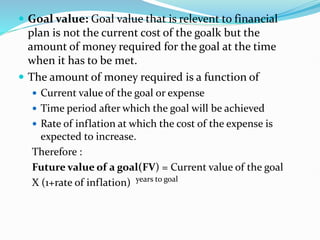

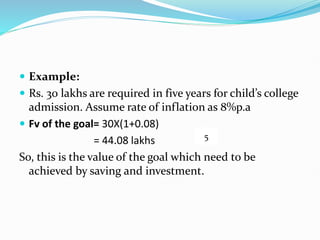

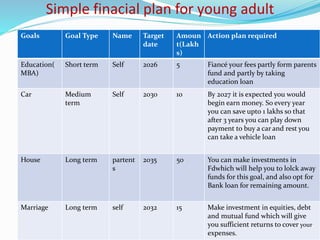

Financial planning involves streamlining income, expenses, assets, and liabilities to meet current and future financial needs. It aims to ensure households have adequate resources to meet expenses now and in the future, such as during retirement. Financial planning identifies key goals and puts an action plan in place to realign finances and meet goals. It also helps manage personal financial situations better. Financial goals specify the amount of money needed for a future need and when it is required. Each goal has a goal value and time to goal.