Case alert Trinity Mirror Plc

- Grant Thornton UK LLP is a member firm of Grant Thornton International Ltd (GTIL) that provides assurance, tax, and advisory services. GTIL and member firms are separate legal entities not liable for each other.

- This publication is intended as guidance only and Grant Thornton cannot be held responsible for any loss resulting from relying on the information herein.

- The document provides contact information for Grant Thornton representatives in Scotland, London, and the Southeast of England.

Case Alert: Trinity Mirror PLC

The principle of proportionality is an unwritten concept of European law. In simple terms and in a VAT context, the principle is intended to ensure that, when dealing with taxpayers, Member State's actions go no further than what is necessary to achieve the objective being pursued.

The objective of the Default Surcharge regime in the UK is to ensure that taxpayers not only submit their VAT returns on time but also pay any VAT due on time.

The First-tier Tribunal found that the surcharge in this case was disproportionate. However, the Upper Tribunal has allowed HMRC's appeal. In the circumstances, the First-tier's decision was wrong in law.

February update 2016

Bill Donaldson, President of CMI, was a guest speaker on a radio talk show for two weeks to discuss alternative Roth conversions and demand for precious metals. He discovered a way to do Roth conversions using alternative assets at a 25% cost compared to higher taxes from traditional conversions. Listeners can access a podcast of the radio interview on his discovery of getting tax-free income from IRAs. Donaldson invites callers to contact him for more information on how these alternative Roth conversions can help people gain advantages for their retirement funds.

Better Roth Solution 2016

This document discusses using precious metals to reduce taxes when converting a traditional IRA to a Roth IRA. It notes that high tax bracket baby boomers face issues with outliving retirement funds and avoiding required minimum distributions (RMDs). It proposes using physical silver proof coins, valued daily based on spot prices, as a non-security asset for Roth conversions. This approach minimizes tax costs compared to using securities, by taking advantage of specialized self-directed IRA custodian valuations for metals. The minimum guidelines for this strategy are having over $150,000 in retirement assets, being over age 60, and having a combined federal and state tax rate over 30%.

Better Roth Solution 2016 (1)

This document discusses converting an existing IRA to a Roth IRA using non-security precious metal coins. It notes that Roth conversions are taxable but distributions are tax-free. It provides guidelines that a person needs over $150,000 in an IRA and be over age 60 in at least a 30% tax bracket to qualify. Converting to a Roth IRA using non-security coins through Coin Management Inc. and a self-directed IRA custodian like Equity Trust costs less than 26% including taxes, making spendable income exceed current IRA distributions. The custodian buys and stores the coins, selling them to fund the Roth and returning proceeds to the original broker.

State Tax Amnesty Pitch

The Maryland Comptroller will offer a tax amnesty program from September 1 to October 31, 2015 that will waive civil penalties and reduce interest charges for delinquent corporate income tax, sales tax, fiduciary income tax, and individual income tax. To qualify for the amnesty waiver, taxpayers must take several steps and meet certain eligibility requirements, which the accounting firm Rosen Sapperstein & Friedlander can explain further. Mike offers to arrange an interview with RS&F tax experts to discuss the program for a news story.

M100 taxes.state.mn.us

To obtain a copy of a Minnesota tax return, a requester must:

1) Pay a $5 processing fee for each requested return and year. Checks should be made payable to Minnesota Revenue.

2) Complete and submit Form M100 with payment. The form requests identifying information and signature of the taxpayer.

3) Mail the completed form and payment to the Minnesota Revenue address provided. Most requests are filled within 30 days of receipt.

Case alert Investment Trust Companies - Supreme Court

1) Grant Thornton UK LLP is a member firm of Grant Thornton International Ltd (GTIL) that provides assurance, tax, and advisory services.

2) GTIL and its member firms are separate legal entities and are not liable for each other's acts or omissions.

3) This publication is intended as guidance only and Grant Thornton cannot be held responsible for any losses resulting from relying on information in this document.

Do I Pay North Dakota Taxes When Someone Leaves Me Money?

The document discusses various taxes that may apply when an individual inherits money or assets from someone who has passed away. It states that in North Dakota, there is no state-level estate or inheritance tax. It also explains that the federal estate tax only applies to estates worth more than $5.43 million and that inherited assets and money are not considered taxable income.

