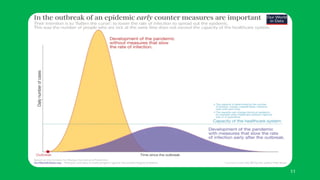

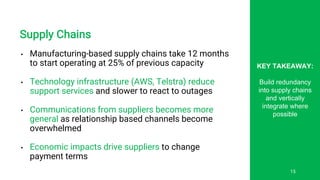

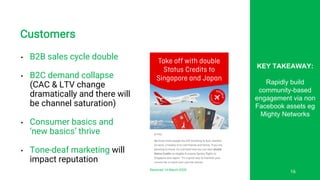

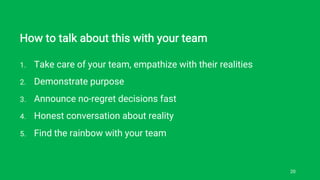

The document discusses strategies for founders to navigate the challenges posed by COVID-19, emphasizing awareness of the pandemic's current state and potential future scenarios. Key recommendations include maintaining open communication, implementing remote work, ensuring liquidity, and fostering community engagement to mitigate risks. It also highlights the importance of empathetic leadership during this crisis and provides resources for further information.