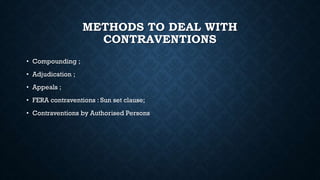

The document provides an overview of the Foreign Exchange Management Act (FEMA) in India. It discusses that FEMA is the rulebook that governs foreign exchange transactions and aims to streamline such transactions, protect national interests, attract foreign investment, and empower individuals. FEMA comprises various chapters, rules, regulations, notifications, and circulars. It outlines the overall structure and scheme of FEMA, including its objectives to facilitate external trade and payments, manage foreign investment, and safeguard interests of resident Indians.

![OVERALL SCHEME OF FEMA

• Section 3 of FEMA provides that making any payment to person not resident of India and receiving any

payment from person resident outside India, acquiring any asset out of India or dealing with foreign

currency or foreign security can be only as per general or special permission of RBI.

• Section 4 of FEMA provides that no person resident in India shall acquire, hold, own or possess or transfer

any foreign exchange, foreign security or any immovable property outside India only as per provisions of

FEMA.

• Broadly, all current account transactions are free. However, Central Government can impose reasonable

instructions by issuing rules.[section 5 of FEMA].

• Capital Account Transactions are permitted to the extent specified by RBI or Central Government by

issuing regulations. [section 6 of FEMA- powers relating to non-debt capital account transactions have

been transferred to Central Government w.e.f.15-10-2019].

• FEMA envisages that RBI will have a controlling role in management of foreign exchange. Since RBI cannot

directly handle foreign exchange transactions, it authorises ‘Authorised Persons’ to deal in foreign

exchange as per directions issued by RBI. [section 10 of FEMA].

• RBI is empowered to issue directions to such ‘Authorised Persons’ under section 11 of FEMA. These

directions are issued through AP(DIR) circulars.

• FEMA also makes provisions for enforcement, penalties,adjudication and appeals.](https://image.slidesharecdn.com/unit031-240402182724-57c55b34/85/Foreign-exchange-management-act-regulations-notifications-12-320.jpg)

![RULES

• As per section 46 of the Act, the Central Government may, by notification,make rules to carry out the provisions

of FEMA, 1999. Inter alia, such rules may provide for:

(a) the imposition of reasonable restrictions on current account transactions under section 5;

(b) the manner in which the contravention may be compounded under sub-section (1) of section 15;

(c) the manner of holding an inquiry by the Adjudicating Authority under sub-section (1) of section 16;

(d) the form of appeal and fee for filing such appeal under sections 17 and 19;

(e) the salary and allowances payable to and the other terms and conditions of service of the Chairperson and

other Members of the Appellate Tribunal and the Special Director (Appeals) under section 23;

(f) the salaries and allowances and other conditions of service of the officers and employees of the Appellate

Tribunal and the office of the Special Director (Appeals) under sub-section (3) of section 27;

(g) the additional matters in respect of which the Appellate Tribunal and the Special Director (Appeals) may

exercise the powers of civil court under clause (i) of sub-section (2) of section 28;

(h) the aggregate value of foreign exchange referred to in sub-section (1) of section 37A;]

(i) the authority or person and the manner in which any document may be authenticated under clause (ii) of

section 39; and

(j) any other matter which is required to be, or may be, prescribed.](https://image.slidesharecdn.com/unit031-240402182724-57c55b34/85/Foreign-exchange-management-act-regulations-notifications-14-320.jpg)

![The main functions of RBI under FEMA are as follows –

(a) Control over dealings in foreign exchange by giving general or special permission for dealing in foreign

exchange, excluding those cases where specific provisions have been made in Act, rules or regulations – section 3 of

FEMA

(b) RBI cannot impose any restrictions on current account transactions. These can be imposed only by Central

Government in consultation with RBI – section 5 of FEMA.

(c) Specifying conditions for payment in respect of capital account transaction involving debt instruments – section

6(2) of FEMA [powers in respect of non-debt instruments are with Central Government w.e.f.15-10-2019].

(d) Regulate/prohibit/restrict specified transactions in foreign exchange – section 6(3) of FEMA

(e) Specify (by regulation) period and manner in which foreign exchange due from export of goods and services

should be received – section 8

(f) To grant exemption from realisation and repatriation in cases specified u/s 9 [These cover provisions in respect of

possession of foreign currency or foreign coins, foreign currency accounts, foreign exchange acquired from

employment,business,trade, services etc.]

(g) Granting authorisation to ‘Authorised Person’ to deal in foreign exchange, to give directions to them and to inspect

the authorised person – sections 10, 11 and 12.

(h) To make regulations – section 47

(i) Administer FEM (Non-debt Instruments) Rules,2019](https://image.slidesharecdn.com/unit031-240402182724-57c55b34/85/Foreign-exchange-management-act-regulations-notifications-16-320.jpg)

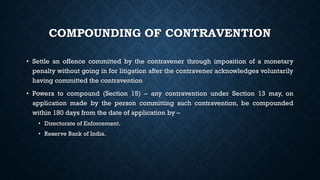

![PENAL PROVISIONS

• Governed by Chapter IV viz. Contravention and penalties.

- Sec 13: Penalties.

- Sec 14: Enforcement of the order of the Adjudication Authority.

- Sec 15:Powers to Compound contravention RBI / DoE [A.P(Dir ) No. 56/2010)].

- Sec 49: Sunset clause [ FERA violations]](https://image.slidesharecdn.com/unit031-240402182724-57c55b34/85/Foreign-exchange-management-act-regulations-notifications-27-320.jpg)