WTReclaim Introduction

WTR Solutions provides withholding tax reclaim solutions and services to help companies reclaim taxes that were withheld. They can be contacted at +44 207 846 0011 or SALES@WTRECLAIM.COM for assistance with withholding tax reclaims. WTR Solutions specializes in being a withholding tax reclaim solutions provider.

What happens if a us expat files their taxes late

You are a US citizen living abroad (abroad in this case is anywhere outside of the united states) - A scenario commonly seen today. Are you aware that you are still liable to file tax returns the US regardless of which country you live in? If this scenario applies to you, and, if you have missed tax return filings up until now, there are steps you can take still to mitigate penalties and get up to date with your tax filings.

Personal Income Tax

Introduction to personal income tax. History of personal income tax. History of Personal Income tax.

IRS Enforced Collection Actions and Alternatives to Enforced Collection.

The Internal Revenue Service (IRS) is a powerful and historically unrelenting creditor. The Internal Revenue Code grants the IRS extraordinary powers to enforce tax collection. The IRS has greater collection powers than those possessed by private creditors, which are usually required to obtain a judgment in court before forcibly collecting from a debtor.

10 Most Expensive Tax Mistakes

Most small businesses are losing thousands of dollars by making expensive tax mistakes. Make sure you're setting up your business correctly and are using the right deductions and expenses. Call us at (214) 600-8609 with any tax questions. Serving small business in the greater Dallas, TX area with tax planning and preparation.

What is Tax Relief and Why

In this presentation i tried to brief, what is tax relief, types of tax reliefs, Innocent Spouse Relief Tax Program, Relief By Separation Of Liability and more about other popular Tax Program,

How Do I Find a Good IRS Tax Attorney?

There are several ways to solve your irs tax troubles, and your tax lawyer can help you decide which solution is best for you.

http://www.irstaxreliefsettlement.com

Taxes

This document discusses various topics related to personal taxes, including:

1. The different types of taxes citizens pay including income tax, property tax, sales tax, and inheritance tax.

2. The purposes of taxes, which fund government services like roads, schools, law enforcement, and more.

3. Key tax forms like the W-4, W-2, and 1040EZ and what information they contain.

4. The concepts of deductions, itemized deductions, and the standard deduction. Itemized deductions can lower your taxable income if they exceed the standard deduction amount.

Withholding tax

Withholding tax is a tax that the payer of income deducts from income payments such as employment income, interest, dividends, and other types of income. The payer pays the withheld tax directly to the tax authorities on behalf of the recipient. Withholding tax aims to combat tax evasion. It is typically treated as a prepayment of the recipient's final tax liability but may be refunded or result in additional taxes owed depending on the recipient's actual tax situation. SAP provides classic and extended withholding tax functions to calculate and report withholding tax amounts.

Overdue Tax Return – ATO Tax Lodgement Advice.pptx

An overdue tax return simply means you haven’t submitted your tax paperwork by the deadline set by the government. Think of it like a deadline for a task—except this task involves organizing your financial information and sending it to the tax office. Originally published at https://taxly.ai/tax-returns/overdue-tax-return/

What Income is Taxable?

Five Last Minute Tax Tips for 2015Are you one of the millions of Americans who hasn't filed (or even...

Learning about your tax return 3

The document summarizes the five main sections of a Form 1040 tax return: 1) Entity, which includes name, address, filing status and exemptions, 2) Income and adjustments, 3) Tax, credits and other taxes, 4) Payments and refund/amount owed, and 5) Jurat for signatures. It provides details on what information belongs in each section and considerations for filling them out correctly.

Taxes

The document discusses several key points about taxes:

1. Governments need tax revenue to fund services like defense, infrastructure, and education. Taxes are required even if unpopular.

2. The US Constitution gives Congress the power to tax and outlines some restrictions like uniformity and prohibiting taxes on exports or churches.

3. The 16th Amendment allowed the federal income tax, now providing nearly 50% of revenue. It addressed the government's growing needs and reduced reliance on other sources.

4. Taxes can be proportional, progressive, or regressive depending on how rates change with income level. Sales taxes are typically regressive.

Settling My IRS Tax Headache

If you are reading this, you like to learn and take action to solve your important concerns. This slideshare will at least educate you on the many options you have when dealing with tax problems and get you started along the path of protecting yourself from the IRS and resolving your tax liabilities.

