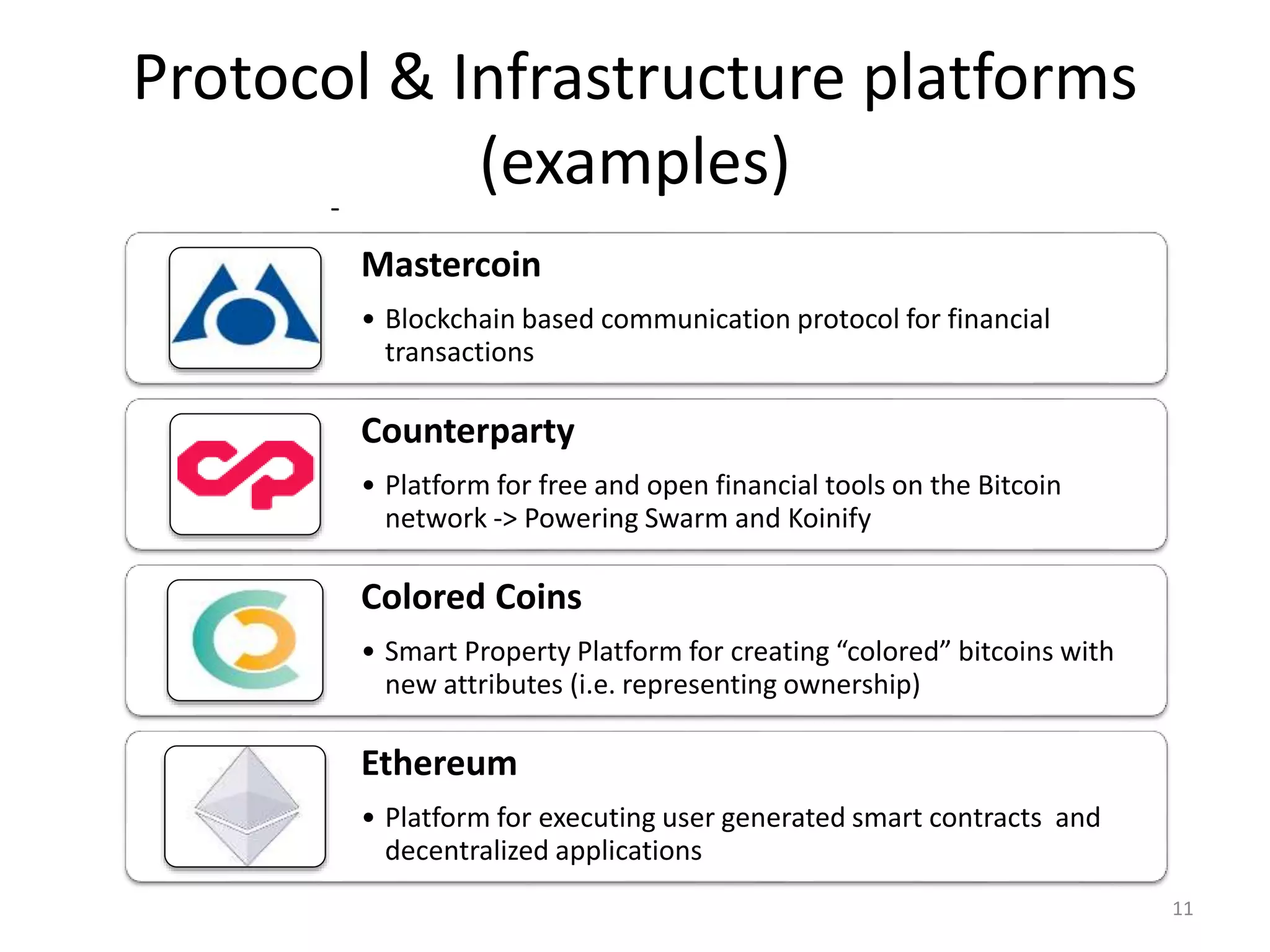

The document discusses emerging applications of blockchain technology such as cryptoequity (secure ownership shares on blockchains beyond currency) and cryptocommons (applying cryptoequity and decentralized apps to shared resources). It outlines the potential benefits of lower costs, transparency, flexibility and accountability of these applications, as well as technical implementations and open challenges around regulation. The research aims to explore further development of protocols, standards, and applications for cryptoequity, decentralized organizations, and cryptocommons.