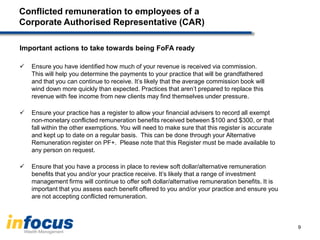

The Fofa reforms aim to eliminate conflicted remuneration in financial advice by banning commissions and payments that could influence product recommendations starting July 1. Employers of financial advisers are prohibited from providing conflicted remuneration, including bonuses and other forms of non-monetary benefits, with specific considerations required for performance benefits to ensure compliance. Practices must prepare by identifying commission revenue, maintaining an accurate register of non-monetary benefits, and reviewing any alternative remuneration to avoid conflicts.