Income taxes

Taxes pay for government services like roads, schools, and national defense. The main types of taxes are income tax, which is deducted from paychecks, and property tax. To file taxes, individuals need a W-2 form from their employer showing their income and taxes paid for the year, as well as a 1040EZ tax form for most individuals making under $100,000. Tax deductions can reduce the amount owed, such as deductions for mortgage interest, charitable donations, or education expenses. Filing jointly with a spouse is also an option.

Taxes

This document discusses different types of taxes. It defines tax as a compulsory contribution to the state to fund common services. Taxes can be proportional, progressive, or regressive depending on how the tax rate changes with income. Direct taxes are paid by the taxpayer, while indirect taxes are paid but the burden falls on consumers. Federal taxes include income tax, FICA, corporate tax, excise tax, estate tax, and customs duties. State and local taxes include sales tax, property tax, and intergovernmental transfers of funds.

More Related Content

What's hot

Better Roth Solution 2016

This document discusses using precious metals to reduce taxes when converting a traditional IRA to a Roth IRA. It notes that high tax bracket baby boomers face issues with outliving retirement funds and avoiding required minimum distributions (RMDs). It proposes using physical silver proof coins, valued daily based on spot prices, as a non-security asset for Roth conversions. This approach minimizes tax costs compared to using securities, by taking advantage of specialized self-directed IRA custodian valuations for metals. The minimum guidelines for this strategy are having over $150,000 in retirement assets, being over age 60, and having a combined federal and state tax rate over 30%.

Better Roth Solution 2016 (1)

This document discusses converting an existing IRA to a Roth IRA using non-security precious metal coins. It notes that Roth conversions are taxable but distributions are tax-free. It provides guidelines that a person needs over $150,000 in an IRA and be over age 60 in at least a 30% tax bracket to qualify. Converting to a Roth IRA using non-security coins through Coin Management Inc. and a self-directed IRA custodian like Equity Trust costs less than 26% including taxes, making spendable income exceed current IRA distributions. The custodian buys and stores the coins, selling them to fund the Roth and returning proceeds to the original broker.

State Tax Amnesty Pitch

The Maryland Comptroller will offer a tax amnesty program from September 1 to October 31, 2015 that will waive civil penalties and reduce interest charges for delinquent corporate income tax, sales tax, fiduciary income tax, and individual income tax. To qualify for the amnesty waiver, taxpayers must take several steps and meet certain eligibility requirements, which the accounting firm Rosen Sapperstein & Friedlander can explain further. Mike offers to arrange an interview with RS&F tax experts to discuss the program for a news story.

M100 taxes.state.mn.us

To obtain a copy of a Minnesota tax return, a requester must:

1) Pay a $5 processing fee for each requested return and year. Checks should be made payable to Minnesota Revenue.

2) Complete and submit Form M100 with payment. The form requests identifying information and signature of the taxpayer.

3) Mail the completed form and payment to the Minnesota Revenue address provided. Most requests are filled within 30 days of receipt.

Case alert Investment Trust Companies - Supreme Court

1) Grant Thornton UK LLP is a member firm of Grant Thornton International Ltd (GTIL) that provides assurance, tax, and advisory services.

2) GTIL and its member firms are separate legal entities and are not liable for each other's acts or omissions.

3) This publication is intended as guidance only and Grant Thornton cannot be held responsible for any losses resulting from relying on information in this document.

Do I Pay North Dakota Taxes When Someone Leaves Me Money?

The document discusses various taxes that may apply when an individual inherits money or assets from someone who has passed away. It states that in North Dakota, there is no state-level estate or inheritance tax. It also explains that the federal estate tax only applies to estates worth more than $5.43 million and that inherited assets and money are not considered taxable income.

WTReclaim Introduction

WTR Solutions provides withholding tax reclaim solutions and services to help companies reclaim taxes that were withheld. They can be contacted at +44 207 846 0011 or SALES@WTRECLAIM.COM for assistance with withholding tax reclaims. WTR Solutions specializes in being a withholding tax reclaim solutions provider.

What's hot (7)

Case alert Investment Trust Companies - Supreme Court

Case alert Investment Trust Companies - Supreme Court

Do I Pay North Dakota Taxes When Someone Leaves Me Money?

Do I Pay North Dakota Taxes When Someone Leaves Me Money?

Similar to FS Flier

What happens if a us expat files their taxes late

You are a US citizen living abroad (abroad in this case is anywhere outside of the united states) - A scenario commonly seen today. Are you aware that you are still liable to file tax returns the US regardless of which country you live in? If this scenario applies to you, and, if you have missed tax return filings up until now, there are steps you can take still to mitigate penalties and get up to date with your tax filings.

Personal Income Tax

Introduction to personal income tax. History of personal income tax. History of Personal Income tax.

IRS Enforced Collection Actions and Alternatives to Enforced Collection.

The Internal Revenue Service (IRS) is a powerful and historically unrelenting creditor. The Internal Revenue Code grants the IRS extraordinary powers to enforce tax collection. The IRS has greater collection powers than those possessed by private creditors, which are usually required to obtain a judgment in court before forcibly collecting from a debtor.

10 Most Expensive Tax Mistakes

Most small businesses are losing thousands of dollars by making expensive tax mistakes. Make sure you're setting up your business correctly and are using the right deductions and expenses. Call us at (214) 600-8609 with any tax questions. Serving small business in the greater Dallas, TX area with tax planning and preparation.

What is Tax Relief and Why

In this presentation i tried to brief, what is tax relief, types of tax reliefs, Innocent Spouse Relief Tax Program, Relief By Separation Of Liability and more about other popular Tax Program,

How Do I Find a Good IRS Tax Attorney?

There are several ways to solve your irs tax troubles, and your tax lawyer can help you decide which solution is best for you.

http://www.irstaxreliefsettlement.com

Taxes

This document discusses various topics related to personal taxes, including:

1. The different types of taxes citizens pay including income tax, property tax, sales tax, and inheritance tax.

2. The purposes of taxes, which fund government services like roads, schools, law enforcement, and more.

3. Key tax forms like the W-4, W-2, and 1040EZ and what information they contain.

4. The concepts of deductions, itemized deductions, and the standard deduction. Itemized deductions can lower your taxable income if they exceed the standard deduction amount.

Withholding tax

Withholding tax is a tax that the payer of income deducts from income payments such as employment income, interest, dividends, and other types of income. The payer pays the withheld tax directly to the tax authorities on behalf of the recipient. Withholding tax aims to combat tax evasion. It is typically treated as a prepayment of the recipient's final tax liability but may be refunded or result in additional taxes owed depending on the recipient's actual tax situation. SAP provides classic and extended withholding tax functions to calculate and report withholding tax amounts.

Overdue Tax Return – ATO Tax Lodgement Advice.pptx

An overdue tax return simply means you haven’t submitted your tax paperwork by the deadline set by the government. Think of it like a deadline for a task—except this task involves organizing your financial information and sending it to the tax office. Originally published at https://taxly.ai/tax-returns/overdue-tax-return/

What Income is Taxable?

Five Last Minute Tax Tips for 2015Are you one of the millions of Americans who hasn't filed (or even...

Learning about your tax return 3

The document summarizes the five main sections of a Form 1040 tax return: 1) Entity, which includes name, address, filing status and exemptions, 2) Income and adjustments, 3) Tax, credits and other taxes, 4) Payments and refund/amount owed, and 5) Jurat for signatures. It provides details on what information belongs in each section and considerations for filling them out correctly.

Taxes

The document discusses several key points about taxes:

1. Governments need tax revenue to fund services like defense, infrastructure, and education. Taxes are required even if unpopular.

2. The US Constitution gives Congress the power to tax and outlines some restrictions like uniformity and prohibiting taxes on exports or churches.

3. The 16th Amendment allowed the federal income tax, now providing nearly 50% of revenue. It addressed the government's growing needs and reduced reliance on other sources.

4. Taxes can be proportional, progressive, or regressive depending on how rates change with income level. Sales taxes are typically regressive.

Settling My IRS Tax Headache

If you are reading this, you like to learn and take action to solve your important concerns. This slideshare will at least educate you on the many options you have when dealing with tax problems and get you started along the path of protecting yourself from the IRS and resolving your tax liabilities.

Income taxes

Taxes pay for government services like roads, schools, and national defense. The main types of taxes are income tax, which is deducted from paychecks, and property tax. To file taxes, individuals need a W-2 form from their employer showing their income and taxes paid for the year, as well as a 1040EZ tax form for most individuals making under $100,000. Tax deductions can reduce the amount owed, such as deductions for mortgage interest, charitable donations, or education expenses. Filing jointly with a spouse is also an option.

Taxes

This document discusses different types of taxes. It defines tax as a compulsory contribution to the state to fund common services. Taxes can be proportional, progressive, or regressive depending on how the tax rate changes with income. Direct taxes are paid by the taxpayer, while indirect taxes are paid but the burden falls on consumers. Federal taxes include income tax, FICA, corporate tax, excise tax, estate tax, and customs duties. State and local taxes include sales tax, property tax, and intergovernmental transfers of funds.

Taxpayers who receive_an_irs_notice_2021

Receiving a notice from the Internal Revenue Service is

usually no cause for alarm. Every year the IRS sends millions

of letters and notices to taxpayers. In the event one

shows up in your mailbox, here are ten things you should

know.

Taxpayers who receive_an_irs_notice_2021

Receiving a notice from the Internal Revenue Service is

usually no cause for alarm. Every year the IRS sends millions

of letters and notices to taxpayers. In the event one

shows up in your mailbox, here are ten things you should

know.

IRS-Tax Resolution Options for Individuals and Businesses

Read about the various tax resolution options available for individual and businesses. One or many of the options are usable depending on the tax issues involved.

What Is Life After Coronavirus? State and Local Tax: First Wave Response & Se...

This free, high-level coronavirus overview is designed to help employers make sense of the state and local tax decisions to consider as the COVID-19 (coronavirus) crisis continues to unfold. Presented by Joe Popp, JD, LLM, a principal with Rea & Associates and the firm's director of state and local tax services, the hour-long presentation will cover the first wave of state and local tax department responses and will then move on to guidance for businesses and individuals who are preparing for the second wave of crisis response.

Specifically, this webinar will cover:

- Insight about the first wave of state and local tax responses and how tax departments are answering individuals and businesses during the COVID-19 crisis.

- Guidance on how to prepare for the next wave of decisions made by your state and local tax departments.

- Predictions on what states will do in the future as a result of the COVID-19 crisis.

Tax Language: Must Know Definitions and Explanations

The document defines key tax terms to help understand filing taxes. It explains that adjusted gross income includes all income minus certain deductions like IRA contributions and alimony payments. Tax credits directly reduce taxes owed, while deductions lower taxable income. Itemized deductions subtract expenses from adjusted gross income. Standard deductions are fixed amounts subtracted based on filing status. Exemptions subtract amounts for dependents. The U.S. uses progressive taxation where higher incomes face higher tax rates. Taxable income is the final amount used to calculate taxes owed after deductions and exemptions. Withholding takes taxes from paychecks throughout the year. Voluntary compliance refers to taxpayers honestly reporting income.

Similar to FS Flier (20)

IRS Enforced Collection Actions and Alternatives to Enforced Collection.

IRS Enforced Collection Actions and Alternatives to Enforced Collection.

Overdue Tax Return – ATO Tax Lodgement Advice.pptx

Overdue Tax Return – ATO Tax Lodgement Advice.pptx

IRS-Tax Resolution Options for Individuals and Businesses

IRS-Tax Resolution Options for Individuals and Businesses

What Is Life After Coronavirus? State and Local Tax: First Wave Response & Se...

What Is Life After Coronavirus? State and Local Tax: First Wave Response & Se...

Tax Language: Must Know Definitions and Explanations

Tax Language: Must Know Definitions and Explanations

FS Flier

- 1. If I don’t tell you anything more ... which bucket do you want most of your money in? 1 Certain interest, although exempt from federal income tax, may still be reportable to the IRS and, in certain circumstances, may be subject to the alternative minimum tax (AMT). Asset: Puts money in your pocket Liability: Takes money out of your pocket Gains or growth of your assets fall into three income taxation categories: 1099 later 1099 never1099 now Tax Deferred Tax Free1 Taxable

- 2. •Are you happy with the percentages? •Would you like to discuss redistributing some of it? Taxable, tax deferred and tax free refers to the tax treatment of any earnings/growth/gain from these assets. _______% _______% Where is it now? What percentage? _______% New York Life Insurance Company New York Life Insurance and Annuity Corporation (A Delaware Corporation) 51 Madison Avenue, New York, NY 10010 www.newyorklife.com AR05050.RB.042015 SMRU481076 (Exp.04.20.2017) Tax Deferred Tax FreeTaxable